July 26th, 2017 by Elma Jane

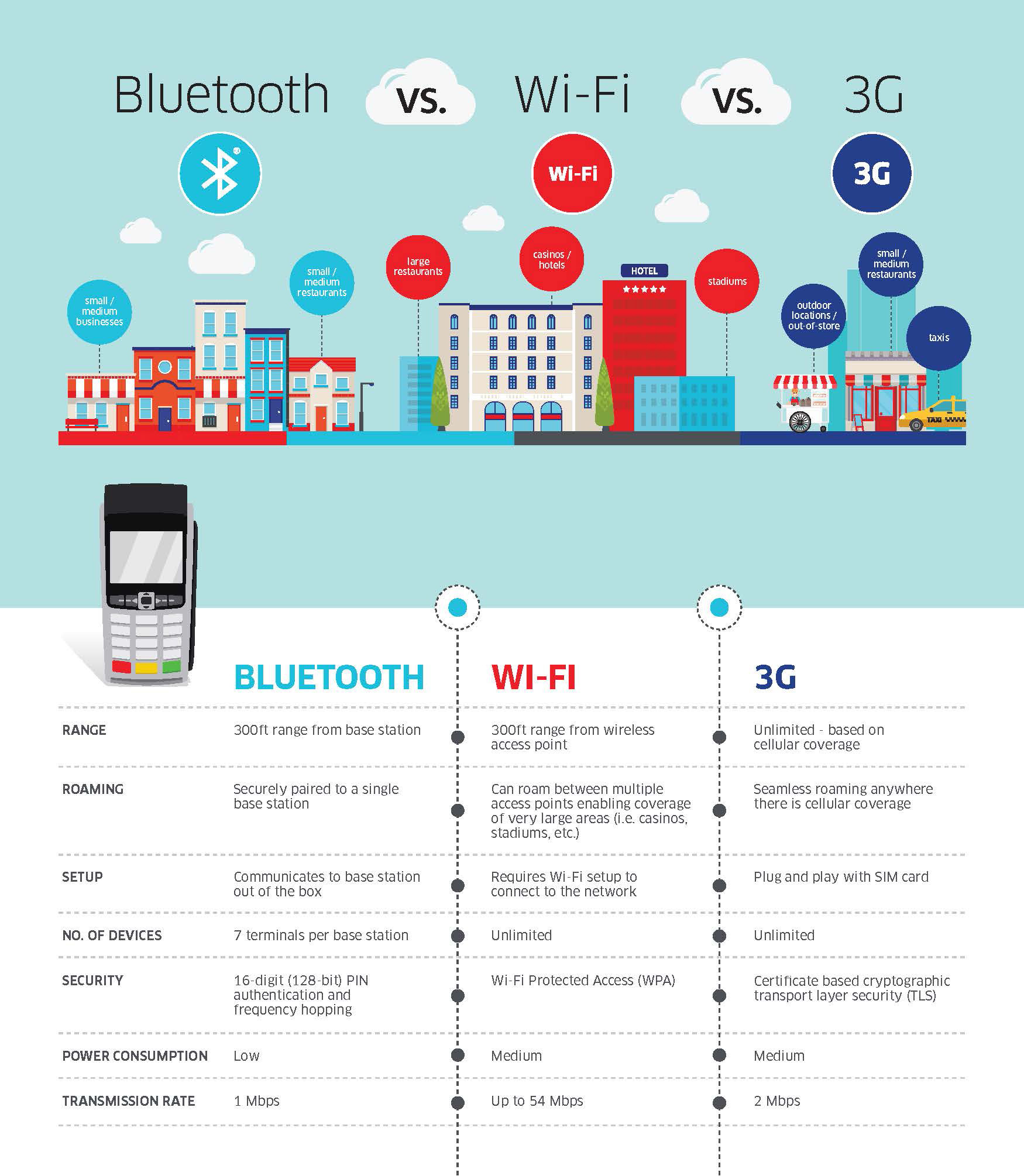

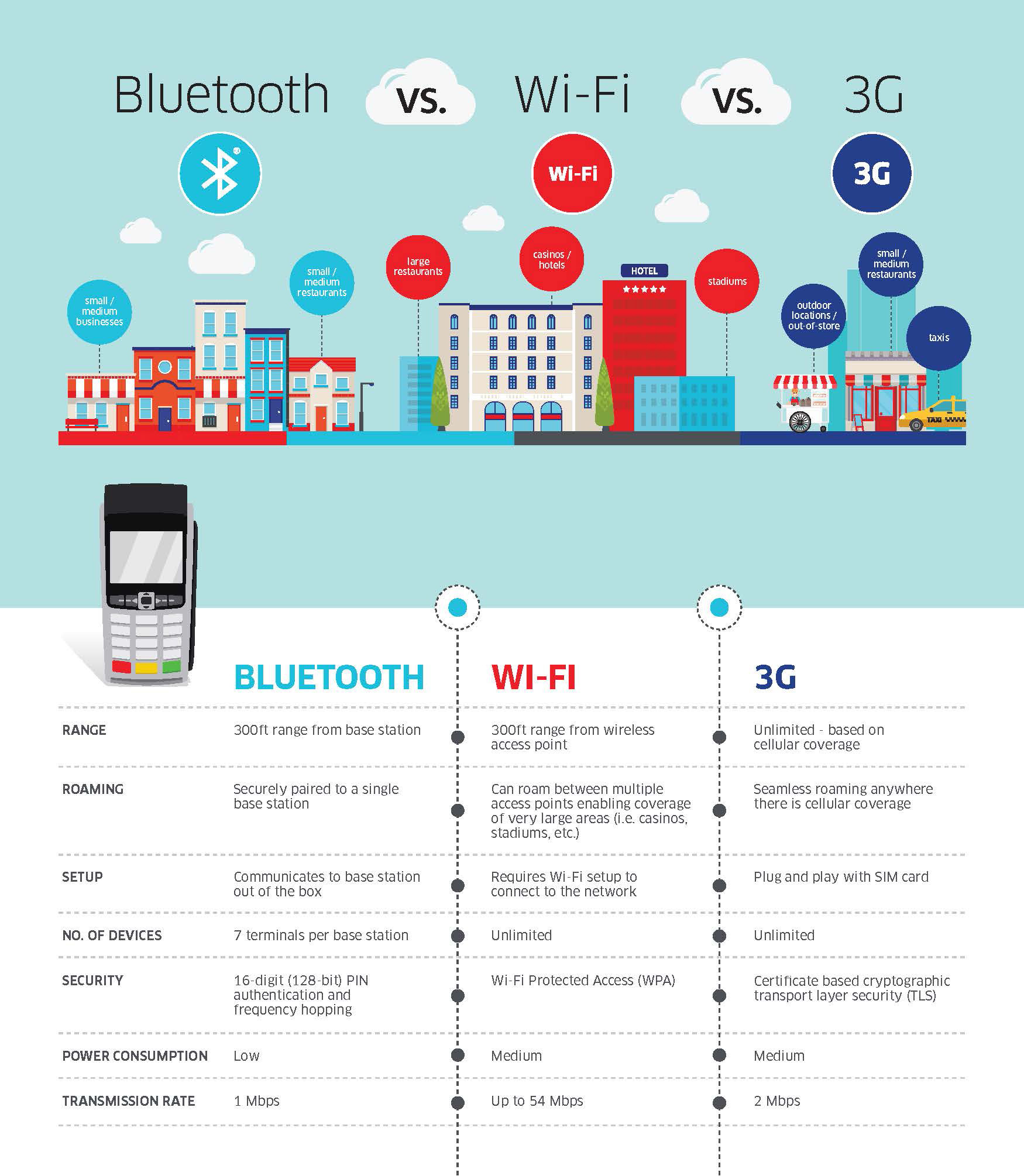

Check out the wide range of smart wireless terminal connectivity options and know the difference.

Bluetooth Wireless: Designed for reliable Bluetooth connectivity even in the most demanding environments.

Rage – 300ft from base station

Roaming – paired to single base station

Setup – Communicates to base station out of the box

No. Of Devices – 7 Terminals per base station

Security – 16-Digit (128-Bit) PIN authentication and frequency hopping

Accept EMV Chip & PIN, magstripe and NFC/Contactless

WiFi: Designed for reliable WiFi connectivity, Wireless mobility for the point of sale.

Rage – 300ft from base station

Roaming – can roam between multiple access points enabling coverage of very large areas.

Setup – Requires WiFi Setup to connect to the network

No. Of Devices – Unlimited

Security – WiFi Protected Access (WPA)

Accept EMV Chip & PIN, magstripe and NFC/Contactless

3G Wireless: Bring compact, reliable 3G Wireless Technology and mobility to the point of sale.

