July 12th, 2017 by Elma Jane

NTC Gives™ is an Electronic Payment Organization that allows congregations to accept payments on multiple platforms and supports non-profit organizations in our communities utilizing the award-winning customer service and industry leading technology of National Transaction Corporation™.

Keep Giving – allows recurring donations regardless of your worshipers attendance.

Mobile Giving – accept donations on a multitude of devices.

Secure Donations – Offload your protection mechanism to the banks payment gateway to ensure security breach while protecting your members.

For church congregations, start accepting donations online as well as recurring donations. Call now 888-996-2273 or go to NTC GIVES.Com

Posted in Best Practices for Merchants Tagged with: banks, electronic payment, gateway, Security

July 10th, 2017 by Elma Jane

One of the most advanced and eye-pleasing smart terminals has generated some buzz. Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience.

For SMB/independent lodging establishments, the benefits include:

- Availability of an EMV terminal solution – a first for the lodging industry – as this option has not been offered in the lodging sector by competitors or legacy terminal providers

- Dynamic, all-in-one smart device that looks great and delivers an exceptional guest experience

- A modern, simple, and intuitive interface (think iPhone/Android) enables lodging establishments to get up and running quickly with minimal employee training

- Powerful security to ensure maximum security, including EMV, encryption, tokenization, and PCI protection

- Robust, cloud-based reporting to help hotel owners manage their business, and see transactions and settlements in real time

Lodging industry customers that will benefit from this smart terminals:

- Smaller, independent hotels

- Hotels without property management systems

- Existing lodging customers using Hypercom terminals (in need of EMV terminal solution)

Branded hotels:

- For pool decks, spas, golf courses, gift shops, and other non-front desk locations

- As a backup for existing systems

For Electronic Payment Account Set Up Call Now! 888-996-2273

Or let’s get started NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, PCI, Security, terminal, tokenization, transactions

June 27th, 2017 by Elma Jane

E-commerce has been growing, and now the overall market is starting to take notice; thanks to advances in online payment processing and electronic payment technology, as well as the willingness of almost all merchants to accept credit cards online.

E-commerce ecosystem are set to double and will account for a rising share of overall card payments. In addition to increased internet and smartphone penetration; more e-commerce merchants and an increase in the use of digital wallets.

Cardholders globally are becoming more confident in the security of the e-commerce channel, with the expected implementation of 3D-Secure 2.0 and increased use of sophisticated anti-fraud systems in many markets it gives consumer assurance that payment cards are safe to use for e-commerce purchases.

Trends indicate that e-commerce is the wave of the future for shoppers. But digital shopping is just one piece of the broader payments ecosystem.

For Electronic Payment Set Up Call Now! 888-996-2273

Let’s Get Started National Transaction.Com

Posted in Best Practices for Merchants Tagged with: card payments, credit cards, Digital wallets, e-commerce, electronic payment, merchants, online, payment, Security, smartphone

May 11th, 2017 by Elma Jane

Three Domain Secure (3-D Secure)

Visa is announcing a global plan to support 3-D Secure 2.0 to help protect e-commerce transactions.

3-D Secure (3DS) – stands for Three-Domain Secure. A messaging protocol to enable consumers to authenticate themselves with their card issuer when making card-not-present (CNP) e-commerce purchases. 3DS is an additional security layer that will help prevent unauthorized CNP transactions and protects the merchant from CNP exposure to fraud.

The three domains consist of:

The merchant/acquirer domain

Issuer domain

the interoperability domain (payment systems)

The purpose of the 3DS protocol within the payments community is to facilitate the exchange of data between the merchant, cardholder and card issuer. The objective is to benefit each of these parties by providing the ability to authenticate cardholders during a CNP e-commerce purchase, reducing fraud.

Visa currently offers its 3-D Secure service through the Verified by Visa program, which supports the existing 3-D Secure 1.0 specifications for consumer authentication.

Visa anticipates that early adoption of 3-D Secure 2.0 will begin in the second half of 2017.

Merchants that authenticate transactions using 3-D Secure are generally protected from issuer card-not-present fraud-related chargeback claims,1 and this rule will extend to merchant-attempted 3-D Secure 2.0 transactions after 12 April 2019, the global program activation date.

