November 2nd, 2015 by Elma Jane

Delivering Paperless, Next-Day Deposits for Health Insurance Payments.

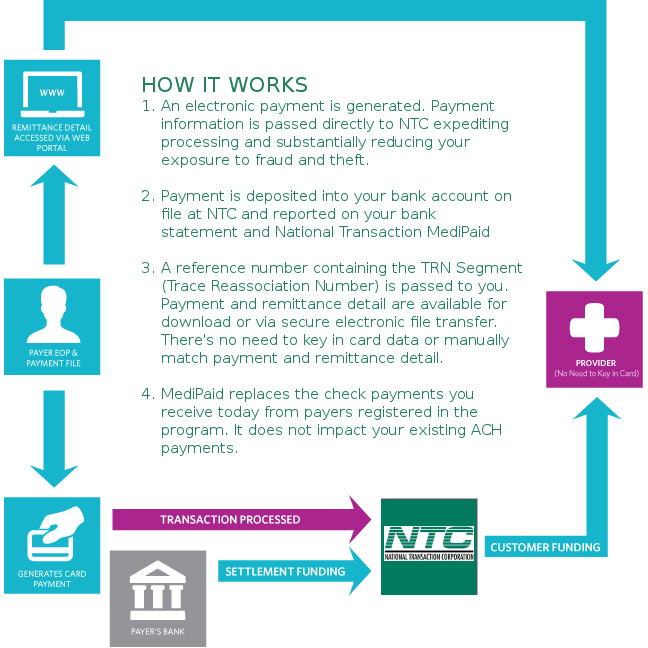

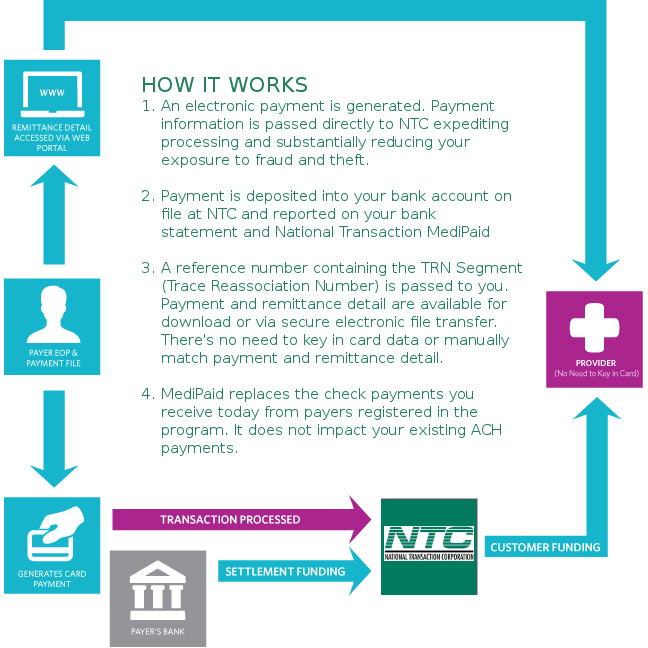

NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance payments. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: checking account, credit card, electronic payments, health insurance, healthcare provider's, medical insurance, MediPaid, merchant accounts, payments, provider's

April 6th, 2015 by Elma Jane

Merchant Cash Advance – A lump-sum payment to a business in exchange for an agreed-upon percentage of future credit card and/or debit card sales. The term is now commonly used to describe a variety of small business financing options characterized by short payment terms (generally under 24 months) and small regular payments (typically paid each business day) as opposed to the larger monthly payments and longer payment terms associated with traditional bank loans.

Merchant Cash Advance companies, provide funds to businesses in exchange for a percentage of the businesses daily credit card income, directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed variable percentage of a merchant’s future credit card sales.

The Term Merchant Cash Advance – may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring or short-term business loans.

This structure has some advantage over the structure of a conventional loan. Most importantly, payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital. Also, because MCA providers like typically give more weight to the underlying performance of a business who may not qualify for a conventional loan.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans, and are generally more expensive than bank loans. Competition and innovation led to downward pressure on rates and terms are now more closely correlated with an applicant’s FICO score.

There are generally three different repayment methods:

Split withholding – when the credit card processing company automatically splits the credit card sales between the business and the finance company per the agreed portion. The most common preferred method of collecting funds for both the clients and finance companies since it is seamless.

Lock box or trust bank account withholding – all of the business’s credit card sales are deposited into bank account controlled by the finance company and then the agreed upon portion is forwarded onto the business via ACH, EFT or wire. The least preferred method since it results in a one-day delay in the business receiving the proceeds of their credit card sales.

ACH withholding – when structured as a sale, the finance company receives the credit card processing information and deducts its portion directly from the business’s checking account via ACH. When structured as a loan, the finance company debits a fixed amount daily regardless of business sales.

