July 18th, 2017 by Elma Jane

1979 was a turning point in the credit card processing industry. Point of sale terminals emerged that year when Visa introduced a bulky electronic data capturing terminal which was the first payment credit card terminal.

In the same year, magnetic information stripe was added to the credit card which allowed card information to be captured electronically. Now Mag stripe was replaced by EMV (Europay, MasterCard and Visa) .

In 1994, the first version of the EMV was released and it became stable in 1998.

The United States started using the EMV Technology in 2014.

The future of payment will see Mobile payments, Electronic payments and Contactless payments like NFC (Near Field Communication) and smart cards, and is now taking over the traditional payment. Electronic Payment Technology will continue to evolve.

Posted in Best Practices for Merchants Tagged with: contactless, credit card, Electronic Data, electronic payment, EMV, mobile, nfc, payment, point of sale, terminals

April 27th, 2017 by Elma Jane

Adding Tokenization Service

Important notes when adding tokenization:

– Tokens replace credit or gift card numbers.

– The terminal must be enabled to accept tokenization.

– Tokens are unique for each merchant, for example:

The same card will produce a different token for each merchant.

– Merchants with multiple terminals sharing tokenization domains will receive the same token for a unique card and the token can be used across their stores if they wish to do so.

– Merchants may supply the token in place of card information in any subsequent transaction.

– Tokenization is supported for both credit cards and gift cards.

Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions. This eliminates the possibility of having card data stolen because it no longer exists within your environment.

Tokens can be used in card not present environments such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments.

Tokens can reside on your POS/PMS or within your e-commerce infrastructure “at rest” and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions “in use”.

For Electronic Payment Set up with Tokenization call now 888-996-2273

or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit, e-commerce, electronic payment, encryption, gift Card, merchant, moto, POS, terminals, tokenization, tokens, transaction