For Electronic Payment Set Up go to NationalTransaction.Com or call now 888-996-2273!

Posted in Best Practices for Merchants Tagged with: card, card-not-present, cnp, data, e-commerce, electronic payment, merchant, payment, Security, transactions

May 8th, 2017 by Elma Jane

Tips for preventing funding delays!

If you’re running an unusual transaction and know of it beforehand, let your merchant provider know; sending an invoice in advance can cut processing time.

Make sure to give your most up to date information. Keeping provider in the loop on the fluctuations in your processing volumes will help tremendously, especially as your business grows.

Funding delays are an inconvenience, but being prepared can keep the delay to a minimum. If you keep these tips in mind, you’ll be processing without ever having to worry about delays again.

Flagged, Security and Review Process

Why some merchant accounts hold funds and others do not?

There are a number of reasons:

Underwriting merchant account is ongoing. Imagine a small business convenience store was set up and accidentally enters $1,000.000 should we transfer that or hold it?

One reason is something has gone with that particular business account.

Another reason could be that particular institution’s practices are more efficient than others.

Financial institutions use different payment processing systems, and they are not uniform in their practices. For this reason, some transactions are significantly faster than others.

Though there are other reasons funds get held, the main reason for this occurrence is when a payment is out of the ordinary patterns.

Unusual transactions are any transaction that vary from your typical processing patterns.

If It’s for security, an account will be flag as a way to reduce fraud as well as ensuring no one is using your account.

How do I know if I’m flagged?

Security checks are carried out by processing banks or processor. You’ll be contacted by a loss prevention officer. They’ll provide all details of the hold, including the review process as well as the next steps.

What’s the review process?

The review is simply to verify your transaction before delivering your funds. A typical review is confirming the transaction with yourself as well as your customer’s credit card company. You’ll speak briefly with a loss prevention officer to discuss the transaction. If further review is required, the loss prevention officer may ask you for a copy of the transaction’s invoice.

How can I speed up the process?

For an easy review, make sure to provide detailed documents. When an invoice is asked for, make sure it clearly shows the following:

- Product Description of Items Sold

- Your Customer’s Name

- Address

- Phone Number

For Electronic Payment set up call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: credit card, electronic payment, funds, merchant provider, processor, Security, transaction

May 5th, 2017 by Elma Jane

Tokenization is a powerful security feature that allows a merchant to support all of their existing business processes that require card data without the risk of holding card data and without any security implications, because tokens are useless to criminals, they can be saved by the merchant as they do not represent any threat.

The liability and costs associated with PCI compliance is substantially reduced and the risk of storing sensitive data is eliminated.

Tokenization applies to credit card and gift card.

Merchants set up for the tokenization service receive responses that include a token.

The token generated is not linked to a specific transaction but to a specific card number and the token generated for that transaction will be identical for every use of that card number and merchant.

Furthermore, you can generate a token and save the token with associated information in the Card Manager.

For Electronic Payments with Tokenization call now 888-996-2273

or click here NationalTransaction.Com

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, Payment Card Industry PCI Security Tagged with: card, credit card, data, electronic payments, merchant, PCI, Security, token, tokenization, transaction