Rage – unlimited – based on cellular coverage

Roaming – Seamless roaming anywhere there is cellular coverage

Setup – Plug and play with SIM card

No. Of Devices – Unlimited

Security – Certificate based cryptographic transport layer security

Accept EMV Chip & PIN, magstripe and NFC/Contactless

Wireless terminals provide merchants with a number of benefits including:

Mobility – enable merchants to better serve the customer and bring the transaction right to the point of service.

Printed Receipt – give your servers the capability to print a receipt for the customer even when away from the POS.

Variety of Payment Options – provide the ability to accept magstripe, EMV, and NFC payments including the latest mobile wallets.

For Electronic Payment Set Up Call Now 888-996-2273

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: bluetooth, chip, Contacless, EMV, magstripe, nfc, PIN, Security

September 11th, 2014 by Elma Jane

Online retailers are finding the bricks-and-clicks strategy to be an effective way to serve and engage shoppers. Perhaps that is why an increasing number of ecommerce merchants are setting up shop offline. It’s important to note, however, that a bricks-and-clicks business isn’t just about having a physical store and an ecommerce site. For this model to be effective, each channel must complement and add value to the other.

Guidelines to execute a bricks-and-clicks strategy:

Allow Access to Online Account Information in Physical Store

Bridge the gap between bricks and clicks by giving your customers and physical-store staff access to online account information. Doing so can enhance shopping experiences and drive sales.

Integrate Online and Offline Inventory, Fulfillment

Offer click-and-collect services that allow shoppers to buy merchandise online and pick it up at a local retail branch or service station. Many consumers would rather forgo the shipping costs and wait time and instead pick up their items at a time and place that’s convenient for them. Also, use your brick-and-mortar inventory when an item is out of stock online.

Use Online Data for Offline Selling, and Vice Versa

Data pertaining to online sales and traffic won’t just help you optimize your ecommerce site. It can also apply to offline decisions. For instance, if you see an increase in sales for a particular product on your website, you should consider promoting it offline, as well, to your brick-and-mortar shoppers.

Also pay attention to social media data such as Facebook likes and Pinterest pins. What’s trending on social sites can help with merchandising and marketing. Consider something similar in your brick-and-mortar business. Take note of the most liked, viewed, and pinned items online and then leverage that information when making decisions regarding product displays, inventory and more.

You can also use offline information to enhance your ecommerce site. Utilize in-store analytics tools, such as people counters and sensors, to better understand how your offline customers behave and then compare that with online behavioral data to spot patterns and opportunities.

Qualitative information, such as shoppers’ common questions and concerns, can also be used to improve your online shop. For instance, if your physical store associates keep getting the same questions about a particular product, there’s a good chance that online shoppers have similar queries. So you may want to include the answer in that item’s product description page.

Use Smartphone Beacons in Physical Stores

Beacons are Bluetooth-enabled devices that let brick-and-mortar merchants send customized offers and recommendations to their shoppers via their smartphones based on where the shoppers are in the store. For example, if a shopper is in the footwear department, the retailer can use its store beacons to send the shopper a coupon for shoes. Bricks-and-clicks businesses can also use the technology to send tailored offers to shoppers based on their online behavior.

Posted in Best Practices for Merchants Tagged with: account, Beacons, bluetooth, brick and mortar, business, consumers, coupon, customers, data, devices, ecommerce, Facebook, inventory, marketing, merchandising, Merchant's, Online Account Information, Online Data, pinterest, product, sales, shoppers, site, smartphone, social sites, store, website

August 8th, 2014 by Elma Jane

Apple talking to Visa about mobile payments

Apple is in talks with Visa as it ponders launching a mobile wallet this autumn. The latest bout of rumours suggest that the ability to make instore payments could finally arrive with the iPhone 6, although the information’s sources offer contradictory takes on the technology, with one saying that the system is likely to be NFC-based and another suggesting that it will rely on Bluetooth and WiFi. The report suggests that Apple will not be going down the host card emulation route, instead making use of the Secure Element, although the famously proprietorial tech titan has no intention of giving up any control to wireless carriers. Apple hopes that working with Visa will also help it bypass the payment processing chain, helping it to lower costs for merchants and customers.