Posted in Best Practices for Merchants, Financial Services, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account Tagged with: ach, bank loans, business loans, checking account, conventional loan, credit card processing, credit card sales, credit-card, debit card, finance company, loan, MCA providers, merchant, merchant cash advance, payments

March 17th, 2015 by Elma Jane

Merchant Cash Advance – A lump-sum payment to a business in exchange for an agreed-upon percentage of future credit card and/or debit card sales. The term is now commonly used to describe a variety of small business financing options characterized by short payment terms (generally under 24 months) and small regular payments (typically paid each business day) as opposed to the larger monthly payments and longer payment terms associated with traditional bank loans. The term Merchant Cash Advance may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring or short-term business loans.

Merchant Cash Advance companies, provide funds to businesses in exchange for a percentage of the businesses daily credit card income, directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed variable percentage of a merchant’s future credit card sales.

These Merchant Cash Advances are not loans – rather, they are a sale of a portion of future credit and/or debit card sales.

This structure has some advantage over the structure of a conventional loan. Most importantly, payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital. Also, because MCA providers like typically give more weight to the underlying performance of a business who may not qualify for a conventional loan.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans, and are generally more expensive than bank loans. Competition and innovation led to downward pressure on rates and terms are now more closely correlated with an applicant’s FICO score.

There are generally three different repayment methods:

Split withholding – when the credit card processing company automatically splits the credit card sales between the business and the finance company per the agreed portion. The most common preferred method of collecting funds for both the clients and finance companies since it is seamless.

Lock box or trust bank account withholding – all of the business’s credit card sales are deposited into bank account controlled by the finance company and then the agreed upon portion is forwarded onto the business via ACH, EFT or wire. The least preferred method since it results in a one-day delay in the business receiving the proceeds of their credit card sales.

ACH withholding – when structured as a sale, the finance company receives the credit card processing information and deducts its portion directly from the business’s checking account via ACH. When structured as a loan, the finance company debits a fixed amount daily regardless of business sales.

Posted in Best Practices for Merchants, Merchant Account Services News Articles, Merchant Cash Advance Tagged with: ach, bank loans, business loans, checking account, conventional loan, credit card processing, credit card sales, credit-card, debit card, finance company, loan, MCA providers, merchant, merchant cash advance, payments

May 19th, 2014 by Elma Jane

T-Mobile customers who use their carrier’s Mobile Money app and prepaid card will now have surcharge-free access to more than 43,000 Allpoint-branded ATMs across the United States, through an agreement with the Allpoint Network. The Mobile Money program unites a money management app, a T-Mobile Visa prepaid card and the Allpoint surcharge-free ATM network on a single mobile device to provide customers many of the features of a checking account. With Mobile Money, registered T-Mobile wireless customers pay nothing when they use their T-Mobile Visa Prepaid Card to withdraw cash at an in-network Allpoint ATM.

When T-Mobile began developing the Mobile Money program, a key goal was to use the smartphone to help consumers both manage their money and keep more of it in their pocket. The Allpoint Network helps accomplish that mission with 43,000 surcharge-free ATMs found in many of America’s most popular retailers, made even more convenient by a free, easy-to-use Allpoint ATM locator within the Mobile Money app.

Easy access to cash, preferably without the surcharge imposed by the ATM owner, is at the heart of the most successful general-purpose prepaid card programs. Having access to Allpoint, the T-Mobile Visa Prepaid Card is a core component of Mobile Money by T-Mobile. Eligible cardholders looking for the nearest surcharge-free Allpoint ATM can use the Allpoint Network ATM locator, available online and as a free app for their smartphones.

Posted in Financial Services, Mobile Payments, Smartphone Tagged with: Allpoint ATM, Allpoint Network, Allpoint surcharge-free ATM network, Allpoint-branded ATMs, ATM locator, cardholders, checking account, free app, mobile device, mobile money, Mobile Money app, Mobile Money program, money management app, prepaid card, smartphone, surcharge-free, T-Mobile, T-Mobile Visa prepaid card, T-Mobile wireless

October 24th, 2013 by Elma Jane

You will be happy to learn that these days there is less hassle when setting up credit card payments online. In the past, companies were required to open a merchant account through a bank in order to be able to accept credit cards. Today, several services enable you to accept credit cards online without opening your own merchant account.

With more than 50 million users worldwide, Paypal is probably the most widely used such service. The company’s Payflow service is a turn-key solution with several added advantages such as recurring billing and fraud protection.

If you still want to take actual credit card payments online, a merchant account service is your best option. To open an Internet merchant account, you must fill in a merchant application and provide support documents. First, you must supply proof that you established a checking account for your Internet business.

If you have sole proprietorship or a micro business, you can open either a personal checking account or business checking account. If you opt for a personal checking account, the account must be in the name of the sole proprietor. If your internet business is a corporation, you must set up a corporate checking account.

This account will be used to deposit sales generated through your internet merchant account, but also to withdraw fees such as online payment gateway fees.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Visa MasterCard American Express Tagged with: accept, application, checking account, companies, credit-card, deposit, fraud protection, internet business, merchant account, merchant account service, micro business, online, payment gateway fees, payments, PayPal, recurring billing, sales, support, turn-key, worldwide