December 17th, 2015 by Elma Jane

We are pleased to announce that the new Converge Mobile App is now available for download in the App Store (Apple iOS devices) and Google Play (Android devices)!

Ingenico iCMP – Item code CICMP for Converge and Converge Mobile

With the launch of the new app, you can now order the Ingenico iCMP PIN Pad for Converge Mobile too!

Please use item code CICMP for those devices that will be used with Converge and Converge Mobile applications.

The Talech iCMP is configured differently and will not work properly without substantial reconfiguration work by our support teams. This creates a negative customer experience and is avoidable when you use the right code – CICMP!

Posted in Best Practices for Merchants Tagged with: Converge, Ingenico iCMP, mobile, Talech iCMP

November 19th, 2015 by Elma Jane

The Ingenico iCMP PIN pad is now available with Converge in the US! This EMV-enabled device is flexible to use with a USB connection and Converge or with a Bluetooth connection and Converge Mobile (launching soon!).

Key features of the Ingenico iCMP include:

Chip, Contactless and Mag Stripe

Accept EMV chip cards, including Chip & Pin and Chip & Signature as well as mag stripe cards and contactless payments – mobile wallets like Apple Pay and contactless cards. The EMV-capabilities of the PIN pad help protect our customers from counterfeit card fraud.

Debit and Credit PIN Based Transactions

Accept debit and credit cards using PIN capabilities on the device. This is important to help further protect our customers from lost, stolen and NRI (not received/issued) fraud.

Encryption

Encrypted to keep card data separate and away from the mobile app/device and safe as it travels through the payment network.

Bluetooth or USB

Connect with a USB connection when using a computer and Converge www.convergepay.com or Bluetooth when using with the upcoming Converge Mobile app.

Pocket size

Takes up little space on a countertop, and it’s easy to carry when on the go.

Give us a call now at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: Apple Pay, card data, Chip & PIN, Chip & Signature, chip cards, contactless cards, contactless payments, Converge, Converge Mobile, credit cards, Debit and Credit, EMV, encryption, ingenico, mag stripe, mobile wallets, payment network, transactions

October 12th, 2015 by Elma Jane

Setting up a merchant account.

- First find a Merchant Service Provider.

- Then setup your Business Profile.

Put together your business profile so you can start applying for a merchant account. There are questions that you’ll need to answer, that way merchant account providers have an idea of how they should setup your account.

Some of the questions are:

- Is your business seasonal? For Travel Company it is seasonal, there will be high and low volume. NTC works with seasonal downtime.

- How do you intend to accept payments? Different business models require different methods of accepting payments. If you’re doing face to face transaction and have physical location then you need a credit card terminal. If you process checks, then you need Electronic Check and ACH Transfers. For e-Commerce shopping carts, wireless/mobile, you can check out our Converge Virtual Merchant and NTC e-Pay.

- How much volume do you plan on processing? Merchant account providers are going to want to know how much sales volume you plan on processing per month. New in the business – give just an estimate average of how much you’ll be processing (per month), within the first 6-months of operation. Been in the business – you’ll already have this number ready.

- What will be your average ticket price?

Example:

Total Sales Revenue = $150,000

Total Number of Sales = 500 150,000/500 = $300 (Average Ticket Price)

If you need to setup an account give us a call now at 888-996-2273 or go to www.nationaltransaction.com to know more about our services.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: ach, Converge, credit card terminal, e-commerce, Electronic Check, merchant account, merchant service provider, NTC e-Pay, payments, Travel Company, virtual merchant

October 6th, 2015 by Elma Jane

If you accept credit cards and don’t know what EMV is here is what you need to know.

EMV stands for Europay, MasterCard and Visa. A credit card that had a chip embedded in it is an EMV. EMV Cards have been standard in Europe for more than 10 years because they’re more secure than magnetic stripe cards. Magnetic stripe cards doesn’t change, it has static data, which makes them easy to clone. The chip embedded card makes it more difficult and costly to counterfeit because the data that is transmitted changes each time the card is read. This means less fraud.

