March 7th, 2017 by Elma Jane

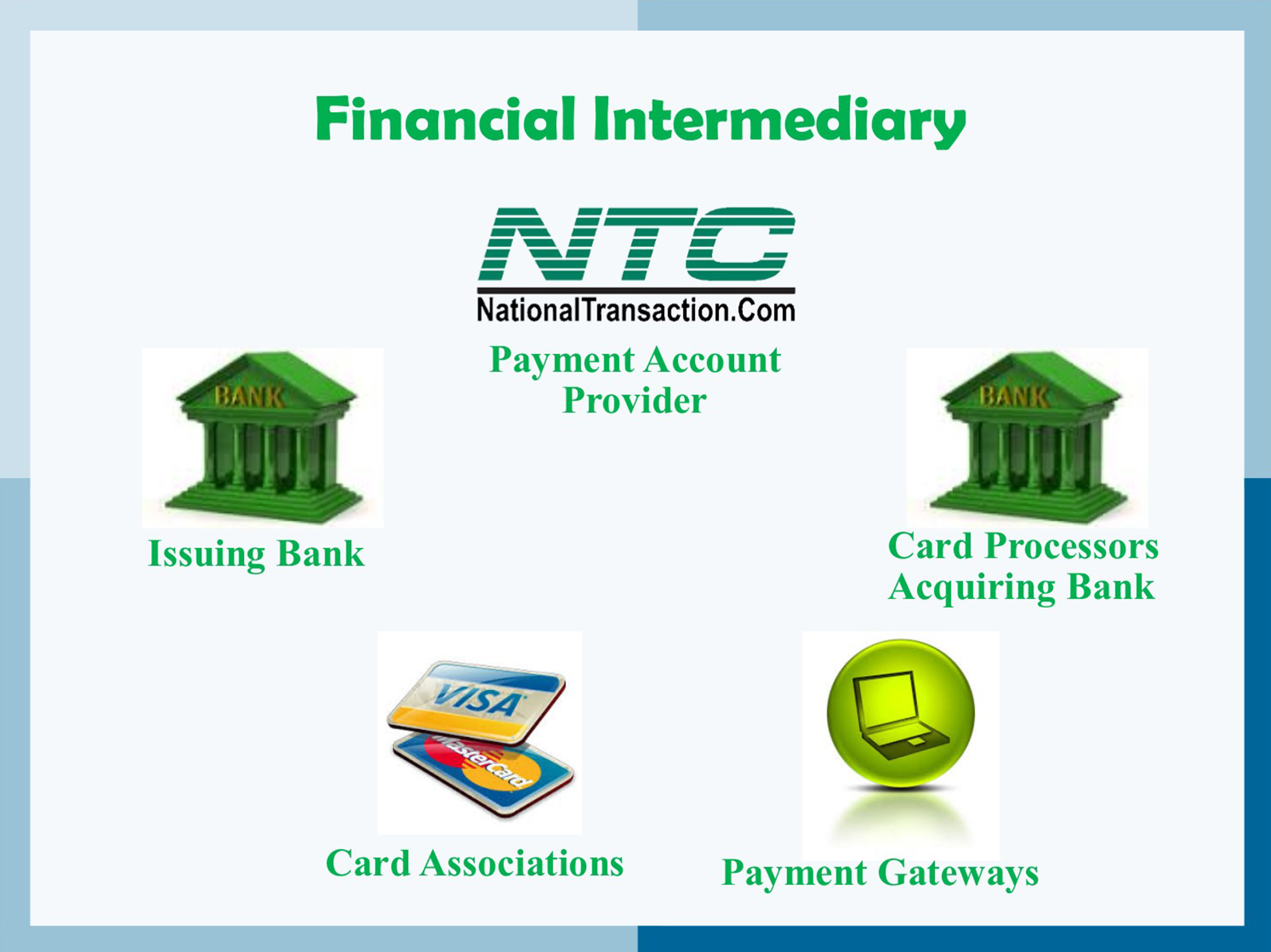

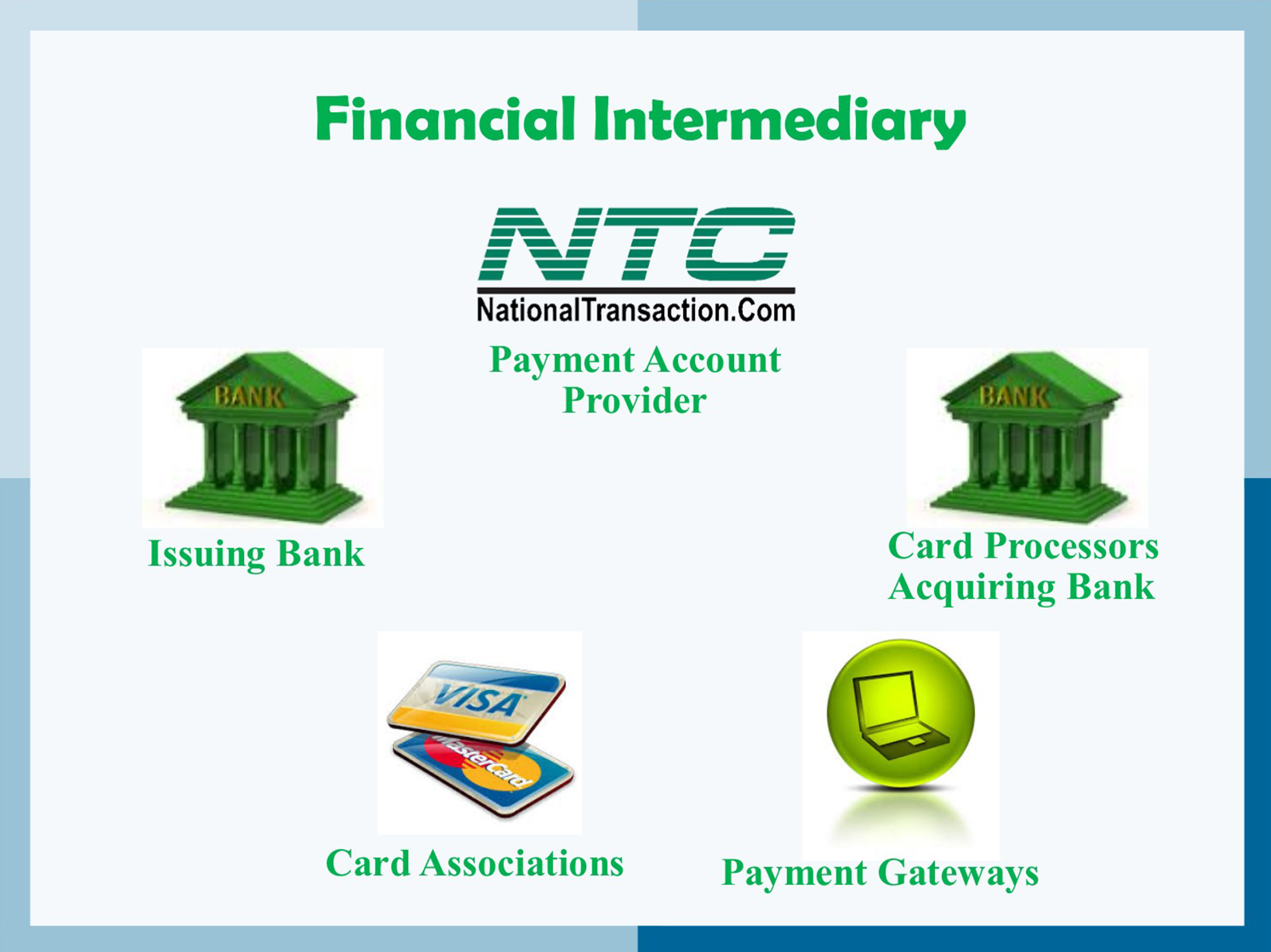

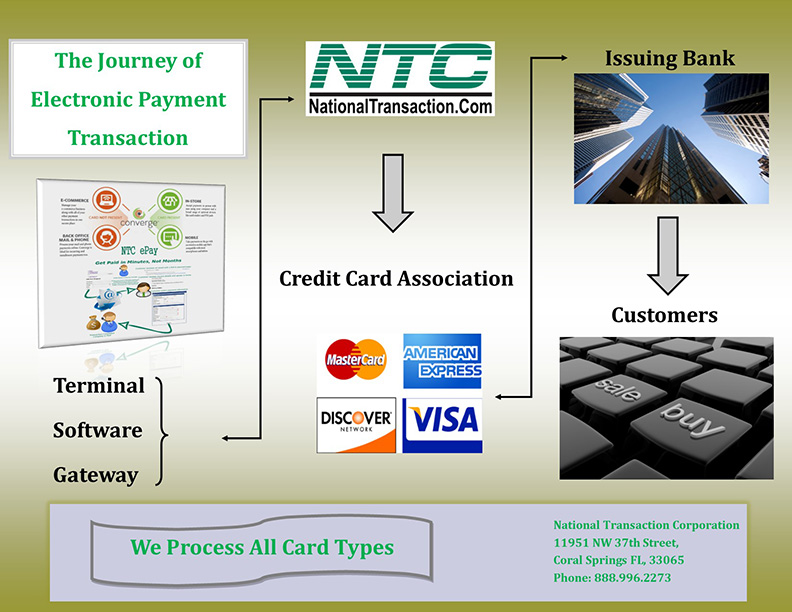

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

November 22nd, 2016 by Elma Jane

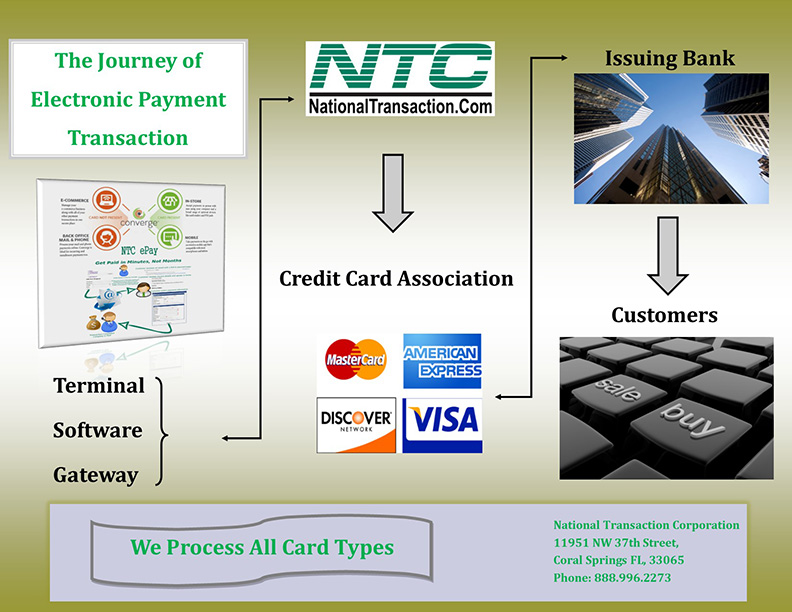

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

In addition, you can enjoy from e-commerce payment gateways to retail and restaurant solutions, business-to-business processing capabilities to electronic invoicing (NTC ePay).

NTC is offering a cost-effective credit card payment processing services that are very fast, secure and easy to integrate.

Get your Secure MerchantConnect Reporting Tool:

Get your Secure MerchantConnect Reporting Tool:

- Review and reconcile all of your transactions settle or batch settle and also much more.

- Create and save your custom reports that also can be imported or exported easily.

- Use our solution to turn any computer, laptop, smartphone or tablet into a processing center.

- Run & enjoy this on one or more devices to process credit card transactions with your merchant account.

- Peripherals allow swiping transactions and printing out receipts.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Receive up to $150,000 per location in less than 10 business days—sometimes in as few as 72 hours.

National Transaction Merchant Cash Advance eliminates many hassles and delays common with bank loans.