January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions

September 9th, 2016 by Elma Jane

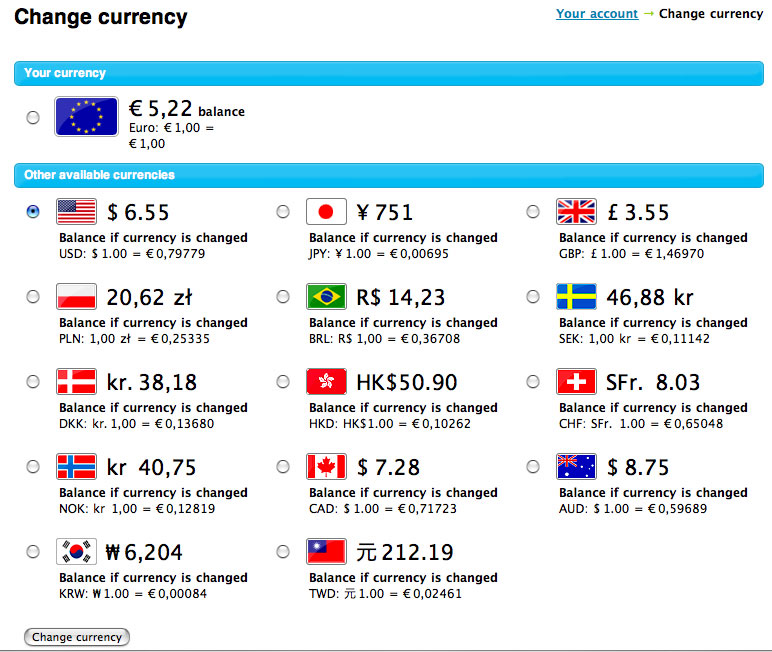

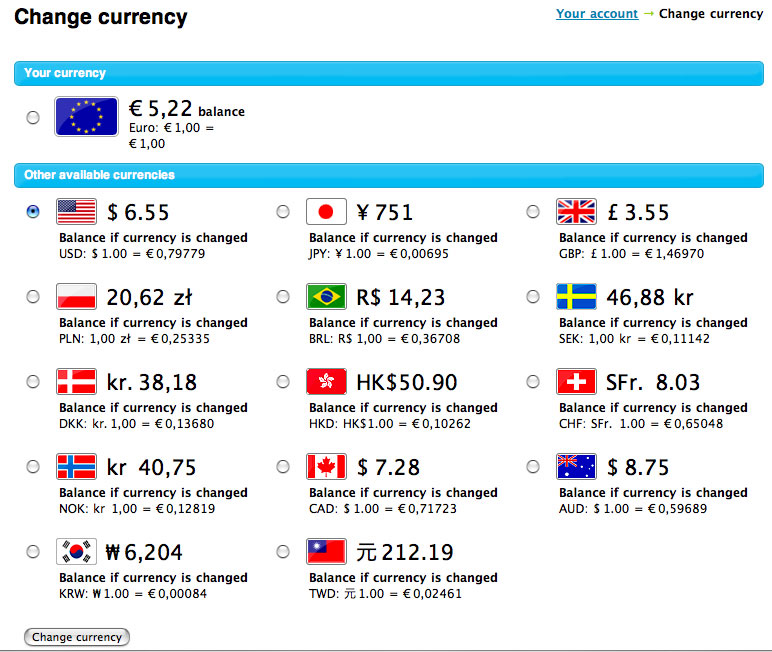

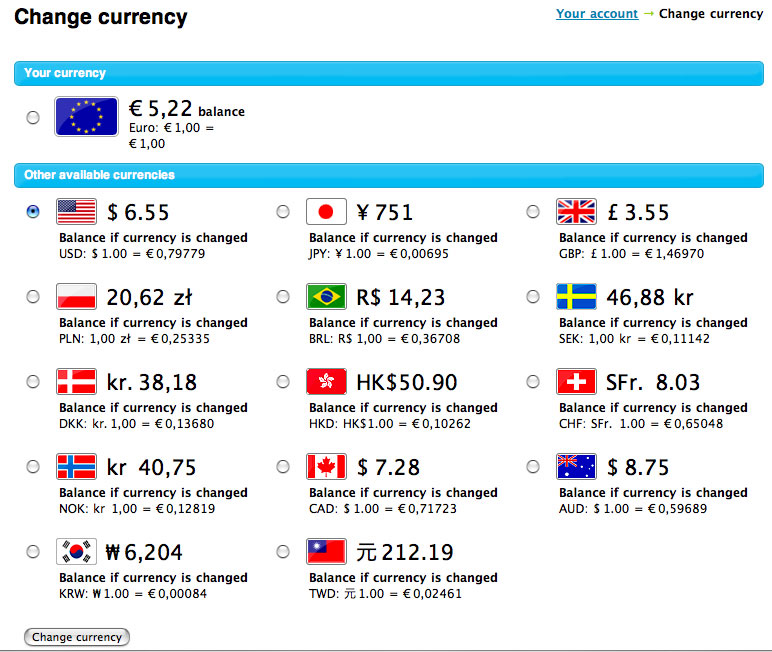

Multi Currency Conversion (MCC):

- In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

- Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

- Conversion occurs between the point of sale and settlement.

- E-commerce only and no merchant rebate.

- Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC):

- Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

- Conversion occurs at the point of sale and five supported currencies less than MCC.

- Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

- Price listed in merchant’s currency conversion.

- For Retail, Restaurant, MOTO and E-commerce.

- Supported by terminals, via Warp and Virtual Merchant.

For more information give us a call at 888-996-2273 or visit our website: www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order Tagged with: customer, e-commerce, merchant, moto, Multi Currency Conversion, point of sale, terminals, transactions, virtual merchant

August 25th, 2016 by Elma Jane

Chargeback bumps still not clear, yet some says consumers are taking advantage of the chargeback system, while others think this increase is due to EMV implementation. Same as other countries experienced.

Whatever the reason, these chargebacks are causing stir in the payments industry.

Merchants should know two facts because of the tide in chargebacks:

- Merchants should not be accountable for chargebacks on valid, non-fraudulent cards without chips.

- Additionally, merchants who do not have EMV terminals are at a higher risk for fraud.

- The merchant is held responsible not the bank if fraud is involved as a result of card swipe.

There are a few things that merchants can do to prevent chargebacks.

- Always swipe non-chip cards rather doing it manually.

- Ask for a signature and verify each transaction.

- Be on the lookout for fraudulent cards.

- EMV chip card should not be swipe or manually keyed in.

- Follow chip card processing procedures, insert them correctly and guide your customers through the chip transaction process.

- If the chip card payment fails, ask for an alternate form of payment. Most of all do not override or swipe the chip card.

- If you have to manually enter a card number, use the security code, check the expiration date and further more take an imprint.

Better be equipped to stop chargebacks by adopting few changes in your business before they happen. If your business is not yet EMV compliant, give us a call at 888-996-2273 or visit us at www.nationaltransction.com

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa Tagged with: chargeback, EMV, fraud, merchants, payments, terminals

August 11th, 2016 by Elma Jane

CURRENCY CONVERSION

Multi Currency Conversion (MCC):

In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

Conversion occurs between the point of sale and settlement.

E-commerce only and no merchant rebate.

Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC): Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

Conversion occurs at the point of sale and five supported currencies less than MCC.

Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

Price listed in merchant’s currency conversion.

For Retail, Restaurant, MOTO and E-commerce.

Supported by terminals, via Warp and Virtual Merchant.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Point of Sale Tagged with: currency, customer, DCC, Dynamic Currency Conversion, e-commerce, Internet Secure, MCC, merchant, moto, Multi Currency Conversion, point of sale, retail, terminals, transactions, virtual merchant

August 2nd, 2016 by Elma Jane

Credit card machine or point of sale terminals are used for processing debit and credit card transactions and are often integrated into a Point of Sale System. Let’s take a look at the POS terminal evolution.

