Category: Small Business Improvement

April 11th, 2014 by Elma Jane

Of the 17 percent of consumers who reported having had their credit card declined during a card-not-present (CNP) transactions. As many as one-third of those declines were unnecessary. The result is consumer aggravation, increased operational costs for banks and credit card companies and as much as $40 billion in lost revenue for online retailers.

TrustInsight which helps establish trusted relationships between financial institutions, merchants and online consumers conducted study. A report and infographic detailing the findings of the study found that avoidable online credit card declines lead to loss of trust for consumers, sales for merchants and increased operational costs for credit card companies and issuing banks.

Study also revealed that consumers handle credit card declines in a variety of ways all of which carried negative economic impact to at least one party in the transaction, resulting in unnecessary operating costs for banks, decreased loyalty for the credit card company and lost revenue for all. Almost half call their issuer immediately when their card is unexpectedly declined. This is a natural response. 34 percent of consumers try again another credit card, other use a different payment method and 24 percent will skip the purchase altogether or shop at a different online retailer.

No one wants to turn away business, and no one wants their business declined. The frustration and impact of wrongful declines is a real problem especially as more and more transactions occur in non-face-to-face situations.

Impact of consumer action in the face of a decline can have real and measurable effects on all parties, including credit card companies, banks and merchants manifesting itself in lost customer loyalty, lost fees and lost revenues. Creating a standard for online trust that enables credit card companies, merchants and issuing banks to better recognize trusted digital consumers and reduce the number of wrongly declined consumers avoiding unnecessary losses.

In a world where people are increasingly reliant on a variety of Internet-connected devices for everything from banking to shopping to entertainment and media, creating friction-free customer experiences and preventing online fraud are constant business challenges.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Merchant Services Account, Small Business Improvement, Visa MasterCard American Express Tagged with: banking, consumers, credit-card, decline, declined, declines, different payment method, digital, digital consumers, financial, frustrate, internet-connected devices, issuing banks, loyalty, Merchant's, online credit card declines, online fraud, online retailers, shopping, transactions, wrongful declines, wrongly declined

April 11th, 2014 by Elma Jane

PCI DSS 3.0 standard, which took effect January 1st, introduces changes that extend across all 12 requirements, aimed to improve security of payment card data and reducing fraud. There will be some shakeups for many organizations when it comes to their day-to-day culture and operations. Transitioning to meet the new requirements will help e-business build a stronger, safer, lower-risk environment for their customers.

While the growing number of digital payment avenues offers convenience to customers, it also offers a larger attack surface for criminals.

As cloud technologies and e-commerce environments continue to grow, creating multiple points of access to cardholder data and online retailers will only become more appealing targets for hackers. Cybercriminals are cunning and determined. They understand payment card infrastructures as well as the engineers who designed them.

A scary proposition and it’s exactly why the payment card industry is so determined to help keep e-commerce organizations protected. Meeting the new standard, businesses will be better armed to fight evolving threats. Changes will also drive more consistency among assessors, help business reduce risk of compromise and create more transparent provider-customer relationships.

Transitioning to PCI DSS 3.0 will involve some work, but doing that work on the front end is going to save much work down the line. Adopting the new standard ultimately will drive your e-commerce business into a secure and efficient era.

Cultural Changes – One of the main themes of 3.0 is shifting from an annual compliance approach to embedding security in daily processes. Threats don’t change just once a year. They’re constantly evolving and that means e-commerce organizations must adopt a culture of vigilance. Only through a proactive business-as-usual approach to security can you achieve true DSS compliance. Realistically, this could mean the need to provide more education and build awareness with staff, partners and providers, so that everyone understands why and how new processes are in place.

Operational Changes – The 3.0 standard addresses common vulnerabilities that probably will ring a bell with many of you. These include weak passwords and authentication procedures, as well as insufficient malware detection systems and vulnerability assessments, just to name a few. Depending on your current security controls program, this could mean you’ll need to step up in these areas by strengthening credential requirements, resolving self-detection challenges, testing and documenting your cardholder data environment and making other corrections.

