July 12th, 2017 by Elma Jane

NTC Gives™ is an Electronic Payment Organization that allows congregations to accept payments on multiple platforms and supports non-profit organizations in our communities utilizing the award-winning customer service and industry leading technology of National Transaction Corporation™.

Keep Giving – allows recurring donations regardless of your worshipers attendance.

Mobile Giving – accept donations on a multitude of devices.

Secure Donations – Offload your protection mechanism to the banks payment gateway to ensure security breach while protecting your members.

For church congregations, start accepting donations online as well as recurring donations. Call now 888-996-2273 or go to NTC GIVES.Com

Posted in Best Practices for Merchants Tagged with: banks, electronic payment, gateway, Security

March 7th, 2017 by Elma Jane

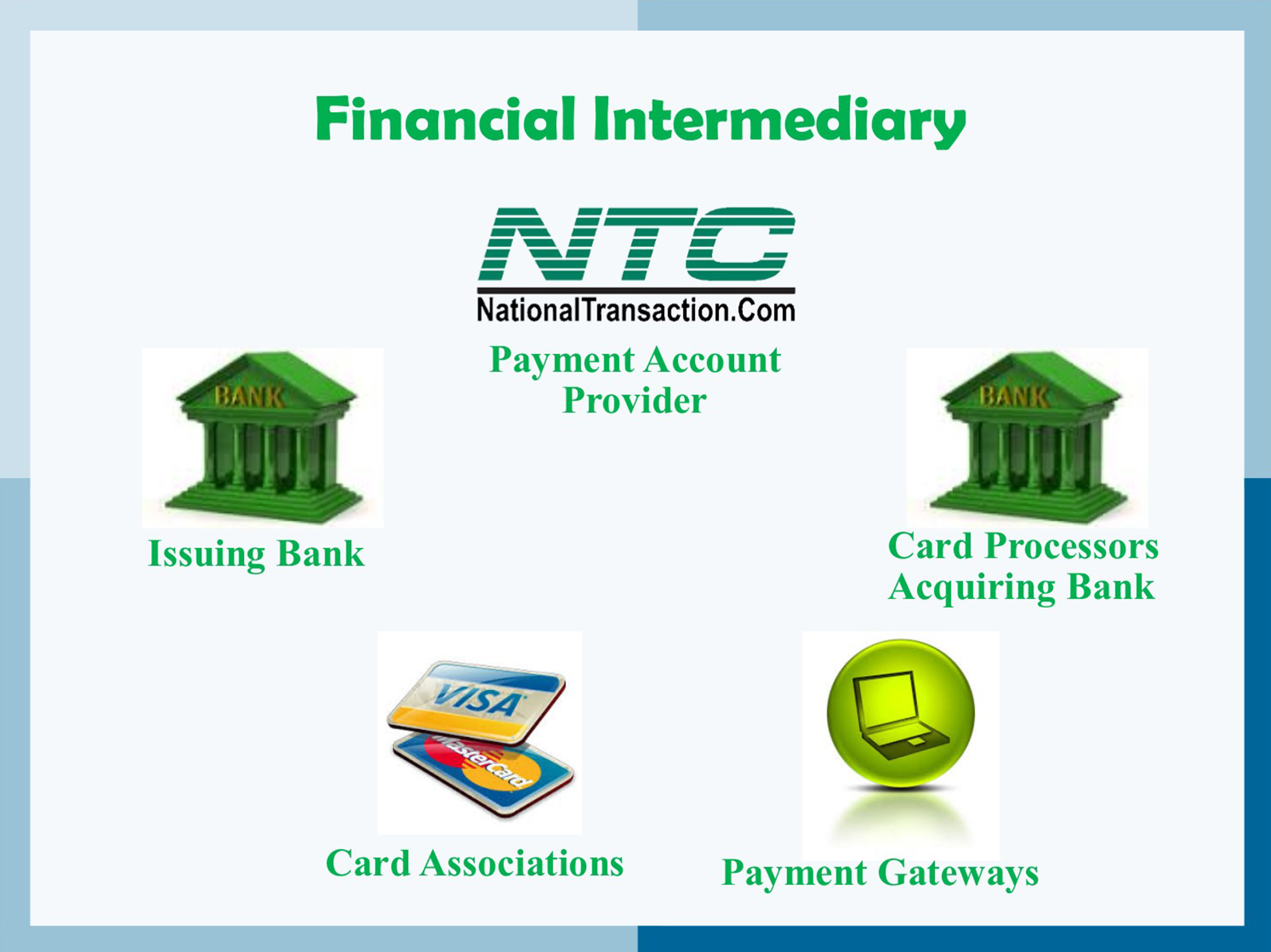

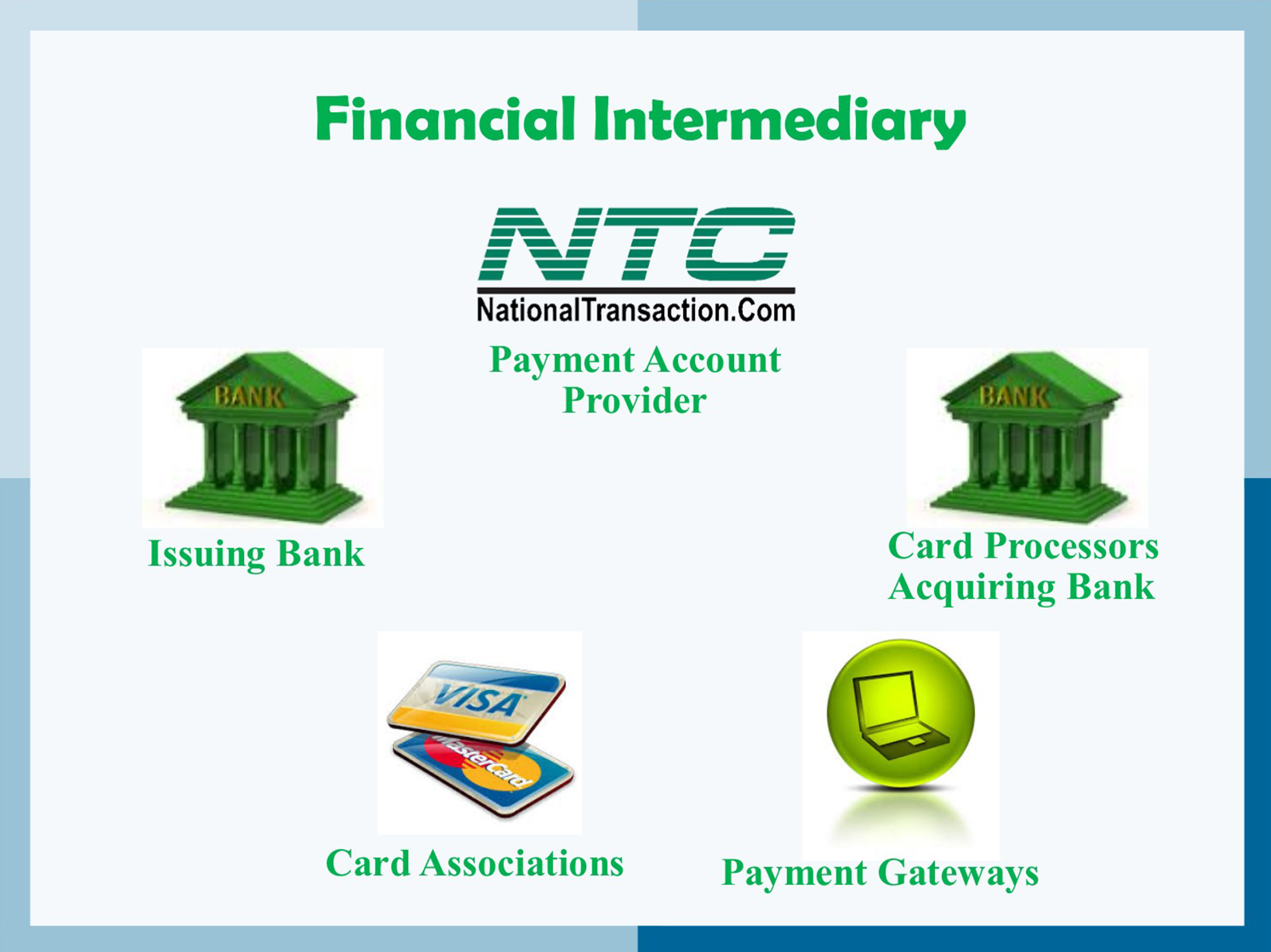

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

January 6th, 2017 by Elma Jane

Online fraud is not going away; hackers are becoming more sophisticated. While technology offer more avenues for consumers to pay, they also offer new ways for hackers to steal data.

There are several factors that increases the growth of online fraud:

EMV migration: because of EMV migration, fraud in face to face transactions becomes more difficult and moves to card-not-present transaction. This has been observed after EMV is implemented in other country.

Banking activity: it is moving online not only via online-only banks, but also mobile and online bank services.

An increase of online marketplaces: financial services pros are more proficient in identifying fraud compare to individual consumers who become sellers that can be victims of online fraud.

How can e-commerce and financial services companies reduce online fraud?

Merchants: Ensure that you have payment security. Fraudsters use sophisticated technologies, ask your payment provider for encryption and tokenization. You can also use BIN LookUp as an added security and number of benefits. Bin LookUp allows merchant or institution to check more about the transaction.

