May 13th, 2016 by Elma Jane

Getting new clients are one of the most time-consuming and expensive parts of running a travel agency.

Here are some travel agency marketing tools that are cost-effective and time-saving to help you.

E-Marketing – email marketing is a key to connecting with your customer on an ongoing basis. You want to make sure you’re in touch since they could plan a trip on a moment’s notice.

Personalized Email Addresses – Gmail is one of the top lists of a free travel agency marketing tool. Gmail is easy-to-use and effectively manages your inbox with labels.

- Gmail is free as long as you have less than 10 email users and each user sends less than 500 emails per day.

- Use your personalized travel agency domain name email address instead of gmail.com.

- Promote your travel agency name using YourName@YourAgencyWebsite.com email address.

CRM Tool – a salesperson’s success usually can be traced back to an efficient sales process. The sales process is the method of sales person takes a perspective customer from lead to a sale.

- Online CRM (Customer Relationship Management) tool can help you manage that process and help you close that sale.

- CRMs are an investment and are an essential travel agency marketing tool.

Website Live Chat – free instant messenger client, a great travel agency marketing tool.

- Choose to interact with the visitor to answer their questions.

- Promote it as another channel existing clients can reach you.

- There’s also a free iPhone app, so you can interact with clients on the go. All for free!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: crm, customer, travel, travel agency

July 14th, 2015 by Elma Jane

If you own a business, you should consider opening a merchant account. If you accept credit cards for transactions, you will take your business to a higher level, increase your revenue, and gain new customers. Most people nowadays use credit cards and debit cards to pay for their purchases, so no business should go without processing card payments. Electronic, Credit card processing payments are a must-have for any kind of business including Internet businesses.

If you accept several forms of payments, you will provide your customers with multiple options and you will enhance their experiences. If you do not accept credit cards, the people who prefer to pay for their purchases with credit cards and debit cards will go somewhere else, and you will lose the transaction. So many benefits are attached with merchant accounts and millions of small business owners have found success with them. If you have a merchant account, you will be able to accept Discover, MasterCard, Visa, and American Express from your customers.

With National Transaction, securing Electronic, Credit card payment processing service instore, online and on the go are easy to acquire. It will boost your income, so it is worth the investment. You can apply online for a merchant account, the applications will only take you a few minutes to complete, and you will find out if you have been approved for a merchant account in a day or so.

A credit card processing service will also protect your business and valued customers against fraud. Customers feel safe using credit cards because they know that if their cards get stolen, they can cancel them, dispute the purchases, and get their money back. Your customers will feel safe when they make purchases. Some consumers will not purchase from a company that does not accept credit/debit card.

National Transaction offers advanced payment processing solutions like Currency Conversion, EBT and Debit Cards Processing, E-commerce Gateways, Electronic Check and ACH Transfers, Gift Loyalty Card Programs, Loans and Advances, Mobile Processing and MediPaid, you will definitely benefit from opening a merchant account. National Transaction offers Free CRM and we can even help promote your business through Social Media Sites. We offer a very competitive rate and Customer/Technical Support to our Partners because we answer our phone.

Merchant accounts are a necessity for any kind of business, so don’t wait. Sign up for a merchant account right now and discover what your business can gain from accepting credit cards! With 73 percent of American households owning a credit card, it’s easy to think that everyday credit card usage is a way of life.

Give us a call 888-996-2273 or check our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: ACH Transfers, Advances, card payments, credit card processing, credit cards, crm, Currency Conversion, debit cards, Debit Cards Processing, e-commerce, EBT, Electronic Check, gateways, Gift Loyalty Card, loans, MediPaid, merchant account, Mobile Processing, payments, transactions

May 28th, 2015 by Elma Jane

No such thing as FREE, but with National Transaction, Customer Relationship Management Software can be! Take advantage of technology and use it for your business success.

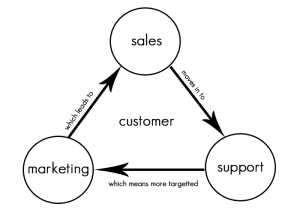

What is CRM? Customer relationship management is a system for managing a company’s interactions with current and future customers. It often involves using technology to organize, automate and synchronize sales, marketing, customer service and technical support.