Overview Changes – How much work lands on your plate will depend on your current security program. Examining your current security strategies and program is a good idea. Below are the areas requiring your attention, which this series will explore in more detail in future installments.

Service Provider Changes – Some organizations made unsafe assumptions in the past when it comes to third-party providers. Some have paid the price, from failed audits to breaches. One reason that the new standard is designed to eliminate any confusion over compliance responsibilities. Responsibilities, specifically for management, operations, security and reporting all will need to be spelled out in detailed contracts. In addition to improved communication, an intensified focus on transparency means that you should have a clear view of your provider’s infrastructure, data storage and security controls, along with subcontractors that can impact your environment. So if your organization isn’t exactly clear on which PCI DSS requirements you manage and which ones your providers handle, prepare to get all of that hammered out.

The Compliance Rewards – The path to preparing for the 3.0 deadline in January 2015 sounds like it’s a lot of work. So to get started request your QSA’s opinion on how the changes will impact your organization, by doing the gap assessment and you’ll be able to address any shortcomings.

Meeting the new 3.0 requirements isn’t just about passing audits. In fast paced payment IT landscape, staying smart and protected is part of our commitment to our customers. Beefing up security game not only reduce audit headaches, but also enjoy stronger brand reputation as a safe and reliable e-commerce business.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Financial Services, Payment Card Industry PCI Security, Small Business Improvement, Visa MasterCard American Express Tagged with: 3.0, attack surface, authentication, breaches, businesses, cardholder data, complance, compliant, credential, cybercriminals, digital payment, DSS, e-business, e-commerce, embedding, hackers, lower-risk, online retailers, passing audits, payment card infrastructures, PCI, processes, reducing fraud, requirements, risk of compromise, security controls, security of payment card data, security program, standards

April 8th, 2014 by Elma Jane

Today’s consumers are defining themselves by their mobile devices, their social presences and how they interact with brands, both offline and online. The digital evolution of the average consumer is alive and kicking.

Today’s consumer is more connected than ever, with more access to and deeper engagement with content and brands. Thanks to the proliferation of digital devices and platforms. Content that was once only available to consumers via specific methods of delivery such as via print, radio and broadcast television can now be sourced and delivered to consumers through their multiple connected devices. This is driving the media revolution and blurring traditional media definitions.

What are the specific characteristics or dynamics shaping today’s consumer behavior? Digital consumers are social-savvy and more connected to their friends, family and favorite brands than ever before.

Focused On The Gadgetry

Consumers love gadgets.

One out of four Americans plan to buy a smartphone in the near future. Thirty percent intend to upgrade from a regular mobile phone to a smartphone once able. For those ages 18 to 24, 49 percent they want to upgrade to a smartphone.

How frequently consumers use their mobile devices in a given month? Consumers spent an average of 34 hours and 17 minutes per month using apps on their devices, an increase of 9 hours and 52 minutes from 2012.

Interestingly, the amount of time consumers spend surfing the Web fell 1 hour and 54 minutes to a total of 27 hours and 3 minutes. The amount of time used to watch videos online increased by 43 minutes, to 6 hours and 41 minutes.

Social Media & Everyday Life

Digital consumers, by and large love their social media.

Sixty-four percent said that they use social media at least once per day. For mobile however, the growth figures reported suggest a broad shift is happening, pushing more people to access social networks via mobile platforms.

Forty-seven percent of smartphone owners log onto a social network each day. Additionally, the number of people who use social-media apps on their smartphones rose by 37 percent from 2012.

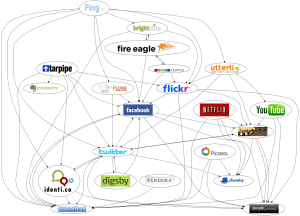

Digital consumers are also diversifying their choice of social networks, opting to use LinkedIn and Pinterest in addition to so-called traditional social media platforms like Facebook and Twitter.

As digital consumers find their own mix of devices and platforms to access and engage with social media, they are building profiles and connections on multiple social networks as well.

