Category: Travel Agency Agents

October 14th, 2016 by Elma Jane

Merchant Account is a LOAN!

Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for processors or payment providers; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Posted in Best Practices for Merchants, Financial Services, Travel Agency Agents Tagged with: bank, credit, credit card, customer, loan, merchant, merchant account, payment, payment providers, processors

September 30th, 2016 by Elma Jane

The Process of Underwriting!

Some of the key things that are reviewed in setting up electronic payments.

Getting a merchant account, is an important step for any businesses that sells services.

Merchants need to understand the following process:

Billing policy – Businesses that bill too far in advance are at greater risk for a chargeback. Knowing how does the business bill is important.

Example: A travel agency who sold travel destination packages six months in advance and cancel the trip.

Business type – Businesses at a higher risk are industries with vague products or services; which are more highly to be examined in detail than those with concrete offerings.

Chargeback history – A business with a lot of chargebacks tied to their old merchant account will have a hard time with underwriting. A chargeback can be issued by the cardholder; if the merchant does not fulfill the product or services being rendered as agreed.

Owner/signer credit score – Credit score plays a big role during merchant account underwriting. However, some processors will review financial statements instead in the case of poor credit. if the original signer’s credit score is insufficient, businesses with multiple partners can also try the application with a different signer.

Requested volumes – This are weighed against the processing volumes requested on the application. New businesses usually start with smaller volumes to build a trustworthy relationship before increasing their processing volumes.

Years in business – Long terms in business go a long way in merchant account underwriting; it speaks for their legitimacy and they are more prepared to respond to something like a chargeback and often have a more stable cash flow.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: cardholder, chargeback, credit, electronic payments, merchant account, processors, travel agency

September 23rd, 2016 by Elma Jane

What is ARC, IATA, and CLIA? what’s the difference? What it does and what type of agents would benefit most from it.

CLIA Number – is a way for vendors to identify you as a travel agent. It is issued by the Cruise Lines International Association; without the ARC accreditation, CLIA agencies cannot issue airline tickets since CLIA numbers were designed specifically for cruise-focused travel agencies.

You don’t need to get your own CLIA number if you’re working with a host agency. You can always go under their umbrella organization and use their identification number therefore, it won’t incur the costs associated with obtaining your own CLIA number.

If you are not issuing airline tickets, CLIA is a practical option because it is NOT accepted by the airlines, but nearly accepted everywhere.

CLIA vs. ARC/IATA Number – If you’re ticketing air-only reservation, ARC and IATA are must-haves.

ARC (Airlines Reporting Corporation) – gives out these ARC numbers to accredited agencies, which allows travel agencies to issue airline tickets.

The use of an ARC number extends from either a hotel to a cruise ship booking not only air tickets for travel agencies.

For a home-based travel agent or a storefront agency that only books leisure travel (no air), having your own ARC number seems too much.

IATA – International Air Transport Association Network use extensive data resource to connect the suppliers to the U.S. travel distribution network.

IATA ID card holders get promotional benefits. A concessionary incentives from suppliers (participating members) who identify the agent with an IATA/IATAN number as a valid associate; in addition to approving travel agents for the sale of travel tickets.

IATA certifies either a referral agent or an affiliate travel agent to find clients for the hosting travel agency’s business needs as well.

Give us a call 888-996-2273 and and process your travel agency payments for less!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card holders, payments, travel, travel agencies, travel agent

September 6th, 2016 by Elma Jane

ASTA Global Convention (AGC) in Reno!

We Look forward seeing you at Booth # 92. Please stop by and say hello! September 25-28.

We offer ASTA Travel Agents opportunity to get paid. 100% next day while you can be your own host agency with No Reserve.

Our expertise is Travel, and we have been in this industry for over 13 years. There is No sign up fee or cancellation fee. TRAMS Sabre Solution integration or any back office GDS system.

We can perform a free statement analysis in addition, to see if we can help reduce your current fees and charges. We will also Meet or Beat other processor’s rates and fees!

If you would like to Make an appointment with us during the ASTA EVENT, please contact or email Elaine Zamora at 888-996-2273 Extension 1111 elaine@nationaltransction.com

Please feel free to visit our website: www.nationaltransaction.com www.ziebest.com/national/ www.turnaroundstripdown.com

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: travel, travel agents

August 29th, 2016 by Elma Jane

ASTA Global Convention in Reno! We Look forward seeing you at Booth # 92. Please stop by and say hello! September 25-28.

