April 27th, 2015 by Elma Jane

I was shopping in Kmart and didn’t understand why my Credit Card transaction was declined. My card is EMV and Kmart is EMV, but the Kmart system did not forced the transaction to run as EMV so, Citibank declined it. Kmart can loose a $600 sale can your small business afford it? If you think hiring a professional is expensive try an amatuer…

A lot of stores, specially big chain stores, have EMV capable terminals, but they haven’t turned them on yet and still force you to swipe. Some think, migration is just getting a new terminal and asking their acquirer to enable EMV on their account. Its not only about the liability shift, and the EMV equipment, It’s the lack of information for the Merchants.

There has to be training and orientation that merchants will need to invest into for their employees. As well as changing our mentality that we all need to be prepared for this upcoming transition….as both consumers and business owners.

The issuing banks can, and are starting to decline transactions when a merchant CAN use EMV but do not. EMV is coming October 2015 and if you are not ready you may loose sales, and will loose when a fraudulent card walks in your business.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: banks, card, consumers, credit card transaction, credit-card, EMV, Merchant's, swipe, terminals

April 21st, 2015 by Elma Jane

An advanced strain of malware called “Punkey,” is capable of attacking Windows point of sale terminals, stealing cardholder data and upgrading itself while hiding in plain sight.

Researchers from Security vendor Trustwave discovered the new strain. The investigation found compromised payment card information and more than 75 infected, and active, Internet Protocol addresses for Windows POS terminals.

Punkey poses a unique threat to payment networks, particularly because it also can download updates for itself.

If the malware author has a new feature it wants to add or updates to get rid of bugs, it actually pushes the malware down from the command and control server, revealed by Trustwave’s SpiderLabs research center. Punkey operates like a typical Botnet.

The malware hides inside of the Explorer process, which exists on every Windows device and manages the opening of individual program windows. Punkey scans other processes on the terminal to find cardholder data, which it sends to the control server.

The malware performs key logging, capturing 200 keystrokes at a time. It sends the information back to its server to store passwords and other private information.

A year ago, security vendors warned retailers against using Windows XP at the point of sale, since Microsoft stopped supporting Windows XP security patches. However, even Punkey is not attacking Windows due to any vulnerability in the systems, so even merchants with newer versions of Windows are at risk.

Punkey just runs like any Windows binary would. Even if the system is upgraded or a new system is put in place, criminals are still getting malware on the POS in other ways.

Many retailers use remote desktop support software, which fraudsters take advantage of, they steal a password and install malware like a technician would install any software.

While Punkey represents a more sophisticated POS malware than Trustwave has seen previously, merchants can still protect themselves through attention to basic security best practices.

Merchants should update antivirus and firewall protections, monitor the remote access software, establish two-factor authentication and check network activity daily for anything out of the ordinary. Unfortunately, many organizations have neither the expertise nor the manpower to perform these tasks.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Mobile Point of Sale, Payment Card Industry PCI Security, Point of Sale Tagged with: card, cardholder, cardholder data, data, Malware, Merchant's, payment, payment networks, point of sale, POS terminals, retailers, terminals

January 21st, 2015 by Elma Jane

With a crucial deadline, the payments industry is starting to look at just what kind of fraud liability and how much fraud merchant acquirers will have to assume if their merchants aren’t ready to accept Europay-MasterCard-Visa (EMV) chip cards by October.

While issuers currently absorb losses under card-network rules, that burden will shift to acquirers this fall in cases where the fraud occurs at merchants unprepared for EMV.

As a result, acquirers will have to reckon with a whole new category of risk exposure.

In card-not-present transactions, acquirers have faced this, but in the overwhelming majority of cases they’ll be confronting it for the first time.

Surprisingly, for all the talk in the industry about the imminent arrival of EMV, it appears few acquiring executives have fully accounted for what the shift really means for them.

Some 24% of U.S. point-of-sale terminals are “EMV-capable,” while 9% of debit/prepaid cards issued, and 2% of credit cards have EMV chips so far. But while terminals may be technically capable, it isn’t known just how many of these merchants have the software and trained personnel to accept EMV.

Foreign issuers, especially, may be licking their chops at the prospect of offloading their consumer-fraud risk onto U.S. acquirers. For years and years, these non-U.S. issuers have invested in EMV, but the U.S. is still using the mag stripe. So non-U.S. issuers appear to be very aware of the liability shift.