Two Screens Is A King

Digital consumers also rely on their mobile devices as a second type of television screen.

In a survey, eighty-four percent said they use their smartphone or tablet to surf the Web or to use apps while watching television. Of those, 44 percent of tablet owners shopped while watching TV, and 24 percent used their smartphones to make purchases.

Fourteen percent of tablet owners used their device to buy a product or service as it was being advertised on TV. Just 7 percent of smartphone owners said they would do the same.

Posted in Best Practices for Merchants, Credit card Processing, Financial Services, Merchant Services Account, Mobile Payments, Small Business Improvement, Smartphone Tagged with: apps on their devices, average consumer, content, deeper engagement, digital consumers, digital devices, digital evolution, Facebook, gadgets, linkedin, media revolution, Mobile Devices, mobile platforms, offline and online, pinterest, regular mobile phone, smartphone, social media, social network, social presences, social-media apps, social-savvy, tablet, traditional media, twitter

April 7th, 2014 by Elma Jane

Integrate Cloud-Based Platforms

E-commerce businesses increasingly rely on cloud-based applications, such as hosted shopping carts, analytics platforms, cloud-based accounting, customer service tools, and more.

To operating smoothly, a merchant’s cloud-based apps should integrate with each other, to save time and to otherwise prevent data loss and ensure accurate reporting.

It’s important, therefore, to have an integration mindset when choosing and using software-as-a-service solutions.

Some tips:

Ask Around

As with evaluating any vendor for your company, go beyond the company’s website. Ask the vendor about other customers. Get references. Contact those companies and ask how the platform is working. Is it easy to set-up? Does it integrate seamlessly with other apps? How long does it take to transfer data from one app to the other? These are just some of the questions you need to ask when evaluating an app. Also check social media sites for any discussions pertaining to the program. Read what people are tweeting. Check relevant LinkedIn groups.

Check the Company’s Integrations Page or API

When evaluating a software-as-a-service (SaaS) solution, first determine if it integrates with the platforms that you’re already using. Pre-built integrations will save much time. Alternatively, if a company has an application programming interface (API), use it to integrate the app with your existing systems.

If you can’t find the integration you need or if you want to avoid the API option, contact the vendor directly and ask if it can make its platform sync with your existing solutions. Don’t underestimate the power of reaching out to your vendors.

Use Cloud App Integration Services

Another option is to use SaaS integration services. You have plenty of choices, depending on what you need to connect. If you just need to integrate two apps, like Dropbox to Gmail, for instance, you can use (IFTTT) If This Then That – a service that lets you assign triggers and actions to each app through a drag-and-drop interface. When one program does something, it will automatically trigger another app to perform an action. For example, you can create a recipe wherein all your Gmail attachments are automatically saved to your Dropbox folder. IFTTT is free to use, to integrate up to 80 apps.

A similar service, Zapier, lets you do the same thing, but on a larger scale. It supports more than 250 applications, including Salesforce, Zoho CRM, Xero accounting, Campaign Monitor email, and more. Zapier is free for five integrations. It also offers Basic, Business, and Business Plus plans that cost $15, $49, and $99 per month, respectively.

IFTTT and Zapier work well to integrate two cloud applications. However, if you’re running a combination of cloud and on-premise applications, or if you have an ecosystem of apps and data sources that have to connect and exchange data, you need more sophisticated options.

That’s where services such as Dell Boomi and SnapLogic come in. Like IFTTT and Zapier, these solutions use a drag-and-drop interface, but at a larger scale. They connect multiple combinations of cloud and on-premise applications.

Use Free Trials

Always test-drive your apps or integration services. Most SaaS platforms offer free trials. Take note of user-friendliness, functionality, and observe how they function with programs you already have.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Financial Services, Internet Payment Gateway, Payment Card Industry PCI Security, Small Business Improvement, Visa MasterCard American Express Tagged with: api, apps and data sources, cloud applicaitons, cloud based applications, cloud based apps, cloud-based accounting, customer service, dropbox, e-commerce, ecommerce, exchange data, existing systems, gmail, integration, SAAS, salesforce, shopping carts, social media, software-as-a-service, sync, zapier

April 7th, 2014 by Elma Jane

Payment processors share an inherent responsibility to keep their systems secure. It requires a system of governance that includes a broad array of policies, procedures, planning activities, responsibilities, practices and resources for implementing and maintaining a secure system and network operating environment.

