October 24th, 2013 by Elma Jane

You will be happy to learn that these days there is less hassle when setting up credit card payments online. In the past, companies were required to open a merchant account through a bank in order to be able to accept credit cards. Today, several services enable you to accept credit cards online without opening your own merchant account.

With more than 50 million users worldwide, Paypal is probably the most widely used such service. The company’s Payflow service is a turn-key solution with several added advantages such as recurring billing and fraud protection.

If you still want to take actual credit card payments online, a merchant account service is your best option. To open an Internet merchant account, you must fill in a merchant application and provide support documents. First, you must supply proof that you established a checking account for your Internet business.

If you have sole proprietorship or a micro business, you can open either a personal checking account or business checking account. If you opt for a personal checking account, the account must be in the name of the sole proprietor. If your internet business is a corporation, you must set up a corporate checking account.

This account will be used to deposit sales generated through your internet merchant account, but also to withdraw fees such as online payment gateway fees.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Visa MasterCard American Express Tagged with: accept, application, checking account, companies, credit-card, deposit, fraud protection, internet business, merchant account, merchant account service, micro business, online, payment gateway fees, payments, PayPal, recurring billing, sales, support, turn-key, worldwide

October 21st, 2013 by Elma Jane

Retailers today collect email at every point of interaction. Collecting customer information in the store at the point of sale (POS) offers the greatest potential to build retailer’s email list quickly and to drive timely offers and communications that increase customer loyalty and retention.

The practice of collecting email addresses at the point of sale (POS) isn’t a new one. However, more companies are embracing the trend, and they’re doing so with increasing regularity.

E-Receipts

One popular technique among retailers is to ask shoppers if they would like a receipt emailed to them. It is important to note that an agreement to receive an e-receipt should not be necessarily interpreted as consent to be added to a commercial email list unless this intent is adequately communicated to the consumer and they consent. It always best practice to reference their consent to marketing emails at the same time as the e-receipt request.

It is possible to collect (PII) Personally Identifiable Information at the counter in a

careful and conscientious manner if you follow guidelines.

1. Be transparent about the commercial intent. A consumer who feels misled is more likely to complain and to seek redress under the consumer protection laws. If following different scripts is a challenge, apply the same disclosure/request script for both credit and cash transactions.

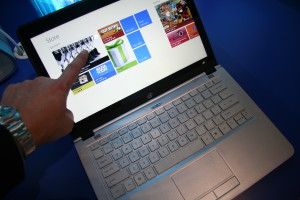

2. Consider using the credit card terminal or other touchpad device for customers to enter their email rather than using the sales associate. The device should first prompt the customer to consent to receiving an in-store e-receipt and/or marketing communications, ideally before proceeding with the transaction, it could be after as well.

3. Decouple PII collection from the credit card purchase. Ask customers for their email addresses before taking their credit cards or after they sign off on the purchase so it is clear that email is not required as part of the transaction.

4. Fulfill any incentives offered at the counter through email. Provide each consumer with a dynamic and unique link. A consumer will have less of a reason to give you a valid email address if you offer and fulfill the incentive at POS. Limiting the use of the incentive to email will help you avoid incentive abuse.

5. Send a welcome permission pass. Don’t assume that the customer wants anything more than an in-store e-receipt even if you can legally claim to have this right. Let the customer make an informed decision at the counter or in a subsequent email.

6. Validate submitted data. Ask customers to verify the accuracy of their PII before submitting. Use appropriate list management tools to prevent avoidable domain errors.

Clients that take the proper steps to overcome POS challenges and risks will reap the rewards of subscriber loyalty, a stronger reputation and better inbox performance in the long run.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments, Gift & Loyalty Card Processing, Point of Sale Tagged with: associate, best practice, cash, commercial, communications, companies, consumer, credit, credit-card, customer, e-receipts, email, emailed, incentive, interaction, list, loyalty, offers, personally identifiable information, pii, point, point of sale, POS, retailers, rewards, sales, script, subscriber, timely, touchpad, transactions, transparent

October 17th, 2013 by Elma Jane

VeriFone and National Payment Card Association (NPCA) debuted a mobile payment and rewards solution that enables convenience store and petroleum retailers to provide customers with smartphone-based payment options at the pump.

Utilizing VeriFone’s Smart Fuel Controller and NPCA’s mobile payment solution, c-store and gas station operators with VeriFone payment acceptance systems can quickly implement a fixed low-cost mobile payment and rewards program built on existing infrastructure used for merchant branded debit cards.

Consumers are increasingly drawn to rewards-based fuel purchase programs and they expect to be able to use their mobile phone to complete transactions at the pump. NPCA and VeriFone are showing how easy it is for CSPs to offer mobile payment and reward options to customers that increase loyalty and sales.

VeriFone Smart Fuel solutions make it easy for CSPs to offer forecourt pump POS payment without incurring the cost of installing new dispensers. The Smart Fuel Controller combines pump and pay-point support into a single unit, simplifying installation and maintenance, and eliminating the need for third-party interface devices to integrate pay-point management with in-store POS systems.

Merchants can develop their own mobile app, or apply their brand to a mobile app supplied by NPCA, to enable customers to pay for purchases and receive loyalty incentives using their smartphones.

Consumers today would rather utilize the capabilities of their smartphones versus pulling out their wallets. Using this solution, retailers can easily and cost-effectively create mobile loyalty programs that attract and reward high-value customers – without having to replace their existing payment infrastructure.

NPCA’s debit-based payment programs provide retailers with the ability to drive customer loyalty and reduce the cost of payments. Fuel discounts are funded from interchange savings that retailers would otherwise pay to banks. Payment processing is done by NPCA using the automated clearing house (ACH) system to clear debits to cardholder checking accounts and net settle with retailers each day. The company holds five patents related to the processing and methods for ACH-based decoupled debit and mobile payments.

Come November VeriFone and NPCA mobile payments solution will be available for beta testing.

Posted in Electronic Payments, Mobile Payments, Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: acceptance, ach, app, apply, cardholder, consumers, cost, debit cards, devices, infrastructure, interchange, interface, loyalty, merchant, mobile, pay-point, payment, payments, phone, POS, Processing, rewards, sales, smart, Smartphones, solution, transactions, verifone, wallets