Category: Payment Card Industry PCI Security

April 21st, 2015 by Elma Jane

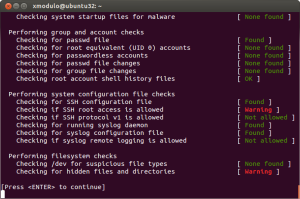

An advanced strain of malware called “Punkey,” is capable of attacking Windows point of sale terminals, stealing cardholder data and upgrading itself while hiding in plain sight.

Researchers from Security vendor Trustwave discovered the new strain. The investigation found compromised payment card information and more than 75 infected, and active, Internet Protocol addresses for Windows POS terminals.

Punkey poses a unique threat to payment networks, particularly because it also can download updates for itself.

If the malware author has a new feature it wants to add or updates to get rid of bugs, it actually pushes the malware down from the command and control server, revealed by Trustwave’s SpiderLabs research center. Punkey operates like a typical Botnet.

The malware hides inside of the Explorer process, which exists on every Windows device and manages the opening of individual program windows. Punkey scans other processes on the terminal to find cardholder data, which it sends to the control server.

The malware performs key logging, capturing 200 keystrokes at a time. It sends the information back to its server to store passwords and other private information.

A year ago, security vendors warned retailers against using Windows XP at the point of sale, since Microsoft stopped supporting Windows XP security patches. However, even Punkey is not attacking Windows due to any vulnerability in the systems, so even merchants with newer versions of Windows are at risk.

Punkey just runs like any Windows binary would. Even if the system is upgraded or a new system is put in place, criminals are still getting malware on the POS in other ways.

Many retailers use remote desktop support software, which fraudsters take advantage of, they steal a password and install malware like a technician would install any software.

While Punkey represents a more sophisticated POS malware than Trustwave has seen previously, merchants can still protect themselves through attention to basic security best practices.

Merchants should update antivirus and firewall protections, monitor the remote access software, establish two-factor authentication and check network activity daily for anything out of the ordinary. Unfortunately, many organizations have neither the expertise nor the manpower to perform these tasks.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Mobile Point of Sale, Payment Card Industry PCI Security, Point of Sale Tagged with: card, cardholder, cardholder data, data, Malware, Merchant's, payment, payment networks, point of sale, POS terminals, retailers, terminals

April 20th, 2015 by Elma Jane

With each year comes a new set of security risks businesses need to be aware of. The threats that have seen the most growth over the last year include point-of sale (POS) malware, malware traffic within secure and encrypted HTTPS websites and attacks on computer systems designed to control remote equipment.

Everyone knows the threats are real and the consequences are dire, so we can no longer blame lack of awareness for the attacks that succeed. Hacks and attacks continue to occur, not because companies aren’t taking security measures, but because they aren’t taking the right ones.

The large number of highly publicized POS breaches last year has heighted the need to make sure that businesses that use these devices are properly protecting them.

Malware targeting point-of-sale systems is evolving drastically, and new trends like memory scraping and the use of encryption to avoid detection from firewalls are on the rise. To guard against the rising tide of breaches, retailers should implement more stringent training and firewall policies, as well as reexamine their data policies with partners and suppliers.

For many years, businesses thought using a secure HTTPS Web connection protected them from a security breach. That no longer appears to be the case. While the increased number of businesses moving to a more secure Web protocol is a positive trend, hackers have identified ways to exploit HTTPS as a means to hide malicious code. Since the malware transmitted over HTTPS is encrypted, traditional firewalls fail to detect it.

Just as encryption can protect sensitive financial or personal information on the Web, it unfortunately can also be used by hackers to protect malware. One way organizations mitigate this risk is through SSL-based Web-browser restrictions, with exceptions for commonly used business applications to avoid slowing company productivity.

Several identified trends and predictions for the coming year, including the following:

Android will remain a main target for hackers. More sophisticated techniques will be developed to hinder Android malware researchers and users by making the malware hard to identify and research.

As wearable technology becomes more prevalent, expect to see malware start to target these devices.

Digital currencies, including Bitcoin, will continue to be targeted.