Posted in EMV EuroPay MasterCard Visa, Mobile Payments, Smartphone, Visa MasterCard American Express Tagged with: Apple, bluetooth, customers, host card emulation, instore payments, iPhone 6, Merchant's, mobile wallet, nfc, payment processing, secure element, visa, wifi, wireless carriers

May 21st, 2014 by Elma Jane

Mobile credit card processing is way cheaper than traditional point-of-sale (POS) systems. Accepting credit cards using mobile devices is stressful, not to mention a hassle to set up and customers would never dare compromise security by saving or swiping their credit cards on a mobile device. Some of the many myths surrounding mobile payments, which allow merchants to process credit card payments using smartphones and tablets. Merchants process payments using a physical credit card reader attached to a mobile device or by scanning previously stored credit card information from a mobile app, as is the case with mobile wallets. Benefits include convenience, a streamlined POS system and access to a breadth of business opportunities based on collected consumer data. Nevertheless, mobile payments as a whole remains a hotly debated topic among retailers, customers and industry experts alike.

Although mobile payment adoption has been slow, consumers are steadily shifting their preferences as an increasing number of merchants implement mobile payment technologies (made easier and more accessible by major mobile payment players such as Square and PayPal). To stay competitive, it’s more important than ever for small businesses to stay current and understand where mobile payment technology is heading.

If you’re considering adopting mobile payments or are simply curious about the technology, here are mobile payment myths that you may have heard, but are completely untrue.

All rates are conveniently the same. Thanks to the marketing of big players like Square and PayPal – which are not actually credit card processors, but aggregators rates can vary widely and significantly. For instance, consider that the average debit rate is 1.35 percent. Square’s is 2.75 percent and PayPal Here’s is 2.7 percent, so customers will have to pay an additional 1.41 percent and 1.35 percent, respectively, using these two services. Some cards also get charged well over 4 percent, such as foreign rewards cards. These companies profit & mobile customers lose. Always read the fine print.

Credit card information is stored on my mobile device after a transaction. Good mobile developers do not store any critical information on the device. That information should only be transferred through an encrypted, secure handshake between the application and the processor. No information should be stored or left hanging around following the transaction.

I already have a POS system – the hassle isn’t worth it. Mobile payments offer more flexibility to reach the customer than ever before. No longer are sales people tied to a cash register and counters to finish the sale. That flexibility can mean the difference between revenue and a lost sale. Mobile payments also have the latest technology to track sales, log revenue, fight chargebacks, and analyze performance quickly and easily.

If we build it, they will come. Many wallet providers believe that if you simply build a new mobile payment method into the phones, consumers will adopt it as their new wallet. This includes proponents of NFC technology, QR codes, Bluetooth and other technologies, but given very few merchants have the POS systems to accept these new types of technologies, consumers have not adopted. Currently, only 6.6 percent of merchants can accept NFC, and even less for QR codes or BLE technology, hence the extremely slow adoption rate. Simply put, the new solutions are NOT convenient, and do not replace consumers’ existing wallets, not even close.

It raises the risk of fraud. Fraud’s always a concern. However, since data isn’t stored on the device for Square and others, the data is stored on their servers, the risk is lessened. For example, there’s no need for you to fear one of your employees walking out with your tablet and downloading all of your customers’ info from the tablet. There’s also no heightened fraud risk for data loss if a tablet or mobile device is ever sold.

Mobile processing apps are error-free. Data corruption glitches do happen on wireless mobile devices. A merchant using mobile credit card processing apps needs to be more diligent to review their mobile processing transactions. Mobile technology is fantastic when it works.

Mobile wallets are about to happen. They aren’t about to happen, especially in developed markets like the U.S. It took 60 years to put in the banking infrastructure we have today and it will take years for mobile wallets to achieve critical mass here.

Setup is difficult and complicated. Setting up usually just involves downloading the vendor’s app and following the necessary steps to get the hardware and software up and running. The beauty of modern payment solutions is that like most mobile apps, they are built to be user-friendly and intuitive so merchants would have little trouble setting them up. Most mobile payment providers offer customer support as well, so you can always give them a call in the unlikely event that you have trouble setting up the system.

The biggest business opportunity in the mobile payments space is in developed markets. While most investments and activity in the Mobile Point of Sale space take place today in developed markets (North America and Western Europe), the largest opportunity is actually in emerging markets where most merchants are informal and by definition can’t get a merchant account to accept card payments. Credit and debit card penetration is higher in developed markets, but informal merchants account for the majority of payments volume in emerging markets and all those transactions are conducted in cash today.