To help organizations identify the best payment processors, a recent white paper from i2c outlines the various governance and security best practices processors should use. And it all starts from the top.

Good governance calls for establishing internal audit, compliance, and information security groups within the organization that have separate reporting channels to upper management and/or a board-level audit committee, the report notes. This organizational structure ensures that all security and operational-related risks are appropriately addressed and that all internal processes and practices remain in compliance with the organization’s defined policies and procedures, which in turn should align with applicable external security standards, regulatory laws and payment systems operating rules.

Resource Dedication

Payment processors also need to dedicate proper resources to the task of understanding, and complying with all applicable government, industry, association, legal and regulatory requirements that are relevant to each of their operating regions, according to the paper. Such applicable requirements need to be carefully identified, documented, applied, and updated on a regular basis.

Payment processors’ compliance activities need to cover not only the applicable government, industry, association operating rules and legal/regulatory requirements pertaining to their operations, but they also need to understand and comply with the applicable rules and regulatory requirements pertaining to their client partners. Let say you process customer data on behalf of a partner whose data is governed by a given regulatory rule, then you as their third-party provider must also apply those regulatory rules when handling their data.

Policies and procedures should be developed and put into practice that ensure the payment processor remains in compliance with these various requirements.

Risk Management

Risk management should be incorporated into every payment processors’ system of governance. It provides a framework for identifying and addressing risks within the organization and provides a process for regular operational review and improvement, according to the report. An effective risk management process should adopt an appropriate risk management methodology to identify, evaluate, mitigate and monitor risks pertaining to critical business assets and operations.

Security best practices also call for a defense-in-depth strategy to ensure the protection of information assets and overall risk reduction. A defense-in-depth approach ensures that the failure of any one control does not lead to successful penetration. By providing multiple layers of protection, the controls collectively ensure the confidentiality, integrity, and availability of critical system assets and data.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Small Business Improvement, Visa MasterCard American Express Tagged with: availability, confidentiality, defense-in-depth, information security, internal audit, layers of protection, network operating, payment processors, risk reduction, secure system, security best practices, system assets and data, system operating rules, systems secure

April 7th, 2014 by Elma Jane

Business-to-business ecommerce describes Internet-enabled transactions between businesses, such as a manufacturer and a wholesaler, a wholesaler and a retailers, or a wholesaler and a business user. The B-to-B ecommerce market was expected to exceed $550 billion in the U.S. last year, offering great opportunities for distributors and manufacturers to streamline sales, boost profits, and engage with new customers.

Since the late 1990s, businesses have been using the Electronic Data Interchange (EDI) system to transfer purchase orders and similar structured information electronically, representing, if you will, a form of B-to-B ecommerce.

Separately, some B-to-B sellers have created websites on which business customers can make purchases as if they were shopping on a business-to-consumer site. This category of B-to-B ecommerce may enjoy the most growth and offer the most opportunity.

Important points to consider of running a B-to-B ecommerce site.

B-to-B Customers Are also B-to-C Customers

B-to-B sites often trail consumer sites in technology, function, capabilities, and design. Typically not good enough.

As an example, the U.S. B-to-B site for a major multinational manufacturer, which includes information for dealers in the U.S., can only be viewed on Internet Explorer, and won’t work in any other browser, including Firefox, Chrome, Opera, or Safari. And don’t even think about visiting this site on a mobile device. It just won’t work.

This is a ridiculous business decision. It forgets a fundamental fact about B-to-B ecommerce customers. They are also B-to-C ecommerce customers.

It is extremely likely that the professional shopper on an ecommerce-enabled B-to-B website has had at least some experience shopping on consumer ecommerce sites, which all have compelling product photography, good navigation, good search capabilities, and good content.

