Over the next three weeks we will explore on this blog some of the reasons why National Transaction Corporation is the preferred choice for travel agents.

The Travel industry is one of the world’s largest industries with a global economic contribution of over 7.6 trillion U.S. dollars in 2016. (Statista)

At NTC we recognize that travel agency payment processing has some unique hurdles to overcome, but we are leveraging our innovation because we want our travel agency partners to explore how our solutions transcend the challenges that travel agents face.

Secure processing is one of the reasons why National Transaction is the preferred choice for travel agents

National Transaction Corporation has Secure Merchant Payment Processing – Because when your customers know their data is safe, they keep coming back!

You’ve heard of the many data breaches within major corporations that have occurred in just the last few years, when customers’ confidential credit card information is stolen and businesses lose a small fortune in repairing the problem. The cost of such a security breach goes far beyond that, however; once a business has lost the trust of its customers, 60% of those cardholders will go elsewhere for their purchases and services, according to studies on the problem.

Imagine if this happened to your travel agency merchant account? It could be disastrous, especially because agencies tend to deal with high-dollar sales from a moderately-sized pool of customers – so every client counts.

NTC knows that you, like us, care about your customers, and we want your travel agency to be seen as a trustworthy place to book a dream vacation. The first step is for your business to be PCI-DSS compliant.

PCI-DSS (Payment Card Industry-Digital Security Standards) requirements were put in place by the credit card associations to deal with the increasing problem of identity theft and data loss. The requirements vary according to the types and the number of payment transactions your agency goes through, but you can be sure that NTC will help you stay compliant with the latest security standards.

In the event of a data breach, we are here to eliminate the negative impact it can have on your company. NTC may be able to help you with the fines, assessments, and other costs from the networks, and we will consult with you on how to proceed to protect your agency and your reputation.

As you know, data security is as much a concern for the business owner as it is for the cardholder – your customer. When your clients know that their data is safe with you, they will keep coming back to your agency to book their next great trip!

If you cannot wait to read blog number two out of this three part series, feel free to call NTC now at 888-996-2273 to find out the best options for your travel agency!

Posted in Credit card Processing, Credit Card Security, Travel Agency Agents Tagged with: cardholder, data, fraud, merchant account, payments, Security, transaction, travel, visa

February 22nd, 2017 by Elma Jane

BEST PRACTICES

Posted in Best Practices for Merchants Tagged with: card, cardholder, voice authorization

February 16th, 2017 by Elma Jane

Chargeback Cycle

A chargeback is also known as a reversal; a credit card transaction that is reversed to a merchant because of the customer or customer’s bank disputes charges. Other reasons include fraud, credit card processing errors, authorization issues and non-fulfillment of copy requests. There’s an assigned reason code for every chargeback. Reason codes may vary by VISA and MasterCard.

How does the chargeback cycle work?

1. A customer files a complaint to card-issuing bank.

2. The bank sends disputed transaction (chargeback) to acquirer.

3. Acquirer receives chargeback and resolves it or forwards to the merchant for documentation.

4. Merchant accepts chargeback or addresses issues and resubmits to Acquirer.

5. Acquirer represents the chargeback to the issues once acquirer agrees the merchant has properly addressed it.

6. The issuer resolves the dispute by reposting to the cardholder’s account.

7. The cardholder receives dispute information and may be rebilled or credited.

Every merchant that offers credit card processing to its customers should be concerned about chargebacks to their merchant account.

Lower your risk of chargebacks by following the tips below:

Verify card logos, credit card numbers, identification, customer signature and check the expiration date.

Call for voice authorization if the card stripe doesn’t work or if the terminal is down or cannot authorize.

Authorize every transaction.

Be sure your customers are familiar with your return or exchange policy.

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, merchant, merchant account, transaction

December 21st, 2016 by Admin

Ways to Prevent CHARGEBACK:

Provide Receipts for every single transaction. Receipt serves as a good reminder to the purchase they make and decreases the likelihood of a charge back. Have the conditions of sale written on the receipt

Be clear about refunds, returns and cancellation policies – include refund, return and cancellation policy on your website.

