April 28th, 2016 by Elma Jane

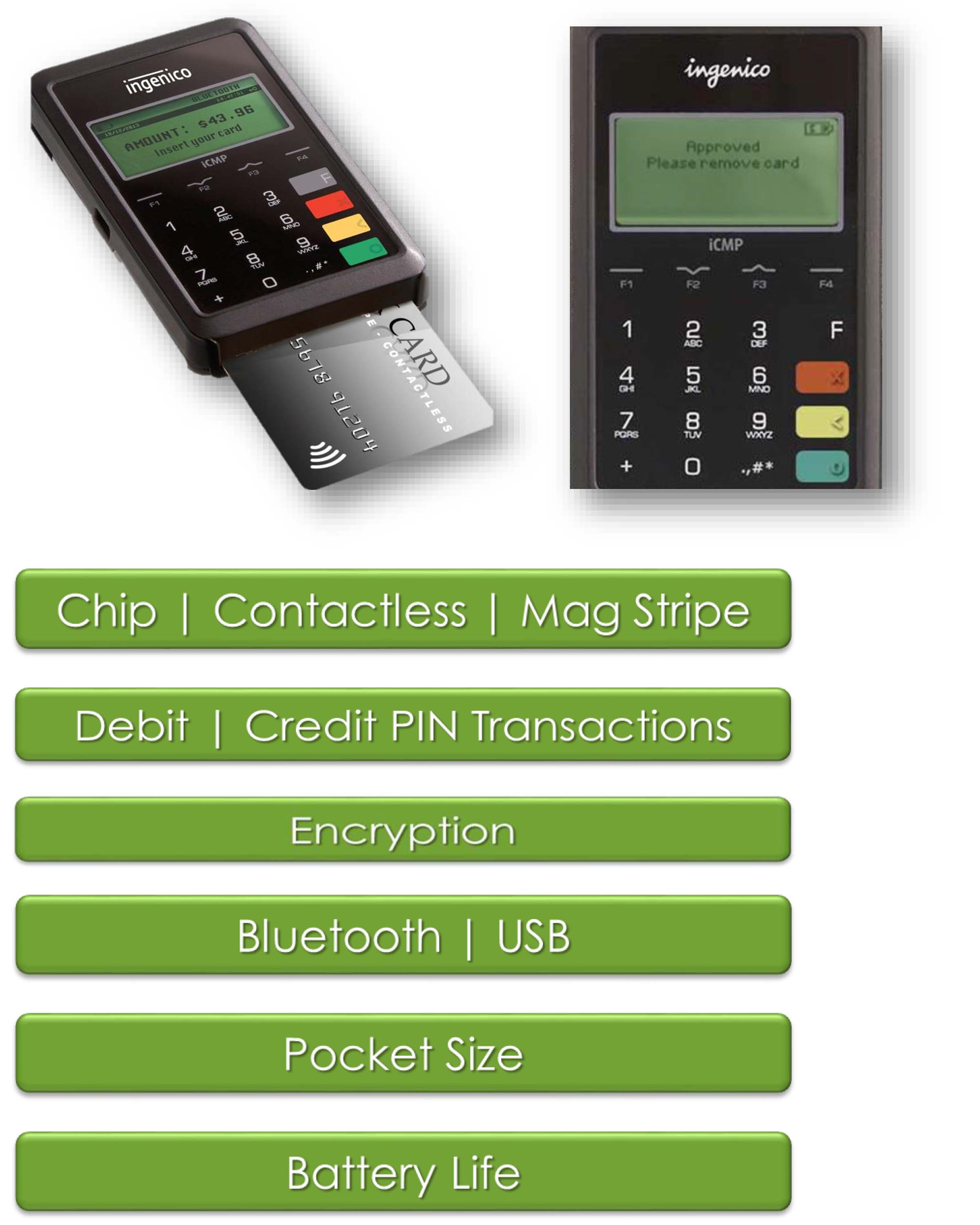

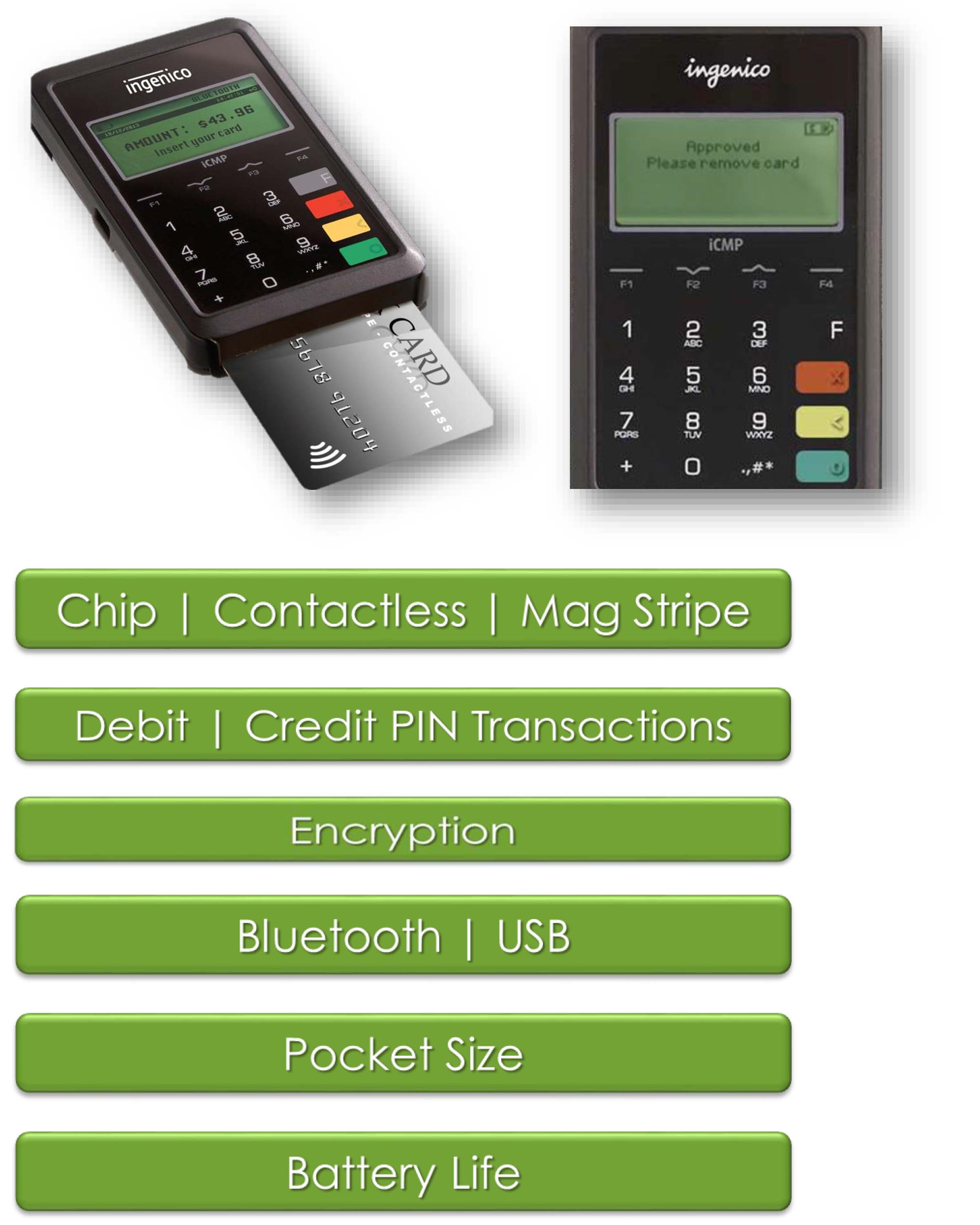

You can offer your customers preferred payment method with the next generation point-of-sales terminals, an all-in-one credit card processing experience: which not only support Near Field Communication (NFC) contactless payment transactions such as Apple Pay but chip cards and the traditional magnetic stripe cards; and manual entry transactions as well.

Contactless payment transactions are happening now. NTC are here to help.

Posted in Best Practices for Merchants Tagged with: chip cards, contactless payment, credit card processing, customers, magnetic stripe cards, Near Field Communication, nfc, payment, point-of-sales, terminals, transactions

December 16th, 2015 by Elma Jane

Google’s contactless payment solution, Android Pay, will now be available through the mobile checkouts of several Android apps in the U.S.

With this addition, it avoids having to pull out your card everytime you make a purchase, meaning card data never makes it to the merchants. A good news for anyone who is concerned about privacy.

