September 16th, 2014 by Elma Jane

Card-not-present merchants are battling increasingly frequent friendly fraud. That type of fraud..The I don’t recognize or I didn’t do it dispute. This occurs when a cardholder makes a purchase, receives the goods or services and initiates a chargeback on the order claiming he or she did not authorize the transaction.

This problem can potentially cripple merchants because of the legitimate nature of the transactions, making it difficult to prove the cardholder is being dishonest. The issuer typically sides with the cardholder, leaving merchants with the cost of goods or services rendered as well as chargeback fees and the time and resources wasted on fighting the chargeback.

Visa recently changed the rules and expanded the scope of what is considered compelling evidence for disputing and representing chargeback for this reason code. The changes included allowing additional types of evidence, added chargeback reason codes and a requirement that issuers attempt to contact the cardholder when a merchant provides compelling evidence.

The changes give acquirers and merchants additional opportunities to resolve disputes. They also mean that cardholders have a better chance to resolve a dispute with the information provided by the merchant. Finally, they provide issuers with clarity on when a dispute should go to pre-arbitration as opposed to arbitration.

Visa has also made other changes to ease the burden on merchants, including allowing merchants to provide compelling evidence to support the position that the charge was not fraudulent, and requiring issuers to a pre-arbitration notice before proceeding to arbitration, which reduces the risk to the merchant when representing fraud reason codes.

The new “Compelling Evidence” rule change does not remedy chargebacks but brings important changes for both issuers and merchants. Merchants can provide information in an attempt to prove the cardholder received goods or services, or participated in or benefited from the transaction. Issuers must initiate pre-arbitration before filing for arbitration. That gives merchants an opportunity to accept liability before incurring arbitration costs, and Visa will be using information from compelling evidence disputes to revise policies and improve the chargeback process

Visa made those changes to reduce the required documentation and streamline the dispute resolution process. While the changes benefit merchants, acquirers and issuers, merchants in particular will benefit with the retrieval request elimination, a simplified dispute resolution process, and reduced time, resources and costs related to the back-office and fraud management. The flexibility in the new rules and the elimination of chargebacks from cards that were electronically read and followed correct acceptance procedures will simplify the process and reduce costs.

Sometimes, an efficient process for total chargeback management requires expertise or in-depth intelligence that may not be available in-house. The rules surrounding chargeback dispute resolution are numerous and ever-changing, and many merchants simply do not have the staffing to keep up in a cost-effective and efficient way. Chargebacks are a way of life for CNP merchants; however, by working with a respected third-party vendor, they can maximize their options without breaking the bank.

Reason Code 83 (Fraud Card-Not-Present) occurs when an issuer receives a complaint from the cardholder related to a CNP transaction. The cardholder claims he or she did not authorize the transaction or that the order was charged to a fictitious account number without approval.

The newest changes to Reason Code 83, a chargeback management protocol, offer merchants a streamlined approach to fighting chargebacks and will ultimately reduce back-office handling and fraud management costs. Independent sales organizations and sales agents who understand chargeback reason codes and their effect on chargeback rates can teach merchants how to prevent chargebacks before they become an issue and successfully represent those that they can’t prevent.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: account, account number, acquirers, agents, Back Office, card, card holder, card-not-present, Card-not-present merchants, cardholder, cards, chargeback, chargeback fees, chargeback rates, cnp, CNP merchants, CNP transaction, fees, fraud, fraud management, Independent sales, independent sales organizations, issuer, management protocol, Merchant's, organizations, protocol, purchase, Rates, resolution, resolution process, resources, risk, sales agents, services, transaction, visa

September 11th, 2014 by Elma Jane

Online retailers are finding the bricks-and-clicks strategy to be an effective way to serve and engage shoppers. Perhaps that is why an increasing number of ecommerce merchants are setting up shop offline. It’s important to note, however, that a bricks-and-clicks business isn’t just about having a physical store and an ecommerce site. For this model to be effective, each channel must complement and add value to the other.