Make sure charge descriptions are clear. Use dynamic descriptors – with dynamic descriptors, you can include specifics like the product purchased, business name, business location and contact information. Include a number as part of the charge description.

Provide accurate descriptions of products and services – accurate product descriptions are particularly important for online ecommerce where customers often dispute transactions because the product they received is not as it was described online.

Get signed proof of delivery products – especially if you’re an online ecommerce vendors that ships products regularly.

Communicate with customers about renewals – if your customer accounts are set to automatically renew, make sure you notify those customers of their renewal months leading up to the renewal day.

When a cardholder contacts their credit card-issuing bank and asks for a refund on a transaction for a purchase or service made on their card is called chargeback.

Most Common Reasons for Chargebacks:

Point-of-sale processing errors

Customer disputes like, customer doesn’t recognize the charge, customer claims they didn’t receive the item they ordered.

Fraud, or potential fraud (customer claims the transaction is fraudulent – the purchase was made with a stolen card).

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, ecommerce, fraud, online, point of sale, transaction

December 1st, 2016 by Elma Jane

The All in One Smart Terminal!

Finally, a dynamic all-in-one smart terminal that offers a turnkey solution for customers to immediately implement in their place of business. Think of it also like a smart phone for accepting payments.

Function meets Form

Enables the speed of business with a modern, engaging design. Here are a few highlights:

- Dual, interactive touchscreens for the customer and cardholder.

- Built-in intuitive software, PIN pad and also signature pad, and printer.

- Charging dock station that includes extra USB ports.

- One card slot for EMV/MSR transactions.

- NFC enabled to accept contactless transactions, for example ApplePay.

- Mobile and web applications to help owners manage their business from anywhere.

- Ability to print, email and also send SMS receipts.

Sleek modern device that delivers an incredible customer experience, therefore a great option for retailers, coffee shops, and pop-up shops.

It comes with the powerful security of Safe-T built in.

For your EMV/NFC terminal needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: ApplePay, cardholder, contactless transactions, customers, EMV, mobile, nfc, payments, PIN pad, smart phone, terminal, transactions

November 15th, 2016 by Elma Jane

SMART TERMINAL

Another all-in-one mobile (IP countertop and Wi-Fi capable) terminal that gives customers the functionality they want and need.

Sleek modern device that delivers an incredible customer experience, and is a great option for retailers, coffee shops, and pop-up shops.

Includes two touch screens: a larger one for easy visibility of orders and other information, as well as a cardholder facing one that can be used for payments and tipping. It also offers a dashboard function, so your customers can monitor their transactions and other reports remotely. On top of that, it comes with the powerful security of Safe-T built in.

For your EMV/NFC terminal needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Reader Terminal Tagged with: cardholder, customers, EMV/NFC, mobile, payments, Security, terminal, transactions

October 13th, 2016 by Elma Jane

Code 10 merchants first line of defense!

How to use “Code 10”

- Call the voice authorization phone number provided by your Merchant Provider. This number can be found on the sticker on your terminal or call your Merchant Service provider and ask to be transferred to the Voice Authorization department.

- Choose the prompt for “Code 10”. Never call a phone number for the card issuing bank provided by a customer; or let the customer call the card issuing bank for you to obtain an authorization code. Do not accept an authorization code given to you by a customer. Authorization code obtained from your Authorization Center can be verified; but not the one from other sources.

- Provide the cardholder name, billing address and shipping address, if the order is a mail order, phone or Internet sale. The representative will attempt to verify the information you provide with the bank that issued the card to the customer.

- The representative will attempt to verify the cardholder information during your call; the data will be forwarded to an investigator for further research and will attempt to contact you within 24 – 72 hours with the current status or results of the investigation.