Android Pay is compatible with all Near Field Communication (NFC) or Host Card Emulation (HCE) enabled devices using any OS released since KitKat.

With Coca-Cola signing up as the first merchant in the Google program, a new loyalty program was recently released for the mobile wallet, by tapping your phone on an NFC-enabled Coke vending machine, you’ll get a Coke and get points added into your Android Pay Account for future purchases.

http://www.pymnts.com/news/payment-methods/2015/android-pay-now-in-app-payment-option/

Posted in Best Practices for Merchants, Credit Card Security, Mobile Payments, Smartphone Tagged with: Android Pay, card, card data, contactless payment, HCE, host card emulation, loyalty program, merchants, mobile wallet, Near Field Communication, nfc, payment

November 13th, 2015 by Elma Jane

It’s important for merchants to understand the basic of how a credit card terminal works. It is the channel through which the process flows and the merchants can choose the right one for their processing needs, whether they use a point-of-sale (POS) countertop model, a cardreader that attaches to a smartphone or mobile device, a sleek handheld version for wireless processing or a virtual terminal for e-commerce transactions.

A credit card terminal’s function is to retrieve the account data stored on the payment card’s EMV microchip or a magnetic stripe and pass it along to the payment processing company (also known as merchant account provider).

For card-not-present (CNP) – mail order, telephone order and online transactions – the merchant enters the information manually using a keypad on the terminal, or the e-commerce shopper enters it on the website’s payment page. The back half of the process remains the same.

The actual data transmission goes from the terminal through a phoneline or Internet connection to a Payment Processing Company, which routes it to the bank that issued the credit card for authorization.

In card-present transactions where the card and cardholder are physically present, the card is connected to the reader housed in the POS terminal. The data is captured and transmitted electronically to the merchant account provider, who handles the authorization process with the issuing bank and credit card networks.

A POS retail terminal with a phone or Internet connection works best in a traditional retail setting that deals exclusively in card present transactions. For a business with a mobile sales, a mobile credit card processing option like Virtual Merchant Converge Mobile relies on a downloadable app to transform a smartphone or tablet into a credit card terminal equipped with a USB cardreader.

Wireless Terminals are compact, allowing you to accept credit cards in the field without relying on a phone connection. If you process debit cards, you’ll need a PIN pad in addition to your terminal so cardholders can enter their personal identification number to complete the sale.

Selecting the right terminal for your credit card processing needs depends largely on the type of business you run and the sorts of transactions you process. Terminals are highly specialized and provide different services. At National Transaction we offer a broad range of terminals with NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC/Contactless payment transactions at your business. An informed business decision benefits your bottom line. Start accepting credit cards today with National Transaction.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Point of Sale Tagged with: Android Pay, Apple Pay, card-not-present, card-present transactions, cardholder, cardreader, cnp, contactless payment, Converge Mobile, credit card, credit card networks, credit card terminal, debit cards, e-commerce, EMV, magnetic stripe, mail order, merchant account provider, merchants, microchip, mobile credit card processing, mobile device, Near Field Communication, nfc, online transactions, payment processing company, PIN pad, point of sale, POS, POS terminal, smartphone, telephone order, virtual merchant, virtual terminal, wireless processing

October 13th, 2015 by Elma Jane

It is difficult to believe that many businesses still do not accept credit or debit cards for payments, while most customers preferred using cards for the following reasons.

- Doesn’t want to carry cash.

- Security and Protection offered by card issuers.

- Desire to earn reward points.

Some of the many advantages for businesses that accept credit card payments include:

Easy and cost efficient – credit card processing has become a highly competitive industry. NTC offers the latest in EMV and NFC technologies that allows businesses to accept contactless payment like Apple and Android Pay. NTC integrates with most POS systems.

Essential for online sales – internet selling is growing. The Internet makes it possible for a small business in a remote location to offer its products to potential customers throughout the nation and even across the world, almost all of those transactions require a credit or debit card.

Increases revenue – people like the convenience and security of paying with a credit or debit card. In fact, 66 percent of point-of-sale transactions use credit, debit or gift cards.

Merchant services accelerate cash flow – credit card transactions process quickly, with proceeds generally available in a bank account within two days or less. That eliminates the time it normally takes checks to clear. It also reduces or eliminates billing and the time spent waiting to receive payment checks from customers.

Reduce transaction risks – Check fraud remains a major problem for U.S. businesses, 77% of businesses were victims of check fraud, only 34% experienced credit card fraud and 92% said they believe new EMV chip and pin, credit cards will significantly reduce fraud at the point of sale.

Setting up a merchant account for your business is as simple as contacting a merchant service provider. A merchant service provider process payments and make sure the money is appropriately withdrawn from a credit card account and placed into the business’s merchant account.

For more details about setting up an account give us a call now! at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: (POS) systems, Android Pay, Apple, Chip and PIN, contactless payment, credit card, debit cards, EMV, Gift Cards, merchant, merchant account, merchant service provider, merchant services, NFC technologies, payments, point of sale

October 13th, 2015 by Elma Jane

What can near field communication do for individual and how can it make lives easier. Many uses of NFC technology offer benefits in a number of everyday tasks ranging from paying for groceries to receiving adequate health care treatments.

Check this out if the benefits are worth it:

Contactless Payments – well-known use of NFC technology is for contactless payment. Customers can use their smartphone over a card reader to make a purchase without swiping or counting out cash. This saves time and also reduces the chances of losing a credit card that comes with carrying multiple cards around.

Health Care – With NFC technology, hospitals can better track patient information and doctors’ notes in real-time. This helps prevent the wrong medications from going to the wrong patient and creates a streamlined system focused on the best in patient care.

Information Sharing – NFC tags most common way NFC is currently used on Android and Windows phones. Using your Phone or Tablet, you can tap a strategically-placed NFC tag, which prompts your phone to take action on something, like automatically prompts your phone to enable Wi-Fi, disable sounds and decrease brightness. Exchange information between two Android phones.

Pairing with Devices – Smart household appliances are adopting NFC. LG’s smart washing machines let you pair your phone with the machine so that you can remotely monitor the washing cycle.

Social Networking Social networking is booming, and NFC tags are looking to get in on the action. NFC allows users to interact with each other and update their location and other info without any unnecessary log-ins or tapping through menu screens.

Transportation – Swiping a smartphone not only allows the passenger access to the subway but also keeps track of the number of trips he has left. Passengers can come and go much faster and easily pay for extra trips.

Posted in Best Practices for Merchants, Near Field Communication, Smartphone Tagged with: Android, card reader, contactless payment, credit card, health care, Near Field Communication, nfc technology, smartphone

September 22nd, 2015 by Elma Jane

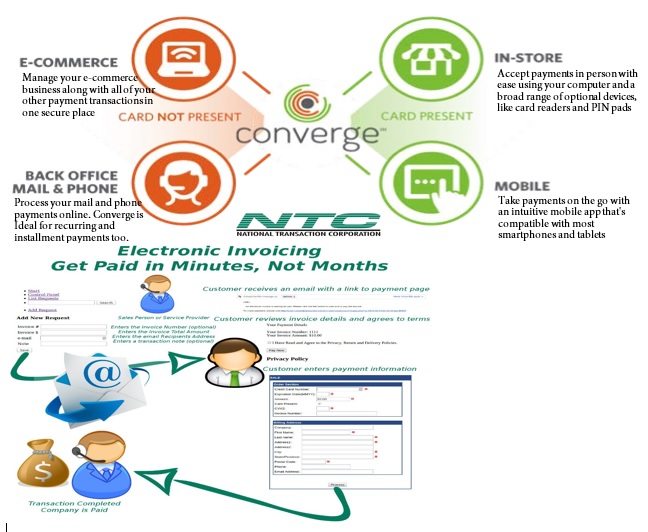

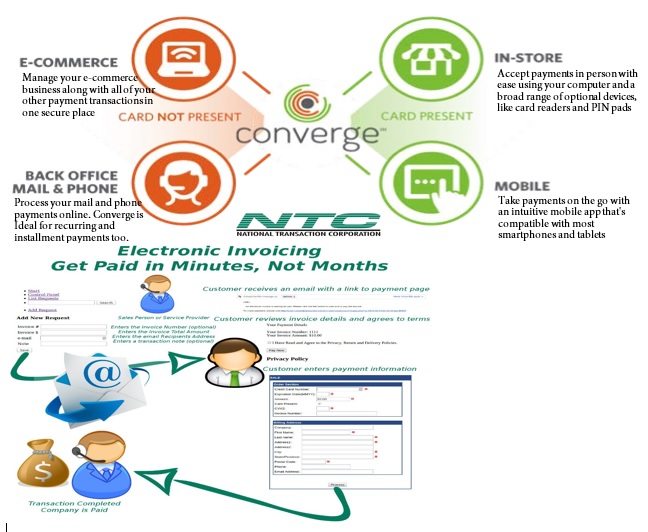

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant

June 18th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal.

Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

By accepting chip cards EMV terminal, you help protect your business from card present fraud liability and prepare your business for the future of payment application technology. If your business accepts and processes a counterfeit card transaction on a non-EMV terminal, the liability for that fraudulent transaction is yours, not incurred by the card issuers.

How do you process an EMV chip card transaction?

- Insert Card. Instead of swiping, the customer will insert the card into the terminal, chip first, face up.

- Leave the Card in the Terminal. The card must remain in the terminal during the entire transaction.

- The Receipt or Enter a PIN. As prompted, the customer will sign the receipt or enter their PIN to complete the transaction.

- Remove Your Card. When the purchase is complete, remind the customer to take the card with them.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: cardholder, cards, chips cards, contactless payment, EMV, emv chip cards, EMV terminal, EuroPay, magnetic stripe cards, MasterCard, merchant, nfc, payment cards, payments, visa

August 8th, 2014 by Elma Jane

MasterCard’s latest Card Personalization Validation module in the Collis EMV Personalization Validation Tool qualified by MasterCard, including the U.S. Common Debit AID. The tool will be used to support EMV card issuers in the U.S., and specifically checks if MasterCard cards are correctly personalized according to the latest MasterCard specifications. It also includes specific personalization profiles to certify compliance with the Durbin Legislation. The Collis EMV Personalization Validation Tool is the most thorough and comprehensive test tool for issuers, card personalization bureaus and card manufacturers that want to validate the personalization of their contact/contactless payment cards and mobile payment applications. With the tool, issuers easily check the correctness of the personalization of any EMV card application according to the latest test specifications of the seven major worldwide payment schemes. He added that the Collis EMV Personalization Validation Tool fits also seamlessly to prepare for the MasterCard CPV Formal Approve Service that UL can deliver.

Posted in Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: card, contactless payment, Debit AID, EMV, EMV card, MasterCard, mobile payment, payment schemes

April 11th, 2014 by Elma Jane

A new standard that uses Host Card Emulation (HCE) was introduced by VISA to enable financial institutions to securely host Visa accounts in the cloud. Visa’s move to support HCE includes tools and services as well as the standard. It is available now and will include support for QR codes and in-app payments in the future.

With this new service and platform that Visa is developing, it will enable clients and partners to issue Visa accounts digitally in the cloud, on secure elements in smartphones, or linked to a digital wallet. The solution will also enable the issuance of payment tokens that will replace the 16-digit payment account number and can be limited for use with a specific device, merchant or payment channel.

Layers of security will deploy by Visa to protect payment accounts in the cloud, including at the Visa network, application and hardware levels. Device fingerprinting technology, one-time use data, payment tokens and real-time transaction analysis will make up a multi-layered defense against unauthorized account access for their services.

Visa has intensified its Visa PayWave contactless payment application and is introducing a new implementation guidelines, program approval process standard and requirements for their standards.

Visa is also developing a tool, its software development kit (SDK) to support clients who wish to develop their own cloud-based payment applications or want to enhance their existing mobile banking applications with Visa PayWave functionality.

HCE is introduced to make it easier for developers to create NFC applications like mobile payments, loyalty programs, transit passes, and other custom services. Visa’s move to enable NFC payments with Android devices is welcome news and will guide the way for the payments industry.

Clients and partners around the globe are continuously looking for cost efficient, flexible and secure ways to enable mobile payments. The Android HCE feature provides with a platform to evolve the Visa PayWave standard, support the development of secure, cloud-based mobile applications, while at the same time offer greater choice.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, Financial Services, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: accounts, android devices, approval, cloud, cloud-based mobile applications, contactless payment, device fingerprinting, Digital Wallet, digitally, financial institutions, HCE, host card emulation, in-app, mobile banking, nfc, payment account number, payment channel, payment tokens, payments, qr codes, real-time transaction, secure elements, securely, Smartphones, unauthorized, visa, visa network