Guidelines to execute a bricks-and-clicks strategy:

Allow Access to Online Account Information in Physical Store

Bridge the gap between bricks and clicks by giving your customers and physical-store staff access to online account information. Doing so can enhance shopping experiences and drive sales.

Integrate Online and Offline Inventory, Fulfillment

Offer click-and-collect services that allow shoppers to buy merchandise online and pick it up at a local retail branch or service station. Many consumers would rather forgo the shipping costs and wait time and instead pick up their items at a time and place that’s convenient for them. Also, use your brick-and-mortar inventory when an item is out of stock online.

Use Online Data for Offline Selling, and Vice Versa

Data pertaining to online sales and traffic won’t just help you optimize your ecommerce site. It can also apply to offline decisions. For instance, if you see an increase in sales for a particular product on your website, you should consider promoting it offline, as well, to your brick-and-mortar shoppers.

Also pay attention to social media data such as Facebook likes and Pinterest pins. What’s trending on social sites can help with merchandising and marketing. Consider something similar in your brick-and-mortar business. Take note of the most liked, viewed, and pinned items online and then leverage that information when making decisions regarding product displays, inventory and more.

You can also use offline information to enhance your ecommerce site. Utilize in-store analytics tools, such as people counters and sensors, to better understand how your offline customers behave and then compare that with online behavioral data to spot patterns and opportunities.

Qualitative information, such as shoppers’ common questions and concerns, can also be used to improve your online shop. For instance, if your physical store associates keep getting the same questions about a particular product, there’s a good chance that online shoppers have similar queries. So you may want to include the answer in that item’s product description page.

Use Smartphone Beacons in Physical Stores

Beacons are Bluetooth-enabled devices that let brick-and-mortar merchants send customized offers and recommendations to their shoppers via their smartphones based on where the shoppers are in the store. For example, if a shopper is in the footwear department, the retailer can use its store beacons to send the shopper a coupon for shoes. Bricks-and-clicks businesses can also use the technology to send tailored offers to shoppers based on their online behavior.

Posted in Best Practices for Merchants Tagged with: account, Beacons, bluetooth, brick and mortar, business, consumers, coupon, customers, data, devices, ecommerce, Facebook, inventory, marketing, merchandising, Merchant's, Online Account Information, Online Data, pinterest, product, sales, shoppers, site, smartphone, social sites, store, website

September 5th, 2014 by Elma Jane

A cup of coffee, a pack of chewing gum., a newspaper at the airport. For even the smallest, most casual purchase, credit cards and debit cards are replacing cash as the preferred form of payment. One in three usually uses a credit card or a debit card for in-person purchases of less than $5. Eleven percent prefer credit cards, 22% debit cards and 65% cash, but the generational divide is striking. A slight majority (51 percent) of consumers 18-29 prefer plastic to cash, the only age group to do so. A preference for cash becomes stronger in each advancing age bracket, until at age 65-plus, 82 percent prefer cash.

Survey conducted by landline and cellphone found that: Credit cards and debit cards are used more frequently for small purchases by those employed full time (42%) or part time (34%) than for the unemployed (23%). People with children are more likely to use the cards for small purchases (41%) than those without children (30%), perhaps because parents have less time to wait around for change. Income doesn’t seem to be much of a differentiator, except for those near the bottom of the scale. A combined 38% of those making $75,000 or more preferred plastic for small purchases, compared with 43 percent of those making $50,000 to $74,900, 32% of those earning $30,000 to $49,900 and only 23% percent of those making less than $30,000.

Politically, we’ve finally found something on which we all can agree. Thirty percent of Democrats and a nearly identical 28% of Republicans favor credit cards or debit cards rather than cash for small purchases. Interestingly, those describing themselves as politically independent also were more independent from cash, 40% of them prefer plastic for such transactions.