- Request another form of payment other than a credit card if an authorization request is declined. Do not split a declined transaction into smaller increments to obtain an authorization.

- Obtain an authorization code for the full amount of the sale. Always obtain the authorization code before shipping the merchandise.

Whether you are in a face-to-face environment, or via mail, phone or Internet that sell goods and services you can employ a “Code 10” authorization to verify additional information on a suspicious transaction.

You may be prompted by your processing terminal to call for voice authorization of the charges (CALL AUTH), or you may simply not feel right about the transaction. In either case, you can use “Code 10” to gain additional information before you release your merchandise.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank, card, cardholder, customer, internet, merchant provider, merchants, service provider, terminal, transaction

October 11th, 2016 by Elma Jane

Cybersecurity via Converge:

Converge uses a multi-layered approach to security which helps keep cardholder data safe throughout the entire payment process; from beginning to end.

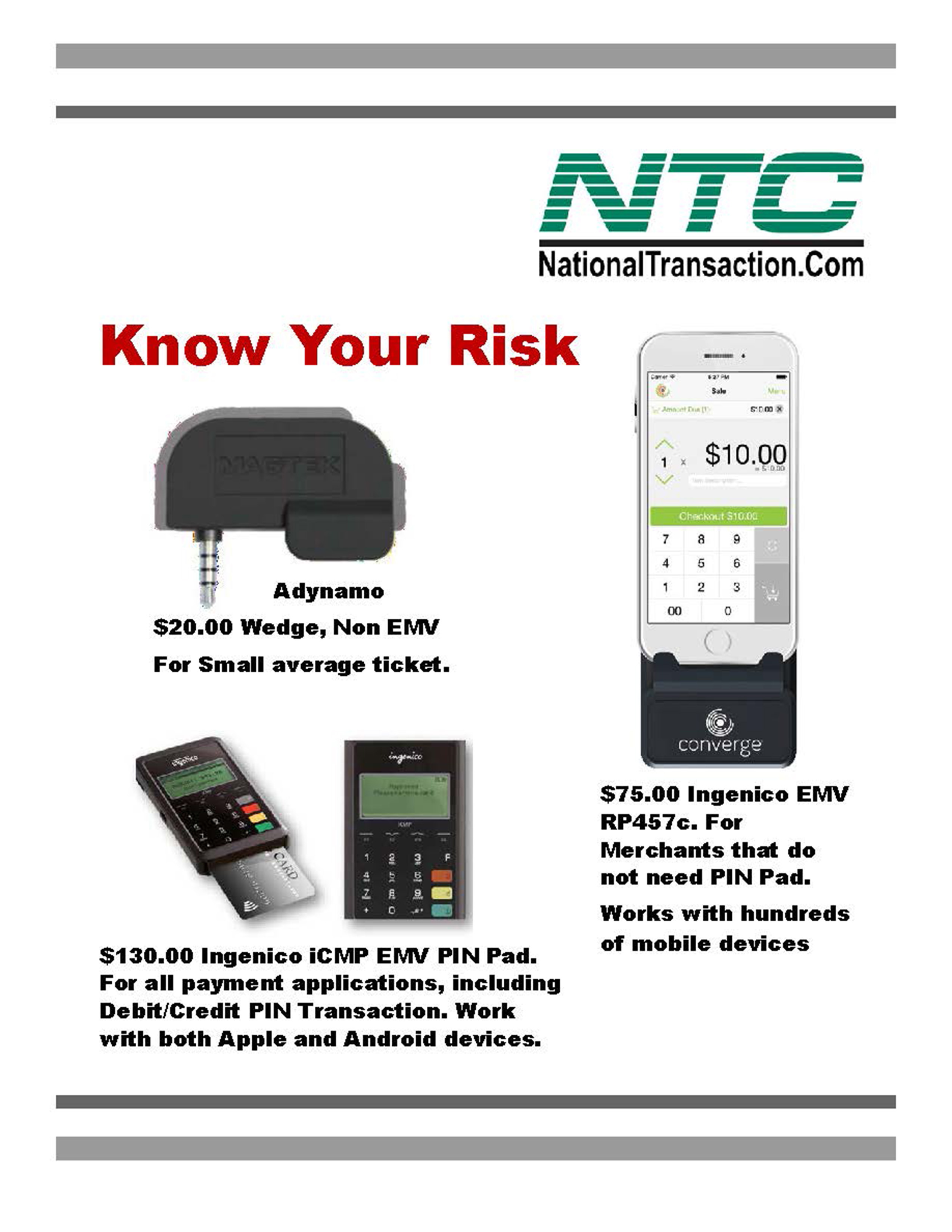

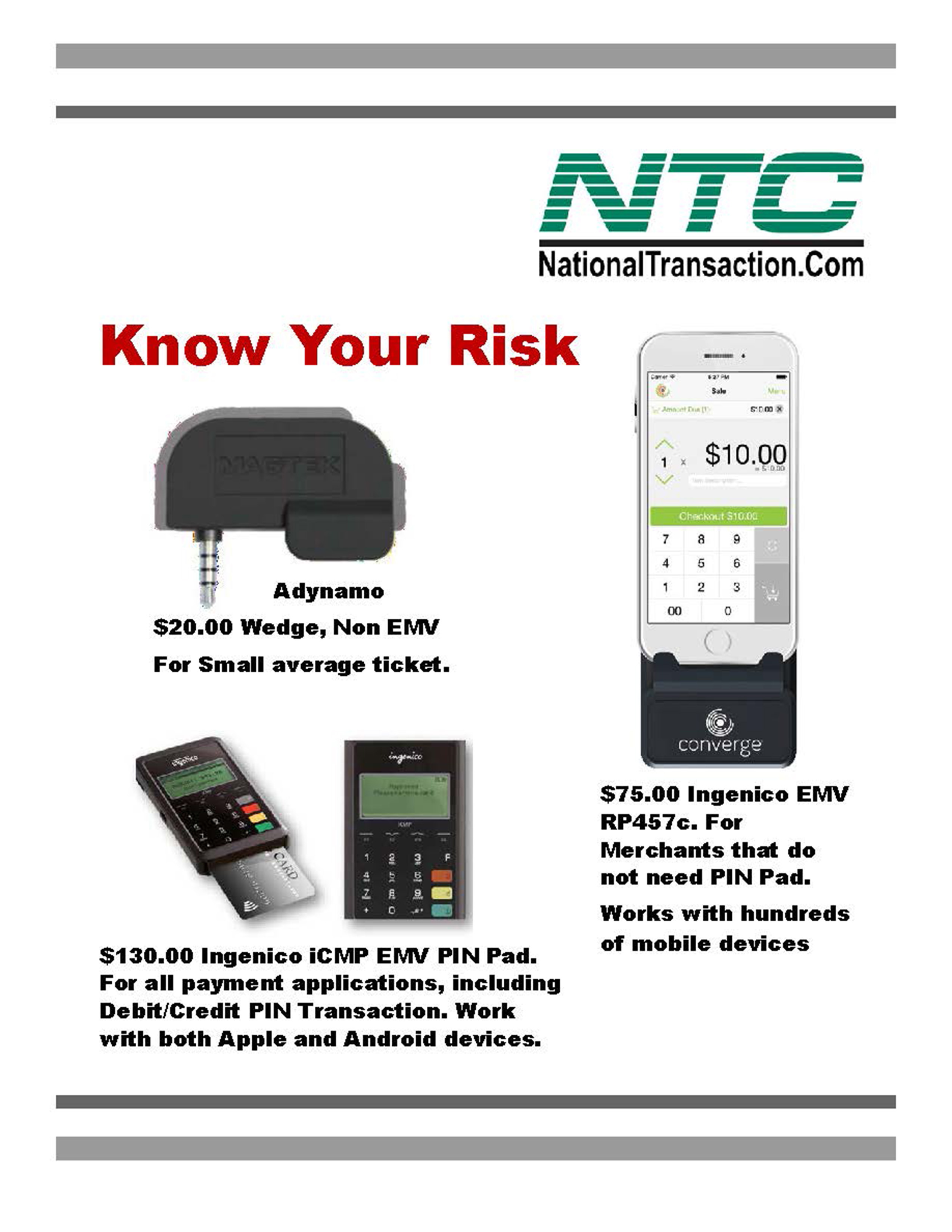

- EMV: All new Ingenico PIN pads and readers – iCMP and RP457c used with Converge Mobile offer EMV to help protect against counterfeit card use. The PIN pads go a step further in helping protect against lost; stolen and NRI (never received/issued) when a PIN-preferred card is accepted with PIN entry.

- Encryption: All new Ingenico devices also include encryption as a standard security component in addition to protect card data in transit.

- Tokenization: An enhanced security feature that is particularly valuable in card-not-present (CNP) environments when cards are stored on file for processing at a later time, or either for recurring/installment payments.