Online marketplaces: Marketplaces can protect their reputation by validating new sellers using sophisticated device and applying advanced models and machine learning to detect unusual patterns of activity that indicate misuse.

Banks: Fraudsters continue to innovate. Bank technology needs to be flexible and stay one step ahead.

For account set up or terminal upgrade call now 888-996-2273 or visit www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale Tagged with: banks, card-not-present, data, e-commerce, EMV, encryption, financial services, fraud, merchants, online, payment, provider, Security, terminal, tokenization, transactions

June 16th, 2016 by Elma Jane

Merchants and cardholders have been challenged by the perceived additional time to complete the EMV transaction.

To address concern over EMV checkout time Visa and MasterCard create an alternate EMV payment process that will improve the speed of transaction:

Quick Chip from Visa is available free-of-charge to acquiring banks, payment networks, and other payment processors to offer to merchants. The enhancement requires only a simple software update to the merchant’s card terminal or point-of-sale system.

M/Chip Fast from MasterCard merchants can easily integrate this with their current systems to provide both speed and security for all chip cards. Designed for select environments where fast transaction times, in addition to security, are at a premium.

The new card network options do not require the financial institution to reissue cards, or the merchants to re-certify their point-of-sale terminals.

Alignment in the payments industry and the ability to process a secure transaction in a timely manner for the consumer experience is important.

Keeping current on the payment industry news like Quick Chip and M/Chip Fast or discussion about EMV developments is a smart move for merchants and cardholder as well.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa Tagged with: banks, card, card network, cardholders, chip cards, EMV, financial institution, merchants, payment, payment networks, payment processors, payments industry, point of sale, Security, terminal, transaction

May 19th, 2016 by Elma Jane

Transaction laundering, the new face of payment fraud is increasing and getting popular in the world of e-commerce.

Studies revealed that there are as many as 6% to 10% of additional unauthorized e-commerce sites that banks may be processing without their consent or awareness. A digital version of money-laundering, engaging in illicit commerce while using legal means to get paid.

Transaction laundering is another form of money-laundering and it is illegal.

Detecting fraudsters are becoming a major challenge not only for banks but financial service organizations like payment service providers as well. There have been dozens of cases where legitimate-looking websites were caught selling illegal products.

Acquirers, banks, and other institutions focused on websites as the central of transaction laundering while the mobile era has opened up a new ground for scammers to operate in. They provide new opportunities for fraudsters to do their work by routing payments for illicit goods and services through their own legitimate front accounts.

Mobile wallet apps, NFC chips, and payment apps are some of the new ways payments are being collected. Not to mention opening up an on-line storefront using web tools, which anyone can do is very easy.

Micro-merchants expansion of doing business on-line and the greater reach they have now to mobile technology, business opportunities for scammers doing transaction laundering have never been better.

It is important for the industry to know what is happening, and how great the risks are. It’s a new challenge for the payments industry, learning and educating ourselves on those dangers is a priority.

Posted in Best Practices for Merchants Tagged with: banks, e-commerce, financial service, fraud, merchants, mobile technology, mobile wallet, nfc, payment, payment service providers, payments industry, transaction

April 26th, 2016 by Elma Jane

The PCI-DSS is a security standard for organizations that handle branded credit cards from the major card including Visa, MasterCard, Amex, Discover, and JCB. It is designed to ensure that ALL companies that process credit card information maintain a secure environment.

PCI applies to organization or merchant, that has a Merchant ID (MID), regardless of size or number of transactions, that accepts credit card.

Merchants will fall into one of the four merchant levels based on Visa transaction volume over a 12-month period.

| Merchant Level |

Description |

| 1 |

Any merchant — regardless of acceptance channel — processing over 6M Visa transactions per year. Any merchant that Visa, at its sole discretion, determines should meet the Level 1 merchant requirements to minimize risk to the Visa system. |

| 2 |

Any merchant — regardless of acceptance channel — processing 1M to 6M Visa transactions per year. |

| 3 |

Any merchant processing 20,000 to 1M Visa e-commerce transactions per year. |

| 4 |

Any merchant processing fewer than 20,000 Visa e-commerce transactions per year, and all other merchants — regardless of acceptance channel — processing up to 1M Visa transactions per year. |

Does is each location required to validate PCI Compliance for multiple business locations?

If a business locations process under the same Tax ID, then you are only required to validate once annually for all locations.

Penalties for non-compliance

The payment brands may fine an acquiring bank $5,000 to $100,000 per month for PCI compliance violations. The banks will pass this fine along until it eventually hits the merchant. The bank will also terminate your relationship or increase transaction fees.