To be sure, acquirers’ increased risk exposure may be relatively short-lived. Under the network rules, liability rests with the issuer in cases where both the merchant and the issuer are EMV-compliant. That could be nearly universally the case within a few years. By 2018, nearly all cards and terminals will be compliant.

But that still leaves open the question of how many of these terminals will really be running chip card transactions.

The issue isn’t so much about terminals as about software. Many mid-size merchants are using so-called integrated solutions that run payments as part of a larger business-management system. That means acquirers must work with a number of other parties to reconfigure software, and that presents a challenge when it comes to getting masses of merchants EMV-compliant.

The bigger problem is the integrated point-of-sale market.

While the liability shift may impact acquirers, not all them are convinced their exposure will rise all that much. Some argue the risk of loss from lost/stolen/counterfeit cards at the point of sale is low and not likely to rise, especially for small-ticket merchants.

Fraudsters, are much more inclined to practice their trade online, where the risk of being caught is lower, compared to face-to-face transactions.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: card network, card-not-present, chip cards, credit cards, debit/prepaid cards, EMV, EuroPay, fraud, integrated solutions, mag stripe, MasterCard, merchant acquirers, Merchant's, payments, payments industry, point of sale, terminals, transactions, visa

September 24th, 2014 by Elma Jane

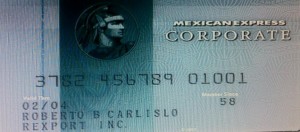

The CVV Number (Card Verification Value) on your credit card or debit card is a 3 digit number on VISA, MasterCard and Discover branded credit and debit cards. On your American Express branded credit or debit card it is a 4 digit numeric code.

The codes have different names:

American Express – CID or unique card code.

Debit Card – CSC or card security code.

Discover – card identification number (CID)

Master Card – card validation code (CVC2)

Visa – card verification value (CVV2)

CVV numbers are NOT your card’s secret PIN (Personal Identification Number).

You should never enter your PIN number when asked to provide your CVV. (PIN numbers allow you to use your credit or debit card at an ATM or when making an in-person purchase with your debit card or a cash advance with any credit card.)

Types of security codes:

CVC1 or CVV1, is encoded on track-2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for card not present transactions occurring by mail or fax or over the telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless card and chip cards may supply their own codes generated electronically, such as iCVV or Dynamic CVV.

Code Location:

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card. On American Express cards, the card security code is the four digits printed (not embossed) on the front towards the right. The card security code is not encoded on the magnetic stripe but is printed flat.

American Express cards have a four-digit code printed on the front side of the card above the number.

MasterCard, Visa, Diners Club, Discover, and JCB credit and debit cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

New North American MasterCard and Visa cards feature the code in a separate panel to the right of the signature strip. This has been done to prevent overwriting of the numbers by signing the card.

Benefits when it comes to security:

As a security measure, merchants who require the CVV2 for card not present payment card transactions are required by the card issuer not to store the CVV2 once the individual transaction is authorized and completed. This way, if a database of transactions is compromised, the CVV2 is not included, and the stolen card numbers are less useful. Virtual Terminals and payment gateways do not store the CVV2 code, therefore employees and customer service representatives with access to these web-based payment interfaces who otherwise have access to complete card numbers, expiration dates, and other information still lack the CVV2 code.

The Payment Card Industry Data Security Standard (PCI DSS) also prohibits the storage of CSC (and other sensitive authorization data) post transaction authorization. This applies globally to anyone who stores, processes or transmits card holder data. Since the CSC is not contained on the magnetic stripe of the card, it is not typically included in the transaction when the card is used face to face at a merchant. However, some merchants in North America require the code. For American Express cards, this has been an invariable practice (for card not present transactions) in European Union (EU) states like Ireland and the United Kingdom since the start of 2005. This provides a level of protection to the bank/cardholder, in that a fraudulent merchant or employee cannot simply capture the magnetic stripe details of a card and use them later for card not present purchases over the phone, mail order or Internet. To do this, a merchant or its employee would also have to note the CVV2 visually and record it, which is more likely to arouse the cardholder’s suspicion.