Get the Ingenico iCMP EMV PIN Pad for only $130.00.

For all payment applications, either Debit or Credit PIN Transaction. Work with both Apple and Android Devices.

Ingenico EMV RP457c card reader for only $75.00.

For Merchants that do not need PIN Pad. Works with hundreds of mobile devices.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Smartphone Tagged with: card, card-not-present, cardholder, data, EMV, mobile, payment, PIN pads, Security, tokenization

September 30th, 2016 by Elma Jane

The Process of Underwriting!

Some of the key things that are reviewed in setting up electronic payments.

Getting a merchant account, is an important step for any businesses that sells services.

Merchants need to understand the following process:

Billing policy – Businesses that bill too far in advance are at greater risk for a chargeback. Knowing how does the business bill is important.

Example: A travel agency who sold travel destination packages six months in advance and cancel the trip.

Business type – Businesses at a higher risk are industries with vague products or services; which are more highly to be examined in detail than those with concrete offerings.

Chargeback history – A business with a lot of chargebacks tied to their old merchant account will have a hard time with underwriting. A chargeback can be issued by the cardholder; if the merchant does not fulfill the product or services being rendered as agreed.

Owner/signer credit score – Credit score plays a big role during merchant account underwriting. However, some processors will review financial statements instead in the case of poor credit. if the original signer’s credit score is insufficient, businesses with multiple partners can also try the application with a different signer.