The casual use of plastic is moving steadily through age brackets and already has a firm grip not only on millennials, but also increasingly on Gen Xers. Crunched another way, the data show that if you’re 49 or younger, you’re almost as likely to pay for a $5 purchase with plastic as you are to pay with cash. Fifty two percent prefer cash, 46% prefer debit or credit cards. Now, if you’re 50 or older, you’re still somewhat unlikely to pay for a $5 purchase with plastic. Seventy seven percent still prefer cash, with 21% reaching for debit cards or credit cards. Those who graduated from or attended college are significantly more comfortable than others with using plastic for small purchases.

A combined 39% of those with college degrees prefer debit cards (21%) or credit cards (18%) over cash (59%). Only 16% of those who have not attended college usually use debit cards for purchases of less than $5, along with only 6 percent who prefer credit cards for that purpose.

The trend is clear. Regardless of some differences in magnitude based on demographic factors, plastic is replacing cash as the currency of choice even for small purchases. Plastic use will increase for small purchases, both for debit and credit cards.

Why the shift to cards There are many reasons:

Technological advancements at the point of sale have made it just as fast to pay by plastic as by cash. Rewards have become a common feature of credit cards, with two out of three credit cards offering rewards, encouraging rewards chasing. Debit cards, with their balances available instantly and online have largely replaced paper checks and tedious manual records.

Financial institutions have spent decades persuading consumers to use and merchants to accept cards universally. Small purchases represent particularly appropriate uses of a debit card, assuming you don’t get carried away and overdraw the card-linked bank account. Why keep going to the bank and then carry cash if you don’t have to? Moving away from cash and moving toward using cards for even small purchases is more convenient.

Debit cards are everywhere already, but because their use can’t be reported to the credit bureaus and thus, they don’t build credit, they should only be used as a matter of convenience. People who frequently use credit cards for small, casual purchases also could overdo it, but probably not to a great degree. It would take a lot of lattes to send someone into credit counseling or bankruptcy court. In truth, we like the idea of using credit cards frequently for small, manageable expenses. This gives users the benefit of an active credit history, but leaves them with monthly bills that are small enough to pay off in full, so they don’t have to pay any interest. It’s getting to the point where, if I’m out and about, I’m using plastic the whole time. It’s just so much easier.

Posted in Best Practices for Merchants Tagged with: account, bank, bank account, bankruptcy, bills, cards, cash, cellphone, credit, credit counseling, credit history, data, debit cards, financial, financial institutions, Merchant's, payment, transactions

August 29th, 2014 by Elma Jane

High risk credit card processing is electronic payment processing for businesses deemed as HIGH RISK by the MERCHANT SERVICES INDUSTRY

The high risk segment of payment processing has become more important as banks and ISO’s have begun to tighten up their credit restrictions and underwriting policies. Businesses are classified as high risk primarily because of their product or service and the way they go to market. In merchant services, risk is related to CHARGEBACKS or customer disputes.

The more likely a business to have chargebacks, the higher risk the business. For instance, online businesses selling a weight loss product through a free trial offer, is more likely to have chargebacks than a retail store selling the same weight loss product.

Merchants are often unaware their business falls into the high risk category when they first start shopping for a merchant account. Getting a high risk merchant account can be difficult.

These providers have more stringent requirements and the application process is longer compared to traditional merchant account providers.

High risk businesses should expect to pay higher rates and fees for payment processing services. As a general rule of thumb, merchants should count on paying at least more than a traditional merchant account. Most high risk merchant accounts also require a contract of at least 18 months, whereas low risk providers offer accounts without cancellation fees or contracts.

ROLLING RESERVES are also a big part of high risk credit card processing. Most high risk merchants have some sort of rolling reserve placed on the account, especially new accounts without any processing history. A Reserve refers to an account where a percentage of the funds from transactions are held in reserve to cover against any chargebacks or fees that the processor may not be able to collect from the merchant. This is similar to a security deposit, but merchants don’t have to pay it up front. Reserves are a pain point for many small high risk merchants, but they are definitely necessary and without them, processors would not accept any high risk merchants at all.

What Businesses Are High Risk?