Supplying the CSC code in a transaction is intended to verify that the customer has the card in their possession. Knowledge of the code proves that the customer has seen the card, or has seen a record made by somebody who saw the card.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Point of Sale, Visa MasterCard American Express Tagged with: (Card Verification Value), (CVC2), American Express, atm, authorization data, bank/cardholder, card holder data, card identification number, card issuers, Card Not Present transactions, card number, card numbers, card security code, card validation code, card-not-present, card-present transactions, cardholder, cards, cash advance, chip cards, CID, code, Contactless card, credit, credit-card, CSC, customer, customer service, CVC1, CVV Number, CVV1, CVV2, Data Security Standard, debit, debit card, debit cards, device, Diners Club, Discover, fax, gateways, iCVV or Dynamic CVV, individual transaction, internet, issuer, JCB credit, magnetic stripe, mail, MasterCard, merchant, payment card, Payment Card Industry, payment card transactions, payment gateways, PCI-DSS, Personal Identification Number, PIN, point of sale, post transaction authorization, security codes, telephone, terminals, unique card code, virtual terminals, visa, web-based payment

September 4th, 2014 by Elma Jane

The move to mobile point of sale (mobile POS) is radically changing the face of customer interactions and payments, as both customers and merchants grow increasingly comfortable with the concept of mobile payments. In the current, crowded marketplace most mobile payment solutions are not compatible with each other. Instead of unifying the payment experience they create islands separated by technology or usage that are tailored to individual providers in the market. Multiple devices are currently needed in-store to process different payment types and the challenge is how they can make payments unified in such a way that only one device is needed in store.

The use of cash by customers also adds a level of complication to the mobile POS story. The removal of IDM terminals, removal of customer queues and ability for customers to simply walk up and pay an assistant or to leave a store and have their bank card automatically debited certainly suits the expectations of customers today, however a large number of customers still use traditional cash methods to pay for goods and services. A number of stores that have gone down the route of implementing mobile POS now have a problem dealing with cash because the wandering shop assistants and personal shoppers can only accept card or web-based payment options. The future for mobile POS has potential to be bright, a dominant player will have to emerge in the market. This will break down the technology barriers and usage barriers between different players. The success to mobile POS lies in the payment process being truly unified with one device in one place and very seamless workflow. This will be very complicated thing to achieve, there have been a lot of attempts and a lot of false starts in the history of mobile POS. MPOS will be the future. Five years from now people will be amazed that they did transactions with landlines. NO child will ever see a telephone with a cord attached. Never a popcorn on top of the stove since we developed microwave ovens. Technology changes, and we are slow to adopt new stuff. Once we change we don’t know how we did without it.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: bank, card, cash, customer, devices, IDM terminals, Merchant's, mobile, mobile point of sale, MPOS, payment solutions, payment types, payments, point of sale, POS, provider's, services, technology, terminals, web-based payment

September 2nd, 2014 by Elma Jane

While Apple doesn’t talk about future products,latest report that the next iPhone would include mobile-payment capabilities powered by a short-distance wireless technology called near-field communication or NFC. Apple is hosting an event on September 9th, that’s widely expected to be the debut of the next iPhone or iPhones. Mobile payments, or the notion that you can pay for goods and services at the checkout with your smartphone, may finally break into the mainstream if Apple and the iPhone 6 get involved.

Apple’s embrace of mobile payments would represent a watershed moment for how people pay at drugstores, supermarkets or for cabs. The technology and capability to pay with a tap of your mobile device has been around for years, you can tap an NFC-enabled Samsung Galaxy S5 or NFC-enabled credit card at point-of-sale terminals found at many Walgreen drugstores, but awareness and usage remain low. Apple has again the opportunity to transform, disrupt and reshape an entire business sector. It is hard to overestimate what impact Apple could have if it really wants to play in the payments market.

Apple won’t be the first to enter the mobile-payments arena. Google introduced its Google Wallet service in May 2011. The wireless carriers formed their joint venture with the intent to create a platform for mobile payments. Apple tends to stay away from new technologies until it has had a chance to smooth out the kinks. It was two years behind some smartphones in offering an iPhone that could tap into the faster LTE wireless network. NFC was rumored to be included in at least the last two iPhones and could finally make its appearance in the iPhone 6. The technology will be the linchpin to enabling transactions at the checkout.

Struggles

The notion of turning smartphones into true digital wallets including the ability to pay at the register, has been hyped up for years. But so far, it’s been more promise than results. There have been many technical hurdles to making mobile devices an alternative to cash, checks, and credit cards. NFC technology has to be included in both the smartphone and the point-of-sale terminal to work, and it’s been a slow process getting NFC chips into more equipment. NFC has largely been relegated to a feature found on higher-end smartphones such as the Galaxy S5 or the Nexus 5. There’s also confusion on both sides, the merchant and the customer, on how the tech works and why tapping your smartphone on a checkout machine is any faster, better or easier than swiping a card. There’s a chicken-and-egg problem between lack of user adoption and lack of retailer adoption. It’s one reason why even powerhouses such as Google have struggled. Despite a splashy launch of its digital wallet and payment service more than three years ago, Google hasn’t won mainstream acceptance or even awareness for its mobile wallet. Google hasn’t said how many people are using Google Wallet, but a look at its page on the Google Play store lists more than 47,000 reviews giving it an average of a four-star rating.