A B-to-B ecommerce site must provide the same visual and functional experience as the best B-to-C ecommerce sites.

Personalization Is Vital

B-to-B shoppers may require a greater level of personalization than B-to-C customers, since businesses may have contract prices, special payment terms, or negotiated shipping rates.

Business relationships may be very deep and complicated. It is not unusual for B-to-B ecommerce sites to require registration before showing prices or shipping rates or offering a quote. This login requirement allows the B-to-B ecommerce site to personalize almost every aspect of the transaction.

A good B-to-B ecommerce site may take a little longer to launch since the system for handling relatively complex business relationships can take some time. But once it is in place, this personalization will mean that the relationship could be longer lasting.

Sales people Are the Primary Marketing Vehicle

While it is both possible and likely that B-to-B ecommerce sites will be able to acquire new customers simply by making products easy to order online, salespeople who contact customers are probably the B-to-B ecommerce seller’s primary and best marketing channel.

Salespeople can attract new customers or deepen relationships with existing shoppers. Sometimes, it can be enough to follow up after a B-to-B sale with a call to make certain that the transaction went as expected.

Shopping Is Part of Your Customer’s Profession

One of the most significant differences between B-to-B and B-to-C ecommerce is that shopping is part of the B-to-B ecommerce customer’s daytime job.

This means that the stakes can be higher for the B-to-B seller. If the shopper has a good experience, that shopper is likely to return and reorder repeatedly – even suggesting the seller to co-workers or other divisions. But if something goes wrong, particularly something that would cause the shopper to miss deadlines at work or appear in some way to have done a poor job, that shopper will likely blame the B-to-B seller. Depending on the unhappy shopper’s influence, the B-to-B seller might lose the entire account, including many individual buyers or divisions.

This means that order handling and transactional communications must be top notch. Some B-to-B ecommerce sellers will call customers to confirm orders or shipments when the customer has ordered a large quantity, very expensive items, or requested express shipping, since these orders may represent important transactions to the customer.

What Ecommerce Can Do for your B-to-B Business

If you sell to other businesses, ecommerce should have three potential benefits for your business.

First, it may help new customers find you. Having an easy-to-find and use ecommerce site means that new customers – customers with a need – will be able to locate your business regardless of geography or prior relationships.

Second, B-to-B ecommerce may streamline sales for existing customers. Some of your current customers will appreciate the ability to order online, 24 hours a day 7 days a week. The process may also be faster than sending emails or, even worse, faxed orders.

Finally, B-to-B ecommerce may improve margins and boost profits. It may be possible to provide customers with a better ordering experience and better customer service using ecommerce while spending less on labor and order processing. Any cost savings that B-to-B ecommerce brings may drop straight to your business’s bottom line.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Small Business Improvement Tagged with: account, b-to-b, b-to-c, better ordering experience, boost profits, business-to-business, business-to-consumer, business's bottom line, communication, consumer, cost savings, customer service, e-commerce, ecommerce, ecommerce sites, electronic data interchange, faxed orders, growth, improve margins, new customers, online, order handling, order processing, personalization, profits, purchase orders, salespeople, seller, sending emails, shopper, special payment terms, transaction, wholesaler

April 1st, 2014 by Elma Jane

One piece of advice that many entrepreneurs receive is to keep their business simple. Expanding too quickly or jumping around from idea to idea without a clear direction can certainly prevent a startup from getting off the ground – but simplicity in the wrong area may be just as detrimental.

It’s great to do something simple, provided customers want what you have to sell. There’s a survivor bias in small business – you read about one success story that started with a simple idea. There are 15 other companies that did equally simple things that nobody wanted. Only the few that really focused on getting that first sale succeeded.

Experimenting with different tactics and learning to concentrate on what worked was the key to success.

Accept that some ideas will fail. Not everything you try with your business is going to work. This can be a difficult reality to face when you and your team have become invested in a project, but the best course of action is to let it go and move on. Continue experimenting and finding out what fits, as long as it doesn’t become an excuse to avoid a difficult problem.

