November 18th, 2016 by Elma Jane

Tokenization and Encryption are completely different technologies when it comes to securing sensitive data, such as credit cards.

Encryption tools and techniques is to mask original data, then allow it to be decrypted. It uses an algorithm to scramble credit card information that makes the data unreadable to anyone.

Encryption is most often “end-to-end.”

Example: When someone enters card data into a web browser to buy an item and decrypted when the purchaser’s authorized credit card information reaches its intended destination, which is the merchant’s e-commerce database.

Encrypted card data is unreadable while it’s “at rest” in a database or “in motion” during a purchase transaction; and inaccessible until a key decrypts it. The chances of a hacker stealing the data is minimal. But, if card data passes through multiple internal systems en route to an acquiring bank or payment gateway, the encrypt/decrypt/re-encrypt process could open a wide security hole, thus creating vulnerabilities to hackers.

Tokenization have found to be cheaper, easier to use and more secure than end-to-end encryption.

Tokenization completely removes credit card data from internal networks and replaces it with a generated, unique “token”. Tokens have no meaning and are worthless to criminals if a company’s system is breached.

Merchants use only the token to retrieve, access, or maintain their customers’ credit card information.

Example: Actual credit card number was 3234 4567 8789 78910, it might become FHIW145BVE65478 when a token is generated. The token is randomly generated and there is no algorithm to regain the original card number. hackers can’t reverse-engineer the actual credit card number, even if they were to grab the tokens off the servers.

Using tokens doesn’t change a merchant’s payment processing experience. Only they’re much safer for a merchant than actual credit cards.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: card, credit cards, customers, data, encryption, gateway, merchants, payment, Security, token, tokenization, transaction

November 17th, 2016 by Elma Jane

Payment Card Industry

What is PCI DSS (Payment Card Industry Data Security Standards)? A set of requirements, founded by Amex, Discover, JCB, MasterCard and Visa; to facilitate industry-wide adoption of consistent data security measures on a global basis. Best practices for enhancing payment account data security.

Why does my business need to be PCI Compliant? You help protect your business

by reducing the risk of a costly breach of your customers’ payment card data. Payment card brands (Amex, Discover, JCB, MasterCard and Visa) mandate that all businesses processing payment cards must be compliant.

Once my business validates PCI-DSS compliance, does that prevent a security breach from happening? No. It helps prevent security breaches and loss of cardholder data but do not provide a guarantee to your business. Also, similar to the regularly required updates to anti-virus and firewall software; data security is also continually subject to new threats.

What happens to my business if I am not PCI Compliant? If you do not comply with the security requirements contained within PCI-DSS as mandated by the payment card networks; you put your organization at risk of a payment card compromise.

In the event that your business is compromised, you may also be subject to additional fines, fees, and assessments by the card brands. You may also lose your credit card acceptance privileges.

What am I required to do to validate PCI compliance? The minimum requirement for PCI Level 4 business is to complete a PCI-DSS Self-Assessment Questionnaire (SAQ) on an annual basis and achieve a passing status.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security Tagged with: card, credit card, customers, data, payment, PCI, Security

November 15th, 2016 by Elma Jane

SMART TERMINAL

Another all-in-one mobile (IP countertop and Wi-Fi capable) terminal that gives customers the functionality they want and need.

Sleek modern device that delivers an incredible customer experience, and is a great option for retailers, coffee shops, and pop-up shops.

Includes two touch screens: a larger one for easy visibility of orders and other information, as well as a cardholder facing one that can be used for payments and tipping. It also offers a dashboard function, so your customers can monitor their transactions and other reports remotely. On top of that, it comes with the powerful security of Safe-T built in.

For your EMV/NFC terminal needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Reader Terminal Tagged with: cardholder, customers, EMV/NFC, mobile, payments, Security, terminal, transactions

October 20th, 2016 by Elma Jane

Ways consumer can use NFC!

Near field communication technology (NFC) is on the rise, and as a result consumers can use NFC not just for making payments.

Top ways consumers can use NFC (Near field communications):

NFC Access Keys – can also be used as your access to certain buildings or hotels.

NFC Boarding Pass – are used in airports to expedite the boarding process. No more keeping track of that printed boarding pass!

File Sharing – on certain Android phones, consumers can also share songs, contacts and files from phone to phone with a simple tap.

Retail – Paying in stores simply requires a wave of the customer’s smartphone. This provides speedier transactions, but also provides merchants the opportunity to offer their customers loyalty points and rewards.

NFC Ticketing – speeds up subway boarding time by allowing consumers to use their phones also at the reader.

Vending Machines – NFC-enabled vending machines will allow customers to simply tap and go.