More organizations will enforce security policies that include two-factor authentication, which will likely increase the number of attacks on these technologies.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Payment Card Industry PCI Security, Point of Sale Tagged with: (POS) malware, Android, bitcoin, Digital currencies, point of sale, POS breaches, security breach, SSL-based Web-browser

October 23rd, 2014 by Elma Jane

The U.S. government will replace roughly 9 million government-issued payment cards with EMV chip-and-PIN versions early next year in a push to increase awareness and use of the more secure cards. Between 5 and 6 million prepaid debit cards used for issuing government payments, including Social Security and veterans benefits, will be reissued in January 2015. Another 3 million cards issued to federal government employees will also be replaced with EMV versions through the General Services Administration’s SmartPay program.

All the cards will be set up for Chip and PIN security as a U.S. government standard under the upgrade program, rather than the Chip and Signature approach required by Visa and MasterCard for most U.S. retailers starting late next year. However, there was no indication that the new cards will actually have the less secure magnetic data stripe removed.

Finding the right answers with the latest technologies to stop these cyber thieves and taking proactive and positive steps by adopting PIN and chip technology for government-issued debit and credit cards shows the importance of protecting financial transactions. While EMV is important, it’s not a total solution to the issue of data security.

POS devices at all federal agencies that accept retail payments will also be converted to accept EMV cards on a schedule set by the U.S. Treasury Dept. No timetable was given for the federal POS conversion.

The rollouts at four of the six largest U.S. retail chains will give a boost to EMV, which despite an October 2015 deadline has seen slow uptake among retailers. Under a mandate by Visa and MasterCard, retailers who experience credit or debit card fraud after next October but haven’t upgraded their POS equipment to accept EMV cards will be liable for the loss. If the bank that issued the card hasn’t upgraded it to EMV, the bank will take the loss.

But despite that October deadline, fewer than half of retailers’ POS terminals are expected to be able to accept EMV cards by the end of 2015, and barely half of U.S. payment cards will have been upgraded by then, according to the Payments Security Task Force, a banking industry group tracking EMV uptake.

The 9 million federally issued cards are a tiny fraction of the 1 billion credit and debit cards in use in the U.S., so the overall impact of accelerated EMV conversion is likely to be small. However, the Buy Secure initiative also explicitly includes a consumer-education component. Visa said it will spend $20 million in a public service campaign, and American Express said it will launch a $10 million program to help small merchants upgrade their POS terminals.

Small merchants are less likely to know about EMV than large retail chains, which have been making implementation plans for years.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security Tagged with: American Express, bank, Chip and PIN, chip and signature, credit cards, data security, debit card fraud, debit cards, EMV, emv cards, EMV conversion, financial transactions, magnetic data stripe, MasterCard, Merchant's, payment cards, Payments Security, POS conversion, POS devices, POS equipment, POS terminals, retail payments, visa

October 8th, 2014 by Elma Jane

When the PCI Security Standards Council (PCI SSC) launched PCI DSS v3.0 in January 2014, businesses were given one year to implement the updated global standard. Now that the deadline is fast approaching, interest is picking up in what v3.0 entails. On Jan. 1, 2015, version 3.0 of the Payment Card Industry (PCI) Data Security Standard (DSS) will reach year one of its three-year lifecycle.

Trustwave, a global data security firm, is on the frontlines of helping secure the networks of merchants and other businesses on the electronic payments value chain against data breaches. As an approved scanning vendor, Trustwave is used by businesses to achieve and validate PCI DSS compliance.

PCI DSS v3.0 is business as usual for the most part, except for a few changes from v2.0 that considers impactful for large swaths of merchants. The top three changes involve e-commerce businesses that redirect consumers to third-party payment providers. The expansion of penetration testing requirements and the data security responsibilities of third-party service providers.

Penetration testing

Penetration testing is the way in which merchants can assess the security of their networks by pretending to be hackers and probing networks for weaknesses. V3.0 of the PCI DSS mandates that merchants follow a formal methodology in conducting penetration tests, and that the methodology goes well beyond what merchants can accomplish using off-the-shelf penetration testing software solutions.