May 1st, 2017 by Elma Jane

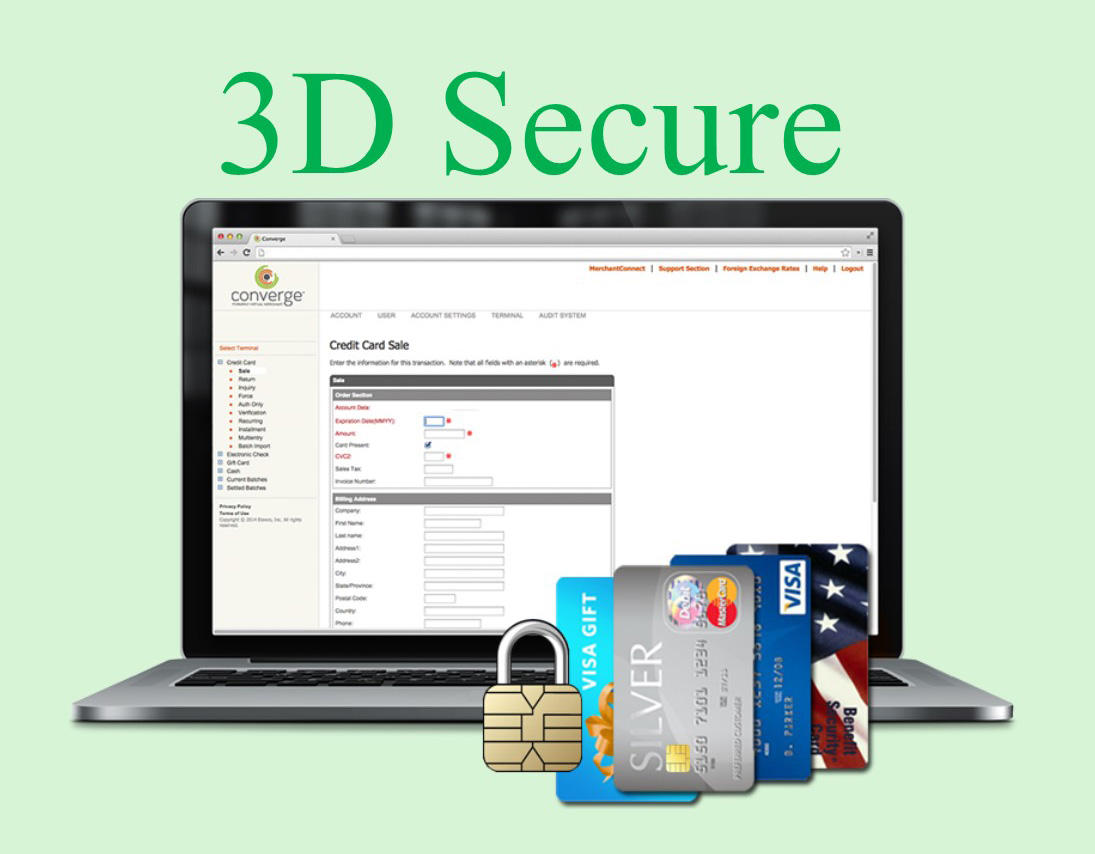

3D Secure Authentication

One of the biggest frustration for e-Commerce businesses has been the risk of chargebacks. If a shopper were to tell their issuers that they did not authorize an Internet purchase with their credit card, the merchant can lose the chargeback and the product.

By using 3D Secure capabilities, merchants get detailed evidence of authorized purchases “authentication data”.

The authentication data, together with an authorization approval gives you a transaction that is guaranteed against the most common types of chargebacks: Cardholder not authorized and cardholder not recognized chargebacks.

3D Secure is a security tool that enables cardholders to authenticate their identity to their card issuer through the use of Visa’s Verified by Visa and MasterCard’s SecureCode services.

3D Secure adds another layer of security to cardholders by preventing fraudulent purchases in an e-Commerce environment and reducing the number of unauthorized transactions.

NTC’s Virtual Merchant users processing transactions in an integrated e-Commerce environment are able to take advantage of this functionality.

3D Secure processing is supported with MasterCard and Visa transactions only. Other card types will process as normal and will not trigger 3D secure processing.

For e-Commerce Electronic Payments set up with 3D Secure

call now 888-996-2273! or click here NationalTransaction.Com

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Visa MasterCard American Express Tagged with: chargebacks, credit card, data, e-commerce, electronic payments, MasterCard, merchant, Security, transaction, visa