The Puzzle

Apple has quietly built the foundation to its mobile-payment service in Passbook, an app introduced two years ago in its iOS software and released as a feature with the iPhone 4S. Passbook has so far served as a repository for airline tickets, membership cards, and credit card statements. While it started out with just a handful of compatible apps, Passbook works with apps from Delta, Starbucks, Fandango, The Home Depot, and more. But it could potentially be more powerful. Apple’s already made great inroads with Passbook, it could totally crack open the mobile payments space in the US. Apple could make up a fifth of the share of the mobile-payment transactions in a short few months after the launch. The company also has the credit or debit card information for virtually all of its customers thanks to its iTunes service, so it doesn’t have to go the extra step of asking people to sign up for a new service. That takes away one of the biggest hurdles to adoption. The last piece of the mobile-payments puzzle with the iPhone is the fingerprint recognition sensor Apple added into last year’s iPhone 5S. That sensor will almost certainly make its way to the upcoming iPhone 6. The fingerprint sensor, which Apple obtained through its acquisition of Authentic in 2012, could serve as a quick and secure way of verifying purchases, not just through online purchases, but large transactions made at big-box retailers such as Best Buy. Today, you can use the fingerprint sensor to quickly buy content from Apple’s iTunes, App and iBooks stores.

The bigger win for Apple is the services and features it could add on to a simple transaction, if it’s successful in raising the awareness of a form of payment that has been quietly lingering for years. Google had previously seen mobile payments as the optimal location for targeted advertisements and offers. It’s those services and features that ultimately matter in the end, replacing a simple credit card swipe isn’t that big of a deal.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: app, Apple, card, card swipe, cash, checkout machine, checks, chips, credit, credit card swipe, credit-card, customer, debit card, Digital wallets, fingerprint recognition, fingerprint sensor, Galaxy S5, Google Wallet, iOS, Iphone, market, merchant, mobile, mobile device, mobile payment, mobile wallet, Near Field Communication, network, Nexus 5, nfc, payment, payment service, platform, point of sale, products, sensor, services, smartphone, software, statements, swiping card, terminals, transactions, wireless technology

August 8th, 2014 by Elma Jane

Visa Inc., the global leader in payments, is helping U.S. fuel retailers prevent credit and debit card fraud at the pump with intelligent analytics that identify higher-risk transactions that may be fraudulent. Visa Transaction Advisor uses sophisticated analytics based on the breadth and scale of VisaNet data to flag the riskiest transactions by working with fuel companies to understand their needs, creating a new service that builds on Visa’s predictive analytics capabilities, providing fuel merchants with more intelligence to prevent fraud and improve their bottom line. While global fraud rates across the Visa payment system remain near historic lows, less than 6 cents for every $100 transacted – fuel pumps can be targets for criminals because they are often self-service terminals. The new solution, Visa Transaction Advisor (VTA), enables merchants to use real-time authorization risk scores to identify transactions that could involve lost, stolen or counterfeit cards. A pilot test of the new service showed a 23 percent reduction in the rate of fraudulent transactions – all without costly infrastructure upgrades or disruption of the customer experience.

How It Works

After a cardholder inserts the card at the pump, Visa analyzes multiple data sets such as past transactions, whether the account has been involved in a data compromise and nearly 500 other pieces of data to create a risk score. This allows merchants to identify those transactions with a higher risk of fraud and perform further cardholder authentication before gas is pumped. The time and costs associated with resolving fraudulent transactions can be substantial for both merchants and financial institutions and inconvenient for cardholders, which is one of the reasons why fraud prevention is critical. Visa’s solution is easy to implement, using existing message fields and formats as well as pump software or hardware to ensure minimal impact to merchants and acquirers. Several fuel merchants who piloted the technology over the last several months noticed a decrease in fraud, without negatively impacting their consumers’ experience. VTA as a tool help mitigate fraudulent transactions. A 23 percent reduction in the rate of fraudulent chargebacks during a pilot program in Los Angeles. This was done with minimal impact to the customer experience, making secure payment at the pump as convenient as possible. Providing fuel to millions of customers each month through approximately 15,000 service stations in the United States, said US Credit Card Operations Manager, from Shell, considering new solutions and technology it has to have a clear business benefit, be customer-centric and easy to implement. With no infrastructure investment, testing VTA as part of proactive fraud prevention tool-set to better identify fraudulent card activity earlier in the transaction cycle, without inconveniencing customers.