Merchants that are self assessing and using such software are going to be surprised by the rigorous new methodology they are now expected to follow.

Additionally, penetration testing requirements in v3.0 raises the compliance bar for small merchants who self assess. Those merchants could lower the scope of their compliance responsibilities by segmenting their networks, which essentially walls off data-sensitive areas of networks from the larger network. In this way merchants could reduce their compliance burdens and not have to undergo penetration testing.

Not so in v3.0. If you do something to try to reduce the scope of the PCI DSS to your systems, you now need to perform a penetration test to prove that those boundaries are in fact rigid.

Redirecting merchants

The new redirect mandate as affecting some, but not all, e-commerce merchants that redirect customers, typically when they are ready to pay for online purchases to a third party to collect payment details. If you are a customer and you are going to a website and you add something to your shopping cart, when it comes time to enter in your credit card, this redirect says I’m going to send you off to this third party.

The redirect can come in several forms. It can be a direct link from the e-commerce merchant’s website to another website, such as in a PayPal Inc. scenario, or it can be done more silently.

An example of the silent method is the use of an iframe, HTML code used to display one website within another website. Real Estate on the merchant’s website is used by the third-party in such a way that consumers don’t even know that the payment details they input are being collected and processed, not by the e-commerce site, but by the third party.

Another redirect strategy is accomplished via pop-up windows for the collection of payments in such environments as online or mobile games. In-game pop-up windows are typically used to get gamers to pay a little money to purchase an enhancement to their gaming avatars or advance to the next level of game activity.

For merchants that employ these types of redirect strategies, PCI DSS v3.0 makes compliance much more complicated. In v2.0, such merchants that opted to take Self Assessment Questionnaires (SAQs), in lieu of undergoing on-site data security assessments, had to fill out the shortest of the eight SAQs. But in v3.0, such redirect merchants have to take the second longest SAQ, which entails over 100 security controls.

The PCI SSC made this change because of the steady uptick in the number and severity of e-commerce breaches, with hackers zeroing in on exploiting weaknesses in redirect strategies to steal cardholder data. Also, redirecting merchants may be putting themselves into greater data breach jeopardy when they believe that third-party payment providers on the receiving end of redirects are reducing merchants’ compliance responsibilities, when that may not, in fact, be the case.

Service providers

Service provider is any entity that stores, processes or transmits payment card data. Examples include gateways, web hosting companies, back-up facilities and call centers. The update to the standard directs service providers to clearly articulate in writing which PCI requirements they are addressing and what areas of the PCI DSS is the responsibility of merchants.

A web hosting company may tell a merchant that the hosting company is PCI compliant. The merchant thought, they have nothing left to do. The reality is there is still always something a merchant needs to do, they just didn’t always recognize what that was.

In v3.0, service providers, specifically value-added resellers (VARs), also need to assign unique passwords, as well as employ two-factor authentication, to each of their merchants in order to remotely access the networks of those merchants. VARs often employ weak passwords or use one password to access multiple networks, which makes it easier for fraudsters to breach multiple systems.

The PCI SSC is trying to at least make it more difficult for the bad guys to break into one site and then move to the hub, so to speak, and then go to all the other different spokes with the same attack.

Overall, v3.0 is more granular by more accurately matching appropriate security controls to specific types of merchants, even though the approach may add complexity to merchants’ compliance obligations. On the whole a lot of these changes are very positive.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: (PCI SSC), call centers, cardholder data, consumers, credit-card, customers, data breaches, data security assessments, Data Security Standard, e-commerce breaches, e-commerce businesses, e-commerce merchant's website, electronic payments, global data security, global standard, Merchant's, merchant’s website, mobile, networks, payment, payment card data, Payment Card Industry, payment providers, PCI Security Standards Council, PCI-DSS, Penetration testing, Service providers, shopping cart, software solutions, web hosting, website

September 5th, 2014 by Elma Jane

Businesses are rapidly adopting a third-party operations model that can put payment data at risk. Today, the PCI Security Standards Council, an open global forum for the development of payment card security standards, published guidance to help organizations and their business partners reduce this risk by better understanding their respective roles in securing card data. Developed by a PCI Special Interest Group (SIG) including merchants, banks and third-party service providers, the information supplement provides recommendations for meeting PCI Data Security Standard (PCI DSS) requirement 12.8 to ensure payment data and systems entrusted to third parties are maintained in a secure and compliant manner.

