August 13th, 2014 by Elma Jane

No sales manager wants to hear that his or her team is losing sales. For some companies, customers jump ship or don’t give them a chance at all, because of a negative experience with an individual sales representative. The outcome of a bad in-person sales experience is more dramatic than just a delay in the sales cycle. In fact, according to a recent survey and research, 70 percent of marketing and sales professionals said a bad sales call results in a loss of revenue and 70 percent noted that it can take months or even years, to recover from it, but for many organizations, lost revenue doesn’t just occur because of bad sales calls. Often, small inefficiencies in the sales process add up to a lot of wasted time and by extension, wasted opportunities.

Sales teams spend 30 to 50 percent of their time not selling, they’re calling, chasing and waiting, trying to get the customer to agree to an appointment. When you change this behavior and drive it down, sales go way up.

How can sales managers solve these issues that stand in the way of growth? Gathering customer feedback may seem like the obvious answer, but before you do, try seeking internal feedback from your team about where they’re struggling.Managers should look at underperforming sales reps and inquire about the obstacles that are keeping them from being successful, is it training or the enablement material? Can they find the right material for each stage of the sales cycle? It’s important that managers understand both the positive and negative patterns so they can provide critical feedback to marketing on content effectiveness and help salespeople orchestrate better conversations.

Another effective strategy for collecting useful feedback is to ask employees what tactics are helping them to succeed. Ask them for the single best thing they’re doing relating to sales. Questions that ask for just one thing generate the best results. It’s easy to act on those answers and it’s valuable and engaging to share them transparently with the rest of the team. Once you’ve asked your team about their process and figured out what’s working, there’s one last question you need to ask yourself as a sales manager, what do you need to stop doing as an organization to free up more time for the tactics that actually work?

If your team is wasting a lot of time on nonselling activity, the best thing to do is eliminate that dead time of waiting around for the phone to ring. Sales teams confuse making 70 phone calls to prospective clients and leaving messages with selling. That activity is not selling. Get prospects engaged in a productive conversation the first time you pick up the phone or meet them by finding out what the customer’s problem is, and if your product or service can solve it.

Posted in Uncategorized Tagged with: companies, customers, marketing, organizations, product, sales, sales calls, sales process, Sales teams, service

October 24th, 2013 by Elma Jane

You will be happy to learn that these days there is less hassle when setting up credit card payments online. In the past, companies were required to open a merchant account through a bank in order to be able to accept credit cards. Today, several services enable you to accept credit cards online without opening your own merchant account.

With more than 50 million users worldwide, Paypal is probably the most widely used such service. The company’s Payflow service is a turn-key solution with several added advantages such as recurring billing and fraud protection.

If you still want to take actual credit card payments online, a merchant account service is your best option. To open an Internet merchant account, you must fill in a merchant application and provide support documents. First, you must supply proof that you established a checking account for your Internet business.

If you have sole proprietorship or a micro business, you can open either a personal checking account or business checking account. If you opt for a personal checking account, the account must be in the name of the sole proprietor. If your internet business is a corporation, you must set up a corporate checking account.

This account will be used to deposit sales generated through your internet merchant account, but also to withdraw fees such as online payment gateway fees.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Visa MasterCard American Express Tagged with: accept, application, checking account, companies, credit-card, deposit, fraud protection, internet business, merchant account, merchant account service, micro business, online, payment gateway fees, payments, PayPal, recurring billing, sales, support, turn-key, worldwide

October 21st, 2013 by Elma Jane

Retailers today collect email at every point of interaction. Collecting customer information in the store at the point of sale (POS) offers the greatest potential to build retailer’s email list quickly and to drive timely offers and communications that increase customer loyalty and retention.

The practice of collecting email addresses at the point of sale (POS) isn’t a new one. However, more companies are embracing the trend, and they’re doing so with increasing regularity.

E-Receipts

One popular technique among retailers is to ask shoppers if they would like a receipt emailed to them. It is important to note that an agreement to receive an e-receipt should not be necessarily interpreted as consent to be added to a commercial email list unless this intent is adequately communicated to the consumer and they consent. It always best practice to reference their consent to marketing emails at the same time as the e-receipt request.

It is possible to collect (PII) Personally Identifiable Information at the counter in a

careful and conscientious manner if you follow guidelines.

1. Be transparent about the commercial intent. A consumer who feels misled is more likely to complain and to seek redress under the consumer protection laws. If following different scripts is a challenge, apply the same disclosure/request script for both credit and cash transactions.

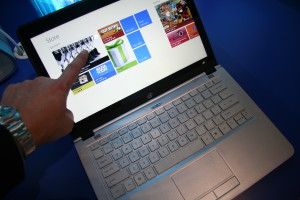

2. Consider using the credit card terminal or other touchpad device for customers to enter their email rather than using the sales associate. The device should first prompt the customer to consent to receiving an in-store e-receipt and/or marketing communications, ideally before proceeding with the transaction, it could be after as well.

3. Decouple PII collection from the credit card purchase. Ask customers for their email addresses before taking their credit cards or after they sign off on the purchase so it is clear that email is not required as part of the transaction.

4. Fulfill any incentives offered at the counter through email. Provide each consumer with a dynamic and unique link. A consumer will have less of a reason to give you a valid email address if you offer and fulfill the incentive at POS. Limiting the use of the incentive to email will help you avoid incentive abuse.

5. Send a welcome permission pass. Don’t assume that the customer wants anything more than an in-store e-receipt even if you can legally claim to have this right. Let the customer make an informed decision at the counter or in a subsequent email.

6. Validate submitted data. Ask customers to verify the accuracy of their PII before submitting. Use appropriate list management tools to prevent avoidable domain errors.

Clients that take the proper steps to overcome POS challenges and risks will reap the rewards of subscriber loyalty, a stronger reputation and better inbox performance in the long run.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments, Gift & Loyalty Card Processing, Point of Sale Tagged with: associate, best practice, cash, commercial, communications, companies, consumer, credit, credit-card, customer, e-receipts, email, emailed, incentive, interaction, list, loyalty, offers, personally identifiable information, pii, point, point of sale, POS, retailers, rewards, sales, script, subscriber, timely, touchpad, transactions, transparent