We offer ASTA Travel Agents opportunity to get paid. 100% next day while you can be your own host agency with No Reserve.

Our expertise is Travel, and we have been in this industry for over 13 years. There is No sign up fee or cancellation fee. TRAMS Sabre Solution integration or any back office GDS system.

We can perform a free statement analysis in addition, to see if we can help reduce your current fees and charges. We will also Meet or Beat other processor’s rates and fees!

If you would like to Make an appointment with us during the ASTA EVENT, please contact or email Elaine Zamora at 888-996-2273 Extension 1111 elaine@nationaltransction.com

Please feel free to visit our website: www.nationaltransaction.com www.ziebest.com/national/

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: travel, travel agents

August 9th, 2016 by Elma Jane

Businesses are discouraged from storing credit card data, but many feel the practice is necessary in order to facilitate recurring payments. Merchants that need to store credit card data are doing it for recurring billing.

Using a third party vault provider is the best way to store credit card data for recurring billing, it helps reduce or eliminate the need for electronically stored cardholder data while still maintaining current business processes. The risk of storing card data is removed from your possession and you are given back a token that can be used for the purpose of recurring billing, by utilizing a vault. Modern payment gateways allow card tokenization.

Any business that storing data via hard copy needs to review and follow PCI DSS requirement in order for the electronic storage of cardholder data to be PCI compliant. Appropriate encryption must be applied to the PAN (primary account number). In this situation, the numbers in the electronic file should be encrypted either at the column level, file level or disk level.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security, Travel Agency Agents Tagged with: cardholder, credit card, data, merchants, payment gateways, payments, PCI, provider, tokenization