Our Merchant Cash Advance builds on the strength of your business’ future credit and debit card sales, so a damaged personal credit history is not an immediate disqualifier.

Posted in Best Practices for Merchants Tagged with: bank, cash advance, credit card, debit card, e-commerce, Electronic invoicing, electronic payment, gateways, loans, merchant account, payment, payment services, Security, smartphone, transactions

October 7th, 2016 by Elma Jane

NEXT DAY FUNDING

To be responsive to the needs of our merchants and to meet that needs, NTC offers next day funding in addition to the value added service for customers and businesses that need to have their funds available quickly.

National Transaction also offers a variety of electronic payment services and technology for businesses; with more than 15 years of experience.

Our services include:

- Currency Conversion

- Credit and debit card processing

- E-commerce and gateways

- Electronic checks

- Gift and loyalty card programs

- Mobile processing

- Cash advances and loans/funding program

- NTC e-Pay and MediPaid

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay!

Free Setup, nothing to Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. In addition, our e-Pay Platform can help Travel Merchants bring new customers while encouraging repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. Another payment platform that flexes with your business.

NTC Business Loans – Fast yet Affordable and most of all Simple Application Process.

MediPaid – another medical health insurance claims payment. Delivering paperless and next-day deposits for Health Insurance Payments.

Furthermore, NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants consequently providing 24/7 customer service and technical support!

To know more about our product and services call us now! 888-996-2273

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Internet Payment Gateway, Medical Healthcare, Mobile Payments Tagged with: credit, Currency Conversion, customers, debit card, e-commerce, E-Pay, electronic checks, electronic payment, funds, gateways, loans, Loyalty Card, merchants, payment services

June 3rd, 2016 by Elma Jane

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 15 years of experience, National Transaction offers a variety of electronic payment services and technology for businesses.

Our services include:

Currency Conversion, credit, and debit card processing, e-commerce and gateways, electronic checks, gift and loyalty card programs, mobile processing, cash advances and loans/funding program. We also have NTC e-Pay and MediPaid.

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, Nothing To Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Travel Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Medical Healthcare, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Small Business Improvement, Travel Agency Agents Tagged with: cash advances, credit, Currency Conversion, customers, debit card, e-commerce, electronic checks, electronic payment, funding, funds, gateways, loans, Loyalty Card, merchants, Mobile Processing, service

July 14th, 2015 by Elma Jane

If you own a business, you should consider opening a merchant account. If you accept credit cards for transactions, you will take your business to a higher level, increase your revenue, and gain new customers. Most people nowadays use credit cards and debit cards to pay for their purchases, so no business should go without processing card payments. Electronic, Credit card processing payments are a must-have for any kind of business including Internet businesses.

If you accept several forms of payments, you will provide your customers with multiple options and you will enhance their experiences. If you do not accept credit cards, the people who prefer to pay for their purchases with credit cards and debit cards will go somewhere else, and you will lose the transaction. So many benefits are attached with merchant accounts and millions of small business owners have found success with them. If you have a merchant account, you will be able to accept Discover, MasterCard, Visa, and American Express from your customers.

With National Transaction, securing Electronic, Credit card payment processing service instore, online and on the go are easy to acquire. It will boost your income, so it is worth the investment. You can apply online for a merchant account, the applications will only take you a few minutes to complete, and you will find out if you have been approved for a merchant account in a day or so.

A credit card processing service will also protect your business and valued customers against fraud. Customers feel safe using credit cards because they know that if their cards get stolen, they can cancel them, dispute the purchases, and get their money back. Your customers will feel safe when they make purchases. Some consumers will not purchase from a company that does not accept credit/debit card.

National Transaction offers advanced payment processing solutions like Currency Conversion, EBT and Debit Cards Processing, E-commerce Gateways, Electronic Check and ACH Transfers, Gift Loyalty Card Programs, Loans and Advances, Mobile Processing and MediPaid, you will definitely benefit from opening a merchant account. National Transaction offers Free CRM and we can even help promote your business through Social Media Sites. We offer a very competitive rate and Customer/Technical Support to our Partners because we answer our phone.