Clearly define your team’s roles. Everyone working with you should have a clearly defined path and know what they’re supposed to be doing at any given time. A good knowledge of your team and each team member’s strengths can help you decide the most effective way to divide up labor for new strategies.

Don’t overload. Trying new ideas for your business can help you find out what works, but it’s important to avoid taking on too many tasks and overwhelming yourself and your team.

Push and contract. It’s tempting to want to keep trying one new strategy after another, especially when you have the resources to do so. But it is recommended going through a push and contract cycle with your business activities.

Push for a couple of months with new ideas, but then have a period of pullback and reflection to see if they’re making money.

Posted in Best Practices for Merchants, Financial Services, Small Business Improvement Tagged with: business, cusomers, making money

March 31st, 2014 by Elma Jane

Money remittance companies can achieve real benefits by embracing a mobile-first strategy. In fact, when it comes to financial institutions, I can definitely say this is a perfect match! Specially for us who are transferring money to our home country for our loved ones.

Here are some factors why.

It decentralizes transaction points, making it inherently safer for customers.

People carrying cash in and out of remittance centers are prime targets for criminals. In some countries, it’s not rare to have people mugged just outside of banks and remittance centers.

By allowing people to transact wherever they are, mobile remittance decentralizes the transaction points, making it harder for thieves to find unsuspecting prey.

It has the potential to reduce bottlenecks in branches.

Mobile remittance can reduce the number of people who would visit a remittance branch to complete transactions. It alleviates traffic inside the branch, reducing lines and wait times and making visits by other customers more hassle-free.

Makes remittances more accessible.

The reduction in costs of running a remittance operation means these companies can actually lower the costs of sending money for the end-customer. This makes remittances more accessible to the areas that most need it, such as developing nations and remote rural areas. Lower costs also make it more attractive for people to use formal remittance solutions to send over money. For the poor, every cent counts, so lower costs can make the added security only a financial institution can provide more attractive for them.

Mobile makes money transfers faster and more convenient.

While today’s contactless mobile payments solutions are still not as simple as handing over a wad of cash or swiping a card for over-the-counter payments, in the world of money remittances, mobile can actually smooth out friction points.

Through mobile, senders can send funds wherever they are. They won’t have to drive or commute to a local remittance center, they don’t have to fill out forms and they don’t have to fall in line to complete the transaction. It’s all seamless and convenient.

For the recipients, mobile remittance can save them the trouble of having to go to a remittance center, fill out a form and fall in line to receive their money. All they’ll need is a simple SMS code that they can use to withdraw funds from a nearby ATM through cardless transactions.

Money can stay within the remittance company’s network longer.

One of the side effects of successful mobile money campaigns is that users are also using these mobile money solutions as storage mediums for their money. They don’t withdraw the funds all in one go. Instead, they only take out what they need and withdraw funds later.

Having the ability to withdraw small sums at a time has multiple benefits. For one, carrying less cash makes it safer for the customer. For the remittance company, the money stays in its network longer.

Opens up doors for financial inclusion

This is particularly true for developing countries where a vast majority of the population are un-banked or under-banked. The costs of building and maintaining a physical presence in poor countries has made traditional financial services difficult to access for their citizens. Even in poor countries, a large number of the population has access to a mobile device, giving them an opportunity to receive financial services.

Opens up other opportunities for remittance companies

Having a mobile service can help remittance companies expand to other services. They can add bill payments into the app, for example, allowing their customers to pay for utility bills using funds sent to them through their mobile devices.

Paves the way forward to progress

Mobile use is so widespread that it is no longer wise for remittance companies to turn a blind eye to it. If they won’t embrace it, you can bet their competitors will. Whoever gains traction in the mobile channel will have a huge advantage in the market. It’s now a case of move now or be left behind.

Reduces costs for remittance companies

Mobile remittance can cut costs for remittance companies by reducing the need for physical branches and personnel to accommodate walk-in clients. Mobile can scale without incurring significant costs making a mobile investment much better in the long-term for remittance companies that want to expand their operations.