As mentioned earlier, businesses are usually classified as high risk due to the product or service they offer, however merchants with severely damaged credit or a recent bankruptcy can also be considered high risk. Below are just of the few common high risk merchant categories:

Adult Websites

Cigars & Pipe Tobacco Online

Collection Agencies

Credit Repair

Debt Consolidation

E-Books & Software

Electronic Cigarettes

Firearms – Online

High Ticket & High Volume

Medical Marijuana Dispensaries

Multi Level Marketing & Business Opportunities

Nutraceuticals like weight loss supplements, cleansers etc.

Penny Auctions

Sports Betting Advice

Ticket Brokers – Online Tickets

TMF Merchants

Travel & Timeshare

Unfortunately this list is growing and some credit card processing companies even classify any start up Internet business, that doesn’t have extensive financials to be high risk. With the recent economic recession in the United States, there has been an increase in these start up Internet ventures. People are either looking to supplement their income or start their own business instead of looking for work.

How To Protect Your Business

Accepting credit cards is the single most important part of most online businesses. Unfortunately, many successful businesses go under after having their merchant account shut down. High risk merchants should always be cognizant of their merchant account and pay attention to chargeback percentages. Below are some tips for high risk merchants looking for payment processing solutions.

Be Upfront: Make sure your processor knows exactly what you sell and how you market the product/service. If they don’t accept your business type, keep shopping for a new merchant account provider. Many merchants will try to fly under the radar by not revealing all their products or fully disclose their marketing methods to the processor. This is a bad move, the processor will eventually find out the details about your business. This is usually from doing an audit on your transactions and contacting your customers.

Negotiate Every 3 Months: Credit card processing companies underwrite applications based on previous processing history. If there is no previous history, the account is riskier and the terms offered are usually more expensive and restrictive. You can always re-negotiate your rates, reserves and other contract terms with your current processor. Once they have 3 months of history to evaluate, they may be able to offer you a better deal. Three months of history is the magic number for most processors. If you applied without the previous history and were declined, there is a chance the same processor will approve your application if you provide 3 months of previous statements.

Prepare For The Worst: All high risk merchants should keep at least 2 active merchant accounts, from different providers. You never know when underwriting guidelines might change, or you may have an influx of chargebacks. Having a backup account or even multiple back up accounts is a good idea. Many high risk providers offer a load balancing gateway, which allows for multiple merchant accounts to be integrated into one payment gateway. This way you can spread transactions across multiple accounts, through one shopping cart/gateway.

Posted in Best Practices for Merchants Tagged with: account, account providers, accounts, banks, card, chargebacks, contract, credit, credit card processing, credit restrictions, customer, customers, deposit, electronic payment, fees, financials, gateway, High risk credit card, High Ticket & High Volume, ISOs, low risk, marketing, merchant, merchant account, merchant services, multiple accounts, payment gateway, payment processing, processing services, processing solutions, processor, product, Rates, reserves, retail store, risk, ROLLING RESERVES, Security, security deposit, service, shopping cart, statements, terms, TMF Merchants, transactions, travel, underwriting

August 27th, 2014 by Elma Jane

Backoff malware that has attacked point of sale systems at hundreds of businesses may accelerate adoption of EMV chip and PIN cards and two-factor authentication as merchants look for ways to soften the next attack. Chip and PIN are a big thing, because it greatly diminishes the value of the information that can be trapped by this malware, said Trustwave, a security company that estimates about 600 businesses have been victims of the new malware. The malware uses infected websites to infiltrate the computing devices that host point of sale systems or are used to make payments, such as PCs, tablets and smartphones. Merchants can install software that monitors their payments systems for intrusions, but the thing is you can’t just have anti-virus programs and think you are safe. Credit card data is particularly vulnerable because the malware can steal data directly from the magnetic stripe or keystrokes used to make card payments.

The point of sale system is low-hanging fruit because a lot of businesses don’t own their own POS system. They rent them, or a small business may hire a third party to implement their own point of sale system. The Payment Card Industry Security Standards Council issued new guidance this month to address security for outsourced digital payments. EMV-chip cards, which are designed to deter counterfeiting, would gut the value of any stolen data. With this magnetic stripe data, the crooks can clone the card and sell it on the black market. With chip and PIN, the data changes for each transaction, so each transaction is unique. Even if the malware grabs the data, there not a lot the crooks can do with it. The EMV transition in the U.S. has recently accelerated, driven in part by recent highprofile data breaches. Even with that momentum, the U.S. may still take longer than the card networks’ October 2015 deadline to fully shift to chip-card acceptance.