Breach reports continue to highlight security vulnerabilities introduced by third parties as a leading cause of data compromise. The leading mistake organizations make when entrusting sensitive and confidential consumer information to third-party vendors is not applying the same level of rigor to information security in vendor networks as they do in their own. Per PCI DSS Requirement 12.8, if a merchant or entity shares cardholder data with a third- party service provider, certain requirements apply to ensure continued protection of this data will be enforced by such providers. The Third-Party Security Assurance Information Supplement focuses on helping organizations and their business partners achieve this by implementing a robust third-party assurance program.

Produced with the expertise and real-world experience of more than 160 organizations involved in the Special Interest Group, the guidance includes practical recommendations on how to:

Conduct due diligence and risk assessment when engaging third party service providers to help organizations understand the services provided and how PCI DSS requirements will be met for those services.

Develop appropriate agreements, policies and procedures with third-party service providers that include considerations for the most common issues that arise in this type of relationship.

Implement a consistent process for engaging third-parties that includes setting expectations, establishing a communication plan, and mapping third-party services and responsibilities to applicable PCI DSS requirements.

Implement an ongoing process for maintaining and managing third-party relationships throughout the lifetime of the engagement, including the development of a robust monitoring program.

The guidance includes high-level suggestions and discussion points for clarifying how responsibilities for PCI DSS requirements may be shared between an entity and its third-party service provider, as well as a sample PCI DSS responsibility matrix that can assist in determining who will be responsible for each specific control area.

PCI Special Interest Groups are PCI community-selected and developed initiatives that provide additional guidance and clarifications or improvements to the PCI Standards and supporting programs. As part of its initial proposal, the group also made specific recommendations that were incorporated into PCI DSS requirements 12.8 and 12.9 in version 3.0 of the standard.One of the big focus areas in PCI DSS 3.0 is security as a shared responsibility. This guidance is an excellent companion document to the standard in helping merchants and their business partners work together to protect consumers’ valuable payment information.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: banks, Breach, card, card data, cardholder, consumer, data, data security, Merchant's, networks, payment, payment card security, payment data, payment information, PCI, PCI-DSS, provider's, Security, Security Assurance, security standards, security standards council, Service providers, services

September 4th, 2014 by Elma Jane

EMV, which stands for Europay, MasterCard and Visa, and is slated to be mandated across the United States starting in October 2015 and automated fuel dispensers have until October 2017 to comply. Unlike magnetic swipe cards, EMV chip cards encrypt data and authenticate communication between the card and card reader. Additionally, chip card user is prompted for a PIN for authentication.

Why are those dates important? Companies lose $5.33 billion to fraud today, with card issuers and merchants incurring 63 and 37 percent of these losses, respectively. Under the EMV mandate, merchants who do not process chip cards will bear the burden of the issuer loss. By accepting chip card transactions, merchants and issuers should see a reduction in fraud.

Overcoming Barriers to EMV Adoption

Given the significant barriers to EMV adoption, it may be tempting for merchants to meet minimum requirements for accepting EMV payments. However, medium to large retailers should also consider the bigger picture of customer security and peace of mind.

Some key critical success factors for a payment initiative of this size include:

Business Continuity Architecture: As with all payment systems, it is imperative to have the EMV system running at all times. The solution should preferably have Active-Active architecture across multiple data centers and have a low Recovery Point Objective (the point in time to which the systems and data must be recovered after an outage).

Cost Benefit Analysis: Take a top down approach and decide accordingly on the scope of the analysis. This will ensure that decisions on scope are made on basis of quantitative data and not just qualitative arguments.