Free CRM comes in two categories: FREE, but limited, and OPEN SOURCE.

Free, but limited versions – set caps on the amount of free users, contacts, storage, extra features, or some combination.

Open source – offers an unlimited, fully functional CRM to users, is extremely customizable. Most open source CRM companies also offer a preconfigured version and/or installation and support for a price.

There are a whole host of affordable CRM options you should be considering even though not free, may be the perfect fit for your organization.

Each CRM system is different and each one will serve some companies better than others. CRM is a category that’s very rich in free and open source programs.

Why is the value of CRM great for Merchants?

It allows you to register your leads and contacts. You need some basic categories to make your data efficient so that you can implement your CRM strategy to fulfill their needs. With a CRM you can store and manage hundreds of clients and let a computer system handle the task of memory and recall.

You can track all customer interaction – A customer relations management system put all the pertinent client information in one central location that was easy to update and easy to see when other’s updated. All communication can be kept in one spot, nothing gets lost and you can now see and share with the rest of your team. This history builds a long-time relationship. Emails should be in your system, and not in each person’s mailbox.

Every time you make a call, send an email, or contact that customer or prospect you can update your CRM with their current status.

It reveals possibilities. Most companies keep their current supplier until they are ignored. That’s why keeping them alive and kicking in your CRM database is so important. And if you have an opt-in newsletter or a great seminar plan, their business might be yours for the next quarter.

It makes your most valuable asset – the customer data – remain. People change jobs. Have you ever experienced someone leaving you, and nothing is left behind? The pipeline wasn’t up to date. The contacts wasn’t updated. The important contacts wasn’t registered – because all relevant information was stored locally. Don’t let it happen. Customer relations systems help keep all conversations in one place and make it easy for you to quickly look back in time and see how things have progressed. See for yourself the progression of a client and their communication as well as your company’s notes and responses. You’ll be able to save more customers from leaving by catching something you would have otherwise missed, and you can learn from your history.

Posted in Best Practices for Merchants Tagged with: crm, CRM database, customer data, customer service, data, database, merchants, open source

All merchants that accepts, transmit or stores cardholder data are required to be PCI (Payment Card Industry) Compliant. Most believe that because they do not charge the credit cards themselves, they are exempt. Why all agencies are required to be complaint even when they don’t charge credit cards themselves, and some steps to ensure your agency is PCI compliant.

What is PCI compliance?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements designed to ensure that all companies that process, store or transmit credit card information maintain a secure environment. PCI applies to all organizations or merchants, regardless of size or number of transactions, that accepts, transmits or stores any cardholder data. Travel agents accepting, storing and transmitting credit card information to suppliers, are required to be compliant too. Suppliers reinforce this through their travel agent guidelines/contracts. Travel Agency must adhere to the applicable credit card company’s procedures for credit card transactions.

Consequences of Not Being PCI Compliant

If an agency is not PCI compliant, the agency can lose the ability to process credit card payments with that supplier. Not being able to pay with client credit cards can be a serious roadblock for agencies, and an inconvenience for clients.

If you have a merchant account and are found to be out of compliance, you can be fined.

How to be PCI Compliant

Don’t store the CCV security code from the client’s credit card. The client does not have the authority to grant you permission to store their CCV code. The credit card company explicitly forbid storage of the CCV code.

Make sure you securely store any client information, including their credit card number and expiration date. If you use a CRM, ensure that you have a strong password. If your CRM database is stored on your computer hard drive, encrypt it (there is a great encryption software that is free of charge). If you have an IT resource, talk to them about installing a firewall on your network, installing anti-virus and anti-malware protection, and any other steps that you can take to secure your client data even further.

If you keep paper copies of client information, keep it in a locked filing cabinet or desk drawer. When you no longer need their credit card information, cross shred it.

Home based businesses are arguably the most vulnerable simply because they are usually not well protected, according to the PCI Compliance Guide. Having strong passwords, encryption, a firewall, anti-virus and anti-malware protection are all inexpensive steps that you can take to protect your business and your clients’ sensitive data.