Wireless devices are unreliable. Reliability is very often brought up as I think many businesses are wary of fully wireless setups. I think this is partly justified, but very easily mitigated, for example with a separate Wi-Fi network solely for point of sale and payments. With the right device, network equipment, software and card processor, reliability shouldn’t be an issue.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: (POS) systems, aggregators rates, apps, BLE technology, bluetooth, card, card processor, card reader, cash, cash register, chargebacks, consumer data, credit, credit card payments, credit card processing, credit card processors, credit card reader, credit-card, customer support, data, data loss, debit card, debit rate, device, fraud, fraud risk, hardware, industry experts, merchant account, Merchant's, mobile, mobile app, mobile credit card processing, Mobile Devices, Mobile Payments, mobile point of sale, Mobile processing apps, mobile processing transactions, mobile technology, mobile wallets, network, network equipment, nfc, nfc technology, payment solutions, payment technology, PayPal, phones, point of sale, qr codes, retailers, rewards cards, Security, Smartphones, software, Square, tablet, tablets, vendor's app, wallet providers, Wi-Fi network, wireless mobile, wireless mobile devices

May 6th, 2014 by Elma Jane

Mobile commerce platform provider ROAM, an Ingenico company has expanded its mPOS solutions to include chip-and-PIN acceptance with the RP750x mobile card reader. The reader allows mPOS players to get to market quickly with their own custom-branded solution, providing merchants with a powerful set of features that include device and fraud management, remote application configuration, and an mPOS application that can be localized for any language and currency in any country. Features include: Backlit display, EMV PIN pad, magnetic stripe reader, NFC reader and smart card reader. Configurable through the cloud, enabling direct shipment from factory to any country. Connects with smartphones, tablets and feature phones via Bluetooth or audio jack. Customizable for branding and form factor. Just Slightly larger than a credit card, a compact form factor. PCI PTS 3.1 with SRED, EMV Level 1 and 2, Visa-ready (Compliant with the latest industry standards).

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Financial Services, Mobile Payments, Mobile Point of Sale, Near Field Communication, Payment Card Industry PCI Security, Point of Sale, Smartphone, smartSD Cards, Visa MasterCard American Express Tagged with: bluetooth, Chip and PIN, cloud, compliant, credit-card, currency, EMV, fraud, magnetic stripe reader, Merchant's, mobile card reader, Mobile commerce platform, mPOS solutions, nfc, PIN pad, smart card reader, Smartphones, tablets, visa

February 20th, 2014 by Elma Jane

Android-iPhone-Credit-Card-Reader

Several options exist for mobile credit card processing.

Credit card processing on iPhone/ipad/Android/BlackBerry or Tablets – Using NTC’s portable credit card readers, merchants can now swipe credit cards on iPad or Android tablet devices. NTC’s Virtual Merchant solution allows users to download a secure application to interfere your smartphone with our merchant account services seamlessly. The application and credit card processing data on the carriers network or a WiFi connection to the internet.

NTC’s MagTek Bullet Swipe Credit Card Reader for Android Phones and Tablets.

Using any Android 2.2. or higher device you can process credit card transactions securely to the smartphone via Bluetooth and utilize wireless devices internet connection (WiFi or Carrier) to send the credit card processing data encrypted for processing approval.

Security anywhere. With the BulleT Secure Credit Card Reader Authenticator (SCRA), security comes with the flexibility and portability of a Bluetooth wireless interface. Small enough to fit into the palm of your hand, the BulleT enables secure wireless communications with a PC or mobile phone using the popular Bluetooth interface. Not only does the BulleT encrypt card data from the moment the card is swiped, but it also enables card authentication to immediately detect counterfeit or altered cards.

Ideal for merchant services accounts and financial institutions’’ mobile credit card processing, NTC’s BulleT offers MagnaSafe credit card processing security features with the convenience of a Bluetooth interface. This powerful combination assures credit card data protection, transaction security and convenience needed to secure mobile credit card processing with strong encryption and 2-factor authentication. The BulleT is specifically designed to leverage the existing magnetic stripe credit card reader as a secure token empowering cardholders with the freedom and confidence of knowing that their credit card transactions are secure and protected anytime, anywhere. Android Credit Card Swipe Reader for Android Phones and Tablets on your wireless mobile merchant account.