March 13th, 2017 by Elma Jane

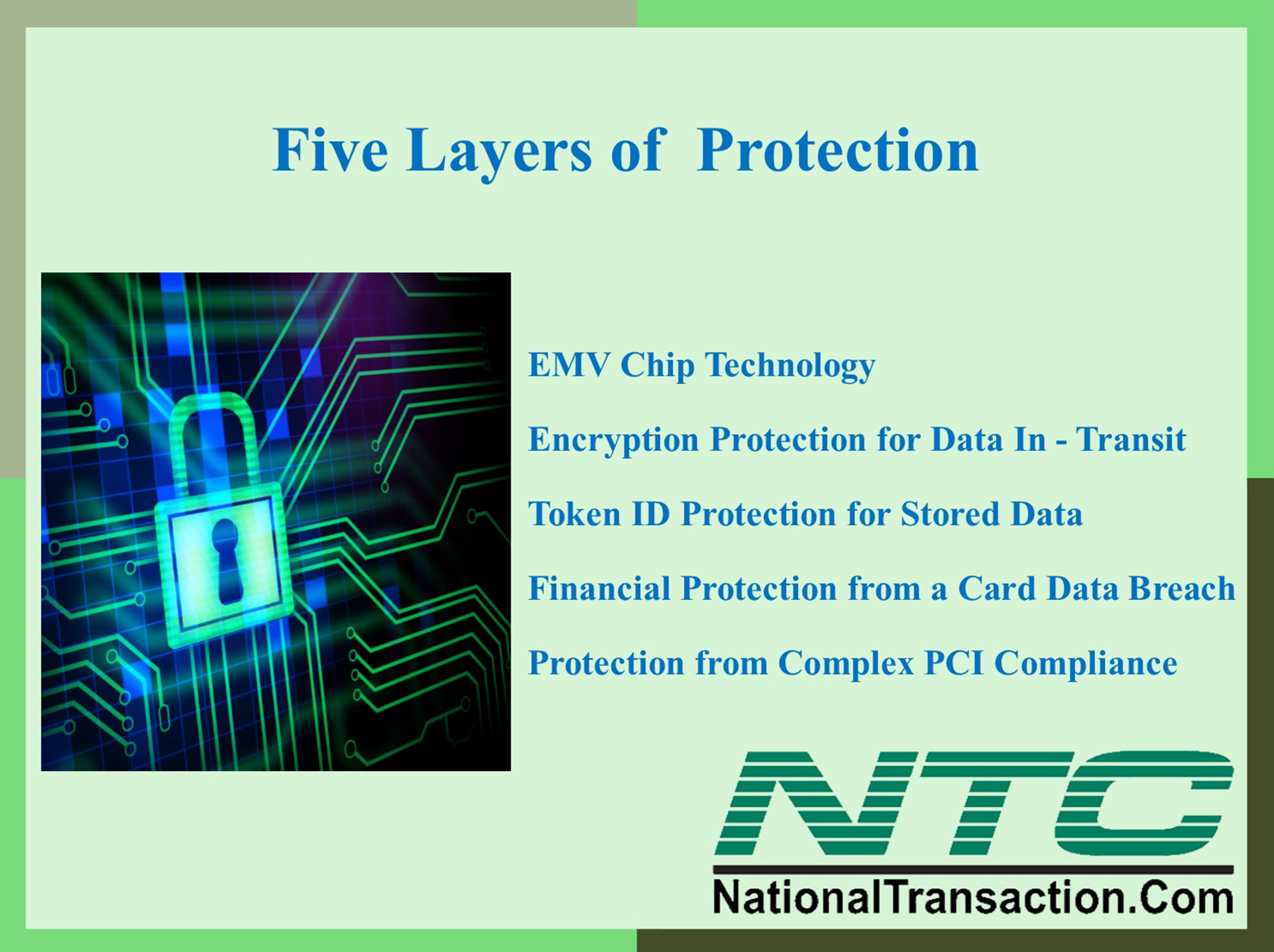

SECURITY PROTECTION

Make smart decisions when it comes to protecting your business with five layers of protection.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security Tagged with: Security