Merchant accounts are a necessity for any kind of business, so don’t wait. Sign up for a merchant account right now and discover what your business can gain from accepting credit cards! With 73 percent of American households owning a credit card, it’s easy to think that everyday credit card usage is a way of life.

Give us a call 888-996-2273 or check our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: ACH Transfers, Advances, card payments, credit card processing, credit cards, crm, Currency Conversion, debit cards, Debit Cards Processing, e-commerce, EBT, Electronic Check, gateways, Gift Loyalty Card, loans, MediPaid, merchant account, Mobile Processing, payments, transactions

September 24th, 2014 by Elma Jane

The CVV Number (Card Verification Value) on your credit card or debit card is a 3 digit number on VISA, MasterCard and Discover branded credit and debit cards. On your American Express branded credit or debit card it is a 4 digit numeric code.

The codes have different names:

American Express – CID or unique card code.

Debit Card – CSC or card security code.

Discover – card identification number (CID)

Master Card – card validation code (CVC2)

Visa – card verification value (CVV2)

CVV numbers are NOT your card’s secret PIN (Personal Identification Number).

You should never enter your PIN number when asked to provide your CVV. (PIN numbers allow you to use your credit or debit card at an ATM or when making an in-person purchase with your debit card or a cash advance with any credit card.)

Types of security codes:

CVC1 or CVV1, is encoded on track-2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for card not present transactions occurring by mail or fax or over the telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless card and chip cards may supply their own codes generated electronically, such as iCVV or Dynamic CVV.

Code Location:

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card. On American Express cards, the card security code is the four digits printed (not embossed) on the front towards the right. The card security code is not encoded on the magnetic stripe but is printed flat.

American Express cards have a four-digit code printed on the front side of the card above the number.

MasterCard, Visa, Diners Club, Discover, and JCB credit and debit cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

New North American MasterCard and Visa cards feature the code in a separate panel to the right of the signature strip. This has been done to prevent overwriting of the numbers by signing the card.

Benefits when it comes to security:

As a security measure, merchants who require the CVV2 for card not present payment card transactions are required by the card issuer not to store the CVV2 once the individual transaction is authorized and completed. This way, if a database of transactions is compromised, the CVV2 is not included, and the stolen card numbers are less useful. Virtual Terminals and payment gateways do not store the CVV2 code, therefore employees and customer service representatives with access to these web-based payment interfaces who otherwise have access to complete card numbers, expiration dates, and other information still lack the CVV2 code.

The Payment Card Industry Data Security Standard (PCI DSS) also prohibits the storage of CSC (and other sensitive authorization data) post transaction authorization. This applies globally to anyone who stores, processes or transmits card holder data. Since the CSC is not contained on the magnetic stripe of the card, it is not typically included in the transaction when the card is used face to face at a merchant. However, some merchants in North America require the code. For American Express cards, this has been an invariable practice (for card not present transactions) in European Union (EU) states like Ireland and the United Kingdom since the start of 2005. This provides a level of protection to the bank/cardholder, in that a fraudulent merchant or employee cannot simply capture the magnetic stripe details of a card and use them later for card not present purchases over the phone, mail order or Internet. To do this, a merchant or its employee would also have to note the CVV2 visually and record it, which is more likely to arouse the cardholder’s suspicion.

Supplying the CSC code in a transaction is intended to verify that the customer has the card in their possession. Knowledge of the code proves that the customer has seen the card, or has seen a record made by somebody who saw the card.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Point of Sale, Visa MasterCard American Express Tagged with: (Card Verification Value), (CVC2), American Express, atm, authorization data, bank/cardholder, card holder data, card identification number, card issuers, Card Not Present transactions, card number, card numbers, card security code, card validation code, card-not-present, card-present transactions, cardholder, cards, cash advance, chip cards, CID, code, Contactless card, credit, credit-card, CSC, customer, customer service, CVC1, CVV Number, CVV1, CVV2, Data Security Standard, debit, debit card, debit cards, device, Diners Club, Discover, fax, gateways, iCVV or Dynamic CVV, individual transaction, internet, issuer, JCB credit, magnetic stripe, mail, MasterCard, merchant, payment card, Payment Card Industry, payment card transactions, payment gateways, PCI-DSS, Personal Identification Number, PIN, point of sale, post transaction authorization, security codes, telephone, terminals, unique card code, virtual terminals, visa, web-based payment

