October 6th, 2016 by Elma Jane

A personal guarantee is an agreement. The guarantors are responsible for repaying the loan with their personal assets; if a business is unable to finish repaying a loan.

This type of agreement is commonly required when you borrow capital from any bank; and also applies to many business credit cards. Traditionally, it is signed by anybody who at least owns 25% of the business.

Different Types of Agreements:

Some of them offer more protection for you and your business partners.

Unlimited Guarantee – is the only agreement available for a single-owner business, there’s a possibility that limitations are negotiable with your lender upon the agreement.

Limited Guarantee – the type of guarantee that are being used for businesses with multiple business partners are signing for a loan.

Two different types of limited guarantee:

Several Guarantee – means that you and your partner are responsible for a set percentage of the outstanding capital and legal fees. It is more desirable because each partner knows and agrees to how much they’ll be responsible for ahead of time.

Joint and Several Guarantee – This type of agreement could lead to problems between you and the other guarantors if something should go wrong because each guarantor is responsible for the full amount of the loan.

Read the fine print before signing a contract.

Posted in Best Practices for Merchants Tagged with: bank, credit cards, loan

July 19th, 2016 by Elma Jane

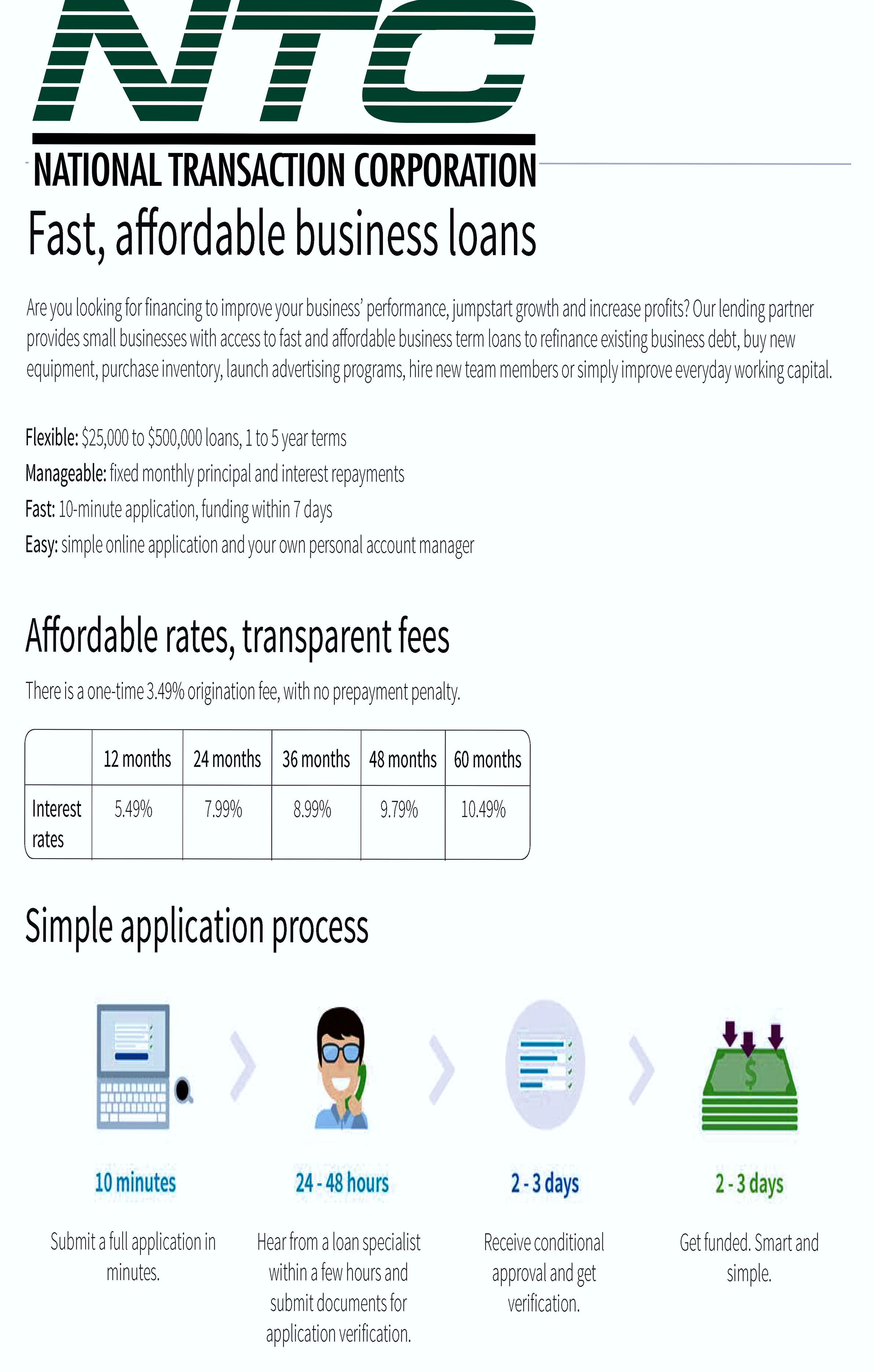

Here are some of the Common Business Loan Fees:

Application Fee – is a fee charged to cover the costs of processing and assessing your loan application.

Bank Wire Fee – When borrowing a loan, lenders commonly wire the money to your bank account via ACH, because the banks need to talk to each other and ensure the money is going to the right place and that no fraud is going on.

Check Processing Fee – ACH transfers are commonly used to collect periodic repayments from the debtor’s bank account. Some lenders offer the option of paying by check, but you’ll have to pay a fee for the extra cost involved.

Closing Cost – not to be confused with closing fees, encapsulate all the fees charged for processing a loan, including origination/closing fees, processing fees, referral fees, and/or packaging fees.

Draw Fee – similar to an origination fee, but is applicable instead for lines of credit.

Guarantee Fee – is charged on all SBA loans above $150K. Guarantee fee is charged to protect against credit-related losses in the mortgage portfolio.

Late Payment Fee – Missing a payment deadline can result in a late fee. A late payment may have an affect on your personal or business credit score.

Origination Fee – an up-front fee charged for processing a new loan application. Prepayment

Penalty – Is a borrower, a bank or mortgage lender agreement that regulates what the borrower is allowed to pay off and when.

Servicing and Maintenance Cost – fees charged to cover the costs associated with collecting payments, maintaining records, following up on delinquencies and any other costs associated with maintaining a term loan or line of credit.

Business loans are available in different types, from merchant cash advances to lines of credit. The most effective way to get the best deal on a business loan is to be educated and know that Fees are Negotiable.

Posted in Best Practices for Merchants, Financial Services Tagged with: ach, bank account, check, credit, fee, fraud, loan, payment

February 29th, 2016 by Elma Jane

True Stories of our Customers in Action

Travel Agency ~ An Independent Travel Firm had been using their bank as credit card processor. When they learned that Virtuoso and NTC were going to team up they jumped on the opportunity. Not only NTC has lowered their fees but NTC has streamlined their credit card processing. The manual type-in process before has been all automated batch process now which saves time. This is a great new partnership for Virtuoso and its members.

Wholesale Hardware Industry ~ Have been turned down his business loan by a traditional bank last year due to his bankruptcy few years ago. He has no option but to borrow using a Cash Advance, making daily payment with a very high-interest rate. NTC was able to get an approval for a Real Business Loan, with monthly payment with an annual rate.

Term loan amount: $85K – Line of credit: $75K

Another Travel Agency ~ NTC has great customer service, the support team will patiently guide you through the PCI compliance. The payments specialist will check whether they could reduce your rates (which they did successfully!). They will even follow up regularly with status updates. NTC is exemplary!

NTC has a lot to offer, from our e-Pay Service and other New Programs for ISO’s, and Options for your merchants. NTC, The Payments and Technology Expert! Visit us at www.nationaltransaction.com or call us at 888-996-2273.

Posted in Best Practices for Merchants, Credit card Processing, Payment Card Industry PCI Security, Travel Agency Agents Tagged with: bank, Business Loan, card, cash advance, credit card, customers, loan, merchants, payment, PCI Compliance, processor, travel, travel agency

April 6th, 2015 by Elma Jane

Merchant Cash Advance – A lump-sum payment to a business in exchange for an agreed-upon percentage of future credit card and/or debit card sales. The term is now commonly used to describe a variety of small business financing options characterized by short payment terms (generally under 24 months) and small regular payments (typically paid each business day) as opposed to the larger monthly payments and longer payment terms associated with traditional bank loans.

Merchant Cash Advance companies, provide funds to businesses in exchange for a percentage of the businesses daily credit card income, directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed variable percentage of a merchant’s future credit card sales.

The Term Merchant Cash Advance – may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring or short-term business loans.

This structure has some advantage over the structure of a conventional loan. Most importantly, payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital. Also, because MCA providers like typically give more weight to the underlying performance of a business who may not qualify for a conventional loan.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans, and are generally more expensive than bank loans. Competition and innovation led to downward pressure on rates and terms are now more closely correlated with an applicant’s FICO score.

There are generally three different repayment methods:

Split withholding – when the credit card processing company automatically splits the credit card sales between the business and the finance company per the agreed portion. The most common preferred method of collecting funds for both the clients and finance companies since it is seamless.

Lock box or trust bank account withholding – all of the business’s credit card sales are deposited into bank account controlled by the finance company and then the agreed upon portion is forwarded onto the business via ACH, EFT or wire. The least preferred method since it results in a one-day delay in the business receiving the proceeds of their credit card sales.

ACH withholding – when structured as a sale, the finance company receives the credit card processing information and deducts its portion directly from the business’s checking account via ACH. When structured as a loan, the finance company debits a fixed amount daily regardless of business sales.

Posted in Best Practices for Merchants, Financial Services, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account Tagged with: ach, bank loans, business loans, checking account, conventional loan, credit card processing, credit card sales, credit-card, debit card, finance company, loan, MCA providers, merchant, merchant cash advance, payments

March 17th, 2015 by Elma Jane

Merchant Cash Advance – A lump-sum payment to a business in exchange for an agreed-upon percentage of future credit card and/or debit card sales. The term is now commonly used to describe a variety of small business financing options characterized by short payment terms (generally under 24 months) and small regular payments (typically paid each business day) as opposed to the larger monthly payments and longer payment terms associated with traditional bank loans. The term Merchant Cash Advance may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring or short-term business loans.

Merchant Cash Advance companies, provide funds to businesses in exchange for a percentage of the businesses daily credit card income, directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed variable percentage of a merchant’s future credit card sales.

These Merchant Cash Advances are not loans – rather, they are a sale of a portion of future credit and/or debit card sales.

This structure has some advantage over the structure of a conventional loan. Most importantly, payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital. Also, because MCA providers like typically give more weight to the underlying performance of a business who may not qualify for a conventional loan.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans, and are generally more expensive than bank loans. Competition and innovation led to downward pressure on rates and terms are now more closely correlated with an applicant’s FICO score.

There are generally three different repayment methods:

Split withholding – when the credit card processing company automatically splits the credit card sales between the business and the finance company per the agreed portion. The most common preferred method of collecting funds for both the clients and finance companies since it is seamless.

Lock box or trust bank account withholding – all of the business’s credit card sales are deposited into bank account controlled by the finance company and then the agreed upon portion is forwarded onto the business via ACH, EFT or wire. The least preferred method since it results in a one-day delay in the business receiving the proceeds of their credit card sales.

ACH withholding – when structured as a sale, the finance company receives the credit card processing information and deducts its portion directly from the business’s checking account via ACH. When structured as a loan, the finance company debits a fixed amount daily regardless of business sales.

Posted in Best Practices for Merchants, Merchant Account Services News Articles, Merchant Cash Advance Tagged with: ach, bank loans, business loans, checking account, conventional loan, credit card processing, credit card sales, credit-card, debit card, finance company, loan, MCA providers, merchant, merchant cash advance, payments

September 12th, 2014 by Elma Jane

If you needed a loan, would you shop around first or go with the first lender you found? Small business owners are more likely to do the latter. For small business owners, personal interaction is key, and with many lenders focusing strictly on online marketing methods to reach new customers, these findings may come as a surprise.

While there is a plethora of alternative online lending options for small businesses, 44% of all loan applications are completed in person, even though business owners of all ages surveyed reported using an online process for researching and initiating a loan application, only younger business owners were very open to using it to complete the process.

User-friendly websites do help aid in conversion, but they don’t influence lender choice. Small business owners are more likely to use the first lender they meet, proof that even in an age of technology and advancements in online lending, human interaction is still one of the most important parts of the loan process, this may be due to the challenges small businesses face during the loan process as restrictions have increased on traditional loans.

First thing business owner do is ask rate…When it is more important to get the terms you want. If a lender term wants a higher rate, but let you pay it off on a longer term you may find more is less!

Despite great interest in strictly online alternative lending, many business owners still desire personal interactions with financial providers that will take the time to discuss business challenges and solutions. National Transaction standout over competitors because of its human/personal interactions.

Posted in Small Business Improvement Tagged with: business, competitors, customers, financial providers, lending options, loan, loan applications, marketing methods, National Transaction, provider's, rate, solutions, traditional loans, websites

October 10th, 2013 by Elma Jane

Merchant Cash Advance was originally structured as a lump sum payment to a business in exchange for an agreed upon percentage of future credit card and/or debit card sales.

Notion Merchant Cash Advance companies provide funds to businesses in exchange for a percentage of the businesses daily credit card income, directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit- and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with card-payment processors and take payments directly from a business owner’s card-swipe terminal.These Merchant Cash Advances are not loans – they are a sale of a portion of future credit and/or debit card sales. Therefore merchant cash advance companies claim that they are not bound by state usury laws which limit lenders from charging excessive interest rates. This technicality allows them to operate in a largely unregulated market and charge much higher interest rates than banks. This structure has some advantages over the structure of a conventional loan. Most importantly, payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical loan, giving borrowers quicker access to capital. Also, because MCA providers typically give more weight to the underlying performance of a business than the owner’s personal credit scores, Merchant Cash Advances offer an alternative to businesses who may not qualify for a conventional loan.

Usage Merchant cash advances are most often used by retail businesses that do not qualify for regular bank loans, and are generally more expensive than bank loans. Competition and innovation led to downward pressure on rates and terms are now more closely correlated with an applicant’s FICO score.

Generally there are three different types of repayment methods for the business.

1. ACH (Automated Clearing House) Withholding: When structured as a sale, the finance company receives the credit card processing information and deducts its portion directly from the business’s checking account via ACH. When structured as a loan, the finance company debits a fixed amount daily regardless of business sales activity.

2. Lock Box or Trust Bank Account Withholding: All of the business’s credit card sales are deposited into bank account controlled by the finance company and then the agreed upon portion is forwarded onto the business via ACH (Automated Clearing House), EFT ( Electronic Funds Transfer) or wire. This is the least preferred method since it results in a one-day delay in the business receiving the proceeds of their credit card sales.

3. Split Withholding: When the credit card processing company automatically splits the credit card sales between the business and the finance company per the agreed portion (generally 10% to 22%). This is generally the most common and preferred method of collecting funds for both the clients and finance companies since it is seamless.

Opting for a merchant cash advance is a decision made by small business owners every day of the week across this country. If you’re having a hard time establishing a business line of credit or getting approved for a business loan, a merchant cash advance may very well be the best option available to you to help you finance your business.

Here are reasons why a business cash advance makes sense.

A. Can take out more advances as advance is repaid

Most business loans will not be extended as you pay off your balance, but with a merchant cash advance, you can get more money as you pay off your advance.

B. Even with less-than-perfect credit, you can be approved

No worries about being approved if you have less-than-perfect credit, a high credit score is not a major factor in whether you are can receive business funding from a cash advance.

C. Flexible repayment terms – repayment is based on sales volume, not a flat rate

Some businesses can run into financial hardships with traditional business loans that require flat-rate monthly payments, but with merchant cash advances your monthly payments are dependent on your sales volume. This means that if you have a slow month, you pay back less.

D. Frees up time because of the simple application/approval process

The application and waiting process for a business loan or even a business line of credit can be outstanding –sometimes you have to wait 30 days just to receive notice of approval from your application, add the wait time to the back and forth calls, document signing, etc – and it can be an arduous process. However, by choosing a merchant cash advance, you can quickly qualify online or by phone.

E. Gives you more money in your pocket to improve cash flow

Cash advances can give you the opportunity to receive more money than you would be able to borrow from a bank.

F. Gives you money right away

With a merchant cash advance you literally can have your cash in as little as 72 hours from your applications approval – and most businesses get their funding in less than a week. Now that’s a simple process

G. New business friendly

Many small business loans require that you have a well-established business (2 years or more) to even consider you for business funding. With a cash advance, you can receive funding even if your company is newly in business.

H. No personal liability for repayment of the cash advance

Much unlike with business lines of credit and small business loans, you are not personally responsible for repayment of the advancement.

I. Non-restrictive usage on what you use the funding for

Too many times business owners are restricted by what they can do with their business loans. But, because a cash advance is designed to help you improve your cash flow, you can use your new funds wherever your business needs them.

J. Qualification is easier than with traditional business loans

Banks have a lot of stipulations for businesses that they loan money to or extend credit lines – cash advances have minimal qualifications and high approval rates.

Posted in Best Practices for Merchants, Merchant Cash Advance, Merchant Services Account Tagged with: ach, automated clearing house, bank, business, businesses, capital, cash advance, credit-card, eff, electronic, excessive, flat-rate, funds, loan, loans, merchant, money, online, pay, payments, Processing, purchases, Rates, signing, transfer