May 6th, 2016 by Elma Jane

A data breach is any instance in which secure data information has been released or stolen intentionally or unintentionally. The organization that exposed or lost your information will notify you. The steps you should take depend on the type of information that was lost or stolen. In general, you may choose to do one or more of the following:

- Monitor all bank and other accounts for suspicious activity.

- Change all passwords, PINs, or user names associated with compromised accounts.

- Order a copy of your credit report.

- Place a fraud alert or credit freeze on your credit file.

Posted in Best Practices for Merchants, Credit Card Security, Travel Agency Agents Tagged with: accounts, bank, credit, data, data breach, fraud

August 29th, 2014 by Elma Jane

High risk credit card processing is electronic payment processing for businesses deemed as HIGH RISK by the MERCHANT SERVICES INDUSTRY

The high risk segment of payment processing has become more important as banks and ISO’s have begun to tighten up their credit restrictions and underwriting policies. Businesses are classified as high risk primarily because of their product or service and the way they go to market. In merchant services, risk is related to CHARGEBACKS or customer disputes.

The more likely a business to have chargebacks, the higher risk the business. For instance, online businesses selling a weight loss product through a free trial offer, is more likely to have chargebacks than a retail store selling the same weight loss product.

Merchants are often unaware their business falls into the high risk category when they first start shopping for a merchant account. Getting a high risk merchant account can be difficult.

These providers have more stringent requirements and the application process is longer compared to traditional merchant account providers.

High risk businesses should expect to pay higher rates and fees for payment processing services. As a general rule of thumb, merchants should count on paying at least more than a traditional merchant account. Most high risk merchant accounts also require a contract of at least 18 months, whereas low risk providers offer accounts without cancellation fees or contracts.

ROLLING RESERVES are also a big part of high risk credit card processing. Most high risk merchants have some sort of rolling reserve placed on the account, especially new accounts without any processing history. A Reserve refers to an account where a percentage of the funds from transactions are held in reserve to cover against any chargebacks or fees that the processor may not be able to collect from the merchant. This is similar to a security deposit, but merchants don’t have to pay it up front. Reserves are a pain point for many small high risk merchants, but they are definitely necessary and without them, processors would not accept any high risk merchants at all.

What Businesses Are High Risk?

As mentioned earlier, businesses are usually classified as high risk due to the product or service they offer, however merchants with severely damaged credit or a recent bankruptcy can also be considered high risk. Below are just of the few common high risk merchant categories:

Adult Websites

Cigars & Pipe Tobacco Online

Collection Agencies

Credit Repair

Debt Consolidation

E-Books & Software

Electronic Cigarettes

Firearms – Online

High Ticket & High Volume

Medical Marijuana Dispensaries

Multi Level Marketing & Business Opportunities

Nutraceuticals like weight loss supplements, cleansers etc.

Penny Auctions

Sports Betting Advice

Ticket Brokers – Online Tickets

TMF Merchants

Travel & Timeshare

Unfortunately this list is growing and some credit card processing companies even classify any start up Internet business, that doesn’t have extensive financials to be high risk. With the recent economic recession in the United States, there has been an increase in these start up Internet ventures. People are either looking to supplement their income or start their own business instead of looking for work.

How To Protect Your Business

Accepting credit cards is the single most important part of most online businesses. Unfortunately, many successful businesses go under after having their merchant account shut down. High risk merchants should always be cognizant of their merchant account and pay attention to chargeback percentages. Below are some tips for high risk merchants looking for payment processing solutions.

Be Upfront: Make sure your processor knows exactly what you sell and how you market the product/service. If they don’t accept your business type, keep shopping for a new merchant account provider. Many merchants will try to fly under the radar by not revealing all their products or fully disclose their marketing methods to the processor. This is a bad move, the processor will eventually find out the details about your business. This is usually from doing an audit on your transactions and contacting your customers.

Negotiate Every 3 Months: Credit card processing companies underwrite applications based on previous processing history. If there is no previous history, the account is riskier and the terms offered are usually more expensive and restrictive. You can always re-negotiate your rates, reserves and other contract terms with your current processor. Once they have 3 months of history to evaluate, they may be able to offer you a better deal. Three months of history is the magic number for most processors. If you applied without the previous history and were declined, there is a chance the same processor will approve your application if you provide 3 months of previous statements.

Prepare For The Worst: All high risk merchants should keep at least 2 active merchant accounts, from different providers. You never know when underwriting guidelines might change, or you may have an influx of chargebacks. Having a backup account or even multiple back up accounts is a good idea. Many high risk providers offer a load balancing gateway, which allows for multiple merchant accounts to be integrated into one payment gateway. This way you can spread transactions across multiple accounts, through one shopping cart/gateway.