Phased Approach: To overcome time or cost overage in a project of this scope and complexity, retailers should try using an iterative approach for development. The rollout can be divided into multiple releases of six to seven months, which will provide the opportunity to review, capture lessons learnt, and improve subsequent releases.

Proactive Monitoring Alerts: Considering the criticality of business function carried out by EMV, tokenization and payment gateway, a vigorous supervising environment must be defined to perform proactive and reactive monitoring. It should take into consideration the monitoring targets, tools, scope and methods. This will provide advance visibility to the failure points and better ensuring maximum system availability.

Resilience Testing: Typically in a software project, the testing is limited to the unit, integration, performance and user acceptance. However, due to the critical nature of the applications and systems involved, robust resiliency testing is vital. This will ensure that there are no single points of failure and the system remains available when running in error conditions.

Stakeholder Identification: This is a key step to ensure that you have varied perspectives from all departments and their support. It will keep your organization from being blindsided and reduce the risk of disagreements in later stages of the program. Key stakeholders should include Store Operations, Card Accounting, Loss Prevention, Contact Center and IT & Data Security.

Organizations should adopt a five step approach to implement a secure, robust and industry-leading payment solution:

Encryption – Point to point encryption will ensure card data is secure and encrypted from the point of capture to the processor. Usually, merchants use data encryption that is not point to point, rendering their organization vulnerable to data breaches. Software encryption is the most common form of encryption, as it is easily installed and quires little or no hardware upgrades; however, it is less secure, may expose encryption keys, and is prone to memory scanning attacks. Hardware encryption is considered more secure but requires more costly terminal upgrades. Hardware encryption is designed to self-destruct the keys if tampered, but is not well-defined as very limited headway has been made in this space.

Tokenization – Build a Card Data Environment (CDE) that will host a centralized card data storage solution. Only limited applications with firewall access and capability to mutually authenticate via certificates can access CDE and receive card data. The rest of the applications will have tokens which are random numbers. This architecture will ease the merchant’s burden with existing and emerging PCI Data Security Standards.

Payment Gateway – Perform a risk assessment on the current payment gateway and identify gaps in functionality, manageability, compliance, scalability, speed to market and best practices. Determine the alternatives to mitigate the risks. Some of the important aspects of a leading payment gateway solution are support for all forms of credit, debit, gift cards and check transactions. Its ability to work with any acquirer, in-built encryption abilities, support for settlement and reconciliation must also be kept into consideration.

Settlement, Funding and Reconciliation – A workflow-based system to handle chargebacks and the automation of chargeback processing will greatly reduce labor-intensive work and enhance the quality of data used for settlement and reconciliation. Upgrades to the existing receipt retrieval system may be needed.

Card fraud is on the rise in the U.S., and merchants are the primary target for stealing information. With the EMV deadline just over a year away, the responsible retailer must take steps to prepare now. Although EMV implementation might seem overwhelming to merchants, they should start their journey to secure payments rather than wait for a looming deadline. Solutions such as data encryption and tokenization should be used in combination with EMV to implement a robust payment solution to better protect merchants against fraud. By proactively adopting EMV payment solutions, merchants can stay ahead of the regulatory curve and better protect their customers from fraud.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: authentication, automation, card, card data, Card Data Environment, card fraud, card issuers, card transactions, CDE, chargeback, chargeback processing, check, check transactions, chip, chip cards, credit, customer, customer security, data, data breaches, data encryption, data security, debit, EMV, emv chip cards, EuroPay, fraud, gateway, Gift Cards, host, integration, magnetic swipe cards, MasterCard, Merchant's, payment, payment gateway, payment solution, payment systems, PCI, PCI Data Security Standards, PIN, processor, retailers, Security, software, swipe, terminal, tokenization, tools, visa

August 28th, 2014 by Elma Jane

Merchants are still using pedestrian passwords that crooks can easily break, security company Trustwave has found. Of the nearly 630,000 stored passwords that Trustwave obtained during penetration tests in the past two years, its technicians were able to crack more than half in just a few minutes and 92% within 31 days. Even though adding new information about weak passwords or ongoing malware investigations gets frustrating because the same problems facing the financial and payments industries persist, it does not surprise Trustwave researchers. For a lot of software or hardware developers, their main concern is availability of the service. They want to make sure their POS is available and running to accept credit cards, often at the cost of a lot of security controls. It is difficult to implement security and to do it correctly.