Manual Imprinters – although the process was time consuming and did not offer the speed or instant transfer capabilities, manual imprinters have been around since the start of a wide acceptance of credit cards. Manual imprinters are still widely used and are considered a great backup processing method.

Electronic Authorizations – Merchants had the choice of calling in for an authorization or imprinting their transactions. The first electronic credit card authorizations were done over the phone, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing a transaction over the phone,

Point of Sale Terminals: Point of sale terminals emerged in 1979, which was a turning point in the credit card processing industry. Visa introduced a bulky electronic data capturing terminal. This was the first of credit card machine or terminal as we know them today, it has greatly reduced the time required to process a credit card. MasterCharge became MasterCard in the same year and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement. Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: credit card, credit card machine, debit, electronic credit card, Electronic Data, EMV/chip, merchants, mobile, nfc, PIN, point of sale, POS, processing industry, terminals, transactions, visa

May 26th, 2016 by Elma Jane

NFC stands for Near Field Communication. It is a technology that allows contactless data exchange between two electronic devices

Contactless Payment is a description for the ability to pay without touching anything.

How do mobile wallets fit into NFC?

Mobile wallets like Apple and Android Pay use NFC technology. NFC technology allows the data to securely pass back and forth between each device to make a contactless payment.

How secure are NFC Payments?

Tokenization converts or replaces cardholder data with a unique token ID. This eliminates the possibility of having card data stolen. These tokens help heighten protection and security for the consumer.

As a merchant, preparing to accept payments that meet customers satisfaction is needed. With the mobile wallet transaction process, it makes the traditional transaction quick and efficient.

NTC terminals allow merchants to accept NFC Payments, allowing you to process more transactions. For more information give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: cardholder, consumer, contactless, customers, data, merchant, mobile wallets, Near Field Communication, nfc, payment, Security, terminals, tokenization, transaction

May 18th, 2016 by Elma Jane

Terminals are ready, but the software isn’t – many merchants have EMV capable equipment, but has not been activated yet because it still needs to be certified.

The certification process includes security and compatibility tests.

For a small merchant, all you need to worry about is your equipment or software is EMV certified.

For software, developers, terminal manufacturers needs to get certification before they can deploy their products to merchants.

So many merchants who want to accept EMV, are now just waiting for their POS system to get necessary upgrades, which they can’t do until they’re certified.

Slower Checkout Time – common complaint by consumers. Dipping takes several seconds longer than swiping the card. There’s also a chance of forgetting your card because you have to leave your card inserted while waiting for the transaction to get approved.

The fastest Path to EMV – Depending on the nature of your business, the risk of landing yourself for credit card fraud is slim. The easiest way is to contact your merchant account provider and they will tell you what equipment and software you need and how much it will cost.

For our retail customers, we have the iCT250, the smart and compact desktop device designed for maximum efficiency. iCT250 offers a smart and effective payment experience on minimum counter space. Accept all electronic payment methods including EMV chip & PIN, magstripe and NFC/contactless.

For card-not-present, we have our payment gateway platform that accepts payments your way Online, In-Store and On the Go.

- E-commerce – manage your e-com business along with all of your other payment transactions in one, secure place.

- In-Store – accept payments in person with ease using your computer and a broad range of an optional device, like card readers and PIN pads.

- Back Office Mail & Phone – Process you mail and phone payments online. Converge is ideal for recurring and installment payments too.

- Mobile – Take payments on the go with an intuitive mobile app that’s compatible with most smartphones and tablets.

For more details give us a call at 888-996-2273 or check out our website for our products and services.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Internet Payment Gateway, Mail Order Telephone Order, Merchant Account Services News Articles, Mobile Payments, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: card, card readers, Chip & PIN, consumers, contactless, credit card, customers, e-commerce, electronic payment, EMV, fraud, in-store, magstripe, merchant account, merchants, mobile, nfc, online, payment, payment gateway, PIN pads, POS, provider, Security, terminals, transaction

May 10th, 2016 by Elma Jane

To our retailer partners, you are now able to accept UnionPay Cards with National Transaction. No additional steps are required; when a client hands you a UnionPay card just swipe it like you would with any other credit card.

What is UnionPay?

UnionPay was established in 2002 and has become the central and pivotal part of China’s bankcard industry. UnionPay cards are being accepted in 150 countries and regions outside of China. Since 2010, the number of bankcard networking merchants, POS terminals and ATM machines accepting UnionPay cards has increased by 40%, 30%, and 31% respectively. Chinese tourists are a huge strategic market with big profits and great potential for merchants in the US. These cards are currently being accepted at many large companies in North America including Niemen Marcus, Walmart, and Hertz.

Thank you for your business. At National Transaction Corporation our goal is to provide merchants with payment solutions and service beyond their expectations. If you have any questions please contact our Customer Service Department at 888-996-2273.

Posted in Best Practices for Merchants, Credit card Processing Tagged with: bankcard, cards, credit card, merchants, payment, payment solutions, POS, terminals