With the growing list of NFC technology uses, merchants should be prepared for the adoption. Upgrade your terminal to be NFC-enabled give us a call at 888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: customers, merchants, nfc, payments, terminal, transactions

October 7th, 2016 by Elma Jane

NEXT DAY FUNDING

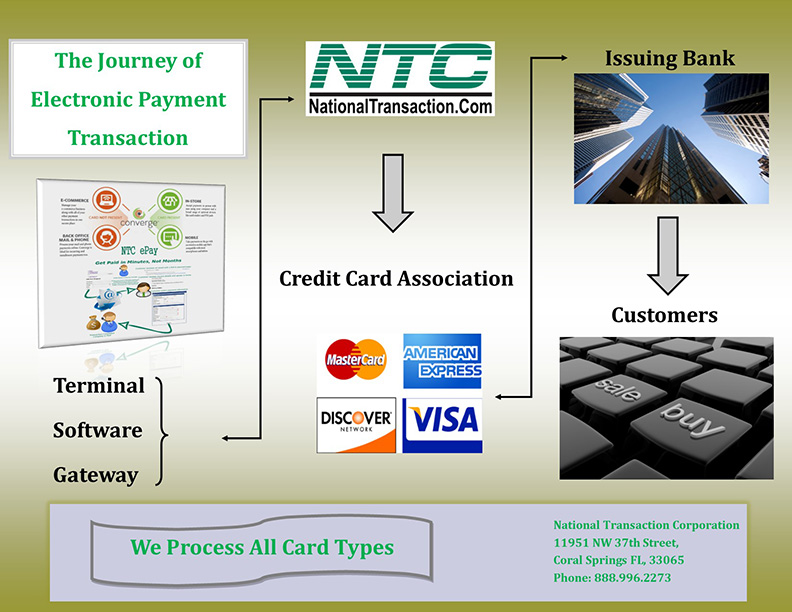

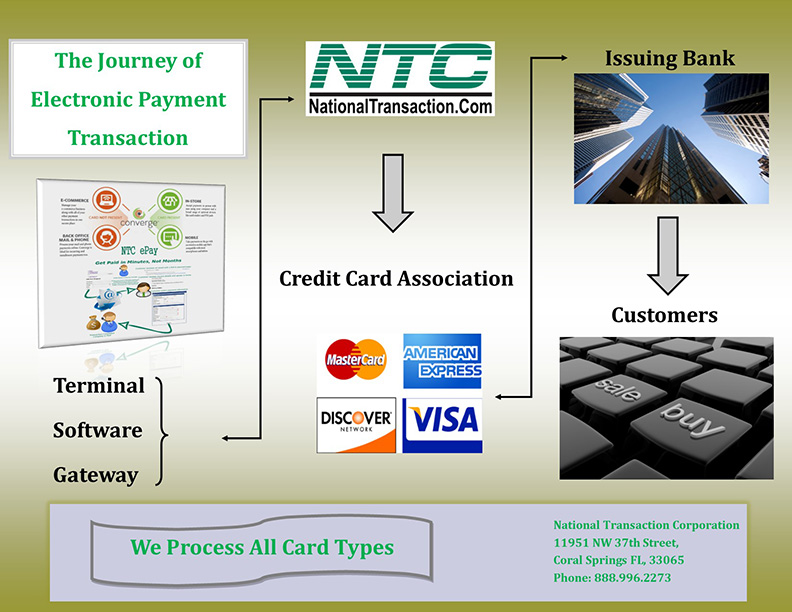

To be responsive to the needs of our merchants and to meet that needs, NTC offers next day funding in addition to the value added service for customers and businesses that need to have their funds available quickly.

National Transaction also offers a variety of electronic payment services and technology for businesses; with more than 15 years of experience.

Our services include:

- Currency Conversion

- Credit and debit card processing

- E-commerce and gateways

- Electronic checks

- Gift and loyalty card programs

- Mobile processing

- Cash advances and loans/funding program

- NTC e-Pay and MediPaid

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay!

Free Setup, nothing to Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. In addition, our e-Pay Platform can help Travel Merchants bring new customers while encouraging repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. Another payment platform that flexes with your business.

NTC Business Loans – Fast yet Affordable and most of all Simple Application Process.

MediPaid – another medical health insurance claims payment. Delivering paperless and next-day deposits for Health Insurance Payments.

Furthermore, NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants consequently providing 24/7 customer service and technical support!

To know more about our product and services call us now! 888-996-2273

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Internet Payment Gateway, Medical Healthcare, Mobile Payments Tagged with: credit, Currency Conversion, customers, debit card, e-commerce, E-Pay, electronic checks, electronic payment, funds, gateways, loans, Loyalty Card, merchants, payment services

September 12th, 2016 by Elma Jane

Ingenico RP457c card reader is now available at NTC for $75.00 plus encryption and shipping!

NTC are pleased to announced the launch of Converge Mobile 1.3, which includes support for the new Ingenico RP457c.

An all-in-one card reader that accepts:

- Mag stripe

- chip card

- contactless payments including mobile wallets

Customers can utilize audio jack to connect the device to their either smartphone, tablet or connect via Bluetooth.

In addition to the converge Mobile portfolio, Ingenico RP457c is a lower price point for customers who are cost sensitive. It offers the same payment flexibility as the iCMP.

Both RP457c’s and iCMP devices also offer encryption technology, adding another layer of security to help protect card data at the point of entry and throughout the payment lifecycle.

One key difference is that iCMP is a PIN pad that supports chip & PIN as well as debit PIN transactions, while the PR457c is a card reader only; therefore chip and signature and signature debit are supported on this device.

For your electronic payment needs or to purchase the device give us a call now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card data, card reader, Chip & PIN, chip and signature, contactless payments, customers, mobile wallets, payment, PIN pad, Security, signature debit, smartphone, transactions

July 26th, 2016 by Elma Jane

Mobile payment space is growing yet, many small businesses and retailers are choosing to overlook the idea of mobile payment acceptance.

Here are stats that prove the importance of mobile payments:

About 45% of consumers use mobile payments out of convenience.

1 billion users will use in-store mobile payments by 2019.

An increase from $3.2 billion in 2014 to $487 billion by 2020 in US in-store mobile payments is predicted.

Millenials use contactless payments on a regular basis.

Over the next five years, mobile payments will reach about $3 trillion in volume.

There are 16 million Starbucks mobile app active users that make 8 million mobile payments per week.

Transactions globally are on mobile devices.

It is a great investment for a merchant to upgrade your point-of-sale (POS) to have near field communication (NFC) capabilities. If you’re not currently accepting mobile payments, you should start now, your customers who are already using mobile payments will thank you and your business will be ahead of the game as more businesses onboard mobile payment acceptance.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, Mobile Payments, Near Field Communication, Point of Sale Tagged with: contactless payments, customers, merchant, mobile payment, Near Field Communication, nfc, point of sale, POS, transactions

June 28th, 2016 by Elma Jane

Financial Cost – on average, it costs a small business between $36,0000 and $50,000 in the event of a data breach. From PCI examination to liability costs and POS upgrades. The many costs of a data breach add up.

Notification Cost – if your business falls victim to a data breach, it is your moral and sometimes legal (depending on the state in which your business operates) obligation to notify your customers of the breach.

Reputation Cost – data breach lessens your credibility and trust with your customers. This can have a long-term affect on your business.

Time Cost – as a small business owner, your focus is on the daily operations of your business. In the event of a data breach, your focus will be shifted entirely to clearing up the issue.

The cost of a data breach is more than financial and can often have a lasting negative impact on your business.

The quickest and easiest way to protect your business is to prevent fraud from happening. At National Transaction, we give importance to your security. For your electronic payments needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: customers, data breach, electronic payments, financial, fraud, PCI, POS, Security

June 21st, 2016 by Elma Jane

The Ingenico iPP320 PIN pad (Item Code: 320CV) is officially launched for Converge, making this the third EMV and NFC-enabled device available to our merchants. The iPP320 accepts mag stripe, chip cards, manual card entry and contactless payments, including Apple Pay.

Don’t Forget!

- Customers can hand-key card information into all of the new Converge PIN pads to encrypt payment information at the point of entry, including card-not-present payment environments. Encryption is a standard feature with all new PIN pads.

- In the February release, gratuity support was launched on devices, which means the consumer will be prompted to add a tip to the payment amount using the PIN pad, versus the business entering an amount into Converge.

For terminal upgrade give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: card-not-present, chip cards, contactless payments, customers, EMV, merchants, nfc, payment

June 14th, 2016 by Elma Jane

Getting a merchant account is an important step for any business that sells services. Helping merchant to understand the underwriting process and some of the key things that are reviewed, in order to get approved.

Billing policy – Does the business bill in advance or after products or services are rendered? Businesses that bill too far in advance are at greater risk for a chargeback.

Example: A travel agency who sold travel destination packages six months in advance and cancel the trip, you’ll need to reimburse your customers.

Business type – Some business types are riskier. Industries with vague products or services are more highly to be examined in detail than those with concrete offerings.

Chargeback history – A business with a lot of chargebacks tied to their old merchant account will have a hard time with underwriting. A chargeback might be issued by the cardholder when they feel that the merchant does not fulfil the product or service being rendered as agreed.

Owner / signer credit score – Credit score plays a big role during merchant account underwriting. However, some processors will review financial statements instead in the case of poor credit. if the original signer’s credit score is insufficient, businesses with multiple partners can also try the application with a different signer.

Requested volumes – Are weighed against the processing volumes requested on the application. New businesses usually start with smaller volumes to build a trustworthy relationship before increasing their processing volumes.

Years in business – Long terms in business go a long way in merchant account underwriting, it speaks for their legitimacy. They are more prepared to respond to something like a chargeback and often have a more stable cash flow.

Posted in Best Practices for Merchants Tagged with: business, cardholder, chargeback, customers, financial, Industries, merchant account, products, services, travel, travel agency