Trustwave recommends longer passwords with more characters, rather than shorter ones with letters and numbers. A longer password that is a phrase not easily figured out is better than a shorter, complex password. These findings have been added to an online version of the 2014 Trustwave Global Security Report. To accommodate the fast changing nature of security threats, Trustwave is regularly updating its research and making the information available to consumers and payments industry stakeholders on the company’s site. The criminals stealing data are a constantly moving target. It no longer made sense for those interested in our research to have to wait a year to see new statistics. Having access to updated security reporting should be helpful to merchants. They can see how trends are tracking over time, instead of constantly having to go online to see what is relevant to them or rely on the trade groups to keep them informed. This provides one switch to keep them in the know, so there is some value there and it’s a smart move on Trustwave’s part. Since the new Payment Card Industry security requirements call for security measures to be embedded in software development lifecycles, there is some utility in Trustwave’s new approach to sharing research information.

Trustwave said the trend of businesses detecting breaches continues to rise, with 29% of businesses doing so in 2013 compared to only 9% in 2009. Trustwave compiled that data from 691 post-breach forensics investigations conducted in 2013. The report also indicated e-commerce breaches are increasing, with 54% of all breaches targeting e-commerce sites in 2013, compared to only 9% in 2010. More regions, including the U.S., being in various stages of converting to EMV chip-based cards for card-present transactions fuels the criminals’ shift to e-commerce fraud. Additionally, the company is working with law enforcement officials after discovering a control center of eight servers behind what is being called Magnitude, an exploit kit of Russian origin that has led to thousands of attacks and millions of attempted malware attacks globally.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security, Point of Sale Tagged with: breaches, card, card-present transactions, company, credit cards, data, e-commerce, EMV chip-based cards, financial, fraud, Global Security, hardware, industry, Malware, Merchant's, online, passwords, payment, Payment Card Industry security, payments, payments industries, POS, Security, servers, software

August 27th, 2014 by Elma Jane

Backoff malware that has attacked point of sale systems at hundreds of businesses may accelerate adoption of EMV chip and PIN cards and two-factor authentication as merchants look for ways to soften the next attack. Chip and PIN are a big thing, because it greatly diminishes the value of the information that can be trapped by this malware, said Trustwave, a security company that estimates about 600 businesses have been victims of the new malware. The malware uses infected websites to infiltrate the computing devices that host point of sale systems or are used to make payments, such as PCs, tablets and smartphones. Merchants can install software that monitors their payments systems for intrusions, but the thing is you can’t just have anti-virus programs and think you are safe. Credit card data is particularly vulnerable because the malware can steal data directly from the magnetic stripe or keystrokes used to make card payments.

The point of sale system is low-hanging fruit because a lot of businesses don’t own their own POS system. They rent them, or a small business may hire a third party to implement their own point of sale system. The Payment Card Industry Security Standards Council issued new guidance this month to address security for outsourced digital payments. EMV-chip cards, which are designed to deter counterfeiting, would gut the value of any stolen data. With this magnetic stripe data, the crooks can clone the card and sell it on the black market. With chip and PIN, the data changes for each transaction, so each transaction is unique. Even if the malware grabs the data, there not a lot the crooks can do with it. The EMV transition in the U.S. has recently accelerated, driven in part by recent highprofile data breaches. Even with that momentum, the U.S. may still take longer than the card networks’ October 2015 deadline to fully shift to chip-card acceptance.

EMV does not by itself mitigate the threat of breaches. Two-factor authentication, or the use of a second channel or computing device to authorize a transaction, will likely share in the boost in investment stemming from data security concerns. The continued compromise of point of sale merchants through a variety of vectors, including malware such as Backoff, will motivate the implementation among merchants of stronger authentication to prevent unauthorized access to card data.