NTC’s MagTek iDynamo Credit Card processing swipe reader for iPhone and Ipad.

Credit card processing on an iPhone has never been easier. Simply attach NTC’s iDynamo card reader to your iPhone or iPad device, install our Virtual Merchant software from the App Store and you’re ready to go. Take advantage of lower credit card processing rates by processing swiped transactions instead of keying the credit card in later and get paid faster. From the company that leads with Security from the Inside MagTek has done it again with the iDynamo, a secure card reader authenticator (SCRA) designed to work with the iPhone and iPad. The iDynamo offers MagnasafeTM security and delivers open standards encryptions with simple, yet proven DUKPT key management, immediate tokenization of card data and MagnePrint card authentication to maximize data protection and prevent the use of counterfeit cards. Mobile merchants can now leverage the power of their iPhone/iPod Touch products without the worries of handling or storing sensitive card data at any time. Ideal for wireless mobile merchant accounts and mobile credit card processing, the iDynamo offers MagneSafe security features combined with the power of iPhone and iPod Touch products. This powerful combination assures convenience and cost savings, while maximizing credit card data protection and credit card transaction security from the moment the card is swiped all the way to authorization. No other credit card reader beats the protection offered by a MagnaSafe product.

Other credit card devices claim to encrypt data in the reader. NTC’s iDynamo encrypts the data inside the read head, closest to the magnetic stripe and offers additional credit card security layers with immediate tokenization of card data and MagnePrint card authentication. This layered approach to security far exceeds the protection of encryption by itself, decreases the scope of PCI compliance, and reduces fraud.

NTC’s iDynamo is rugged and affordable, so it not only withstands real world use, it performs to the high standards set by MagTek as the leader in magnetic credit card swipe reading products for nearly 40 years.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Payment Card Industry PCI Security, Smartphone Tagged with: Android, android phones and tablets, authenticator, blackberry, bluetooth, card authentication, credit card processing data, devices, encrypt card data, encrypted, internet, ipad, Iphone, magnetic stripe, magtek bullet, merchant account, merchant services accounts, Merchant's, mobile credit card processing, portable credit card readers, process credit card transactions, processing approval, secure, secure application, secure token, smartphone, swipe credit card reader, swipe credit cards, tablets, transaction security, virtual merchant, wifi, wireless devices internet connection

October 21st, 2013 by Elma Jane

UL’s (Underwriter Laboratories) latest contribution to the future of payments has been accomplished through its three years of work with National Security, a French biometrics company that has created a commercially viable biometric technology solution for the point of sale.

The move positions UL and National Security at the forefront of an industry that is expected to expand by 140 percent to reach $12 billion in revenue over the next five years, potentially transforming online, mobile and in-store commerce by increasing the speed of transactions in the process.

Still, arguments can be made that biometric use at the point of sale will remain limited. Why does UL believe the market is right for biometrics, and how did it successfully ensure biometric payments will be ready for all parts of the payment process?

Why The Time Is Now For Biometrics

Consumer concerns regarding identity theft and violence are on the rise, and the solution according to many is a viable biometrics payment solution. Reports show that there is already strong demand in the U.S. and Asian markets for such products, and major research outlets have put their support behind the technology.

UL’s case study elaborates on the benefits illustrating how biometric data has been developed to be harder for hackers to infiltrate and compliant with EMV security standards.

Developing The Technology

UL’s work to ensure biometrics will remove friction at the POS has been extensive. For example, its latest case study profiles how UL developed the underlying technology to overcome challenges and work in harmony with wireless technologies such as bluetooth and Wi-Fi. Further, it explains how UL assessed the human health impact of National Security’s biometric solutions.

Posted in Credit card Processing, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: biometric, bluetooth, commerce, data, developing, EMV, future, hackers, identity theft, impact, in-store, mobile, online, payment process, payments, point of sale, POS, process, security standards, solution, speed, transactions, viable, Wi-Fi, wireless

October 3rd, 2013 by Elma Jane

National Transaction Gift Card Programs

Features & Benefits

Why National Transaction Gift Card? A gift card program offers you a great opportunity to boost sales by increasing customer loyalty and enhancing your business brand. Gift cards are used like credit cards and can be loaded with any dollar amount. NTC offers customized gift card processing merchant services tailored to your gift card processing needs. It’s secured and easy to manage.