Requested volumes – This are weighed against the processing volumes requested on the application. New businesses usually start with smaller volumes to build a trustworthy relationship before increasing their processing volumes.

Years in business – Long terms in business go a long way in merchant account underwriting; it speaks for their legitimacy and they are more prepared to respond to something like a chargeback and often have a more stable cash flow.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: cardholder, chargeback, credit, electronic payments, merchant account, processors, travel agency

September 21st, 2016 by Elma Jane

PCI compliance applies to any company, organization or merchant of any size or transaction volume that either accepts, stores or transmits cardholder data.

Any merchant accepting payments directly from the customer via credit or debit card must be Compliant. The merchant themselves are therefore responsible for becoming Compliant, as the deadline for the merchant becomes overdue.

Understanding and knowing the details of Payment Card Industry Compliance can help you better prepare your business. Because failing and waiting to become compliant or ignoring them, could end up being an expensive mistake.

The VISA regulations have to adhere to the PCI standard forms as part of the operating regulations. The regulations signed when you open an account at the bank. The rules under which merchants are allowed to operate merchant accounts.

The Payment Card Industry Data Security Standard (PCI DSS) is a proprietary information security standard for organizations that handle branded credit cards from the major card schemes including Visa, MasterCard, American Express, Discover, and JCB.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, cardholder, compliance, credit, customer, data, debit card, Discover, jcb, MasterCard, merchant, Payment Card Industry, payments, PCI, transaction, visa