Posted in Best Practices for Merchants Tagged with: account, account providers, accounts, banks, card, chargebacks, contract, credit, credit card processing, credit restrictions, customer, customers, deposit, electronic payment, fees, financials, gateway, High risk credit card, High Ticket & High Volume, ISOs, low risk, marketing, merchant, merchant account, merchant services, multiple accounts, payment gateway, payment processing, processing services, processing solutions, processor, product, Rates, reserves, retail store, risk, ROLLING RESERVES, Security, security deposit, service, shopping cart, statements, terms, TMF Merchants, transactions, travel, underwriting

July 21st, 2014 by Elma Jane

European authorities dismantled a Romanian-dominated cybercrime network that used a host of tactics to steal more than EUR2 million. As a direct result of the excellent cooperation and outstanding work by police officers and prosecutors from Romania, France and other European countries, a key criminal network has been successfully taken down this week.

Hundreds of police in Romania and France, backed by the European Cybercrime Centre, carried out raids on 177 addresses, interrogating 115 people and detaining 65. Those held are suspected of participating in sophisticated electronic payment crimes, using malware to take over and gain access to computers used by money transfer services all over Europe. They are also accused of stealing card data through skimming, money laundering and drug trafficking.Proceeds of the crimes were invested in different types of property, deposited in bank accounts or transferred electronically, says the EC3. Large sums of money, luxury vehicles and IT equipment were seized during the raids.

Posted in Uncategorized Tagged with: accounts, bank, bank accounts, card, card data, cybercrime, data, electronic payment, host, Malware, money transfer, network, payment

May 19th, 2014 by Elma Jane

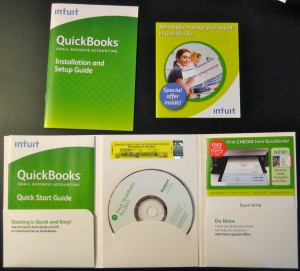

Keeping your business’s finances in order doesn’t have to take all day. Bookkeeping is a necessary for small business owners, but it’s a time-consuming chore.

If you use QuickBooks for payroll, inventory or keeping track of sales, there are several timesaving shortcuts you can utilize to make bookkeeping easier.

Time-saving tips for getting the most out of QuickBooks in the least amount of time. Help you spend more time building your business and less time using QuickBooks.

Download data whenever possible. Even after factoring in initial setup time, downloading banking and credit card activity directly into QuickBooks is a huge time saver. Doing this will minimize the chance of human error and enable you to record activity faster than if you did it manually.

Make the Find feature your friend. Using the Find feature is the most efficient way to locate a particular invoice in QuickBooks. Those who usually open the form and click Previous until the form appears on the screen know how tedious this process can be. The Find tool will search for almost any transaction-level data, depending on your filters.

Memorize transactions. QuickBooks has the capability to memorize recurring transactions (invoices, bills, checks, etc.) and set them for automatic posts daily, weekly, monthly, quarterly and annually, eliminating the need to enter the same transaction into the software every month.

Use accounts payable aging. Use this feature for a snapshot on who you owe money to and manage your cash flow more efficiently.

Use accounts-receivable aging. Use this feature for a snapshot of information on who owes you money, how much you are owed and how long the individual has owed you.

Use classes. Classes can be very helpful to track income and expenses by department, location, separate properties or other meaningful breakdowns of your business.

Use QuickBooks on the go with remote access. Remote-access methods include QuickBooks Online, desktop sharing and QuickBooks hosting on the cloud, which allows you to take the program on the go and make changes no matter where you are.

Posted in Best Practices for Merchants Tagged with: accounts, accounts payable, banking, banking and credit card, bills, Bookkeeping, card, cash flow, checks, cloud, credit, data, desktop, desktop sharing, finances, hosting, income and expenses, invoices, online, program, QuickBooks, Remote-access, software, transaction

May 13th, 2014 by Elma Jane

Walmart US, says: After listening to customers complain about the high fees and confusion associated with transferring money, we knew there had to be a solution. Walmart-2-Walmart brings new competition and transparent, everyday low prices to a market that has become complicated and costly for customers.

Walmart is taking on Western Union and MoneyGram through the launch of a low-fee store-to-store money transfer service. The retail giant has teamed up with Euronet Worldwide subsidiary Ria on the Walmart-2-Walmart service, which will enable customers to transfer money to and from more than 4000 stores when it launches next week. The partners say that their service is far cheaper than rivals, with just two pricing tiers: customers pay $4.50 for transferring up to $50 and $9.50 for sending up to $900. Walmart argues that its service will particularly benefit the tens of millions of America’s underbanked. The retailer has long had its sights on this market, teaming up with American Express in 2012 to launch Bluebird, a mobile-heavy alternative to bank debit and current accounts.

Posted in Best Practices for Merchants, Financial Services Tagged with: accounts, American Express, bank, bank debit, current accounts, customers, debit, Euronet, fees, low-fee, low-fee store-to-store money transfer service, market, mobile, money transfer, MoneyGram, retailer, store-to-store, walmart, western union

April 11th, 2014 by Elma Jane

A new standard that uses Host Card Emulation (HCE) was introduced by VISA to enable financial institutions to securely host Visa accounts in the cloud. Visa’s move to support HCE includes tools and services as well as the standard. It is available now and will include support for QR codes and in-app payments in the future.

With this new service and platform that Visa is developing, it will enable clients and partners to issue Visa accounts digitally in the cloud, on secure elements in smartphones, or linked to a digital wallet. The solution will also enable the issuance of payment tokens that will replace the 16-digit payment account number and can be limited for use with a specific device, merchant or payment channel.

Layers of security will deploy by Visa to protect payment accounts in the cloud, including at the Visa network, application and hardware levels. Device fingerprinting technology, one-time use data, payment tokens and real-time transaction analysis will make up a multi-layered defense against unauthorized account access for their services.

Visa has intensified its Visa PayWave contactless payment application and is introducing a new implementation guidelines, program approval process standard and requirements for their standards.

Visa is also developing a tool, its software development kit (SDK) to support clients who wish to develop their own cloud-based payment applications or want to enhance their existing mobile banking applications with Visa PayWave functionality.

HCE is introduced to make it easier for developers to create NFC applications like mobile payments, loyalty programs, transit passes, and other custom services. Visa’s move to enable NFC payments with Android devices is welcome news and will guide the way for the payments industry.

Clients and partners around the globe are continuously looking for cost efficient, flexible and secure ways to enable mobile payments. The Android HCE feature provides with a platform to evolve the Visa PayWave standard, support the development of secure, cloud-based mobile applications, while at the same time offer greater choice.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, Financial Services, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: accounts, android devices, approval, cloud, cloud-based mobile applications, contactless payment, device fingerprinting, Digital Wallet, digitally, financial institutions, HCE, host card emulation, in-app, mobile banking, nfc, payment account number, payment channel, payment tokens, payments, qr codes, real-time transaction, secure elements, securely, Smartphones, unauthorized, visa, visa network

December 5th, 2013 by Elma Jane

Recently, Consumer Reports reviewed 26 different prepaid cards and evaluated them based on different factors. The cards Consumer Reports considered to be the best scored well in each of these four factors:

- Clarity of Fees — How well the fees are disclosed.

- Convenience — Availability of in-network ATMs, bill pay features and how widely the card network brand is accepted.

- Safety — Whether funds are protected with FDIC deposit insurance.

- Value — How much they cost to use.

This is the first time Consumer Reports has evaluated and ranked prepaid cards, revealing a shift in the market for prepaid. As prepaid cards continue to grow in popularity, consumers are going to become savvier about which prepaid cards they purchase. Consider taking a closer look at this Consumer Report to determine how your financial institution’s (FI’s) prepaid offering measures up.

Highest ranked cards are those like the ATIRA suite of prepaid cards TMG’s clients issue. They have fewer fees and make it easier for consumers to avoid them, carry FDIC insurance for each cardholder, offer features comparable to traditional checking accounts and do a better job of disclosing fees.

Not surprisingly, the worst prepaid cards reviewed scored poorly in at least one, and sometimes several, of the above categories. All of the lowest ranked cards have high, unavoidable fees, including activation and monthly fees. Additionally, the lower scoring cards fail to make their fees clear and easy for consumers to access and understand.

Specifically, the report found some prepaid cards fail to provide clear explanations of how to use features such as electronic payments, text alerts and mobile remote deposit capture, and the fees that may be charged for them. Further, while all of the cards reviewed claim to offer some form of protection for consumers, the report found in these policies are often not clearly defined.

Consumer Reports also found it problematic that although issuers provide safeguards voluntarily, they can cancel them at any time. Additionally, according to the report, fee information is often hard to find and difficult to understand. The report states this problem is compounded by the lack of consistency with fee names and descriptions” from card to card, making it challenging for consumers to compare fees and costs. Consumer Reports also found that prepaid cards offered by some of the big banks are not necessarily less expensive than other prepaid cards. Also, these big bank offerings may be less attractive to consumers because they often don’t provide the option of making both electronic payments and payment by paper check.

Posted in Credit card Processing, Financial Services Tagged with: accounts, activation, ATMs, banks, bill pay, card network, cardholder, cards, costs, deposit, electronic payments, fees, financial institution, In-network, insurance, mobile remote deposit capture, monthly fees, paper check, prepaid, text alerts

November 18th, 2013 by Elma Jane

Big players are entering the merchant cash advance business and the industry’s smaller players are maturing. Meanwhile, the market is growing with the help of automated clearinghouse transactions.

The industry has caught the attention of high rollers who are transforming merchant cash advance into a mainstream option for funding small to midsize businesses.

In the past two years, venture capitalists and hedge funds have invested tens of millions of dollars in long-standing merchant cash advance firms and startups alike.

Meanwhile, big players such as PayPal and the card brands have launched their own programs to provide working capital to merchants.

The business has changed so much in the five years, it’s almost not the same business anymore, says a hybrid ISO and merchant cash advance company based in New York.

CEO of Capital Stack LLC, a merchant cash advance company in New York, has been monitoring the industry’s growth on his DailyFunder blog. He estimates that a year ago, there were about 50 merchant cash advance funders and about $1.5 billion in funding. This year, that number is north of 120, and the funding volume has doubled to $3 billion.

Counting mainstream funders such as Amazon and PayPal, which offer products that follow the cash advance model, the numbers are closer to $5 billion.

Until now, ISOs were using cash advances as an acquiring tool for credit card accounts. An estimate that of the 20 million to 25 million businesses in the U.S., about 5 million accept credit cards. When ACH opened up the remainder of those businesses for loans, the funding volume went off the charts. Now it’s going to grow 50-fold in a 10-year period, just because there are so many more businesses that are approvable.

The popularity of cash advance is good news for ISOs, who might have an easier time pitching the product to merchants because they already know about it and know to ask for it.

A number of factors have coincided to make merchant cash advances more attractive.

Previously, cash advances were associated with luring merchants into a high-rate source of cash. Funders could charge any rates they wanted because the industry was so unregulated. As the industry has matured, the more disciplined companies have survived, while the others have fallen by the wayside, and with the recession causing fewer banks to offer traditional loans, the market is wide open for alternative funders of all shapes and sizes to enter the fray.

The industry has also outgrown the one-size-fits-all pricing that once defined it. Before, all lenders set high prices. Now, companies rely on risk-based pricing, which means better clients get better deals, and ISOs can offer more competitive pricing. That changed the dynamics of the industry.

But the real change in merchant cash advance, members of the industry say, has been the widespread use of automated clearinghouse payment transfers. It used to be that merchant cash advance was available only to companies that accepted credit cards. Now with more businesses accepting payments online via ACH, there is another mechanism for collecting from merchants.

It took some time for people to accept people going into their bank account and debiting their account. Five or six years ago, no one would have allowed someone to do something like that.

Today, everybody’s fundable, as long as you have a bank account. Gone are the days when ISOs had to walk away from potentially big deals because the merchant didn’t accept credit cards, or didn’t have enough processing volume. ISOs and merchants now have more flexibility to walk into just about any business and offer financing. That’s why it’s mainstream.

Posted in Best Practices for Merchants, Financial Services, Merchant Cash Advance Tagged with: accept credit cards, accounts, ach, acquiring, Amazon, approvable, automated, clearinghouse, credit-card, funders, funding, high rate, high rollers, ISO, merchant cash advance, PayPal, traditional loans, transactions, unregulated, venture capitalist, working capital

November 11th, 2013 by Elma Jane

MasterCard is releasing a new program for its corporate clients that allows them to closely monitor and control their travel expenses online. The program, known as Travel Controller, lets businesses track all of their individual travel accounts under one system, giving owners a chance to reduce those travel expenses.

Typically, travel and entertainment is the second-largest controllable expense after salaries and benefits, and yet companies worldwide are overwhelmed with huge amounts of travel spend data requiring expense reconciliation said, head of travel and entertainment at MasterCard. “With minimal upfront investment and systems integration, Travel Controller gives companies the opportunity to remedy this pain point.

This program is somewhat an extension of the Smart Data service that MasterCard launched in July. This program lets company treasurers analyze business-wide spending by assessing big data from all employees.