If you receive a courtesy call reminding you about PCI Compliance, don’t ignore it.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Payment Card Industry PCI Security Tagged with: cardholder, cardholder data, cards, CCV, CCV code, credit, credit card company, credit card number, credit card payments, credit card transactions, credit cards, crm, CRM database, data, database, encryption software, merchant account, Merchant's, network, Payment Card Industry, PCI, security code, transactions, travel agents

January 15th, 2015 by Elma Jane

The fact that your business needs a mobile presence is by no means news. Brands today know that being accessible to the increasing number of smartphones and tablet users is a must NOW, the goal is to provide a top-notch user experience.

Mobile is opening the door for designing new experiences that complement a brand’s physical presence. The context of WHEN, WHERE and WHAT a customer is doing during their day allows companies to enhance a person’s interaction and customize device-specific experiences.

Brands will need to meet the following mobile experience expectations in 2015:

Combating fraud through mobile. Mobile users want to safeguard themselves against fraud, and 56 percent are willing to deal with a slightly more complex user experience if it means greater protection. Businesses can provide an intuitive, high-quality mobile experience that also protects against fraud by offering to validate transactions, set fraud controls and generate unique payment IDs through the user’s mobile device.

Complement, not copy: E-commerce providers must leverage mobile to complement the user experience, rather than provide a replica of what users get through a Web browser. Nearly 4 in 10 mobile users are most likely to use their mobile phone for shopping, so businesses need to ensure that those customers are getting something unique from their mobile interaction.

CRM through mobile marketing: Mobile marketing isn’t just for acquisition anymore. Today, it’s about boosting loyalty by using mobile for customer, consumers always have their mobile device on them and check it more than 150 times a day. Businesses can communicate with their existing customers through alert notifications, in-app, email and mobile Web. But don’t overdo it. The key to maintaining an effective relationship is doing so in a complementary way, giving users what they need when they need it.

Mobile apps and mobile Web: Got a mobile app but not a mobile-friendly website, or vice versa? You might want to put your energy into leveling out your mobile presence. Consumers are about equally split when it comes to their preference of app versus browser: The percentage of users who prefer their mobile browser when completing a task 28 percent is only slightly higher than the 23 percent that prefer to use an app. Both app and Web designs are critical for businesses in the mobile space, so it pays to do them right.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: consumers, crm, customers, e-commerce, mobile, mobile device, payment, provider's, Smartphones, transactions

September 10th, 2014 by Elma Jane

If your businesses considering an iPad point-of-sale (POS) system, you may be up for a challenge. Not only can the plethora of providers be overwhelming, but you must also remember that not all iPad POS systems are created equal. iPad POS systems do more than process payments and complete transactions. They also offer advanced capabilities that streamline operations. For instance, they can eliminate manual data entry by integrating accounting software, customer databases and inventory counts in real time, as each transaction occurs. With these systems, you get 24/7 access to sales data without having to be in the store. The challenge, however, is knowing which provider and set of features offer the best iPad POS solution for your business. iPad POS systems vary in functionality far more than the traditional POS solutions and are often targeted at specific verticals rather than the entire market. For that reason, it’s especially important to compare features between systems to ultimately select the right system for your business.

To help you choose a provider, here are things to look for in an iPad POS system.

Backend capabilities

One of the biggest benefits of an iPad POS system is that it offers advanced features that can streamline your entire operations. These include backend processes, such as inventory tracking, data analysis and reporting, and social media integration. As a small business, two of the most important time saving and productivity-boosting features to look for are customer relationship management (CRM) capabilities and connectivity to other sales channels. You’ll want an iPad POS that has robust CRM and a customizable customer loyalty program. It should tell you which products are most and least frequently purchased by specific customers at various store locations. It should also be able to identify the frequent VIP shoppers from the less frequent ones at any one of your store locations, creating the ultimate customer loyalty program for the small business owner. If you own an online store or use a mobile app to sell your products and services, your iPad POS software should also be able to integrate those online platforms with in-store sales. Not only will this provide an automated, centralized sales database, but it can also help increase total sales. You should be able to sell effortlessly through online, mobile and in-store channels. Why should your customers be limited to the people who walk by your store? Your iPad POS should be able to help you sell your products through more channels, online and on mobile. E-commerce and mobile commerce (mCommerce) aren’t just for big box retailers.