August 3rd, 2016 by Elma Jane

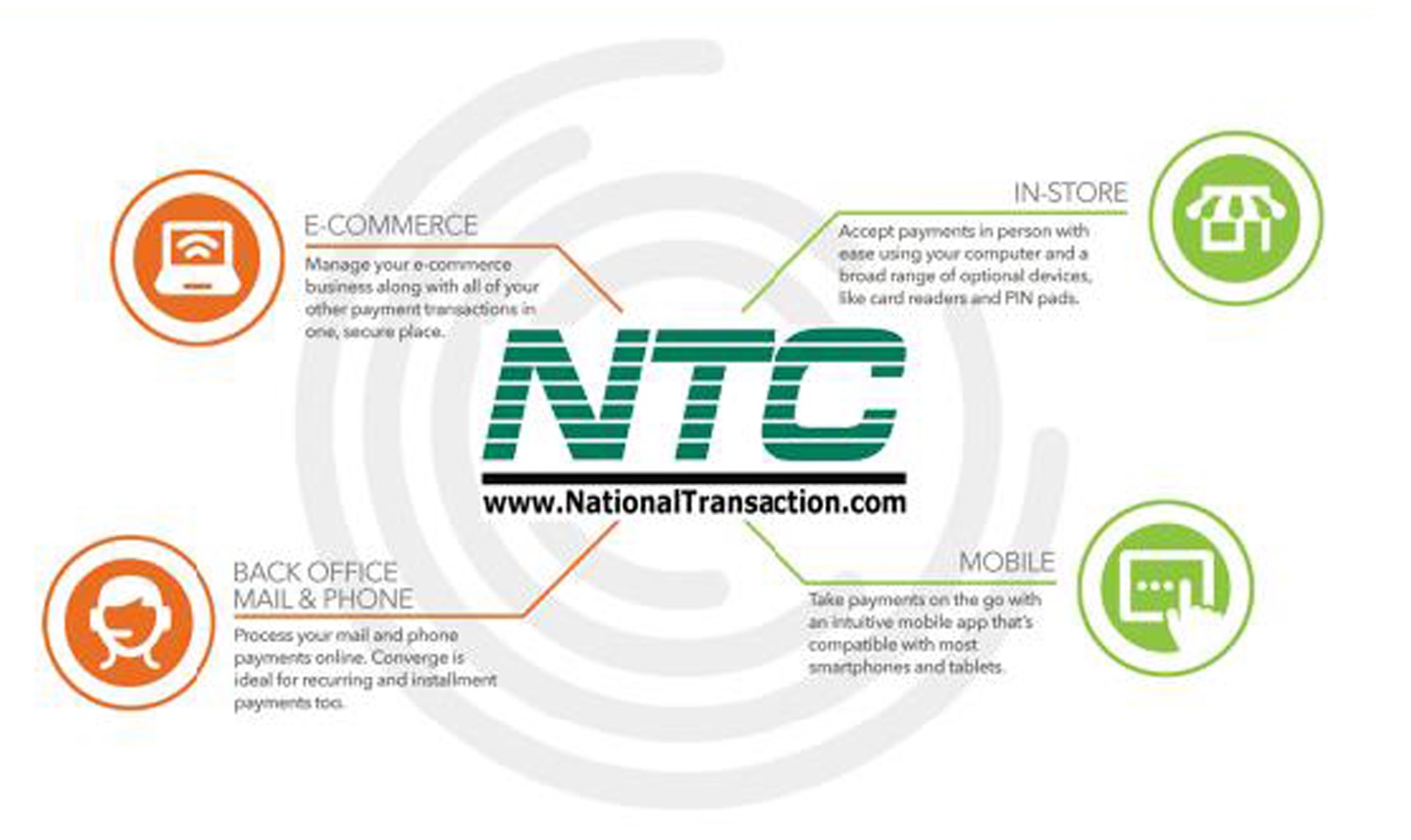

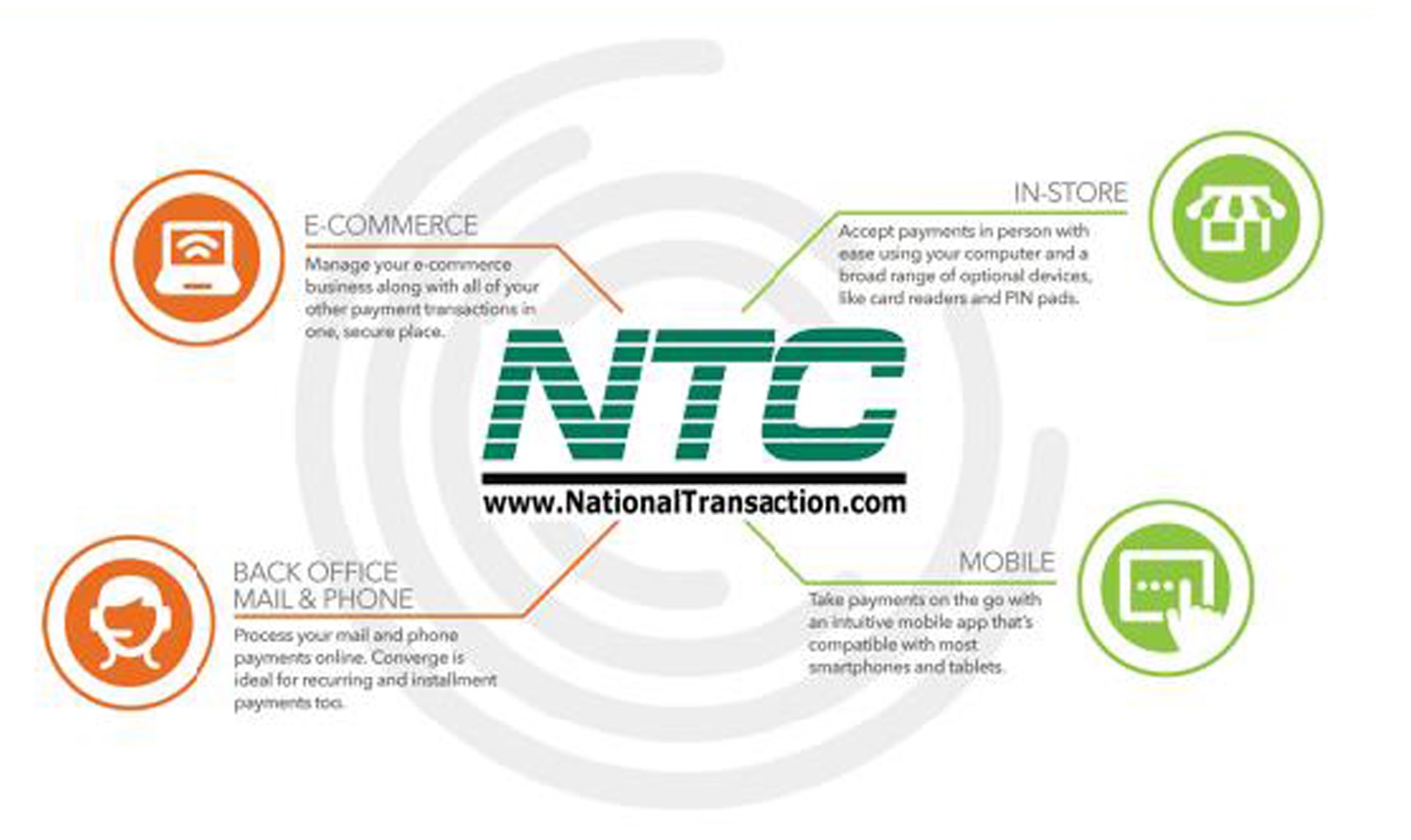

National Transaction offer valuable features and benefits. If you want to improve your business’s productivity, you should look for this features that you need from your merchant account provider.

Advanced Security Options – did you know that 6 out of 10 small businesses close within six months of a card data breach? Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. With National Transaction we have Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. Top-tier security is important on all your business’s data especially customer information, consider adding additional authentication procedures. Merchant account providers bundle various security features to make the process of becoming secure.

Fast Payment Processing – having up-to-date technology is the first step because some customers might become annoyed by slow service and leave. The sooner you have the money processed by your merchant account provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – Look for a merchant provider that appropriately addresses your payment concerns. Obtaining the features you need from your merchant services provider is very important.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. The app works with most Apple and Android mobile devices. You can accept key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad. Merchants who aren’t mobile payment capable do demonstrate unwillingness to progress with payment technology and might lose customers eventually.

Reliable Customer Support – NTC is available 24/7 answering the phone by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is perhaps the most important feature of any business partnership you make. You don’t want to choose the wrong provider.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a merchant service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Small Business Improvement, Travel Agency Agents Tagged with: account, Breach, card data, chip card, customer, EMV, encryption, merchant, mobile, payment, point of sale, provider, Security, tokenization, transactions

August 1st, 2016 by Elma Jane

ASTA/NACTA Florida Summit & FAM Trip with Richard Delos Santos, NTC Specialist; and Robert Duglin, Vice President of Business Development at ASTA (American Society of Travel Agents) and NACTA: The National Association of Career Travel Agents