Posted in Best Practices for Merchants, Financial Services, Mobile Payments, Small Business Improvement, Smartphone Tagged with: atm, bill payments, cardless transactions, complete the transaction, contactless mobile payments, financial services, mobile channel, mobile device, mobile money, mobile remittance, mobile service, mobile-first, money remittance, network, payments, sms, swiping a card, transaction, transferring money

March 17th, 2014 by Elma Jane

With so much to do each day, it’s easy for a small business owner to get bogged down in details. That’s where your smartphone comes in. With the right apps, your mobile device can automate the tasks that used to be daily chores. Whether you need help keeping track of all your business documents, or organizing your calendar and contacts list, it’s time to let your smartphone do some of the heavy lifting.

Back up your business files. Your work machine contains everything you need for a productive day, including every file and document you are working on. But you can’t always be at the office. With your smartphone and the right apps, however, you can back up and access your business files from anywhere. Dropbox, Box, Google Drive, SkyDrive and iCloud are all solid mobile apps that automate the process of syncing your business files to the cloud so you can access them from any Web-connected device, including your smartphone or tablet. Better yet, any edits you make will be synced across all your devices, so you can stay productive and organized.

Manage new contacts. Swapping business cards is a great networking strategy, but cards are easy to lose, and manually inputting all that contact information into your address book is a chore. So let your smartphone enter all that data into your address books. CamCard (available for iOS and Android) is an all-in-one business card management solution. Just point your iPhone camera at a card and snap a photo. The app’s text-recognition software will pull out the key details and update your address book automatically. It can even search for new contacts on LinkedIn to add a photo and additional personal details for each new contact.

Silence your smartphone. A buzzing or ringing smartphone can be distracting – not to mention embarrassing – during a business meeting. Silencing your phone is simple, but chances are you’ll occasionally forget. That’s why there are handy apps that monitor your smartphone calendar for meetings and appointments, then silence your phone for the duration of that event. You can even whitelist specific numbers so you won’t miss an emergency call. When the meeting is over, your smartphone’s ringer and vibration settings will be returned to their normal state. That way, you can stay focused and free from distraction when it matters most. Android users can try Silencify. For iPhone users, AutoSilent is a good option.

Sync your calendars. Both Android and iOS have built-in calendars to help you plan your week and schedule meetings. But juggling both a mobile calendar and a desktop office calendar is a pain, so why not use your smartphone to synchronize the two? If you use Microsoft Outlook as your business calendar, for example, Google Calendar offers an easy way to link them. And iPhone users can synchronize their mobile calendar with Outlook by plugging their smartphone into their computer and accessing the Calendars tab in the iTunes options menu. Automating the process of syncing your calendars means you’ll never mix up appointments. And if you share your business calendar with your employees, it ensures that everyone is always on the same page.

Sync your social media accounts. A strong presence on Facebook and Twitter can help you engage your customers and grow your business. Mobile apps can help you keep your business profiles fresh when you’re on the go, but reposting those updates on each platform individually can be a chore especially from a tiny smartphone screen. Fortunately, there’s an easy way to automate the process of synchronizing social media posts between your business profiles. Simply visit this page to link your Facebook and Twitter accounts. After that, go ahead and use the Facebook mobile app to post updates, news or promotions to your business’s Facebook page, each post will be automatically funneled to your Twitter followers as well.

Posted in Best Practices for Merchants, Mobile Payments, Small Business Improvement, Smartphone Tagged with: all-in-one, Android, apps, automate, automate the process, automating, box, business documents, business profiles, camcard, devices, dropbox, Facebook, google drive, icloud, iOS, Iphone, linkedin, Mobile Apps, mobile device, networking, organizing, productive, skydrive, small business, smartphone, synchronize, synchronizing social media, syncing, tablet, twitter, web-connected

March 14th, 2014 by Elma Jane

Merchant and Consumer Groups Seek Senate Support To Forego EMV Chip and Signature As Breach Concerns Rise

There’s no shortage of answers in trying to put a stop to hackers set on throwing chaos into the way consumers transact at the point of sale, or online for that matter. Yesterday, the Banking, Housing and Urban Affairs subcommittee on national security and international trade and finance got its chance to hear some of them.