Cloud-based

The functions of an iPad POS solution don’t necessarily have to stop in-store. If you want to have anytime, anywhere access to your POS system, you can use one of the many providers with advanced features that give business owners visibility over their stores, its records and backend processes using the cloud. The best tablet-based POS systems operate on a cloud and allow you to operate it from any location you want. An iPad POS provider, with a cloud-based iPad POS system, businesses can keep tabs on stores in real time using any device, as well as automatically back up data. This gives business owners access to the system on their desktops, tablets or smartphones, even when not inside their stores. Using a cloud-based system also protects all the data that’s stored in your point of sale so you don’t have to worry about losing your data or, even worse, getting it stolen. Because the cloud plays such a significant role, businesses should also look into the kind of cloud service an iPad POS provider uses. In other words, is the system a cloud solution capable of expanding, or is it an app on the iPad that is not dependent on the Internet? Who is the cloud vendor? Is it a premium vendor? The type of cloud a provider uses can give you an idea about its reliability and the functions the provider will offer.

Downtime and technical support

As a small business, you need an iPad POS provider that has your back when something goes wrong. There are two types of customer support to look for: Downtime support and technical support.

iPad POS systems are often cheaper and simpler than traditional systems, but that doesn’t mean you can ignore the product support needs. The POS is a key element of your business and any downtime will likely result in significant revenue loss. You could, for instance, experience costly downtime when you lose Internet connectivity. iPad POS systems primarily rely on the Web to perform their core functions, but this doesn’t mean that when the Internet goes down, your business has to go down, too. Many providers offer offline support to keep your business going, such as Always on Mode. The Always on Mode setting enables your business to continue running even in the event of an Internet outage. Otherwise, your business will lose money during a loss of connectivity. Downtime can also happen due to technical problems within the hardware or software. Most iPad POS providers boast of providing excellent tech support, but you never really know what type of customer service you’ll actually receive until a problem occurs.

Test the friendliness of customer service reps by calling or emailing the provider with questions and concerns before signing any contracts. This way, you can see how helpful their responses are before you purchase their solution. Your POS is the most important device in your store. It’s essentially the gateway to all your transactions, customer data and inventory. If anything happens to it, you’ll need to be comfortable knowing that someone is there to answer your questions and guide you through everything.

Grows with your business

All growing businesses need tech solutions that can grow right along with them. Not all iPad POS systems are scalable, so look for a provider that makes it easy to add on more terminals and employees as your business expands. Pay attention to how the software handles growth in sales and in personnel. As a business grows, so does it sales volume and the required software capabilities. Some iPad POS solutions are designed for very small businesses, offering very limited features and transactions. If you have plans for growth, look for a provider that can handle the changes in transactions your business will be going through. Find out about features and customization. Does the system do what you want it to do? Can it handle large volume? How much volume? What modules can you add, and how do you interface to third parties? You should also consider the impacts of physical expansion and adding on new equipment and employees. If there are plans in the future for you to open another store location, you’ll need to make sure that your point of sale has the capabilities of actually handling another store location without adding more work for you. If you plan on hiring more employees for your store, you’ll also want to know that the solution you choose can easily be learned, so onboarding new staff won’t take up too much of your time.

Security

POS cyber attacks have risen dramatically over the past couple of years, making it more critical than ever to protect your business. Otherwise, it’s not just your business information at risk, but also your reputation and entire operations. iPad POS system security is a bit tricky, however. Unlike credit card swipers and mobile credit card readers that have long-established security standards namely, Payment Card Industry (PCI) compliance — the criteria for the iPad hardware itself as a POS terminal aren’t quite so clear-cut. Since iPads cannot be certified as PCI compliant, merchants must utilize a point-to-point encryption system that leaves the iPad out of scope. This means treating the iPad as its own system, which includes making sure it doesn’t save credit-card information or sensitive data on the iPad itself. To stay protected, look for PCI-certified, encrypted card swipers.