National Transaction the Payments Expert for Travel Agency! For more information give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: payments, travel agency, travel agents

July 14th, 2016 by Elma Jane

PCI Compliance applies to every merchant who is accepting credit cards large or small. Refusing or delaying to become PCI Compliant can end up being a costly mistake.

If you accept any credit or debit card payment, you need to be PCI Compliant no matter the volume is.

PCI applies to any company, organization or merchant of any size or transaction volume that accepts, stores or transmits cardholder data. Any merchant accepting payments directly from the customer via credit or debit card must be PCI Compliant.

The merchant themselves are responsible for becoming PCI Compliant, as the deadline for merchants to become Compliant is long overdue

Understanding and knowing the details of PCI Compliance can help you better prepare your business. Failing and waiting to become compliant or ignoring them, could end up being an expensive mistake.

The VISA regulations have to adhere to the PCI standard forms part of the operating regulations, the regulations signed when you open an account at the bank. The rules under which merchants are allowed to operate merchant accounts.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: cardholder, credit cards, customer, data, debit card, merchant, payment, PCI Compliance, transaction

July 13th, 2016 by Elma Jane

Monthly statement fee is a fixed fee that is charged monthly and is associated with the statement that is sent to a merchant in one billing cycle, approximately 30 days worth of credit card processing by the merchant account provider; whether it’s a printed one, a mailed statement or an electronic version. Requesting online statements won’t necessarily be able to waive statement fee.

Every credit card and merchant account provider have a different set of costs associated with its services, but remember that there are several processors out there that are very transparent with their fees like National Transaction.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, fee, merchant, merchant account, processors, provider, services