Category: Digital Wallet Privacy

February 20th, 2014 by Elma Jane

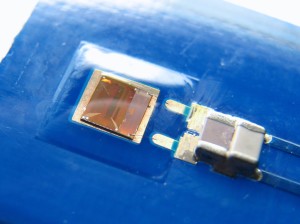

Android-iPhone-Credit-Card-Reader

Several options exist for mobile credit card processing.

Credit card processing on iPhone/ipad/Android/BlackBerry or Tablets – Using NTC’s portable credit card readers, merchants can now swipe credit cards on iPad or Android tablet devices. NTC’s Virtual Merchant solution allows users to download a secure application to interfere your smartphone with our merchant account services seamlessly. The application and credit card processing data on the carriers network or a WiFi connection to the internet.

NTC’s MagTek Bullet Swipe Credit Card Reader for Android Phones and Tablets.

Using any Android 2.2. or higher device you can process credit card transactions securely to the smartphone via Bluetooth and utilize wireless devices internet connection (WiFi or Carrier) to send the credit card processing data encrypted for processing approval.

Security anywhere. With the BulleT Secure Credit Card Reader Authenticator (SCRA), security comes with the flexibility and portability of a Bluetooth wireless interface. Small enough to fit into the palm of your hand, the BulleT enables secure wireless communications with a PC or mobile phone using the popular Bluetooth interface. Not only does the BulleT encrypt card data from the moment the card is swiped, but it also enables card authentication to immediately detect counterfeit or altered cards.

Ideal for merchant services accounts and financial institutions’’ mobile credit card processing, NTC’s BulleT offers MagnaSafe credit card processing security features with the convenience of a Bluetooth interface. This powerful combination assures credit card data protection, transaction security and convenience needed to secure mobile credit card processing with strong encryption and 2-factor authentication. The BulleT is specifically designed to leverage the existing magnetic stripe credit card reader as a secure token empowering cardholders with the freedom and confidence of knowing that their credit card transactions are secure and protected anytime, anywhere. Android Credit Card Swipe Reader for Android Phones and Tablets on your wireless mobile merchant account.

NTC’s MagTek iDynamo Credit Card processing swipe reader for iPhone and Ipad.

Credit card processing on an iPhone has never been easier. Simply attach NTC’s iDynamo card reader to your iPhone or iPad device, install our Virtual Merchant software from the App Store and you’re ready to go. Take advantage of lower credit card processing rates by processing swiped transactions instead of keying the credit card in later and get paid faster. From the company that leads with Security from the Inside MagTek has done it again with the iDynamo, a secure card reader authenticator (SCRA) designed to work with the iPhone and iPad. The iDynamo offers MagnasafeTM security and delivers open standards encryptions with simple, yet proven DUKPT key management, immediate tokenization of card data and MagnePrint card authentication to maximize data protection and prevent the use of counterfeit cards. Mobile merchants can now leverage the power of their iPhone/iPod Touch products without the worries of handling or storing sensitive card data at any time. Ideal for wireless mobile merchant accounts and mobile credit card processing, the iDynamo offers MagneSafe security features combined with the power of iPhone and iPod Touch products. This powerful combination assures convenience and cost savings, while maximizing credit card data protection and credit card transaction security from the moment the card is swiped all the way to authorization. No other credit card reader beats the protection offered by a MagnaSafe product.

Other credit card devices claim to encrypt data in the reader. NTC’s iDynamo encrypts the data inside the read head, closest to the magnetic stripe and offers additional credit card security layers with immediate tokenization of card data and MagnePrint card authentication. This layered approach to security far exceeds the protection of encryption by itself, decreases the scope of PCI compliance, and reduces fraud.

NTC’s iDynamo is rugged and affordable, so it not only withstands real world use, it performs to the high standards set by MagTek as the leader in magnetic credit card swipe reading products for nearly 40 years.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Payment Card Industry PCI Security, Smartphone Tagged with: Android, android phones and tablets, authenticator, blackberry, bluetooth, card authentication, credit card processing data, devices, encrypt card data, encrypted, internet, ipad, Iphone, magnetic stripe, magtek bullet, merchant account, merchant services accounts, Merchant's, mobile credit card processing, portable credit card readers, process credit card transactions, processing approval, secure, secure application, secure token, smartphone, swipe credit card reader, swipe credit cards, tablets, transaction security, virtual merchant, wifi, wireless devices internet connection

February 18th, 2014 by Elma Jane

Payment Tokenization Standards

Tokenization is the process of replacing a traditional card account number with a unique payment token that is restricted in how it can be used with a specific device, merchant, transaction type or channel. When using tokenization, merchants and digital wallet operators do not need to store card account numbers; instead they are able to store payment tokens that can only be used for their designated purpose. The tokenization process happens in the background in a manner that is expected to be invisible to the consumer.

EMVCo – which is collectively owned by American Express, Discover, JCB, MasterCard, UnionPay and Visa – has announced that it is expanding its scope to lead the payments industry’s work to standardize payment tokenization. EMVCo says that the new specification will help provide the payments community with a consistent, secure and interoperable environment to make digital payments when using a mobile handset, tablet, personal computer or other smart device.

Key elements of EMVCo’s work include adding new data fields to provide richer industry information about the transaction, which will improve transaction efficiency and enhance the consumer and merchant payment experience by helping to prevent fraudulent card account use. EMVCo will also create a consistent approach to identify and verify the valid use of a token during payment processing including authorization, capture, clearing and settlement.

EMVCo’s announcement follows an earlier joint announcement from MasterCard, Visa and American Express that proposed an initial framework for industry collaboration to standardize payment tokenization. EMVCo says it will now build on this framework with collective input from all of its members and the industry as a whole.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Financial Services, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, authorization, capture, card account numbers, clearing, data fields, device, digital payments, Digital Wallet, Discover, EMV, emvco, fraudulent card account, interoperable, jcb, MasterCard, merchant, mobile handset, payment, payment processing, payment token, secure, security standards, settlement, smart device, specification, standardize, tablet, token, tokenization, transaction, visa

January 30th, 2014 by Elma Jane

As many as 40 million Target customers hacked over the holidays when thieves got into their credit and debit card. If you shopped at Target between November 27 and December 15 while thieves were hacking data, you’re unlikely to lose a dime. Federal law and industry practices protect virtually all customers from any liability for fraudulent charges. So many breaches occur in the first place. Credit and debit card fraud has nearly quadrupled in the past decade, hitting $11.3 billion in losses worldwide last year. That hurts profits and raises the cost of goods. The U.S. accounts for more than its share of fraud, and hardly a month goes by when there isn’t a breach from some large U.S. retailer, in part because the U.S. lags other countries in card security.

After the Target breach, the stolen account information flooded underground markets that operate on the Internet, selling batches of data that allow thieves to counterfeit cards and shop till they drop. The best thing that could happen is if this latest megabreach forced the industry and Congress to fix some of the system’s most troubling vulnerabilities.

Cyberthieves are growing more sophisticated, and nothing can prevent every data breach. But when a company as big as Target can be hacked for 19 days to the tune of 40 million records, consumers deserve more modern and tougher protections.

Some ideas for curbing cybercrime:

Put stronger protections on debit cards. Credit cards carry the gold standard in protection against having to pay for fraudulent charges. Federal law limits losses to $50, and most issuers take that down to zero. After a data breach, debit cards are similarly protected. But if your debit card is lost or stolen, by law you could lose up to $500, and reimbursement may depend on how quickly you report the loss. There’s no sound reason for the gap. It should be eliminated.

Set federal standards to protect data. The industry, led by Visa and MasterCard, has always provided its own security standards to keep data safe. Obviously, they’re not working. Federal standards could help, especially if backed by sanctions for flouting them. The Federal Trade Commission has some authority, but the law is nearly 100 years old, and some companies have challenged the agency in court. Since the Target breach, several senators are calling for more federal authority.

Get with the 21st century. The U.S. is far behind Europe, which almost a decade ago replaced the magnetic strip on cards with a digital chip that prevents thieves from counterfeiting cards with stolen data. That’s one reason the U.S. has become a mecca for hackers. The U.S. industry is migrating to these “EMV” cards, but it has moved slowly. The players fight among themselves over everything from who pays to the type of security. Requiring cardholders to use PIN numbers would provide the best security. Whatever the decision, the industry needs to get moving to meet a self-imposed 2015 deadline.

Posted in Best Practices for Merchants, Credit Card Security, Digital Wallet Privacy, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Payment Card Industry PCI Security, Visa MasterCard American Express

December 30th, 2013 by Elma Jane

Google

With New Debit Card, Google Admits Digital Isn’t Everything

The maker of all things digital is introducing a debit card for accessing Google Wallet accounts. Google is getting physical.

A debit card alone is not a platform, or at least not a new one. In this case, it’s the payments version of comfort food: an everyday, easy-to-use technology to drive greater adoption of the less familiar Wallet platform.

This isn’t a new concept for a digital wallet. PayPal itself has a debit card. The significance for Google is more in its apparent acknowledgment that its business needs to play in the physical world. Earlier this week, the company ramped up its Google Shopping Express service with a partnership with Costco, further expanding its presence in the buying and selling of physical goods. Its self-driving cars are another way the company is reaching beyond digital, though never losing sight of the digital-derived lesson that the real business opportunity is in platforms, not just products.

The MasterCard-branded card is swipe-able at stores, and it can be used to withdraw cash at ATMs, Google said. The company pitched its new plastic in a blog post today as a way to pay for things offline without waiting for the money in your Google Wallet to transfer to a bank account.

This should sound familiar to users of PayPal or any other digital wallet, where the lag time between receiving money and being able to spend it makes such services marginal in the brick-and-mortar world, where most consumer dollars get spent.

That it took Google this long to make such a card available shows just how hard it is for the company to re-imagine itself as expanding beyond digital. For years, Google has supported NFC tap-to-pay technology that lets users of the few phones with such chips use their handsets to pay by Wallet at the few merchants with point-of-sale systems that support NFC. With the release of a debit card, Google seems to be acknowledging that battle is lost for now. In a world Google is trying to remake in its digital-first image, plastic still prevails.

Posted in Digital Wallet Privacy, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: brick and mortar, costco, debit card, digital, handsets, MasterCard, nfc, payments, PayPal, phones, plastic, platform, point of sale, Tap to Pay, wallet

December 20th, 2013 by Elma Jane

Third-party Cookies vs. Consumer Privacy

Some interesting tools that consumers and businesses should be aware of. As consumers, we will likely see more opportunities to opt out of online activities that collect data about our behaviors. We could also see more tools that allow consumers to provide more accurate information.

The Drive to Personalize

Most every ecommerce merchant uses data to personalize shoppers’ experiences. Some common personalization tactics are:

Present upsell and cross-sell offers.

Online merchants use first-party information from their own databases and cookies to track shopping behaviors. They also purchase third-party databases that help predict behavior and products that will appeal to a specific target shopper. Similar methods have been used with offline direct marketing for years. Online tools like third-party cookies…i.e. cookies left by a domain other than the one a user is visiting…and deep data mining have made the practice easier.

Retarget shoppers who have visited a store but did not make a purchase; Segment and personalize merchandising offers in your online store. Target emails at selected consumers who are more likely to buy a certain product;

When used properly with ad networks and ecommerce personalization and recommendation engines, third-party databases increase conversion rates and average order values. They also increase customer loyalty by providing a better customer experience.

Data Collection

Most of the data is now collected with third-party cookies or other means that consumers have opted into, even if they did not necessarily think of it that way. Every time you agree to a license agreement, for example, it’s likely that you are agreeing to share your data in aggregate and anonymously with third parties. Most companies put that in their agreements to protect themselves in the future, regardless of whether they collect the data now.

If third-party cookies are eventually eliminated, there will likely be some type of replacement system that will provide similar functionality. In fact, there’s already a scarier method of tracking consumer behaviors…using digital fingerprinting techniques that profile your computer.

This technique is virtually impossible to block as other devices can see things like your operating system, browser type, your fonts, screen size and depth, time zone, cookie settings, browser plugins, and http header information. The good news is that the use of fingerprinting is relatively small. But, some observers believe this will be a future alternative to third-party cookies.

Tools for Consumers

Axciom, one of the larger data providers, is now offering a tool at AboutTheData.com that allows consumers to see information that Axciom has collected about them and actually correct it if they choose. The bad news is that you have to provide Axciom with even more information than it already has to view the information it has on file. However, you can also choose to opt out of its databases.

You will need to create a login and answer a series of questions to verify your identity. Once that is done, you can review your data, which is broken into several categories.

You may be surprised by the amount of information Axciom maintains. Realize that this is just one of many databases that have information about you that is used in online and offline applications.

Posted in Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments Tagged with: anonymously, average, browser, cookies, customer, data, data mining, databases, digital, domain, ecommerce, fingerprinting, identity, license agreement, loyalty, offline, online, operating system, opted, order, privacy, purchase, Rates, shoppers, values

November 19th, 2013 by Elma Jane

ISIS Electronic Wallet

Available Nationwide Isis Mobile Wallet

Latest version of the Isis Mobile Wallet has been announced. This is now available to consumers for download in the Google Play app store and at thousands of AT&T, T-Mobile and Verizon Wireless retail stores nationwide. Isis Mobile Wallet allows customers to pay at contactless payment terminals, and to save money through special offers and loyalty cards at participating merchants – all from their Isis Ready smartphone.

Today’s Isis Mobile Wallet nationwide launch is a milestone for consumers, merchants and banks. It’s the start of a smarter way to pay.

Together with Isis partners, a seamless mobile commerce experience have been built. Isis pleased to bring the magic and simplicity of the Isis Mobile Wallet to consumers across the U.S.

The redesigned Isis Mobile Wallet features a simplified user interface with a clean, white background and easy-to-navigate toolbars. Starting today, customers with one of the more than 40 Isis Ready smartphones available from AT&T, T-Mobile or Verizon Wireless can receive a free enhanced SIM card from their wireless carrier and download the Isis Mobile Wallet for free from Google Play. Integration with American Express Serve makes it convenient for Isis Mobile Wallet users to load funds to their American Express Serve Account from a U.S. debit or credit card, bank account, or through direct deposit, as well as pay bills online and send money to friends and family using an American Express Serve Account.

Posted in Digital Wallet Privacy, Electronic Payments, Mobile Payments, Near Field Communication, Smartphone, Visa MasterCard American Express Tagged with: American Express, AT&T, banks, bills, carrier, contactless, debit or credit, google, interface, ISIS, loyalty cards, Merchant's, mobile wallet, online, payment terminal, play app, smartphone, T-Mobile, Verizon, wireless

October 31st, 2013 by Elma Jane

While credit card processors and retailers have made strides to combat credit card fraud, it is still rampant across the U.S. In fact, credit card fraud jumped 17 percent between January, 2011, and September, 2012, according to the most recent data from the FICO Falcon Fraud Manager Consortium.

Debit cards obviously have better safeguard measures in place, since debit card fraud rose less than 1 percent between January, 2011, and September, 2012. Plus, the average fraud loss per compromised account fell by 3 percent.

Card-not-present (CNP) fraud is the biggest challenge by far, accounting for 47 percent of all credit card fraud. CNP fraud – which includes payments via the internet, mail and phone – grew 25 percent over the two-year period. So, where the problems with credit cards lie.

Unfortunately, CNP fraud may get worse before it gets better, in FICO’s Banking Analytics Blog. This problem may even intensify as the US moves away from magnetic stripe and toward EMV [chip] card technology. In other countries adopting chip-based authentication technology, we’ve seen counterfeit fraud decline, but as a counterbalance, fraudsters often ramp up efforts around CNP fraud.

However, there was a glimmer of light in the credit card fraud fiasco. While card fraud attempts rose, the average loss per compromised account dropped 10 percent. Plus, the ratio of fraud to non-fraud spending remained constant. “In other words, the volume of card fraud increased proportionally to the volume of consumer credit card spending.

Even though many retailers have implemented successful fraud prevention programs, Visa provides retailers with the warning signs for CNP fraud, including:

Multiple cards used from a single IP address. Orders made up of “big ticket” items. Orders that include several of the same item. Shipping to an international address. Transactions with similar account numbers.

Posted in Digital Wallet Privacy, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Payment Card Industry PCI Security Tagged with: account, analytics, authentication, banking, big ticket, card-not-present, chip card, chip-based, cnp, counterfeit, credit-card, debit cards, EMV, fraud, fraudsters, international, internet, magnetic stripe, mail, non-fraud, orders, payments, phone, prevent, processors, retailers, safeguard, spending, transactions, visa

October 24th, 2013 by Elma Jane

Reflecting recent research that concludes mobile payment adoption remains low, Total System Services Inc. (TSYS) issued results from a survey that confirm consumers prefer banking applications other than payments for their mobile devices.

While reinforcing the dominance of debit and credit cards as payment mechanisms, the TSYS 2013 Consumer Payment Choice Study revealed that mobile devices are used as a tool for ancillary financial services, such as checking account balances and accessing discounts and rewards.

“For now, the hype largely remains hope for mobile from a payments standpoint,” the survey said. “On a relative basis, consumers would overwhelmingly prefer to have the ability to use their smartphone to monitor transaction activity or prevent fraud versus using their mobile phone as a form factor in a transaction.”

Columbus, Georgia-based processor TSYS found in its third annual survey that, out of 1,000 consumers surveyed online in the summer of 2013, 40 percent of respondents were interested in using mobile devices to instantly stop illegitimate transactions. Additionally, 37 percent indicated that the ability to view in real-time the transactions made with debit and credit cards was also an important feature.

Receiving instant offers and promotions from stores being visited (33 percent); temporarily blocking and unblocking purchases using certain bankcards (29 percent); and paying for purchases using reward/loyalty points (28 percent) rounded out the top payment-related uses for smartphones.

At the bottom of the scale was to pay for purchases with mobile wallets (25 percent) and to use credit or debit card-funded prepaid accounts for the same purpose (22 percent). “Industry observers regard mobile payments as an assumed eventuality,” TSYS stated. “Our survey results indicate that consumers are presently more interested in increased non-payment functionality on their mobile device.”

But the processor remains optimistic about the promise of mobile payments. “We believe that as the infrastructure matures and the ability to use mobile payments becomes more widespread, this trend will change,” TSYS said.

Prepaid undermarketed?

In addressing the role of prepaid cards in the payment mix, TSYS expressed surprise that prepaid cards are apparently not being marketed aggressively by financial institutions. The processor noted that major banks jumped into the prepaid card industry in 2012 to offer general-purpose reloadable (GPR) prepaid cards as checking account alternatives.

But TSYS found that just over 10 percent of survey respondents indicated they had received GPR card offers from their banks. TSYS attributed that low percentage to the fact that the survey respondents were by default credit and debit card users, while GPR cards are primarily targeted to individuals without access to credit or debit cards.

Regardless, survey respondents aged 35 and younger accounted for 64 percent of those who had received such offers. “It could be that the younger demographic on average represents a less profitable checking relationship for banks, or that banks perceive them to be more receptive to the offering,” TSYS said.

Steady goes debit and credit

Consumer payment preferences in 2013 remain relatively unchanged from previous years, according to TSYS. Debit still trumps credit as the preferred payment instrument overall, with both methods being favored by every eight of 10 survey respondents. Debit is still the clear winner when it comes to supermarket shopping and gas purchasing, while credit is preferred when dining out and shopping in department stores. But when it comes to fast food cravings, cash is still king.

On the opposite end of the spectrum, and also consistent with TSYS’ 2012 report, only 11 percent of respondents said being able to set up text message alerts for account balances and transactions was most valuable, and a mere 6 percent valued the ability to register payment cards in mobile wallets.

However, credit tops debit for online purchases, TSYS said. Further of note is that PayPal Inc.’s digital wallet service rivals debit online, with both payment methods favored by roughly one-fifth of respondents. But for small-dollar purchases, like coffee and donuts, cash remains the preferred payment vehicle, despite innovative mobile schemes offered by companies like Starbucks and Dunkin’ Donuts.

Posted in Credit card Processing, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Gift & Loyalty Card Processing, Internet Payment Gateway, Mail Order Telephone Order, Merchant Services Account, Mobile Payments, Smartphone Tagged with: account, adoption, applications, banking, checking, consumers, credit cards, debit, devices, discounts, financial services, form factor, general-purpose, gpr, infrastructure, low percentage, mechanisms, mobile, mobile wallets, non-payment, offers, online, payment, payment related, phone, prepaid, processor, profitable, promotions, real-time, reloadable, reward/loyalty, rewards, smartphone, transaction, tsys

October 1st, 2013 by Elma Jane

PayPal announces updated app, device for hands-free, in store payment.

A busy few days at PayPal. Late last week, the global payments giant announced a major update to its app for Android and iOS. The new features have a strong mobile payments bent. And now, the company has announced the planned roll-out of “Beacon,” which uses Bluetooth Low Energy Technology to let customers check into retail stores and pay by verbal consent.

Paypal’s President calls the solution PayPal’s “most significant contribution to date in reinventing the in-store shopping experience.”

Beacon is a new add-on technology that merchants plug into an A/C outlet. When a PayPal customer walks into a participating store and agrees to check-in, Beacon triggers a quick vibration or sound to confirm a check-in; customer’s photo then appears on a point-of-sale screen. To pay, the customer simply gives a verbal confirmation. “No wallet and no card. Nothing to do. Not even touching your phone.

BLE was chosen to resolve some problems posed by traditional geo-location, including power consumption. It will look for any store running a PayPal compatible POS system, and will only transmit information to PayPal or to the merchant if the customer agrees to check in.

The solution aims to improve on the credit-card-swiping experience. PayPal figured the only better way to pay would be to do nothing.

The company will be piloting Beacon in the fourth quarter.

New App

PayPal’s vastly redesigned app for creating a more seamless in-store shopping experience is getting a lot of kudos across the web.

A New tab called “Shop” the first thing that appears when the app is opened, it displays nearby stores or restaurants that accept PayPal payments. Users can check in and open a tab, then select various payment methods from the check-in screen. Upon payment, the app generates a confirmation alert and sends an email receipt.

You’ve really got access to your entire wallet in the app.

The app also lets you order food ahead of your arrival bypassing the line. The feature works through PayPal’s partnership with Eat24 . Dinners can pay at the table, and at some locations, order more drinks.

For the first time, the app includes a Bill Me Later tab that lets users apply to finance PayPal purchases, and it integrates coupons and offers.

The company wanted the new app to help solve problem, and that payment isn’t something they typically complain about. So they focused on other potentially problematic experiences in the retail environment, waiting in line, waiting to pay the bill at their table and keeping track of coupons.

Posted in Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Mobile Payments, Near Field Communication, Point of Sale, Smartphone Tagged with: Android, app, Apple, card, credit-card-swiping, geo-location, iOS, payment, PayPal, POS, retail, system, wallet

September 30th, 2013 by Elma Jane

Facebook this week began testing a new feature dubbed “Autofill with Facebook” that aims to simplify mobile purchases by filling in customers’ credit card information for them, thus eliminating the need to type it in each time. This “Autofill with Facebook gives people the option to use their payment information already stored on Facebook to populate the payment form when they make a purchase in a mobile app,” Facebook spokesperson told the E-Commerce Times. “The app then processes and completes the payment.” The feature “is designed to make it easier and faster for people to make a purchase in a mobile app by simply pre-populating your payment information.”During the test period, which began Monday evening, the feature will show up only to Facebook users who have already provided credit card information to the social network — in other words, those who have made in-game purchases or bought gifts for friends.

Facebook has partnered with PayPal, Braintree and Stripe as financial partners on the service, which is initially available only on the e-commerce iOS apps JackThreads and Mosaic.

Ironing Out the Wrinkles Autofill with Facebook isn’t a move to compete with PayPal and credit card companies, but to complement payment services by adding a layer for convenience, much the way Facebook, Google and Amazon have created a single login that works across a network of websites.

“Facebook is not interested in being a payments company,” an analyst, told the E-Commerce Times. “Instead, it is aiming to be the entity that irons out bumps in the payment process — something it is well-positioned to do. “With Autofill, Facebook will act as the lubricant that makes the commerce experience more seamless, providing a number of benefits to all stakeholders.”

Partners in the deal ensure that Facebook will succeed in Autofill with Facebook, it doesn’t care about payments, it cares about reaping the benefits that come from making the payment experience better.”

‘The Potential to Be Lucrative’ There could be significant financial benefits as well. “This approach has the potential to be lucrative for Facebook in that it will help plug the mobile conversion gap,” McKee suggested. “If Facebook can prove to its partner merchants that an ad on its site led to a purchase, the validity of its platform can easily be proven. Ideally, this will help convince other companies to advertise with Facebook as well.”

Taking it a step farther, Facebook will also gain transaction data, which McKee believes has considerable value. “Facebook can leverage transaction data with what it already knows about us for precision ad targeting. This will increase the relevance and placement of ads on Facebook.”

The Security Factor While many mobile customers will appreciate the Autofill function, security issues still lurk in the back of every consumer’s mind. Yet while privacy concerns have been an ongoing issue for Facebook, it has a good track record where security is concerned. “Facebook has been relatively incident-free when it comes to security breaches.” “However, this is more a problem of consumer perception. Will consumers feel comfortable storing their payment credentials with a social media platform?

“Facebook is already approaching ‘big brother’ status, and this takes it one step further.” “To succeed, Facebook must provide visibility into what it plans to do with transaction data.”

‘It’s a No-Brainer’ The convenience factor, meanwhile, could be a compelling one for consumers. “It’s no-brainer useful to mobile users…who wants to enter their credit card on a mobile phone more than once?” “It could be more secure than mobile payment alternatives.” If Facebook gets past its hurdles, it will also succeed in building strengths in areas where it has been lacking to date.

“Right now Facebook isn’t super strong at the conversion side of e-commerce.” “Autofill will give them a lot of data about purchases, which might help them remedy that.”

‘Strategic Smarts and Ambition’ As for those benefits to Facebook, there are potentially many. One example,”Autofill admits them to the online payments world.”

“This is another example of the strategic smarts and ambition of Zuck.” “One gets the sense that he wants to be a major competitor for everything online.”

Posted in Credit card Processing, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Mobile Payments Tagged with: Amazon, commerce, credit card, e-commerce, Facebook, google, media, mobile, mobile phone, network, payment, payment information, payment services, PayPal, platform, processes, secure, social, transaction