March 8th, 2017 by Elma Jane

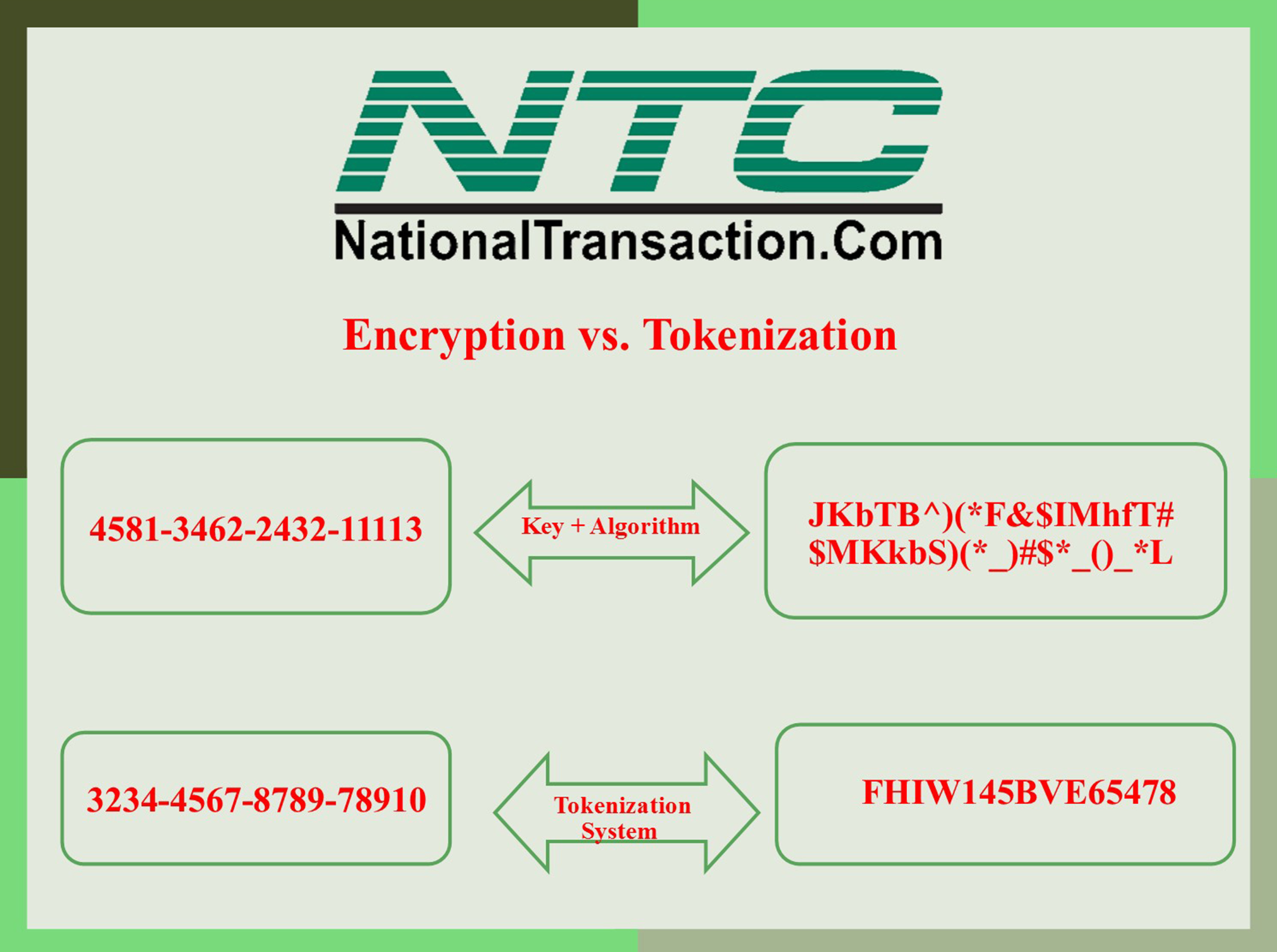

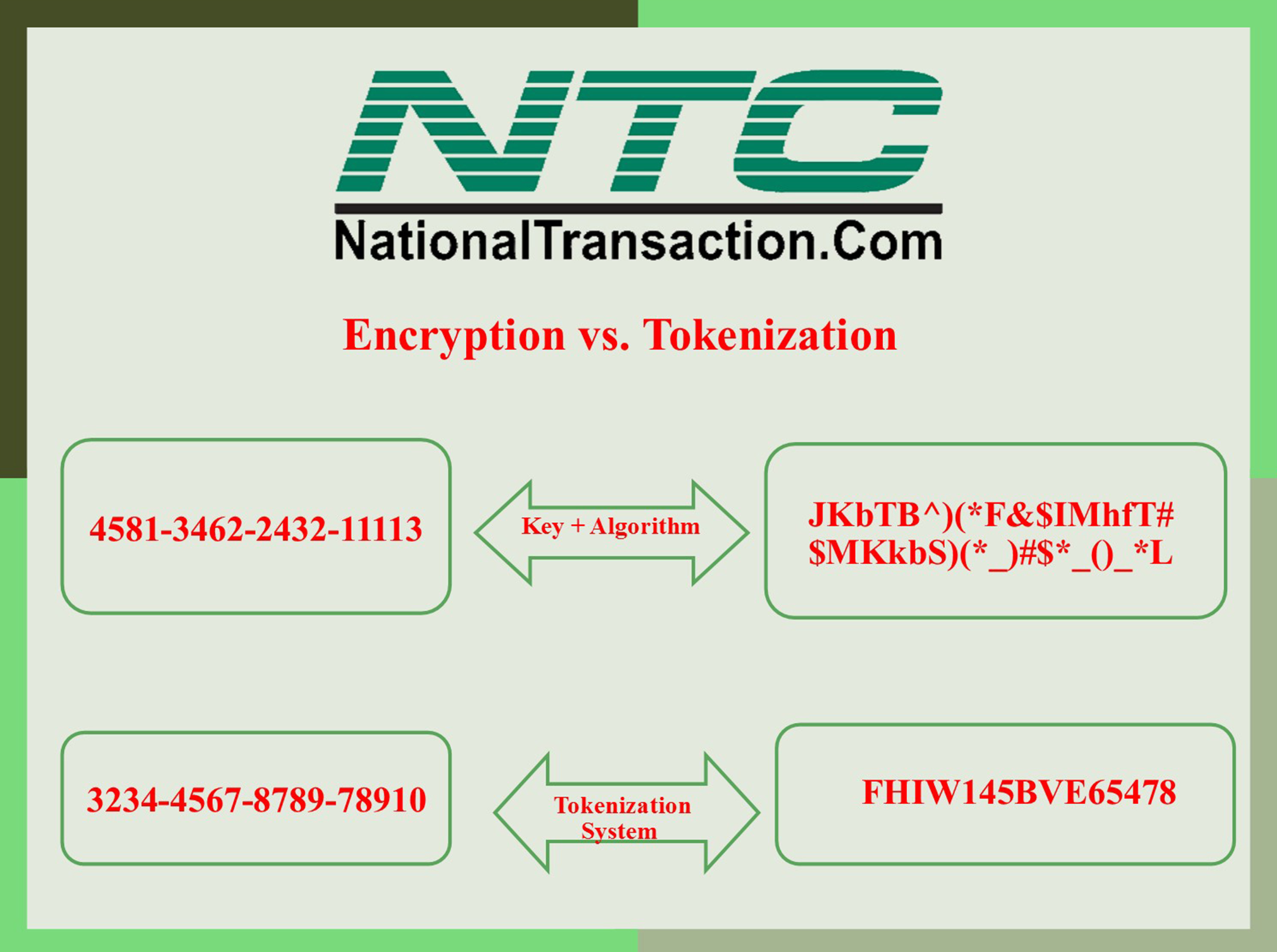

TOKENIZATION AND ENCRYPTION SECURITY

Encryption is reversible. Encrypted data can be returned back to its original, unencrypted form. The encryption strength is based on the algorithm it uses. A more complex algorithm will create stronger encryption to secure the data. Encryption is most often “end-to-end.”

PCI Security Standards Council and other governing compliance entities still view encrypted data as sensitive data.

Tokenization system replaces sensitive data and the token cannot be reversed into true data, it has no value. The real, sensitive information is stored in a secured offsite platform. An entirely different location. That means sensitive customer data does not enter or reside within your environment.

Unlike encryption, tokenization isn’t subject to issues with PCI compliance or other data security organizations, because tokens do not contain any real data.

If a hacker managed to steal your tokens they cannot be used for a fraudulent transaction.

Using tokens doesn’t change a merchant’s payment processing experience. Only they’re much safer for a merchant than actual credit cards.

For Electronic Payments call us now 888-996-2273

Posted in Best Practices for Merchants, Payment Card Industry PCI Security Tagged with: data, encryption, PCI, Security, tokenization, transaction

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization