May 9th, 2014 by Elma Jane

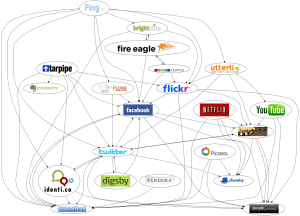

Facebook is apparently ready to become a person-to-person (P2P) money transfer network. The clear decision to launch a money transfer service in the region can be seen as a test bed for Facebook’s larger ambitions of becoming a payments hub for its 1 billion user base. Facebook was only weeks away from gaining regulatory approval in Ireland for its remittance platform FT quoted unnamed sources. Facebook’s P2P platform will be geared to facilitating migrant remittances, with the goal of expanding its payment presence in emerging markets such as India. Facebook makes the bulk of its revenue from advertising, but 10 percent of its profits reportedly come from in-game payments for online and mobile games, such as Zynga’s popular FarmVille.

From WhatsApp to what’s next

Facebook’s February 2014 acquisition of mobile messaging service WhatsApp for $19 billion clarified the social network’s strategy. The WhatsApp acquisition and the expected P2P network launch as part of the first phase of Facebook’s deeper immersion into payments.

Tech giants face up to payments

When comparing the payment strategies of tech giants Google Inc., Apple Inc. and Facebook, the latter two competitors as having bigger potential upsides than Google. Facebook and Apple (via iTunes) already have established financial relationships with millions of users who have attached funding mechanisms – debit and credit cards – to their social media accounts. As primarily a search engine, Google is playing catch up to persuade its users to set up Google Wallet accounts.

In May 2013, Google launched its own P2P network by integrating Google Wallet with Gmail accounts, so that wallet users can facilitate money transfers via email. More recently, reports have surfaced indicating Google plans to extend Google Wallet to its wearable technology solution Google Glass. But the success of such ventures rests on users’ confidence with Google as a financial service provider.

Facebook as having a brighter financial services future than Apple. Apple’s reach is limited to consumers who have iPhones and iPads, whereas Facebook is not tied to any branded mobile devices, it is a very ubiquitous offering. It could apply to anybody with any type of phone or tablet.

Eventually, tech companies like Facebook will need to partner with payment businesses in order to expand into the merchant-centric brick-and-mortar world. The mobile POS solution provider, a business unit of global POS terminal manufacturer Ingenico SA, would be an ideal partner for Facebook. If they extend what they do from P2P payments to more of a wallet purchasing capability for their users, then the next step could very easily be an extension of that into servicing the merchant side.

Posted in Financial Services, Mobile Payments, Smartphone Tagged with: Apple Inc.Facebook, consumers, credit cards, debit, device, financial service, financial service provider, Gmail accounts, Google Glass, Google Inc., Google Wallet accounts, ingenico, iPads, iPhones, iTunes, merchant-centric brick-and-mortar, migrant remittances, mobile, Mobile Devices, mobile games, mobile messaging service, mobile pos, mobile POS solution, mobile POS solution provider, money transfer, money transfer network, money transfer service, network, online, p2p, P2P network, P2P payments, P2P platform, payment businesses, payments, payments hub, phone, POS terminal, remittance, remittance platform, search engine, service provider, social media, social media accounts, social networks, tablet, wearable technology

April 8th, 2014 by Elma Jane

Today’s consumers are defining themselves by their mobile devices, their social presences and how they interact with brands, both offline and online. The digital evolution of the average consumer is alive and kicking.

Today’s consumer is more connected than ever, with more access to and deeper engagement with content and brands. Thanks to the proliferation of digital devices and platforms. Content that was once only available to consumers via specific methods of delivery such as via print, radio and broadcast television can now be sourced and delivered to consumers through their multiple connected devices. This is driving the media revolution and blurring traditional media definitions.

What are the specific characteristics or dynamics shaping today’s consumer behavior? Digital consumers are social-savvy and more connected to their friends, family and favorite brands than ever before.

Focused On The Gadgetry

Consumers love gadgets.

One out of four Americans plan to buy a smartphone in the near future. Thirty percent intend to upgrade from a regular mobile phone to a smartphone once able. For those ages 18 to 24, 49 percent they want to upgrade to a smartphone.

How frequently consumers use their mobile devices in a given month? Consumers spent an average of 34 hours and 17 minutes per month using apps on their devices, an increase of 9 hours and 52 minutes from 2012.

Interestingly, the amount of time consumers spend surfing the Web fell 1 hour and 54 minutes to a total of 27 hours and 3 minutes. The amount of time used to watch videos online increased by 43 minutes, to 6 hours and 41 minutes.

Social Media & Everyday Life

Digital consumers, by and large love their social media.

Sixty-four percent said that they use social media at least once per day. For mobile however, the growth figures reported suggest a broad shift is happening, pushing more people to access social networks via mobile platforms.

Forty-seven percent of smartphone owners log onto a social network each day. Additionally, the number of people who use social-media apps on their smartphones rose by 37 percent from 2012.

Digital consumers are also diversifying their choice of social networks, opting to use LinkedIn and Pinterest in addition to so-called traditional social media platforms like Facebook and Twitter.

As digital consumers find their own mix of devices and platforms to access and engage with social media, they are building profiles and connections on multiple social networks as well.

Two Screens Is A King

Digital consumers also rely on their mobile devices as a second type of television screen.

In a survey, eighty-four percent said they use their smartphone or tablet to surf the Web or to use apps while watching television. Of those, 44 percent of tablet owners shopped while watching TV, and 24 percent used their smartphones to make purchases.

Fourteen percent of tablet owners used their device to buy a product or service as it was being advertised on TV. Just 7 percent of smartphone owners said they would do the same.

Posted in Best Practices for Merchants, Credit card Processing, Financial Services, Merchant Services Account, Mobile Payments, Small Business Improvement, Smartphone Tagged with: apps on their devices, average consumer, content, deeper engagement, digital consumers, digital devices, digital evolution, Facebook, gadgets, linkedin, media revolution, Mobile Devices, mobile platforms, offline and online, pinterest, regular mobile phone, smartphone, social media, social network, social presences, social-media apps, social-savvy, tablet, traditional media, twitter

March 17th, 2014 by Elma Jane

With so much to do each day, it’s easy for a small business owner to get bogged down in details. That’s where your smartphone comes in. With the right apps, your mobile device can automate the tasks that used to be daily chores. Whether you need help keeping track of all your business documents, or organizing your calendar and contacts list, it’s time to let your smartphone do some of the heavy lifting.

Back up your business files. Your work machine contains everything you need for a productive day, including every file and document you are working on. But you can’t always be at the office. With your smartphone and the right apps, however, you can back up and access your business files from anywhere. Dropbox, Box, Google Drive, SkyDrive and iCloud are all solid mobile apps that automate the process of syncing your business files to the cloud so you can access them from any Web-connected device, including your smartphone or tablet. Better yet, any edits you make will be synced across all your devices, so you can stay productive and organized.

Manage new contacts. Swapping business cards is a great networking strategy, but cards are easy to lose, and manually inputting all that contact information into your address book is a chore. So let your smartphone enter all that data into your address books. CamCard (available for iOS and Android) is an all-in-one business card management solution. Just point your iPhone camera at a card and snap a photo. The app’s text-recognition software will pull out the key details and update your address book automatically. It can even search for new contacts on LinkedIn to add a photo and additional personal details for each new contact.

Silence your smartphone. A buzzing or ringing smartphone can be distracting – not to mention embarrassing – during a business meeting. Silencing your phone is simple, but chances are you’ll occasionally forget. That’s why there are handy apps that monitor your smartphone calendar for meetings and appointments, then silence your phone for the duration of that event. You can even whitelist specific numbers so you won’t miss an emergency call. When the meeting is over, your smartphone’s ringer and vibration settings will be returned to their normal state. That way, you can stay focused and free from distraction when it matters most. Android users can try Silencify. For iPhone users, AutoSilent is a good option.

Sync your calendars. Both Android and iOS have built-in calendars to help you plan your week and schedule meetings. But juggling both a mobile calendar and a desktop office calendar is a pain, so why not use your smartphone to synchronize the two? If you use Microsoft Outlook as your business calendar, for example, Google Calendar offers an easy way to link them. And iPhone users can synchronize their mobile calendar with Outlook by plugging their smartphone into their computer and accessing the Calendars tab in the iTunes options menu. Automating the process of syncing your calendars means you’ll never mix up appointments. And if you share your business calendar with your employees, it ensures that everyone is always on the same page.

Sync your social media accounts. A strong presence on Facebook and Twitter can help you engage your customers and grow your business. Mobile apps can help you keep your business profiles fresh when you’re on the go, but reposting those updates on each platform individually can be a chore especially from a tiny smartphone screen. Fortunately, there’s an easy way to automate the process of synchronizing social media posts between your business profiles. Simply visit this page to link your Facebook and Twitter accounts. After that, go ahead and use the Facebook mobile app to post updates, news or promotions to your business’s Facebook page, each post will be automatically funneled to your Twitter followers as well.

Posted in Best Practices for Merchants, Mobile Payments, Small Business Improvement, Smartphone Tagged with: all-in-one, Android, apps, automate, automate the process, automating, box, business documents, business profiles, camcard, devices, dropbox, Facebook, google drive, icloud, iOS, Iphone, linkedin, Mobile Apps, mobile device, networking, organizing, productive, skydrive, small business, smartphone, synchronize, synchronizing social media, syncing, tablet, twitter, web-connected

February 18th, 2014 by Elma Jane

Payment Tokenization Standards

Tokenization is the process of replacing a traditional card account number with a unique payment token that is restricted in how it can be used with a specific device, merchant, transaction type or channel. When using tokenization, merchants and digital wallet operators do not need to store card account numbers; instead they are able to store payment tokens that can only be used for their designated purpose. The tokenization process happens in the background in a manner that is expected to be invisible to the consumer.

EMVCo – which is collectively owned by American Express, Discover, JCB, MasterCard, UnionPay and Visa – has announced that it is expanding its scope to lead the payments industry’s work to standardize payment tokenization. EMVCo says that the new specification will help provide the payments community with a consistent, secure and interoperable environment to make digital payments when using a mobile handset, tablet, personal computer or other smart device.

Key elements of EMVCo’s work include adding new data fields to provide richer industry information about the transaction, which will improve transaction efficiency and enhance the consumer and merchant payment experience by helping to prevent fraudulent card account use. EMVCo will also create a consistent approach to identify and verify the valid use of a token during payment processing including authorization, capture, clearing and settlement.

EMVCo’s announcement follows an earlier joint announcement from MasterCard, Visa and American Express that proposed an initial framework for industry collaboration to standardize payment tokenization. EMVCo says it will now build on this framework with collective input from all of its members and the industry as a whole.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Financial Services, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, authorization, capture, card account numbers, clearing, data fields, device, digital payments, Digital Wallet, Discover, EMV, emvco, fraudulent card account, interoperable, jcb, MasterCard, merchant, mobile handset, payment, payment processing, payment token, secure, security standards, settlement, smart device, specification, standardize, tablet, token, tokenization, transaction, visa

January 29th, 2014 by Elma Jane

Ecommerce and mobile-based e-commerce have grown significantly this year. Cyber Monday ecommerce sales, as an example, reached $1.735 billion originating from desktop and laptop devices, according to comScore. Even Black Friday, which is better known for brick-and-mortar retail sales, saw online spending reach $1.198 billion in the United States, again according to comScore. Mobile online spending may also have grown, as some reports indicate that mobile-based site traffic was up 55 percent around Thanksgiving.

Many ecommerce merchants are enjoying a robust holiday selling season even as some brick-and-mortar stores are seeing relatively flat Christmas sales. To ensure continued growth and success, Internet retailers may want to challenge their businesses to improve in several areas in 2014.

Retailers, however, should not rest on their current success, but rather should challenge their businesses to improve in several areas, including free shipping offers, mobile optimization, personalization, data driven decision making, and cross channel sales.

Offer Free, Two-Day Shipping

The first challenge for online sellers in 2014 may be to find ways to offer free, two-day shipping to all or most shoppers. While it is likely there will still be minimum purchase and maximum weight requirements and restrictions, online shoppers are going to expect faster free shipping options thanks, in part, to the growth in services like Amazon Prime and ShopRunner.

Consider order fulfillment services, distributed warehouses, drop shipping, or even partnerships with other retailers to help meet this challenge.

Offer Personalization and Customization

Personalization and customization could be a significant competitive advantage in 2014.

Challenge your business to finally begin offering personalization and customization both onsite and in marketing. The easiest place to start may be with email marketing. Work to segment email marketing campaigns so that they address customers by name and with relevant products and offers that are based on an individual’s or group of shoppers’ stated preferences or on-site behavior.

Taking on this challenge means that the retailer’s marketing department will need to collect meaningful information about what interests shoppers and organize separate, custom campaigns around those interests.

Put Mobile Design and Marketing First

In November, IBM reported that mobile devices accounted for 31 percent of U.S. ecommerce-related web traffic around the Thanksgiving holiday this year, and that 17 percent of ecommerce transactions came from smartphones or tablets. On average, tablet users spent more than $126.00 per order, and smartphone users spent about $106 per order.

This data shows that mobile e commerce is not simply a novelty, but rather a must have for 2014.

If an e-commerce business is not optimized for mobile sales, 2014 is the year to take on that challenge, including offering a responsive design and mobile friendly payment options.

Sell Seamlessly Across Channels, Devices

Try to think of every way that a shopper might interact with an online store, and then make all of those touch points work together in 2014.

Retailers online or in physical stores need to offer shoppers a seamless, cross channel shopping experience that makes buying things easier for the customer. To continue to enjoy success in 2014, consider offering shoppers the ability to share orders across devices, applications, and even marketplaces.

In practice, this might mean that items added to a cart in an online store show up in the cart for the retailer’s iPhone app too. Or that a customer’s order history displayed on a retailer’s site shows orders placed on-site and via a marketplace like Amazon or eBay.

Use Big Data for Big Information

In 2014, find sources of good, usable Big Data, and put the resulting big information to use.

As an example consider, Weather Trends International, a Big Data company that uses historical weather information and advanced data processing to accurately predict weather 11 months in advance. This sort of Big Data information could show a snowboard and ski retailer what sort of winter major ski resorts are likely to have next year, and could inform purchasing and inventory choices.

Similarly, knowing that a particular region is going to have a warmer than normal July and August might impact how, where, and when a clothing retailer promotes shorts or bikinis on Facebook or AdWords.

Big Data is a popular trend in business and in marketing. The concept can mean different things to different businesses. For ecommerce, retailers should seek to use Big Data to gather big information, if you will, that may be used to make better buying and selling decisions.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: adwords, Amazon, big data, big information, brick and mortar, cross channel, cyber, drop shipping, e-commerce, ecommerce, Facebook, internet retailers, laptop devices, Mobile Devices, mobile friendly payment options, mobile optimization, mobile-based site, on-site, online, online shoppers, online store, onsite, personalization, retailers marketing, retailers online, shopping experience, smartphone, Smartphones, tablet, tablets

December 16th, 2013 by Elma Jane

1. Account Updater (Visa)

Incorrect billing information leads to declined credit cards, loss of sales and unhappy customers.

Visa touts its Account Updater as an easier way to keep customer data current. The tool appends all card data with up-to-date customer info so businesses can avoid difficulties over address changes, name changes, expired cards and more.

The tool can benefit any business that bills customers on a recurring basis.

It eliminates the need for manual administration, so it can lower your business’s operational costs and customer-service expenses. And by saving your clients the hassle of a declined payment, you can boost customer satisfaction and overall sales.

2. Netswipe

Paying online is convenient for customers, but keying in an unwieldy credit card number is still a pain.

Netswipe from Jumio gives customers an easier way: The tool lets users pay by snapping a photo of their credit card; it’s almost as easy as swiping your card through a traditional card reader.

According to Jumio, customers can use their smartphone or tablet to scan a card in as little as 5 seconds, whereas traditional key entry takes 60 seconds or more, on average. Having a quick and convenient way to pay could help contribute to a positive buying experience and encourage repeat business.

The system is compatible with any iOS or Android mobile device, as well as with any computer with a webcam.

3. Netverify

Jumio’s fraud-scrubbing tool helps you determine if your customers are who they say they are.

Net verify allows customers to snap a picture of their driver’s license or other identification using a smartphone, tablet or PC webcam. Once the image is taken, the tool can verify the authenticity of the documentation in as little as 60 seconds.

That’s much faster and more convenient than asking a customer to fax or mail a copy of their ID in the middle of a transaction.

The tool can verify identifying documents from more than 60 countries…including passports, ID cards and driver’s licenses, and even bank statements and utility bills. Jumio says its software is smart enough to automatically reject nonauthentic documents.

And customers can rest easy knowing that all submitted information is protected with 256-bit encryption to prevent identity theft.

Online merchants embed Netverify into their websites as part of the checkout process.

4. Payment Gateway

Payment Gateway service does all the heavy lifting of routing and managing credit card transactions online.

Portals like this one benefit small businesses by providing a fast and secure transmission of credit card data between your website and the major payment networks. It works a lot like a traditional credit card reader, but uses the Internet to process transactions instead of a phone line.

Payment Gateway also offers built-in fraud-prevention tools and supports a range of payment options, including all major credit cards and debit cards.

5. PayPal Here

Mobile credit card processing services like PayPal Here make it easy to accept credit cards in person using a smartphone or tablet.

PayPal Here and other similar services send you a dongle that attaches directly to your iPhone, iPad or Android device, allowing you to swipe physical credit cards wherever you are.

One major benefit of mobile credit card readers is that they work with the devices you already own. That means there’s no need to carry around additional hardware, aside from the reader add-on itself. Most credit card readers attach to your device via the headphone jack or charger port, and are small enough to fit in your pocket.

The smallest businesses have the most to gain by opting for mobile credit card readers, which are cheaper and far more portable than traditional options.

6. Virtual Terminal

If you do business online, your website needs the infrastructure to accept credit card information.

Web-based applications like virtual terminal offer the basic processing functionality of a physical point-of-sale system, and are easy to install on your business’s website.

The system allows merchants to collect orders straight from the Web, or take orders via phone or mail and before initiating card authorizations online.

It also includes extensive transaction history to help you manage payment data, split shipments, back orders and reversals. Business owners can even receive a daily email report of all credit card transaction activity from the prior day.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, e-commerce & m-commerce, Electronic Payments, EMV EuroPay MasterCard Visa, Gift & Loyalty Card Processing, Mail Order Telephone Order, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: account, Android, authenticity, card data, card reader, checkout, checkout process, credit card number, credit card transactions, debit cards, declined payment, expired, fraud, id, iOS, mail, mobile device, nonauthentic, online, online merchants, passports, payment data, payment gateway, payment options, phone, point of sale, recurring, smartphone, tablet, verify, visa, webcam

December 12th, 2013 by Elma Jane

A new study reveals that a staggering 68% of smartphone owners plan to use their devices to assist with their holiday shopping this year. According to Deloitte’s 28th annual survey of holiday spending intentions and trends, 56% of smartphone owners plan to use their phones to search for store locations. 54% will compare prices with their phones and 47% expect to use their phones to learn more about the products they wish to purchase.

The survey showed smartphone shoppers plan to spend 27% more on holiday gifts than non-mobile shoppers. Smartphone ownership has skyrocketed in 2013, rising from 42% last year to 61%, a change that is sure to influence the biggest buying season of the year.

The study also showed 38% of the consumers in the survey owned a tablet. 63% of those tablet owners will use their devices for holiday shopping this year. “Tablets are a two-way street for retailers. They have opened up an entirely new consumer touchpoint, where shoppers can view multiple retailers’ products regardless of their location…from their couch to the point of purchase. Retailers can also put tablets to work in their stores, providing both their sales team and customers with a broader lens into merchandise selection,” said Alison Paul, a vice chairman of Deloitte LLP retail & distribution. Now that the majority of consumers also own smartphones, these two devices have altered the way they interact with a brand, while also yielding a higher spend per customer.

Posted in Electronic Payments, Mobile Payments, Near Field Communication, Smartphone Tagged with: devices, merchandise, phones, retailers, shoppers, shopping, smartphone, tablet, touchpoint

October 3rd, 2013 by Admin

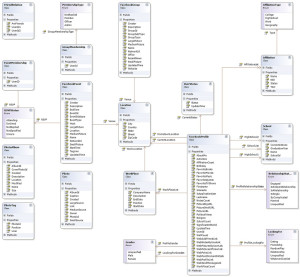

When managing a business nothing helps more than raw data. Storing that data in a database makes it infinitely more flexible and accessible. A database is an application that efficiently and effectively stores and retrieves data as well as ties that data to other data. Many large scale accounting applications like QuickBooks, PeachTree and many other titles store all their information in some form of a database.

Tables are like spreadsheets. Rows and columns group together data in an organized manner. Databases can have many tables with many columns or just a few. Relational databases like SQL database engines link tables together using what are known as primary and foreign keys. So in the example of an invoice the Customer table has a Primary key uniquely identifying a specific customer from the rest of all of the customers. The Invoice table stores a foreign key in its table so the match between customer id’s links the two tables. The invoices themselves also have a primary key so that there can be many invoices for the same customer. These concepts are actually born of a mathematics branch known as Algebra.

Data at its most basic level is a specific bit of information. Like the number 19 or a specific date and/or time. A database holds these bits of data and an application built to interact with a database is used to generate information from the data. A clearer example is the invoice. An invoice has quantities, part numbers, serial numbers, account numbers, dates and even totals which are not stored in the database but are calculated each time the invoice is accessed. Invoices bring many bits of data to a single entity most commonly referred to as a report. Looking at a common invoice explains a transaction with the details stored in many tables all tying back to a single transaction.

Database servers run a service that can be connected over connections on a local area network or over the internet to allow applications on different computers access to data simultaneously. Many websites like Facebook, NASA and even Google make extended use of databases to supply services to millions of users concurrently. Whether it’s over the internet or across a physical office space, a database can be the heart of a businesses information technology.

SQL databases conform to an industry standardized set of functionality so that complex queries can be performed without knowing the underlying technical architecture.

Open Source

Open Source is usually associated with applications that are free to download, distribute and modify. Many times open source applications are developed by a community of developers over the internet that take feature suggestions from the user community and build them into the application. Open source applications tend to follow one of several ‘licenses’ like the GPL or General Public License to make sure the program is unmolested or incorporated into a proprietary software trying to take credit for the programming code.

There are many examples of open source titles here.

http://directory.fsf.org/wiki/All

https://en.wikipedia.org/wiki/List_of_free_and_open-source_software_packages

Open Source Databases

One aspect of open source known as LAMP has become wildly popular as the internet has matured. Lamp stands for Linux, the operating system, Apache, the web server component, MySQL, a wildly popular free and open database engine and the P stands for Perl, Python or PHP the three most popular languages of backend programming. Combining these components provides a very fertile ground for developing Web Applications that can be served across an office or the world. Many sites like Google and WordPress take full advantage of these technology to create feature rich applications that run in a web browser but work like a traditional desktop application like Microsoft Word. Being open source allows anyone to build on top of or out of the offering. This means you can customize the programming of any of these applications to best fit your particular style or way of doing business. This is a huge time saver for any small business.

Some common examples of open source applications that utilize Lamp architecture are listed below:

SugarCRM – A contact and lead management system to manage a sales force.

WordPress – The most popular blogging application on the internet.

OpenCart – An extremely flexible shopping cart software.

GNUCash – A full fledged accounting program.

Mobile Devices

Today we have smartphones and tablets that have web browsers built in and available for each platform. Using new techniques known as adaptive or responsive web layouts, information on a page automatically transform a web page to smaller displays. So any page can be designed once and displayed on a desktop browser, a tablet browser or a mobile phone browser. This allows web designers to best optimize the content for smaller displays while leaving the pages viewed on a desktop for a larger view. Using responsive design techniques your business data can even extend to mobile devices like iPhones and Android or Blackberry phones and tablets. The potential is huge for your business.

Posted in Best Practices for Merchants, Point of Sale Tagged with: Android, bits, blackberry, data, database, e-commerce, information technology, Iphone, MySQL, open source, relational, shopping cart, smartphone, SQL, tablet

September 30th, 2013 by Elma Jane

Mind-Blowing 3D Trickery for Work or Play Occipital Promises

Get in on the ground floor as we look at the most exciting crowdfunded tech projects out there. Structure Sensor, which is pitched as the world’s first 3D sensor for mobile devices. The device is designed to be an attached-hardware add-on for mobile tablets and phones that allows the user to capture spatial models of objects and indoor areas.

If you’ve ever used Microsoft’s Kinect motion-sensing input device for the Xbox 360 game console, you’ll have an initial grasp of how Occipital’s 3D scanner for mobile devices, called “Structure Sensor”, functions. Whereas game add-on Kinect is a sensor for detecting and interpreting movement, new Kickstarter crowdsourced funding project Structure Sensor is for mapping three-dimensional spaces or objects.

What Is It? Occipital’s Structure Sensor is pitched as the world’s first 3D sensor for mobile devices. The device is designed to be an attached-hardware add-on for mobile devices that allows the user to capture spacial models of indoor areas – 3D models of objects – and perform augmented reality. The creator uses rooms, furniture and augmented reality games as examples. The captured 3D models can then be imported into CAD software of the kind used by architects and designers, or to a 3D printer to be replicated.

Technical Details Structure Sensor contains a precision infrared emitter, camera and optics that are housed in an anodized aluminum shell. The shell affixes to a bracket designed to clip to the 4th Generation Apple iPad. Data-streaming connectivity is with Apple’s Lightning Connector. Hardened glass is used to protect the dual infrared lenses. Range is from 40 cm to 3.5 m. Some iOS demo apps included in the package consist of an object scanner; room capture; Fetch, which is a virtual pet; and Ball Physics, an augmented reality demo with virtual balls. An SDK is available.

The Downsides The creator has recently said that the technology is still in development and some planned features haven’t been implemented yet. We’re concerned about the lack of software or brackets for any Android devices, even though the creator has said it will be producing open-source drivers. We would also like to see more work go into precision measurement because we think that an architect planning a remodel, for example, is going to want the same kind of tolerances as are available in laser measurement.

The Upsides Occipital has been involved in panorama-creation apps and a successful shopping-scanner app, so it’s familiar with the spatial and optical-scanning area. The project creator has said it has already inked agreements with manufacturers and suppliers and is almost ready to start manufacturing a run of beta sensors. We like the way that the creator has plans to simply redesign the bracket rather than the entire scanner assembly as new mobile devices come to market.

The Numbers After launching a Kickstarter project on Sept. 17, Occipital already had more than 2,000 backers a week later pledging more than US$700,000 of a $100,000 goal. So, its funding goal has been achieved. The funding period ends Nov. 1. Pledge rewards range from a T-shirt for $25 to a Structure Sensor in your choice of silver or blue, a USB hacker cable, drivers and open CAD models for $349 — everything, in other words, that you need to develop with the iPad.

Underlying Concepts Kinect and Structure Sensor both work on the same principal – one shared also with golfing and shooting-sports range finders – in that they send out radio signals, like laser, or infrared frequencies that bounce off objects. The returned signal is then interpreted to calculate gestures in 3D for gaming, map an object – in the case of Structure Sensor – or measure golf-hole distance. Varying levels of sophistication are employed in the resulting rendering, depending on software, that can include 3D reconstructed images and so on.

Conclusion Pre-beta, and with available demo apps only, this product is at a supremely early product life-cycle stage, but is a potentially exciting product, particularly for software and app developers.

Posted in Smartphone Tagged with: 35, 3D Printer, Apple, architects, CAD, camera, iOS, ipad, Mobile Devices, object scanner, occipital, optics, sensor, shopping, tablet

August 30th, 2013 by Admin

According to a poll by OnePoll on behalf of I Love Velvet titled “Consumer Mobile Point-of-Sale (MPOS) Attitudes Report” over half of retail customers think cash registers are outdated. The poll found that 51% of Americans think the cash register could soon be gone altogether as retailers opt for mobile point of sale systems. Consumers seem to favor MPOS systems allowing the shoppers to check out from anywhere in the store and that they return more often to stores with modern electronic payment technologies. Thirty five percent cited they would shop more often at stores with mobile point of sale payment systems. An additional 17% said they would share their shopping experience via social networking sites and 35% report they likely would tell a friend or recommend stores with these technologies. Forty six percent say that stores that have mobile payment systems seem to be more tech savvy and even more (56%) praise the store for making the experience more convenient and secure. Retailers are struggling to modernize their payment platforms to cut down long lines at registers, and place staff on the floor for better customer access. “It’s a great opportunity for retail store owners to dip into the mobile point of sale arena” said Richard Delos Santos of National Transaction Corporation.

Mobile point-of-sale equipment and software manufacturers are stepping up to the security plate as they seek to pass PCI DSS and other security related issues. As new mobile kiosks and point of sale hardware and software evolve so do the security challenges used to thwart credit card fraud and identity theft. The challenge for point of sale system providers is to create an increasingly secure and convenient way for customers to make electronic payments in-store or on their mobile devices. iPads, iPhones and Android tablets are often used by curious shoppers to compare and contrast features, prices and availability, why not let digital wallets be used to close the transaction? The use and connectivity of these new devices mean more complex security measures are needed to thwart attackers, crackers, and hackers.

In the coming years everything from NFC, to fingerprint readers in smartphones and tablets and even QR codes will change the landscape of mobile payment transaction processing and things are beginning to heat up. An estimated $17 Trillion of mobile transactions are predicted by 2020 and security and adoption will reign king on the streets. It might be time to look into the security and features that a mobile point-of-sale system can add over any existing point of sale systems and cash registers. Mobility is a great tool for a sales force, but security and convenience for the customer is a necessity that will only grow in the future.

Posted in Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Android, ipad, Iphone, mobile, MPOS, payments, point of sale, Processing, smartphone, tablet, transaction