During the hearing, William Noonan, deputy special agent in charge, U.S. Secret Service, noted the advances in computer technology and greater access to personally identifiable information online, which have created a virtual marketplace for transnational cyber criminals to share stolen information and criminal methodologies. As a result, the Secret Service has observed a marked increase in the quality, quantity, and complexity of cyber crimes targeting private industry and critical infrastructure. These crimes include network intrusions, hacking attacks, malicious software, and account takeovers leading to significant data breaches affecting every sector of the world economy.

The recently reported data breaches of Target and Neiman Marcus represent only the most recent, well-publicized examples of this decade-long trend of major data breaches perpetrated by cyber criminals intent on targeting the nation’s retailers and financial payment systems. The increasing level of collaboration among cyber-criminals allows them to compartmentalize their operations, greatly increasing the sophistication of their criminal endeavors and allowing for development of expert specialization. These specialties raise both the complexity of investigating these cases, as well as the level of potential harm to companies and individuals.

So how should the industry react to prevent further breaches? Those opinions provided during testimony at the hearing varied widely, though both consumer and merchant groups would like the card networks to give up requiring only signatures for smart card purchases at the point of sale.

Consumer program director at the U.S. Public Interest Research Group, called for myriad of changes, citing that the greater risk from the recent breaches is less related to identity theft than it is to fraud on existing accounts, and he said it’s time for players on both sides of the transaction to focus more on protecting consumers than on managing their own risk.

Until now, both banks and merchants have looked at fraud and identity theft as a modest cost of doing business and have not protected the payment system well enough. They have failed to look seriously at harms to their customers from fraud and identity theft -including not just monetary losses and the hassles of restoring their good names, but also the emotional harm that they must face as they wonder whether future credit applications will be rejected due to the fraudulent accounts.

As a first step, Congress should institute the same fraud cap, $50, on debit/ATM cards that exists on credit cards, or eliminate the $50 cap entirely, since it is never imposed because of the zero-liability policies issuers have voluntarily have imposed. Congress also should provide debit and prepaid card customers with the stronger billing-dispute rights and rights to dispute payment for products that do not arrive or do not work as promised, just as many credit card users enjoy.

Congress should endorse a specific technology, such as EMV smart cards and if it does, require the use of PINs when initiating smart card transactions. The current pending U.S. rollout of chip cards will allow use of the less-secure chip-and-signature cards rather than the more-secure chip-and-PIN cards. Why not go to the higher-and-PIN authentication standard immediately and skip past chip and signature? There is still time to make this improvement.”

Retailers have spent billions of dollars on card-security measures and upgrades to comply with PCI card security requirements, but it hasn’t made them immune to data breaches and fraud. The card networks have made those decisions for merchants, and the increases in fraud demonstrate that their decisions have not been as effective as they should have been.

The card networks should forego chip and signature and go straight to chip and PIN. To do otherwise would mean that merchants would spend billions to install new card readers without they or their customers obtaining PINs’ fraud-reducing benefits. We would essentially be spending billions to combine a 1990’s technology chips with a 1960’s relic signature in the face of 21st century threats.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Merchant Services Account, Payment Card Industry PCI Security, Point of Sale, Small Business Improvement, Visa MasterCard American Express Tagged with: banking, Breach, card networks, card-security, chip and signature, chip cards, chip-and-PIN cards, computer technology, credit applications, credit cards, critical infrastructure, cyber crimes, cyber-criminals, data breaches, debit atm cards, EMV, hackers, hacking attacks, international trade and finance, malicious software, managing risk, merchant, national security, netwrok intrusions, new card readers, online, payment system, pci card security requirements, PIN, point of sale, prepaid card customers, smart card transactions, technology chips, the secret service, transnational cyber criminals, virtual marketplace, world economy