May 28th, 2015 by Elma Jane

No such thing as FREE, but with National Transaction, Customer Relationship Management Software can be! Take advantage of technology and use it for your business success.

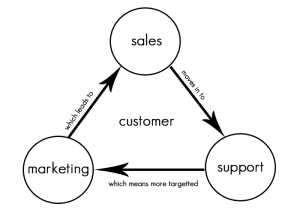

What is CRM? Customer relationship management is a system for managing a company’s interactions with current and future customers. It often involves using technology to organize, automate and synchronize sales, marketing, customer service and technical support.

Free CRM comes in two categories: FREE, but limited, and OPEN SOURCE.

Free, but limited versions – set caps on the amount of free users, contacts, storage, extra features, or some combination.

Open source – offers an unlimited, fully functional CRM to users, is extremely customizable. Most open source CRM companies also offer a preconfigured version and/or installation and support for a price.

There are a whole host of affordable CRM options you should be considering even though not free, may be the perfect fit for your organization.

Each CRM system is different and each one will serve some companies better than others. CRM is a category that’s very rich in free and open source programs.

Why is the value of CRM great for Merchants?

It allows you to register your leads and contacts. You need some basic categories to make your data efficient so that you can implement your CRM strategy to fulfill their needs. With a CRM you can store and manage hundreds of clients and let a computer system handle the task of memory and recall.

You can track all customer interaction – A customer relations management system put all the pertinent client information in one central location that was easy to update and easy to see when other’s updated. All communication can be kept in one spot, nothing gets lost and you can now see and share with the rest of your team. This history builds a long-time relationship. Emails should be in your system, and not in each person’s mailbox.

Every time you make a call, send an email, or contact that customer or prospect you can update your CRM with their current status.

It reveals possibilities. Most companies keep their current supplier until they are ignored. That’s why keeping them alive and kicking in your CRM database is so important. And if you have an opt-in newsletter or a great seminar plan, their business might be yours for the next quarter.

It makes your most valuable asset – the customer data – remain. People change jobs. Have you ever experienced someone leaving you, and nothing is left behind? The pipeline wasn’t up to date. The contacts wasn’t updated. The important contacts wasn’t registered – because all relevant information was stored locally. Don’t let it happen. Customer relations systems help keep all conversations in one place and make it easy for you to quickly look back in time and see how things have progressed. See for yourself the progression of a client and their communication as well as your company’s notes and responses. You’ll be able to save more customers from leaving by catching something you would have otherwise missed, and you can learn from your history.

Posted in Best Practices for Merchants Tagged with: crm, CRM database, customer data, customer service, data, database, merchants, open source

All merchants that accepts, transmit or stores cardholder data are required to be PCI (Payment Card Industry) Compliant. Most believe that because they do not charge the credit cards themselves, they are exempt. Why all agencies are required to be complaint even when they don’t charge credit cards themselves, and some steps to ensure your agency is PCI compliant.

What is PCI compliance?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements designed to ensure that all companies that process, store or transmit credit card information maintain a secure environment. PCI applies to all organizations or merchants, regardless of size or number of transactions, that accepts, transmits or stores any cardholder data. Travel agents accepting, storing and transmitting credit card information to suppliers, are required to be compliant too. Suppliers reinforce this through their travel agent guidelines/contracts. Travel Agency must adhere to the applicable credit card company’s procedures for credit card transactions.

Consequences of Not Being PCI Compliant

If an agency is not PCI compliant, the agency can lose the ability to process credit card payments with that supplier. Not being able to pay with client credit cards can be a serious roadblock for agencies, and an inconvenience for clients.

If you have a merchant account and are found to be out of compliance, you can be fined.

How to be PCI Compliant

Don’t store the CCV security code from the client’s credit card. The client does not have the authority to grant you permission to store their CCV code. The credit card company explicitly forbid storage of the CCV code.

Make sure you securely store any client information, including their credit card number and expiration date. If you use a CRM, ensure that you have a strong password. If your CRM database is stored on your computer hard drive, encrypt it (there is a great encryption software that is free of charge). If you have an IT resource, talk to them about installing a firewall on your network, installing anti-virus and anti-malware protection, and any other steps that you can take to secure your client data even further.

If you keep paper copies of client information, keep it in a locked filing cabinet or desk drawer. When you no longer need their credit card information, cross shred it.

Home based businesses are arguably the most vulnerable simply because they are usually not well protected, according to the PCI Compliance Guide. Having strong passwords, encryption, a firewall, anti-virus and anti-malware protection are all inexpensive steps that you can take to protect your business and your clients’ sensitive data.

If you receive a courtesy call reminding you about PCI Compliance, don’t ignore it.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Payment Card Industry PCI Security Tagged with: cardholder, cardholder data, cards, CCV, CCV code, credit, credit card company, credit card number, credit card payments, credit card transactions, credit cards, crm, CRM database, data, database, encryption software, merchant account, Merchant's, network, Payment Card Industry, PCI, security code, transactions, travel agents