Visa Transaction Advisor is available to merchants through participating U.S. acquirers. Visa has partnered with Vantiv and is also working with other acquirers to offer the service to its fuel clients. Ease of implementation is a critical requirement whenever talking about a new merchant service. Visa Transaction Advisor builds on existing payment infrastructure, is easy to implement and flexible enough to allow customization by merchants.

Posted in Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: account, acquirers, analytics, authorization, card, cardholder, counterfeit cards, credit, Credit Card Operations, customer, data, debit, financial institutions, fraud, higher-risk transactions, Merchant's, payments, Rates, retailers, terminals, transactions, visa, Visa payment, Visa Transaction, Visa Transaction Advisor, VisaNet, VTA

June 5th, 2014 by Elma Jane

The days of salespeople peddling point of sale terminals by simply pulling hardware out of a box are numbered. That model is being replaced by integrated payments from software developers who add payment capabilities to applications that run at the point of sale, in the back office or on mobile devices.

Integrated payments are becoming common in the restaurant industry, where systems are developed to combine payment acceptance with the ability to manage orders, tables and food delivery. As integrated payments become more common, companies working in the payments industry will seek ways to offer marketing analytics. You tie that type of data to the payment mechanism and you can learn more about your business and your customers.

There is a place in the ecosystem for traditional payment acceptance, but today, when a retailer shops for a point of sale terminal or other business solutions, they expect payments to be part of the integrated bundle. Many of these systems are now delivered in a software-as-a-service model or through tablets, making them cost-effective for businesses of any size.

Integrated commerce includes mobile acceptance, offers, coupons and loyalty. It enables a merchant to buy a point of sale system for the physical store, website and mobile environment at the same time. Then the merchant can send out offers and begin running a loyalty program, while accepting NFC transactions all at once. Merchants can also review transactions from all channels directly from their offices to monitor against data breaches. With those integrated services becoming more readily available for merchants, it is not surprising that the topic comes up when executives discuss their company’s goals.

Relationships with merchants through integrated payments tend to be sticky because it is an embedded solution. You tend to get better pricing because it’s not necessarily an acquiring decision but a POS software/hardware decision and acquiring is part of that package. Payments as a service will be an important global product, selling a terminal now means selling data security, warranty and service, and numerous merchant tools.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Point of Sale Tagged with: breaches, coupons and loyalty, data, data breaches, data security, global product, integrated bundle, Integrated commerce, integrated payments, integrated services, loyalty program, marketing analytics, merchant, merchant tools, mobile, Mobile Devices, NFC transactions, payment, payment mechanism, payments industry, point of sale, POS software/hardware, Security, tablets, terminal, terminals, traditional payment, warranty and service, website and mobile environment

December 5th, 2013 by Elma Jane

Three key benefits mPOS can provide PSPs. mPOS:

1. Maintains A Continuity Of Operations

mPOS solutions also ease the process of accepting and approving payments, according to the white paper. By enabling face-to-face card present transactions, mPOS allows transactions to be conducted in a highly secure manner. Further, once the encrypted transaction data is decrypted securely by the PSP at the payment gateway (with no access granted to the merchant), the onward presentation of the data into the acquiring network is consistent with that used historically for traditional POS terminals.

2. Simplifies Merchant Support

Thales suggests the biggest benefit to PSPs is that mPOS reduces the variety of costs PSPs need to cover to support merchants, cutting expenses related to equipment, security and PCI DSS compliance. This, the white paper says, allows PSPs that utilize mPOS to better allocate resources toward handling higher transaction volumes and acquiring business.

3. Supports Both Magnetic Stripe and EMV Cards

Another benefit to PSPs is that mPOS, despite its recent entrance to the market, is already widely available. The white paper explains that since the mPOS revolution quickly migrated from the U.S. abroad, mPOS solutions now exist to serve the unique needs of both markets. While this means challenges for merchants operating globally, PSPs benefit from being able to address the needs of merchants who want to opt for any and all available market solutions.