Liability Shift rules set by Visa and MasterCard as of October 1st. The liability for fraud carried out in physical stores with counterfeit cards belongs to the merchant if it has not yet upgraded its POS system to accept EMV-enabled chip cards.

- Calculate your risk – Consider the cost of replacing your point-of-sale (POS) terminal vs. potential risk. Whether you replace it now or at a later time, eventually all businesses will have to replace their POS terminals.

- Educate your staff – Educated employees translate to better-educated customers. Merchants can help customers better understand this change and what it means for them.

- Upgrade your POS system – Consider using an EMV compliant credit-card reader on a wireless device for an ultra-secure mobile solution. This is also a chance to upgrade other options, such as near field communication NFC technology, which lets consumers use their mobile devices to make payments at the point of sale.

National Transaction Terminals with EMV and NFC (near field communication) Capability To accept Apple Pay, Android Pay and other NFC Transactions at your business. You will need to adopt point-of-sale devices with NFC/contactless readers.

National Transaction offer a range of options to suite your specific needs.

If you’re using Virtual Merchant Mobile now called Converge please contact our office at 888-996-2273 to know your options.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: Android Pay, Apple Pay, chip cards, contactless readers, Converge, credit cards, EMV, EuroPay, magnetic stripe, MasterCard, merchants, Near Field Communication, nfc, payments, POS, terminal, Virtual Merchant Mobile, visa