Benefits to Consider:

Brand Building and Loyalty Gift cards can be a great source of advertising for your business. Gift cards are re-loadable; customers often reload them and continue to use them.

Cash Flow Enhancement Prepaid gift cards are purchased prior to customers receiving their goods and services from you. You can re-invest these dollars back into your business. Earn money; research shows that customers tend to spend more than the value of the gift card.

Easy to Manage Merchant gift cards are easy for your customers to use and easy for your employees to issue and redeem, as they work similar to credit cards.

Eliminate or Remove Cashback Don’t have to use the full balance of the card – the balance remains on the card. It can be issued for returned merchandise, thereby reducing fraud. Gift cards can only be activated by swiping through a POS terminal.

Get and Bring New Customers Using gift cards as presents (e.g. Showers, Mother’s Day, Birthdays, Graduation and Christmas) is more popular than ever before. Offering a gift card program can help bring new customers to your business, thereby increasing sales.

Increasing Brand Awareness Gift cards customized with your business name or logo are an effective way to advertise your business and leave a lasting impression with customers.

Electronic gift card vs paper certificates? An electronic gift card solution provides a number of benefits over certificates, such as:

Minimize Fraud – card are difficult to duplicate while paper certificates can be photocopies or duplicated. Save Money – cards can be reloaded. Paper certificates can only be used once. Save Time and Maximize Efficiency – gift cards can be loaded and redeemed easily, and provide electronic reporting. Paper certificates require manual work.

NTC Gift Card Operations How does a Gift Card work? Cards are activated through your NTC merchant account with a dollar value requested by your customer and not dependent on things like proprietary equipment. Once the card is activated, it’s ready to use as payment at your location.

Are my Gift Cards reloadable? Yes, and may be reloaded as many times as you wish. You may consider offering an incentive to thank your customers for their loyalty. Incentives can range from providing a free product or service from your store.

What NTC Merchant Services terminals do I need to process NTC Gift Cards?

Your NTC Gift Card will function on any Standalone, Wireless and Bluetooth terminals.

Card Ordering/Design

What is the standard gift card size? Most gift cards are the exact same size as a credit card:

What options do I have to advertise my business name on my cards?

To help promote and advertise your business brand on your cards, you can choose one of these options:

Basic – Include your company’s name, address and phone number on a pre-selected style. Standard – You can choose from an attractive selection of pre-designed card styles. Add a single color logo or customized text in your choice of font style and color.

Custom Cards – Custom cards designed by you or with our help, invest with style.

How long does it take for me to be set-up and receive my gift cards?

Your application and set-up on NTC systems will take approximately 5 – 7 business days. Non-peak times (outside Christmas) – 2 weeks Peak times – 4 to 6 weeks

How many cards I can order? Quantities of 50 for Basic, 100, 1,000 for Standard.

Posted in Best Practices for Merchants, Electronic Payments, Gift & Loyalty Card Processing, Merchant Services Account Tagged with: advertising, bluetooth, certificates, credit cards, earn, electronic, function, gift, gift Card, loyalty, merchant account, ntc, payment, POS, Processing, re-loadable, reload, reporting, secured, standalone, Swiping, terminal, terminals, value, wireless

In discussions about merchant service providers, Square and PayPal entering talks is a given. Sqaure offers free credit card readers to entice merchants to switch their credit card processing to them. PayPal recently launched an initiative to expand it’s reach into retail stores and offers to waive processing fees through 2013. With the coming rush to mobile transaction processing more companies are entering the fray. AT&T, Verizon, T-mobile and Sprint are looking to get into the credit card transaction processing gig as they already carry that data over their cellular networks. ISIS Wallet and Google’s digital wallet bring credit card transactions to Android smartphones and tablets, and Visa is expected to launch its Visa Ready program as it rolls out test merchants. Read more of this article »

Posted in Mobile Payments Tagged with: Android, bluetooth, Chip & PIN, credit card processing, Digital Wallet, EMV, fees, google, ISIS, m-commerce, merchant, merchant account, nfc, payment processor, PayPal, Rates, Square, transactions, Visa MasterCard American Express

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Posted in Mobile Payments Tagged with: bluetooth, Chip and PIN, EMV, gift Card, Mobile Payments, MPOS, nfc, PayPal, QR Code Payments, retailers, smartphone, Square, tablet, Tap to Pay

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.