Much has been said about the recent explosion of the mobile point-of-sale (mPOS) market and how micromerchants are driving this payments revolution. But, what this story doesn’t communicate effectively is that small merchants aren’t the only stakeholders benefiting from the ongoing mPOS migration.

Payment service providers (PSPs) are another member of the mPOS value chain that can gain flexibility and security through these solutions, new research from data protection solution provider Thales suggests.

“Both merchants and PSPs have operational and logistical issues with traditional POS terminals associated mainly with the highly controlled and certified environment in which they must be used,” Thales writes in its latest white paper on the topic, “mPOS: Secure Mobile Card Acceptance.”

The 27-page white paper provides an extensive overview of the ongoing POS revolution, explaining how mPOS can reduce friction and costs for merchants, illustrating how the technology works step-by-step and highlighting the roles that each stakeholder plays along the value chain.

Posted in Electronic Payments, Mobile Payments, Mobile Point of Sale, Payment Card Industry PCI Security, Point of Sale, Smartphone Tagged with: acceptance, acquiring network, card present, compliance, decrypted, DSS, emv cards, encrypted, face-to-face, magnetic stripe, merchant, micromerchants, migration, mobile card, mobile point of sale, MPOS, payment gateway, payment service providers, payments, PCI, POS, psps, secure, securely, Security, terminals, transactions

October 29th, 2013 by Elma Jane

In addition to my article about Credit Card Purchases give way to Tap and Go.

I would like to add an example of contactless payments which was introduced in 1997 called Speedpass.

Speedpass is a keychain RFID (Radio Frequency Identification Device) introduced in 1997 by Mobil Oil Corp. (which merged with Exxon to become ExxonMobil in 1999) for electronic payment. It was originally developed byVerifone. As of 2004, more than seven million people possess Speedpass tags, which can be used at approximately 10,000 Exxon, Mobil and Esso gas stations worldwide. Speedpass has also been previously available through a Speedpass Car Tag and Speedpass-enabled Timex watch.

Speedpass is another example of “contactless” payment system that provides members with a quick and easy way to pay for purchases at participating Exxon and Mobil stations nation-wide. Speedpass is similar to the electronic toll technology successfully used on subway, bus, and highway systems around the world.

Speedpass key tag has a built-in chip and radio frequency antenna that allows it to communicate with Speedpass readers at gasoline pumps, convenience store terminals, and car wash kiosks at Exxon and Mobil locations.

A quick wave of your Speedpass key tag in front of the reader initiates the automatic transmission of a unique identification and security code to the Speedpass payment system so your account can be located. Your payment is instantly processed using the credit/debit card that is linked to your Speedpass. If the transaction is approved, you will receive a payment confirmation and you can be quickly on your way.

You can securely access your Speedpass account and change the credit/debit card that is linked to your device. You can also specify whether or not you would like to receive a receipt for gasoline purchases made at the pump using your Speedpass. Even if you change your receipt settings to specify that you don’t want a printed receipt, you can always view your complete Speedpass transaction history and all electronic receipts online by logging into your account at any time.

Speedpass is safe and secure. Your card information, preferences, and personal details are not stored in your Speedpass device, so your information is protected from unauthorized use.

Speedpass is a cool payment method for people on the go! You can use your Speedpass to pay for gasoline, food, merchandise, and car washes at participating Exxon and Mobil locations nation-wide.

Speedpass Benefits:

Fast and Convenient

Simply wave your Speedpass key tag across the area of the gasoline pump, convenience store terminal, or car wash kiosk that says “Place Speedpass Here”.

Free

There are no fees to acquire or use Speedpass key tags.

Easy and Simple

When you use Speedpass, there is no need to sign a receipt.

Online Account Access

If you are an existing Speedpass member, you can login to speedpass.com to access your account 24/7. You can review your purchase history, access electronic receipts, update your contact information, change the credit/debit card that is linked to your device, and more! If you are an existing member, but don’t yet have a username and password, setup your online profile today by clicking on the My Account button on this site.

Safe and Secure

Your credit/debit card number and personal information are not stored in

your Speedpass device.

Posted in Electronic Payments, Mobile Point of Sale, Near Field Communication Tagged with: antenna, built-in-chip, communicate, confirmation, contactless, convenience store, credit card purchases, electronic, electronic toll, exxon, fees, keychain, kiosks, locations, logging into, merchandise, mobil oil corp, nation-wide, online, payments, radio frequency identification device, receipts, RFID, security code, speedpass, Tags, tap and go, terminals, timex, transaction, unauthorized, verifone, watch, wave