EMV does not by itself mitigate the threat of breaches. Two-factor authentication, or the use of a second channel or computing device to authorize a transaction, will likely share in the boost in investment stemming from data security concerns. The continued compromise of point of sale merchants through a variety of vectors, including malware such as Backoff, will motivate the implementation among merchants of stronger authentication to prevent unauthorized access to card data.

Backoff has garnered a lot of attention, including a warning from the U.S. government, but it’s not the only malware targeting payment card data. It is not the types of threats which are new, but rather the frequency with which they are occurring which has put merchants on their heels. There is also an acute need to educate small merchants on both the threats and respective mitigation techniques.. The heightened alert over data vulnerability should boost the card networks’ plans to replace account numbers with substitute tokens to protect digital payments. Tokens would not necessarily stop crooks from infiltrating point of sale systems, but like EMV technology, they would limit the value of the stolen data. There are two sides to the equation, the issuers and the merchants. To the extent we see both sides adopt tokenization, you will see fewer breaches and they will be less severe because the crooks will be getting a token instead of card data.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Point of Sale Tagged with: access, account, account numbers, anti-virus programs, authentication, Backoff, card, card networks, chip, credit, Credit card data, credit-card, data, data breaches, devices, digital payments, EMV, magnetic stripe, Malware, Merchant's, Payment Card Industry, payments, PCs, PIN, PIN cards, point of sale, POS, POS system, programs, Security, security standards, Smartphones, software, system, tablets, tokenization, tokens, transaction, Trustwave, websites

August 25th, 2014 by Elma Jane

Let’s talk about success stories of the people who worked with National Transaction and made it big in this field. One great story that we have is about Big Daddy. I named this guy Big Daddy, because of the great success that he made in this industry. Big Daddy was a Physical fitness trainer with an outgoing personality before he joined National Transaction. He gained knowledge about the card industry and build a good working relationship with NTC’s President Mr. M. Together, they secure a relationship with several associations and negotiated a deal. Now, they were able to partner with a high risk account. While these associations continue to profit from the relationship, Big Daddy took 3 years off. These associations assist merchants become more profitable and is the leading global advocate for travel agents, the travel industry and the traveling public, also the world’s largest association of travel professionals. National Transaction has been ASTA member and a partner since then for almost 10 years now. As Big Daddy broaden his knowledge and skills about the industry, he started to build his own portfolio which gave him the ability to form his residual income. As of this date, he averages $30,000 monthly with National Transaction, while running his own business. If Big Daddy made it, then other Sales Representatives can make it bigger too. With the right company to work with like National Transaction, right tools and full support from our Team and Customer Service your on the right track, so why not make a move??? Start building your portfolio and give it a shot or if you already have one, work it out. You will never know. In all labor there is a profit.

Posted in nationaltransaction.com Tagged with: account, ASTA, card, card industry, customer service, high risk account, Merchant's, National Transaction, residual, residual income, sales, travel, travel agents

August 8th, 2014 by Elma Jane

Visa Inc., the global leader in payments, is helping U.S. fuel retailers prevent credit and debit card fraud at the pump with intelligent analytics that identify higher-risk transactions that may be fraudulent. Visa Transaction Advisor uses sophisticated analytics based on the breadth and scale of VisaNet data to flag the riskiest transactions by working with fuel companies to understand their needs, creating a new service that builds on Visa’s predictive analytics capabilities, providing fuel merchants with more intelligence to prevent fraud and improve their bottom line. While global fraud rates across the Visa payment system remain near historic lows, less than 6 cents for every $100 transacted – fuel pumps can be targets for criminals because they are often self-service terminals. The new solution, Visa Transaction Advisor (VTA), enables merchants to use real-time authorization risk scores to identify transactions that could involve lost, stolen or counterfeit cards. A pilot test of the new service showed a 23 percent reduction in the rate of fraudulent transactions – all without costly infrastructure upgrades or disruption of the customer experience.

How It Works

After a cardholder inserts the card at the pump, Visa analyzes multiple data sets such as past transactions, whether the account has been involved in a data compromise and nearly 500 other pieces of data to create a risk score. This allows merchants to identify those transactions with a higher risk of fraud and perform further cardholder authentication before gas is pumped. The time and costs associated with resolving fraudulent transactions can be substantial for both merchants and financial institutions and inconvenient for cardholders, which is one of the reasons why fraud prevention is critical. Visa’s solution is easy to implement, using existing message fields and formats as well as pump software or hardware to ensure minimal impact to merchants and acquirers. Several fuel merchants who piloted the technology over the last several months noticed a decrease in fraud, without negatively impacting their consumers’ experience. VTA as a tool help mitigate fraudulent transactions. A 23 percent reduction in the rate of fraudulent chargebacks during a pilot program in Los Angeles. This was done with minimal impact to the customer experience, making secure payment at the pump as convenient as possible. Providing fuel to millions of customers each month through approximately 15,000 service stations in the United States, said US Credit Card Operations Manager, from Shell, considering new solutions and technology it has to have a clear business benefit, be customer-centric and easy to implement. With no infrastructure investment, testing VTA as part of proactive fraud prevention tool-set to better identify fraudulent card activity earlier in the transaction cycle, without inconveniencing customers.

Visa Transaction Advisor is available to merchants through participating U.S. acquirers. Visa has partnered with Vantiv and is also working with other acquirers to offer the service to its fuel clients. Ease of implementation is a critical requirement whenever talking about a new merchant service. Visa Transaction Advisor builds on existing payment infrastructure, is easy to implement and flexible enough to allow customization by merchants.

Posted in Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: account, acquirers, analytics, authorization, card, cardholder, counterfeit cards, credit, Credit Card Operations, customer, data, debit, financial institutions, fraud, higher-risk transactions, Merchant's, payments, Rates, retailers, terminals, transactions, visa, Visa payment, Visa Transaction, Visa Transaction Advisor, VisaNet, VTA

June 19th, 2014 by Elma Jane

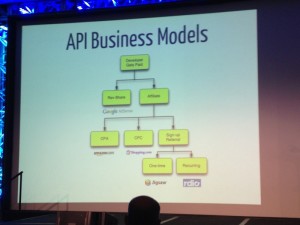

API Software Inc. has created an application ISOs can use to help merchants tabulate the best payment services deals. The Square Deal Pro app for the merchant services industry enables sales reps to compare their company’s rates to those of Square, PayPal, Stripe and other payments aggregators. Essentially, the application takes the mathematics burden off of the merchant and helps an ISO or agent compare bundled pricing with interchange-plus pricing.

Frank Haggar, a software developer, started asking merchants why they chose a certain provider and they just said the pricing was simpler. It might be more expensive, but it was easier for them to understand. That moved to develop Square Deal Pro. It’s a software that salespeople can have right on their phones and it makes a comparison and is easy to understand. Square Deal Pro, which operates on iPhones, Android devices and Windows phones, was established as a vendor-neutral tool that is also available for merchants to download if they were inclined to want to crunch numbers themselves. Service providers pay for the application and all of its sales features, but a free version for price comparisons only is available to merchants.

Merchants are experts in what they know how to do and they may not want something that includes math distracting them from that, but the sales rep can do it for them and use it along the lines of a calculator helping someone figure out mortgage rates. ISOs have various tools at their disposal and lock in key information in their brains to prepare for sales presentations, but most will likely find Square Deal Pro a valuable addition. Something that takes complicated pricing schemes and factors it all into an easy interface that puts out a clear comparison that is valuable, certainly out in the field.