PCI Compliance Manager

To help you achieve and report compliance, we have Trustwave PCI Compliance Manager. It’s an online portal that enables you to understand requirements that apply to your business, and guides you through your self-assessment, step by step.

If you have any questions regarding your PCI Compliance please call our office at 888-996-2273. We would be more than happy to help.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: banks, credit cards, merchant, PCI-DSS, Security, transactions

March 3rd, 2016 by Elma Jane

Apple and Samsung, Plus HCE, Lending Momentum to Contactless

EMV migration in the U.S. is helping to establish NFC since nearly all EMV terminals come with built-in NFC capability. Consumers worldwide will make mobile payments with their handsets using near-field communication this year, nearly 70% will be Apple Pay and Samsung Pay users.

Some banks were offering mobile wallets based on HCE. Banks have responded to HCE because its cloud configuration stores and manages payments information, bypassing the secure element in the phone. This allows banks to introduce tap-and-pay mobile-payments services quickly because it eliminates the need to negotiate terms with mobile carriers and device manufacturers to gain access to the secure element. Cloud-based credentials can be tokenized to protect from hackers. Tokenization and HCE combination is extremely attractive to banks.

Apple, Samsung and a cloud-based technology host card emulation are playing a big role in spreading contactless payments.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: banks, consumers, contactless, contactless payments, EMV, HCE, host card emulation, mobile, Mobile Payments, mobile wallets, Near Field Communication, nfc, payments, terminals, tokenization

February 8th, 2016 by Elma Jane

The U.S. House of Representatives voted to end the Obama administration’s Operation Choke Point.

The vote was 250-169, which represented a group of all Republicans and 10 Democrats voting to revoke the law.

Operation Choke Point, which began in 2013, leveraged the government’s regulatory power over merchant banks, acquirers and payment processors, forcing them to drop clients engaged in industries like payday lending, firearms and other high-risk sectors especially online like gambling and adult entertainment.

In a statement by U.S. House Rep. Luetkemeyer, the first step has been taken to ensure that federal banking agencies can no longer compel financial or payment institutions from offering financial services to licensed, legally-operating businesses that has been a target not because of potential wrongdoing, but purely on personal and political motivations and without due process.

Posted in Best Practices for Merchants Tagged with: acquirers, banks, financial services, merchant, payment, payment institutions, processors

February 5th, 2016 by Elma Jane

Businesses and banking institutions must require consumers to use other types of authentication methods, like biometrics, mobile verification codes and geo-location.

Merchants and banks can expect more hackers to breach customer accounts that rely only on usernames and passwords for online authentication.

This type of fraud will only grow more as hackers recognize and take advantage of the opportunity presented by on-file accounts protected by weak authentication.

Many online users use the same username and password for multiple accounts, once those credentials are compromised, criminals can use them to access accounts on different websites.

With the ease and simplicity of password vaults and safes that are easy and efficient to use and user education, this problem finds a solution.

A stronger authentication that goes far beyond username and password, is a powerful tool in effort to prevent data breaches.

Posted in Best Practices for Merchants Tagged with: banking institutions, banks, biometrics, consumers, customer, data, data breaches, fraud, merchants, mobile, online

December 18th, 2015 by Elma Jane

A leading provider of mobile point of sale and mobile payment technology, published today the EMV Migration Tracker.

Many merchants have deployed EMV capable terminals while cardholders have received cards with EMV chips, but not much data has been published about the real world use of EMV chip card technology in the U.S. Most published statistics rely on surveys or forecasts rather than real transactional data.

The EMV Migration Tracker shows new data and insights since the October 1 liability shift, including:

- Over 50% of all cards in use now have EMV chips on them. From October to November, the percent grew 5% as banks and card issuers accelerated their rollout of new chip cards.

- Over 83% of American Express cards have EMV chips, while Discover lags at 40%

- Over 63% of the cards used in Hawaii have EMV chips, but Mississippi sees just 11% penetration of chip cards.

While EMV chip card technology has been implemented in Europe years ago, the rollout of EMV in the U.S is just beginning. The rollout came earlier this year with the October 1 liability shift in card present transaction, meaning that merchants who have not upgraded their POS system can become liable for counterfeit card fraud losses that occur at their stores. This is an early step in an ongoing process that the Payments Security Task Force predicts will lead to 98 percent of U.S. credit and debit cards containing EMV chips by the end of 2017.

http://www.finextra.com/news/announcement.aspx?pressreleaseid=62506

Posted in Best Practices for Merchants Tagged with: American Express, banks, card issuers, card present, card technology, cardholders, chip cards, credit, data, debit, Discover, EMV, EMV chips, merchants, mobile payment, mobile point of sale, payment technology, point of sale, POS, provider