Posted in Best Practices for Merchants, Mobile Point of Sale, Point of Sale Tagged with: (POS) systems, accounting, app, business, card, cloud-based, credit, credit card readers, credit-card, crm, customer, customer relationship management, customer support, data, data analysis, database, desktops, e-commerce, inventory, iPad Point-Of-Sale, loyalty program, mcommerce, mobile, mobile app, mobile commerce, online, online platforms, Payment Card Industry, payments, PCI, platforms, POS, POS solution, products, sales, Security, security standards, services, Smartphones, social media, software, tablets, terminal, transactions, web

October 25th, 2013 by Elma Jane

Some brands have managed to pull themselves together to mobilize their online sites…that’s design them to be visually friendly to mobile users.

Earlier this month the quick-service restaurant debuted a new item on its menu…the Smoke Brisket Sandwich…with a campaign that involved a number of social media components. Included among those were a game that awards points based on a customer’s tweets, the online challenges he or she wins and the photos uploaded to Instagram.

It starts with a purchase of the sandwich at an Arby’s outlet. When the customers receives her receipt she takes a picture of it and uploads it to mobile site PunchTab created for the campaign.

What sets this campaign apart from many others is that it is coordinated at the point of sale.

For this campaign, PunchTab created mobile Web onto which Arby’s customers upload a receipt. When users make a purchase, they can take a picture of their receipt and submit it via the mobile website. From there, points are dispersed, the players advance…and hopefully, return to Arby’s for more purchases, err, points.

Helping Business

There’s definitely been a trend in the POS and payments industry to add value offerings by helping businesses better understand their customers. This trend is built on the wealth of transactional data being collected by POS and payments companies, and the goal is to present simplified consumer behavior analyses that can be used by merchants to generate more revenue.

Looking ahead, more and more retailers will understand the value that capturing this customer data can unlock for this business, and will put the software in place to tap into a customer’s purchase history and thus their preferences.

Now the focus is on salespeople delivering a personalized experience to customers. The next stage, will focus on extending to individual customers the inside track on new products that will appeal to them and complement or replace things they have previously purchased.

Pimping Out The POS

Engaging with the customer at the point of sale is hardly a new idea. It certainly is an established practice in traditional brick and mortar operations…think credit card solicitations and offers for loyalty points and cards…as we all as e-commerce sites, where a customer is usually presented with several offers before the checkout is complete.

Now CRM is making its way into the mobile POS and customers are finding that there are a number of unique benefits to the model.

In the case of PunchTab, it ties the receipt-scanning functionality that doesn’t require an app…not to mention several other benefits to the system.

For example, Marketers get greater insight into purchasing behavior because a receipt is usually involved. Consumers are right there and thinking about the campaign…which they wouldn’t necessarily be when they got home to go online, and it is relatively easy system to set up.

Arby’s for example, has 40 POS systems and because it is a franchise, it requires coordinating with multiple owners. For them, mobile is the best and easiest way to engage with customers at the point of sale.

Real-Time Offers

Other companies…such as Groupon with its Breadcrumb mobile app…are adding even more advanced CRM capabilities, such as reporting at the mobile point of sale.

It is a growing trend for all mobile applications and most especially apps in the mobile POS to bring more CRM capabilities into their service platform.

Eventually, some of these CRM-infused mobile POS systems will be able to make offers in real time to customers based on their purchase at the moment and accumulated knowledge about the preferences of other customers that make similar purchases. Example it might be noted that in 20 percent of all purchases of a particular type of coffee the customer also purchase a biscotti, then the server can offer up the option as a reminder for purchase/order.

The example assumes the mobile POS system has access to customer data about purchase and preferences…which is somewhat rare now, but a trend gaining momentum.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: app, awards, brick and mortar, crm, customers, data, design, franchise, functionality, mobile, mobile pos, mobilize, online, payments, payments industry, point of sale, points, POS, purchase/order, purchases, receipt, receipt-scanning, restaurant, retailers, revenue, social media, transactional, uploaded, users, web, website