September 22nd, 2015 by Elma Jane

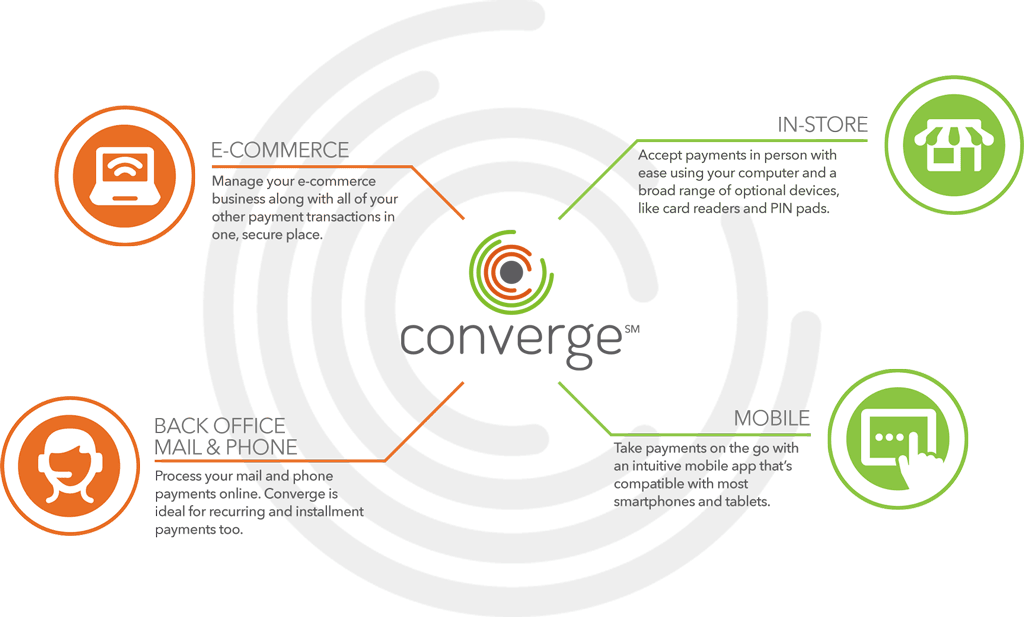

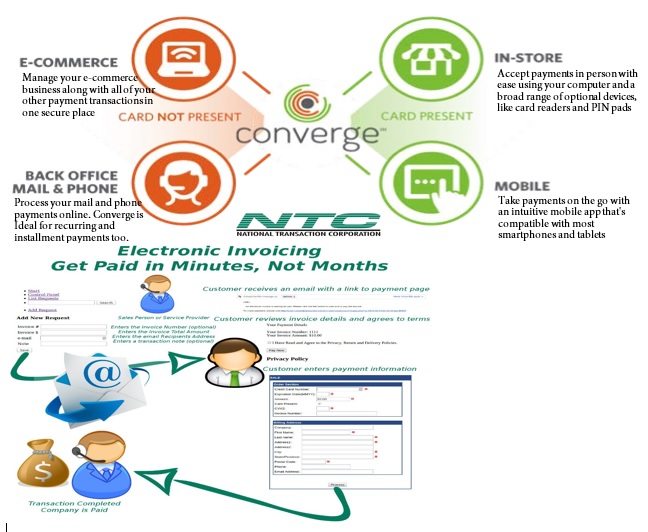

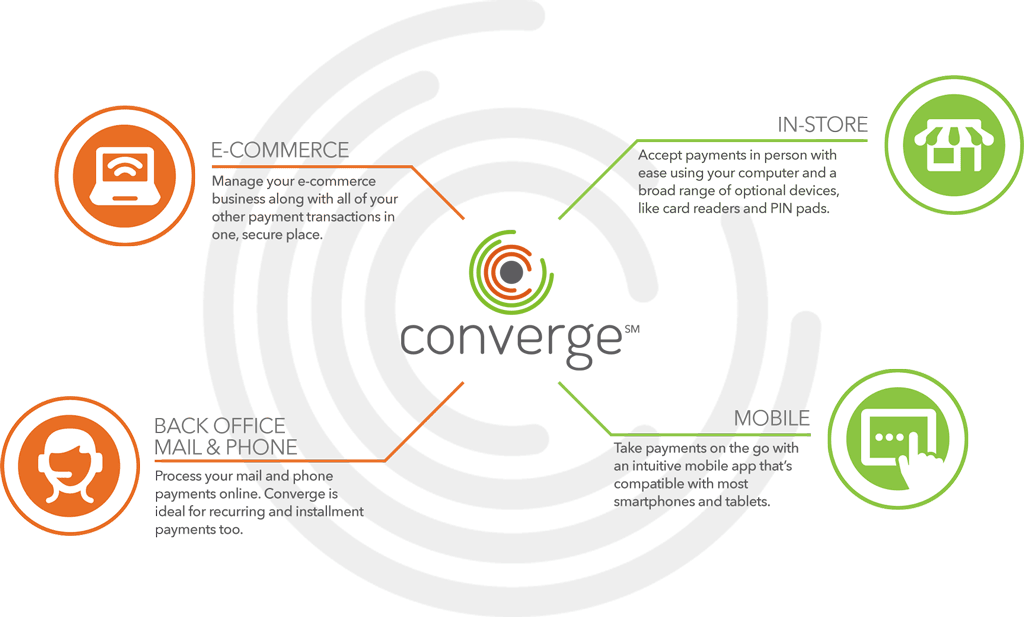

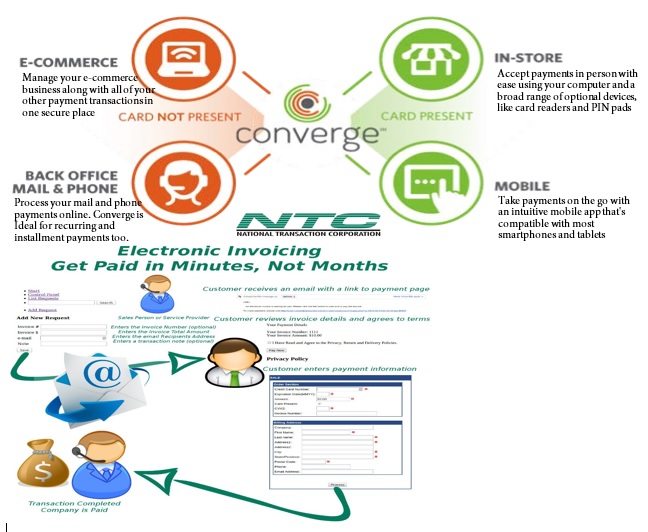

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant