May 6th, 2016 by Elma Jane

A data breach is any instance in which secure data information has been released or stolen intentionally or unintentionally. The organization that exposed or lost your information will notify you. The steps you should take depend on the type of information that was lost or stolen. In general, you may choose to do one or more of the following:

- Monitor all bank and other accounts for suspicious activity.

- Change all passwords, PINs, or user names associated with compromised accounts.

- Order a copy of your credit report.

- Place a fraud alert or credit freeze on your credit file.

Posted in Best Practices for Merchants, Credit Card Security, Travel Agency Agents Tagged with: accounts, bank, credit, data, data breach, fraud

May 3rd, 2016 by Elma Jane

MerchantConnet is a great tool for merchants, it contains all the information that a merchant needs to manage their electronic payment activity. It’s fast, easy and secure!

- Merchant can view or update account information and make changes.

- Find copies of statements.

- Find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History.

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal.

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, card, chargeback, merchants, payment, terminal, transactions

April 25th, 2016 by Elma Jane

There are a lot more details of what makes up a credit card rate, this information is a good start to know more about a merchant account. All merchant accounts are subject to the same costs with respect to interchange fees and assessments.

Most rates are made up of three parts:

Assessments – are paid directly to card network associations (Visa, MasterCard, Amex, etc.)

Interchange – are paid to the issuing bank that issued the card, and is typically made up of a flat rate.

Card present transactions (the card is physically present or swiped) are typically lower than card-not-present transactions (the card is keyed-In like e-commerce and mail-order transactions).

Card-not-present transactions have higher interchange rates because they are riskier.

Processor fees – the fees involved with providing the service, risk assessments, the type and size of the transaction. This includes the margin between the total rate and the two previous parts, along with other fees, like chargeback or statement fees.

Posted in Best Practices for Merchants, Credit card Processing, Travel Agency Agents Tagged with: bank, card, card network, chargeback, credit card, merchant account, rate, transaction

April 20th, 2016 by Elma Jane

ECS: An Electronic Mode Of Funds Transfer From One Bank Account To Another

- Paper check conversion

- Debit Processing

- Automated Returns Management

- Reporting: Merchant Connect, ACS Standard and Custom Files, Enquire and Corporate Management Reports

- Monthly Statement

- Risk Services: Verification, Conversion

- Image

ACH E-CHECK: Uses Bank Routing and Account Number In a CNP Environment.

- Card-Not-Present e-Processing of ACH Debit

- Known Relationship B/Consumer and Business

- NOT for Ecommerce “Sale of Goods and Services”

- Debit Processing

- Automated Returns Management

- Reporting: Merchant Connect, ACS Standard and Custom Files, Enquire and Corporate Management Reports

- Monthly Statement

- Risk Services: Verification, Conversion

- No Image

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: account, ACS, bank, card-not-present, cnp, consumer, debit, ecommerce, ECS, merchant, risk, services

April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction

March 17th, 2016 by Elma Jane

A bank in Mexico is the first in the world to publicly experiment with this technology. With their mobile wallet application, cardholders are able to use dynamic CVC/CVV codes, which are generated every twenty minutes.

If somebody is using credit card information stolen from a data intrusion and the merchant accepting payment online asks for the CVV, it likely would have changed by that time, they would enter the wrong CVV and the transaction would be declined.

Cards with CVV code display that randomly changes will ensure that users making orders online are who they say they are. Many e-Commerce sites already ask shoppers for the CVV code during online transactions or over the phone.

The technology is an intuitive solution, but costly to issuers. Cards with displays that enable a dynamic CVV code are 10 times more expensive than chip cards.

As mobile banking, e-commerce, and m-commerce is growing, something had to change sooner or later in the online payment industry.

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce Tagged with: bank, cardholders, cards, credit card, data, e-commerce, m-commerce, merchant, mobile, online, payment, payment industry, transaction, wallet

March 9th, 2016 by Elma Jane

Lisa an independent Travel agent started her business in October 2006. She has been using her bank as their credit card processor and use to do a manual type-in process. When she learned about NTC while trying to shop online because she thinks it’s time for her to upgrade her system, Lisa found that NTC is not only a payment expert when it comes to travel, but a technology expert as well that met her business’s needs.

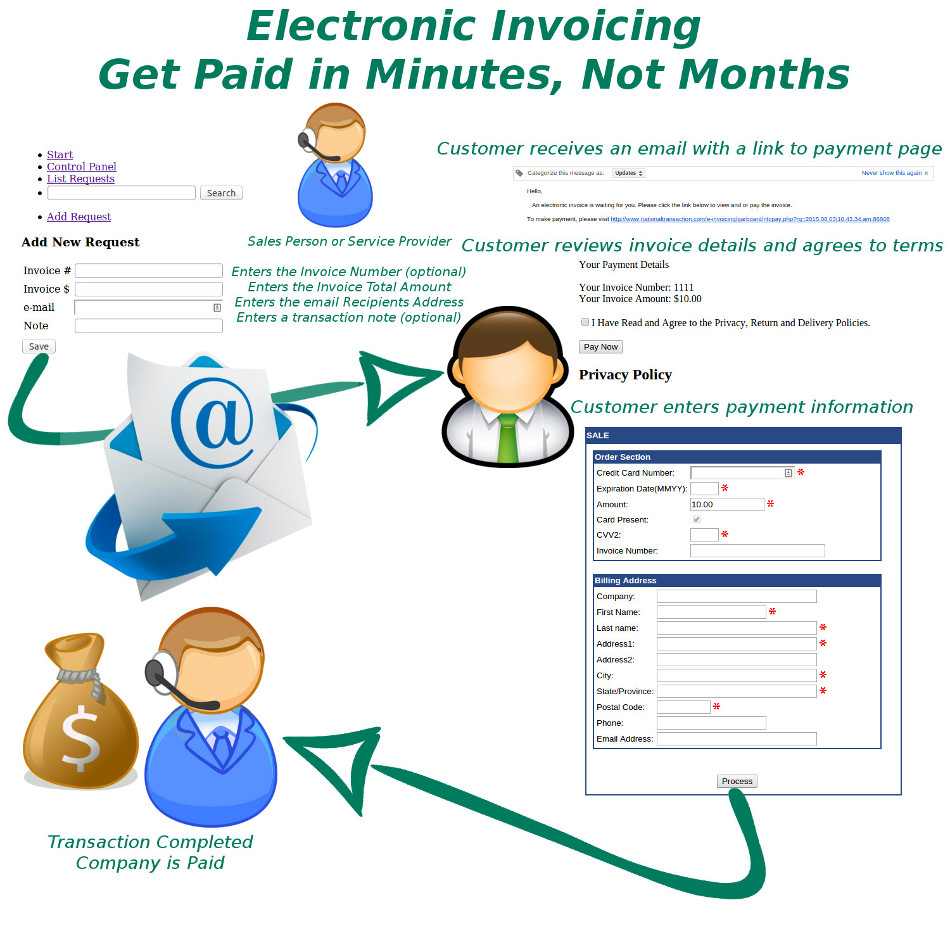

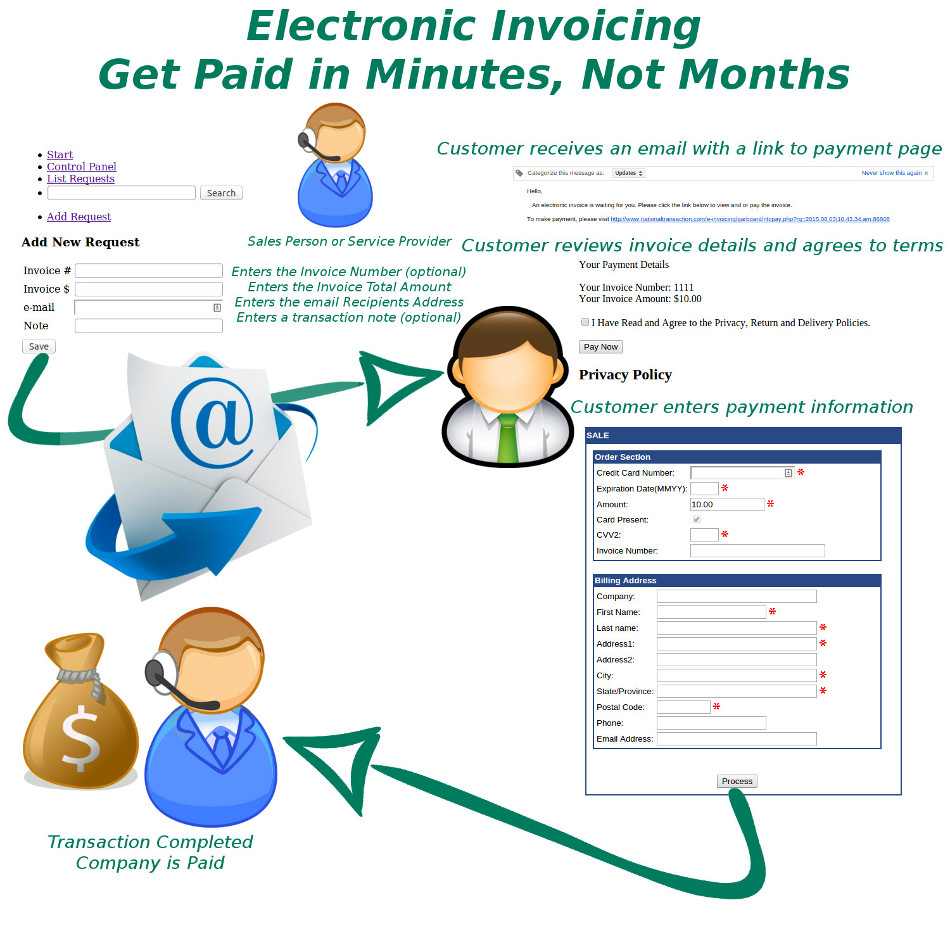

Lisa is using NTC e-Pay an electronic invoicing that has streamlined their credit card processing. The process not only has it saved money with competitive rates but most importantly it saves time. The level of assistance provided went above and beyond what she expected.

NTC e-Pay is for all types of merchants in a Card-Not-Present Transaction.

Consumer Acess – consumer will have access to their transaction details on their device. For travel merchants, the consumer can have access to their itinerary while on the go!

Customizable Pricing – when custom pricing becomes an issue, shopping carts, POS systems and booking engines tend to get really complicated.

Fast – saves time and unnecessary cost. Moves money efficiently and effectively. Simply email payment request that can be paid in 2 simple steps.

- The customer receives an email with a link to the payment page. Customer reviews invoice details and agrees to terms. The customer enters payment information.

- Process, transaction is completed company is paid. You get paid in minutes, not months.

Protects you from Chargeback – the customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy.

Secured – credit card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

The no shopping cart e-Commerce solution! – avoids the complexities of a shopping cart or integration into an accounting or POS.

Thinking of upgrading your system give us a call at 888-996-2273 and know more of our NTC e-Pay platform.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, consumer, credit card, Electronic invoicing, merchants, online, payment, POS, processor, shopping carts, transaction, travel, travel agent

March 4th, 2016 by Elma Jane

A number of financial institutions are beginning to implement biometric authentication. They started to replace traditional knowledge-based passwords with biometric authentication.

A British multinational banking is introducing biometric tests for its customers in U.K., letting account holders access online banking using their fingerprint or voice. If you’re using phone-banking services you can register your voiceprint with the company instead of using a regular password. A special voice biometrics technology will analyze a customer’s voice when they call the bank.

Customers using Apple’s Touch ID will be able to access their accounts on their mobile phones using their fingerprint.

Customers in the U.S., Canada, Mexico, Hong Kong, and France will have the technology by the end of the year. Other markets will follow in 2017 and 2018. The British multinational banking and financial services company have nearly 50 million retail banking customers around the world.

Posted in Best Practices for Merchants, Financial Services Tagged with: account, bank, banking, biometric, customers, financial, financial institutions, financial services, mobile, online, retail

February 29th, 2016 by Elma Jane

True Stories of our Customers in Action

Travel Agency ~ An Independent Travel Firm had been using their bank as credit card processor. When they learned that Virtuoso and NTC were going to team up they jumped on the opportunity. Not only NTC has lowered their fees but NTC has streamlined their credit card processing. The manual type-in process before has been all automated batch process now which saves time. This is a great new partnership for Virtuoso and its members.

Wholesale Hardware Industry ~ Have been turned down his business loan by a traditional bank last year due to his bankruptcy few years ago. He has no option but to borrow using a Cash Advance, making daily payment with a very high-interest rate. NTC was able to get an approval for a Real Business Loan, with monthly payment with an annual rate.

Term loan amount: $85K – Line of credit: $75K

Another Travel Agency ~ NTC has great customer service, the support team will patiently guide you through the PCI compliance. The payments specialist will check whether they could reduce your rates (which they did successfully!). They will even follow up regularly with status updates. NTC is exemplary!

NTC has a lot to offer, from our e-Pay Service and other New Programs for ISO’s, and Options for your merchants. NTC, The Payments and Technology Expert! Visit us at www.nationaltransaction.com or call us at 888-996-2273.

Posted in Best Practices for Merchants, Credit card Processing, Payment Card Industry PCI Security, Travel Agency Agents Tagged with: bank, Business Loan, card, cash advance, credit card, customers, loan, merchants, payment, PCI Compliance, processor, travel, travel agency

February 4th, 2016 by Elma Jane

Companies providing electronic money services, such as online or mobile payments accounts, have more than doubled since 2013.

This number has been on the rise over the past few years as consumer confidence in alternative payments methods has increased.

UK consumers and businesses are increasingly comfortable with the idea of a cashless economy, in which they might not be able to physically see or access money. More are embracing pre-paid cards, contactless and mobile payment systems for ease of use, efficiency and enhanced security.

According to a specialist financial services regulatory consultancy, there has been a significant increase in the number of electronic money providers registered with the Financial Conduct Authority (FCA).

E money providers must be authorized with the FCA under the Electronic Money Regulations 2011 and meet stringent consumer protection criteria, including adequate capital, the separation of customer’s money from the company’s funds.

The regulatory background is complex and electronic money providers need to ensure that systems, processes and controls are tight to ensure a high level of consumer protection. The FCA is not afraid to place these businesses under a microscope.

Many are concerned that this increase in alternative payments methods will lead to the death of the traditional bank, but only if they fail to innovate and adapt to market trends and consumer needs.

Posted in Best Practices for Merchants Tagged with: bank, cards, consumers, contactless, customers, electronic money, financial services, Mobile Payments, online, payment systems, payments, payments methods, provider's, Security