July 18th, 2017 by Elma Jane

1979 was a turning point in the credit card processing industry. Point of sale terminals emerged that year when Visa introduced a bulky electronic data capturing terminal which was the first payment credit card terminal.

In the same year, magnetic information stripe was added to the credit card which allowed card information to be captured electronically. Now Mag stripe was replaced by EMV (Europay, MasterCard and Visa) .

In 1994, the first version of the EMV was released and it became stable in 1998.

The United States started using the EMV Technology in 2014.

The future of payment will see Mobile payments, Electronic payments and Contactless payments like NFC (Near Field Communication) and smart cards, and is now taking over the traditional payment. Electronic Payment Technology will continue to evolve.

Posted in Best Practices for Merchants Tagged with: contactless, credit card, Electronic Data, electronic payment, EMV, mobile, nfc, payment, point of sale, terminals

August 2nd, 2016 by Elma Jane

Credit card machine or point of sale terminals are used for processing debit and credit card transactions and are often integrated into a Point of Sale System. Let’s take a look at the POS terminal evolution.

Manual Imprinters – although the process was time consuming and did not offer the speed or instant transfer capabilities, manual imprinters have been around since the start of a wide acceptance of credit cards. Manual imprinters are still widely used and are considered a great backup processing method.

Electronic Authorizations – Merchants had the choice of calling in for an authorization or imprinting their transactions. The first electronic credit card authorizations were done over the phone, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing a transaction over the phone,

Point of Sale Terminals: Point of sale terminals emerged in 1979, which was a turning point in the credit card processing industry. Visa introduced a bulky electronic data capturing terminal. This was the first of credit card machine or terminal as we know them today, it has greatly reduced the time required to process a credit card. MasterCharge became MasterCard in the same year and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement. Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: credit card, credit card machine, debit, electronic credit card, Electronic Data, EMV/chip, merchants, mobile, nfc, PIN, point of sale, POS, processing industry, terminals, transactions, visa

March 31st, 2016 by Elma Jane

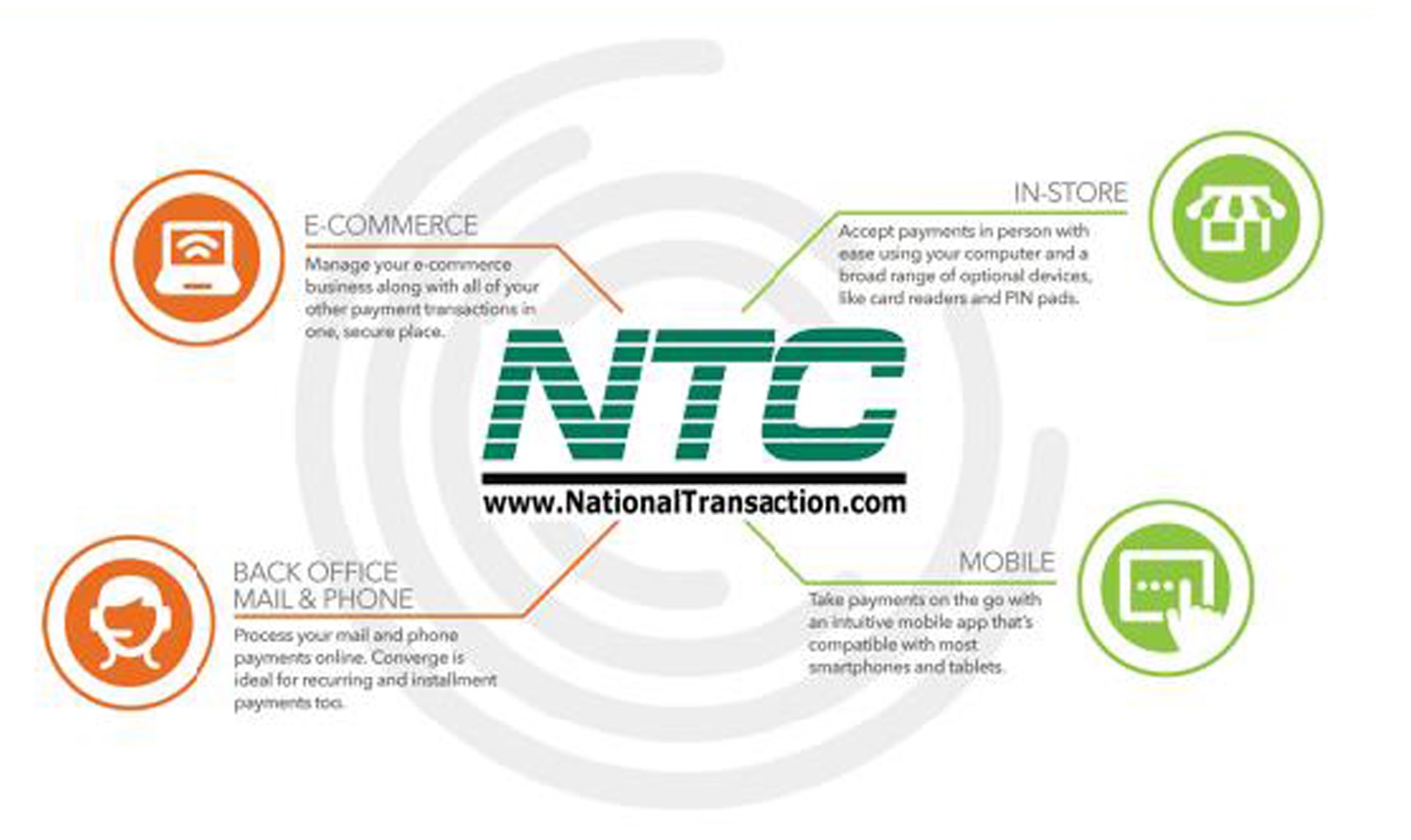

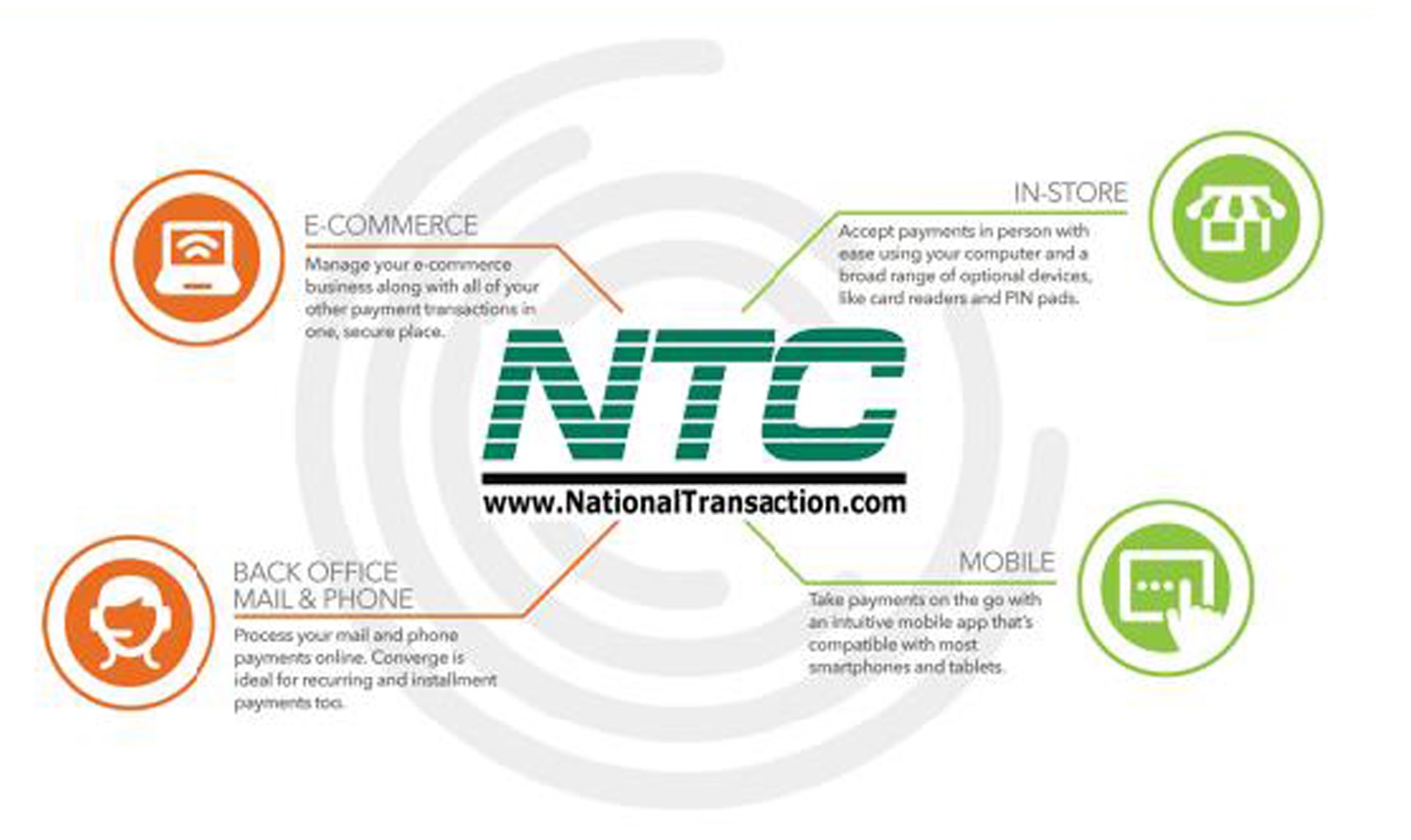

E-commerce – the process of using the Internet or computer networks in order to buy or sell information, services, or products.

Everyday people go on the Internet and make purchases for different products or services, just like they would in a store. The act of buying or selling over these networks allows for secure paperless transactions to happen electronically.

Electronic transactions have been around for quite some time involving business to business transactions over private networks in the form of EDI. Electronic Data Interchange (EDI), which was a transfer of electronic data from a computer to another computer and Electronic Funds Transfer (EFT), which was a transfer of money electronically from a computer to another in order to do business with each other.

Accepting online payments is very rewarding. If you’re new to e-commerce keep things simple check out our NTC e-Pay the NO SHOPPING CART E-Commerce Solution!

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: e-commerce, Electronic Data, electronic transactions, online payments, payments, transactions