API Software has to deliver something difficult or impossible to copy because that would set this permanently apart as opposed to being a lead to other similar products in the market. An ISO can change rates or make adjustments for a client if the numbers show that another provider is offering a less expensive option, but the numbers in the app don’t lie. The app will show how a bundled rate can work in your favor, such as if you are selling Girl Scouts cookies at $3 a box. Then use Square all day long, but an ISO can compare how his product works compared to others and the app can show, that at a certain time, it might be beneficial to switch over.

Square Deal Pro takes into account factors other than interchange rates, including merchant volume, average ticket price and whether transactions are keyed or swiped or both. All of those things determine where you fit in on the diagram of how your rate should be structured. There is a lot of analysis on minimal focal points. The application may also help defuse potential problems with merchants who sometimes feel their sales rep was not providing a fair assessment of pricing structure or comparisons.

As for the application’s name, Haggar doesn’t want any confusion over whether this might be a new Square product.

Posted in Best Practices for Merchants Tagged with: account, aggregators, Android, assessment, bundled pricing, developer, devices, interchange, interchange rates, interchange-plus pricing, iPhones, ISOs, market, merchant services, merchant volume, Merchant's, mortgage rates, payment, PayPal, phones, pricing, Pro app, products, provider, Rates, sales, Service providers, software, Square, Square Deal Pro app, Stripe, transactions, Windows phones

May 12th, 2014 by Elma Jane

Let’s talk about success stories of the people who worked with National Transaction and made it big in this field. One great story that we have is about Big Daddy. I named this guy Big Daddy, because of the great success that he made in this industry. Big Daddy was a Physical fitness trainer with an outgoing personality before he joined National Transaction. He gained knowledge about the card industry and build a good working relationship with NTC’s President Mr. M. Together, they secure a relationship with several associations and negotiated a deal. Now, they were able to partner with a high risk account. While these associations continue to profit from the relationship, Big Daddy took 3 years off. These associations assist merchants become more profitable and is the leading global advocate for travel agents, the travel industry and the traveling public, also the world’s largest association of travel professionals. National Transaction has been ASTA member and a partner since then for almost 10 years now. As Big Daddy broaden his knowledge and skills about the industry, he started to build his own portfolio which gave him the ability to form his residual income. As of this date, he averages $30,000 monthly with National Transaction, while running his own business. If Big Daddy made it, then other Sales Representatives can make it bigger too. With the right company to work with like National Transaction, right tools and full support from our Team and Customer Service your on the right track, so why not make a move??? Start building your portfolio and give it a shot or if you already have one, work it out. You will never know. In all labor there is a profit.

Posted in nationaltransaction.com Tagged with: account, ASTA, card, card industry, customer service, high risk account, Merchant's, National Transaction, residual, residual income, sales, travel, travel agents

April 18th, 2014 by Elma Jane

Capital One joins existing stakeholders equally owned by Bank of America, JPMorgan Chase, and Wells Fargo. Member-owner of the ClearXchange network.

Capital One has taken a stake in ClearXchange, the US bank-backed clearing house for person-to-person online payments transfer.

ClearXchange is the first network in the U.S. created by banks that lets customers send and receive (P2P) person-to-person payments easily and securely using an email address or mobile number.

With only the recipient’s mobile number or email address, the ClearXchange network enables customers to send funds directly from their bank account to the recipient’s bank account without the need to pass on more sensitive account information.

EVP of digital at Capital One, says partnering with clearXchange is another way of bringing safe and secure payments through convenient, digital channels to their customers.

With membership open to banks and credit unions of all sizes, ClearXchange has so far signed up only FirstBank as its sole non-owner participant, although it nonetheless claims to represent more than 50 percent of the consumer online banking market.

Posted in Credit card Processing, Electronic Payments, Merchant Services Account, Mobile Payments, Payment Card Industry PCI Security, Small Business Improvement, Smartphone, Visa MasterCard American Express Tagged with: account, bank account, Bank of America, Capital One, consumer online banking, digital channels, JP Morgan, market, mobile, online payments transfer, p2p, payments, person-to-person, secure payments, securely, U.S. Bank, US Bank, Wells Fargo