MasterCard’s Travel Controller is not scheduled to be on the market until early 2014, but it is currently being used as a pilot at a select group of banks. With this program, business owners can gain a better understanding of how their travel expenses are being spent. If an employee is spending more than the amount dictated by the company’s travel policy, the Travel Controller will show that information.

Posted in Credit card Processing, Travel Agency Agents, Visa MasterCard American Express Tagged with: accounts, benefits, control, corporate, entertainment, expenses, investment, market, MasterCard, online, pilot, reconcilliation, remedy, salaries, systems integration, travel, travel controller, upfront

October 28th, 2013 by Elma Jane

With banks and shops starting to let customers pay by tapping their smart phones on terminals in stores, the future of plastic credit cards is looking shaky.

MasterCard, which has teamed with Coles and CommBank on these ventures, yesterday said Australians were rapidly embracing contactless payments using PayPass and rival Visa’s payWave. At Coles, six out of 10 MasterCard and Visa payments were contactless.

MasterCard head of market development and innovation for Australasia said three out of 10 MasterCard terminal payments were contactless and there were now more than 175,000 terminals nationwide that could accept them. More than 10 million MasterCards in Australia could make contactless payments.

An EMV (Europay, MasterCard and Visa) standard meant all terminals were capable of handling different brands of contactless payments.

The first stage of the contactless payments or “tap and go” revolution began with Visa payWave and MasterCard PayPass in Australia and the first institution to make contactless payments available locally was the Commonwealth Bank in 2006.

The next stage is to use smartphones rather than just plastic cards for contactless payments. Customers still use their Visa and MasterCard accounts, but the transaction is effected using a Near Field Communication sticker placed on the back of the phone, or an embedded, secure NFC element inside modern Android smartphones.

In Europe, NFC-enabled watches, wristbands, key rings and fobs also were being used for contactless payments and there was no reason this couldn’t happen here.

Visa said it had made a “significant investment” in a mobile NFC ecosystem.

“Visa is working closely with partners like Samsung, Vodafone and Optus on a range of mobile payment solutions that use the secure element and prepaid SIM models.”

CommBank, which previously enabled contactless payments from an iPhone housed in a special case, last week said it would let customers pay directly from their Apple phone using an NFC sticker, and from newer Android phones with embedded secure NFC technology.

The new facility, to be rolled out in the current financial year, is part of a revamp of the bank’s smartphones apps.

Coles said contactless payments had increased in the past year by more than 70 per cent while CommBank’s volume of contactless payments had increased six fold in 12 months. Westpac said it was piloting an Android mobile contactless payment application and was also investigating smartwatch payments.

“We also believe that the next big trend after the rise of mobiles and NFC in Australia will be mobile checkouts, where shoppers purchase products and have them delivered within two or three clicks,” a spokeswoman said, and the moves were “as big a market shift as we’ve ever seen”.

Coles also announced a trial of its own contactless payments technology using NFC stickers. Funds would be drawn from Coles Rewards MasterCards. Some 5000 mobile phone tags would be issued in a trial.

ANZ said it was continuing its trial of a mobile wallet for Android phones begun last year, ahead of making the solution available to customers.

“Our NFC pilot with Samsung and Optus is tracking well and we’re also investigating other payment options such as QR codes,” an ANZ spokesman said.

“Given the fragmentation of the market, we will continue to monitor developments before finalising how we will bring a viable mobile wallet solution for our customers to market.”

St George Bank chief information officer said his bank planned to have a contactless phone payments solution in the market “sometime in 2014”.

The bank has previously been reported to be looking at payments via the Pebble and Samsung smart watches.

National Australia Bank, which unveiled its peer-to-peer payments app, NAB Flik, last month, said it was watching how the contactless payments market developed with “less focus on being first to market and more focus on being best in market.”

The Australian reported last month that Apple and PayPal were exploring an alternative to NFC-enabled contactless payments called iBeacons. When you pass close to a store in a shopping centre, a beacon will detect your phone’s presence and automatically alert you to signature items for sale and specials, or offer other information to lure you inside, and process payments.

CommBank last week told The Australian it was looking at iBeacons technology.

Posted in Credit card Processing, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Visa MasterCard American Express Tagged with: accounts, Android, banks, checkouts, contactless, embedded, EMV, EuroPay, fobs, Iphone, MasterCard, mobile, mobile wallet, Near Field Communication, nfc, optus, payments, paypass, paywave, phone, plastic credit cards, prepaid, process payments, qr codes, Samsung, secure, shops, sim, smart phones, Smartphones, smartwatch, sticker, store's, Tags, tap and go, tapping, terminal, terminals, transaction, visa's, vodafone