Backoff has garnered a lot of attention, including a warning from the U.S. government, but it’s not the only malware targeting payment card data. It is not the types of threats which are new, but rather the frequency with which they are occurring which has put merchants on their heels. There is also an acute need to educate small merchants on both the threats and respective mitigation techniques.. The heightened alert over data vulnerability should boost the card networks’ plans to replace account numbers with substitute tokens to protect digital payments. Tokens would not necessarily stop crooks from infiltrating point of sale systems, but like EMV technology, they would limit the value of the stolen data. There are two sides to the equation, the issuers and the merchants. To the extent we see both sides adopt tokenization, you will see fewer breaches and they will be less severe because the crooks will be getting a token instead of card data.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Point of Sale Tagged with: access, account, account numbers, anti-virus programs, authentication, Backoff, card, card networks, chip, credit, Credit card data, credit-card, data, data breaches, devices, digital payments, EMV, magnetic stripe, Malware, Merchant's, Payment Card Industry, payments, PCs, PIN, PIN cards, point of sale, POS, POS system, programs, Security, security standards, Smartphones, software, system, tablets, tokenization, tokens, transaction, Trustwave, websites

August 19th, 2014 by Elma Jane

In response to the third-party threat, the PCI Security Standards Council has published a guide to help organizations and their business partners reduce risk by better understanding their respective roles in securing card data.

The Third-Party Security Assurance Information Supplement provides guidance practical recommendations to help businesses and their partners protect data, including:

Conduct due diligence and risk assessment when engaging third party service providers to help organizations understand the services provided and how PCI DSS requirements will be met for those services.

Develop appropriate agreements, policies and procedures with third-party service providers that include considerations for the most common issues that arise in this type of relationship.

Implement an ongoing process for maintaining and managing third-party relationships throughout the lifetime of the engagement, including the development of a robust monitoring program.

Implement a consistent process for engaging third-parties that includes setting expectations, establishing a communication plan, and mapping third-party services and responsibilities to applicable PCI DSS requirements.

One of the big focus areas in PCI DSS 3.0 is security as a shared responsibility. This guidance is an excellent companion document to the standard in helping merchants and their business partners work together to protect consumers’ valuable payment information.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: card, card data, consumers, data, Merchant's, payment, PCI, Service providers

June 24th, 2014 by Elma Jane

Compliance with a single set of regulations is often taxing enough, without other regulations causing a conflict, but this is exactly the situation that the insurance industry finds itself in with its contact centres.

PCI-DSS compliance insists that sensitive information in particular credit card numbers, must be protected and cannot be stored. However, the Financial Conduct Authority (FCA), the UK regulator for the financial services industry, demands that insurers keep sufficient detail of their transactions.

In insurance contact centres, FCA recommendations are met by recording calls. So in order to comply with PCI-DSS regulations, some contact centres simply pause recordings while the card information is read out, and resume recording once the payment process is complete. There’s a very big problem with this method, it undermines the very reason calls are recorded. The call recording is there to provide an unequivocal record of the circumstances under which the policy is granted. A gap in this record creates doubt. What was said during this time? If a customer is claiming a policy is mis-sold or they were misinformed in some way, a complete record to refute this claim no longer exists. Because of situations such as this, the insurance industry has an inherent dependence on contact centres and person-to-person interaction when selling policies, though in the process has to somehow comply with both regulations. But how? One way is to get the sensitive card information directly and securely to the bank’s payment gateway without storing it. Online, this is done quite easily, insurers can embed a secure payment page into a website and the customer can enter information securely that way. By phone a similar method can be used. A caller can input information directly on their telephone keypad and the tones are only transmitted to the credit card payment gateway not the contact centre. This solves the paradox of the conflicting regulations.

Insurance contact centres need to walk a very fine line, ensuring that they comply with all of the relevant regulations from multiple regulators – even those that, at first glance, contradict each other.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: (FCA), card information, compliance, contact centres, credit card payment, credit-card, customer, Financial Conduct Authority, financial services industry, insurance industry, payment gateway, payment process, PCI-DSS, phone, regulations, secure payment, taxing, telephone keypad, transactions, website