August 4th, 2014 by Elma Jane

Run through a non-profit organisation, Stellar is a decentralized protocol for sending and receiving money in any pair of currencies, be they dollar, yen or bitcoin. The system works through the concept of gateways that let people get in and out of the network. Users hold a balance with a gateway, which is any network participant that they trust to accept a deposit in exchange for credit on the network. To cash out, a user invokes the promise represented by a gateway’s credits, returning them in exchange for the corresponding currency.

Like Ripple, Stellar comes with its own built-in digital currency, which will be given away for free to people who sign up via Facebook, to nonprofits and to current bitcoin and Ripple holders. Initially there will be 100 billion ‘stellars’ (five per cent of which will be kept back to fund the nonprofit) with the supply increasing at one per cent a year. Although stellars will have a market-determined value, their main purpose will be to provide a conversion path between other currencies. This means that when two parties exchange money through the distributed exchange, stellars sit in the middle. Example, a user might submit a transaction which converts EUR credits to stellar and then converts those stellar to AUD credits. Ultimately, the user will have sent EUR, the recipient will have received AUD, and two exchange orders will have been fulfilled.

Developers are being invited to jump in and work with the open-source code and build applications on top of Stellar. The project has secured the backing of payment industry darling Stripe, which has handed over $3 million in exchange for two per cent of stellars. Stellar is highly experimental, but it’s important to invest effort in basic infrastructure when the opportunity arises. Stellar could become a much better substrate for a lot of the world’s financial systems.

Posted in Internet Payment Gateway Tagged with: AUD credits, bitcoin, code, credit, credits, currencies, deposit, digital currency, EUR credits, Facebook, gateways, network, payment industry, transaction

September 10th, 2013 by Admin

Verizon annually releases it’s Data Breach Investigation Reports which probes data breaches in various industries and studies the nature of fraud reported by merchants and other agencies. In the past Verizon has worked with the U.S. Secret Service, now the information gathered on the electronic payment breaches have expanded to Police Central e-Crime Unit, Australian Federal Police, the Dutch National High Tech Crime Unit, and the Irish Reporting & Information Security Service in addition to the United States Secret Service.

One area that Verizon broke out and performed independent studies on was the healthcare industry. In 2010 the Health Information Technology for Economic and Clinical Health (HI TECH) Act included a provision to report healthcare and medical data breaches to a variety of outlets including the Secretary of Health and Human Services. Medical record protections keep the casual cyber criminal at bay but the majority of security data breaches are in large part targeted at information attackers can profit from. The data cybercriminals target most often includes health insurance data, personal and electronic payment transaction data. Hardware is another assett that is targeted both because of the data on the hardware and the cost of the hardware itself.

Remote data breaches on health care providers were typically carried out through some form of hacking or malware. That is consistent with other industries in the report and is considered the favorites among cybercriminal organizations. Exploiting of default or guessable credentials rang in at the top of the chart. Of those, point of sale payment systems and desktop computers were the highest targeted areas of the health care industry. Although electronic medical records and transcriptions stored on file and database servers were a target, those criminals were more likely interested in indentity theft and fraudulent loans than what was actually in any individuals medical records.

Point of sale payment terminals are the most targeted assett with POS servers and gateways as the second most targeted. Like all other sectors, professional criminals tend to follow the money trail and that ends up being at POS payment systems. So much so that even desktop computers and emails try to get malware onto medical systems to render security policies inneffective. To find out how to better protect medical and healthcare records from cybercriminals and data breaches read the reports here and here.

Posted in Best Practices for Merchants, Credit Card Security, Point of Sale Tagged with: Breach, breaches, electronic payment, gateways, healthcare, medical, point of sale, POS, Security, transactions, transcription