July 13th, 2016 by Elma Jane

Monthly statement fee is a fixed fee that is charged monthly and is associated with the statement that is sent to a merchant in one billing cycle, approximately 30 days worth of credit card processing by the merchant account provider; whether it’s a printed one, a mailed statement or an electronic version. Requesting online statements won’t necessarily be able to waive statement fee.

Every credit card and merchant account provider have a different set of costs associated with its services, but remember that there are several processors out there that are very transparent with their fees like National Transaction.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, fee, merchant, merchant account, processors, provider, services

June 14th, 2016 by Elma Jane

Getting a merchant account is an important step for any business that sells services. Helping merchant to understand the underwriting process and some of the key things that are reviewed, in order to get approved.

Billing policy – Does the business bill in advance or after products or services are rendered? Businesses that bill too far in advance are at greater risk for a chargeback.

Example: A travel agency who sold travel destination packages six months in advance and cancel the trip, you’ll need to reimburse your customers.

Business type – Some business types are riskier. Industries with vague products or services are more highly to be examined in detail than those with concrete offerings.

Chargeback history – A business with a lot of chargebacks tied to their old merchant account will have a hard time with underwriting. A chargeback might be issued by the cardholder when they feel that the merchant does not fulfil the product or service being rendered as agreed.

Owner / signer credit score – Credit score plays a big role during merchant account underwriting. However, some processors will review financial statements instead in the case of poor credit. if the original signer’s credit score is insufficient, businesses with multiple partners can also try the application with a different signer.

Requested volumes – Are weighed against the processing volumes requested on the application. New businesses usually start with smaller volumes to build a trustworthy relationship before increasing their processing volumes.

Years in business – Long terms in business go a long way in merchant account underwriting, it speaks for their legitimacy. They are more prepared to respond to something like a chargeback and often have a more stable cash flow.

Posted in Best Practices for Merchants Tagged with: business, cardholder, chargeback, customers, financial, Industries, merchant account, products, services, travel, travel agency

May 27th, 2016 by Elma Jane

Refunds – transfers funds from your merchant account to the customer’s account.

Refunds are always associated with a transaction that has settled.

A settled transaction – is funds that have already transferred from the customer to the merchant. You can only refund a transaction with a Settling or Settled status.

The refunded transaction goes through the typical settlement process. As the refund settles, the funds are sent back to the customer’s bank account. It is normal for your customer to experience a delay because the customer’s bank may take a couple of days to deposit these funds.

Voids – will cancel the transfer of funds from the customer to the merchant and can be issued if the transaction is either Submitted for Settlement or Authorized. The original authorization should disappear from the customer’s statement within 24 to 48 hours.

Posted in Best Practices for Merchants Tagged with: account, bank, customer, funds, merchant, merchant account, refunds, transaction

May 24th, 2016 by Elma Jane

Top terms in your Merchant Statement:

Interchange – are the variable fees charged by the card payment networks for processing transaction. Credit card brands set these non-negotiable rates based on card type, business size, and industry.

Ancillary Fees – this include statement, batch and customer service fees, monthly minimums and more.

Authorizations – this section shows the charges per authorization that come from an interchange plus provider and is then split by card brand and transaction type. On your statement, you will see these charges as either AUTH or WAT charges.

Deposit Summary – following the summary is the deposit summary, where lists of your account activity broken down by day and card type.

Discount Rate – every transaction percentage that is deducted as a fee. Rates are categorized as qualified, mid-qualified and non-qualified.

Processing Services – this states your discount rate charges that you receive from your interchanges plus processor. This is divided by card brand and sales volume.

Summary – summary shows the processed sales by AMEX, Discover, JCB, MasterCard or Visa, as well as the total fees paid in order to process these sales. You can find this at the top of your statement.

Other items included in the summary:

Account adjustments, chargebacks, the breakdown of sales by card brand and number of refunds.

Understanding these terms on your statement will give you the confidence to read your merchant account statement with ease.

Posted in Best Practices for Merchants Tagged with: card, chargebacks, credit card, customer, fees, merchant, merchant account, payment, refunds, service, transaction

May 18th, 2016 by Elma Jane

Terminals are ready, but the software isn’t – many merchants have EMV capable equipment, but has not been activated yet because it still needs to be certified.

The certification process includes security and compatibility tests.

For a small merchant, all you need to worry about is your equipment or software is EMV certified.

For software, developers, terminal manufacturers needs to get certification before they can deploy their products to merchants.

So many merchants who want to accept EMV, are now just waiting for their POS system to get necessary upgrades, which they can’t do until they’re certified.

Slower Checkout Time – common complaint by consumers. Dipping takes several seconds longer than swiping the card. There’s also a chance of forgetting your card because you have to leave your card inserted while waiting for the transaction to get approved.

The fastest Path to EMV – Depending on the nature of your business, the risk of landing yourself for credit card fraud is slim. The easiest way is to contact your merchant account provider and they will tell you what equipment and software you need and how much it will cost.

For our retail customers, we have the iCT250, the smart and compact desktop device designed for maximum efficiency. iCT250 offers a smart and effective payment experience on minimum counter space. Accept all electronic payment methods including EMV chip & PIN, magstripe and NFC/contactless.

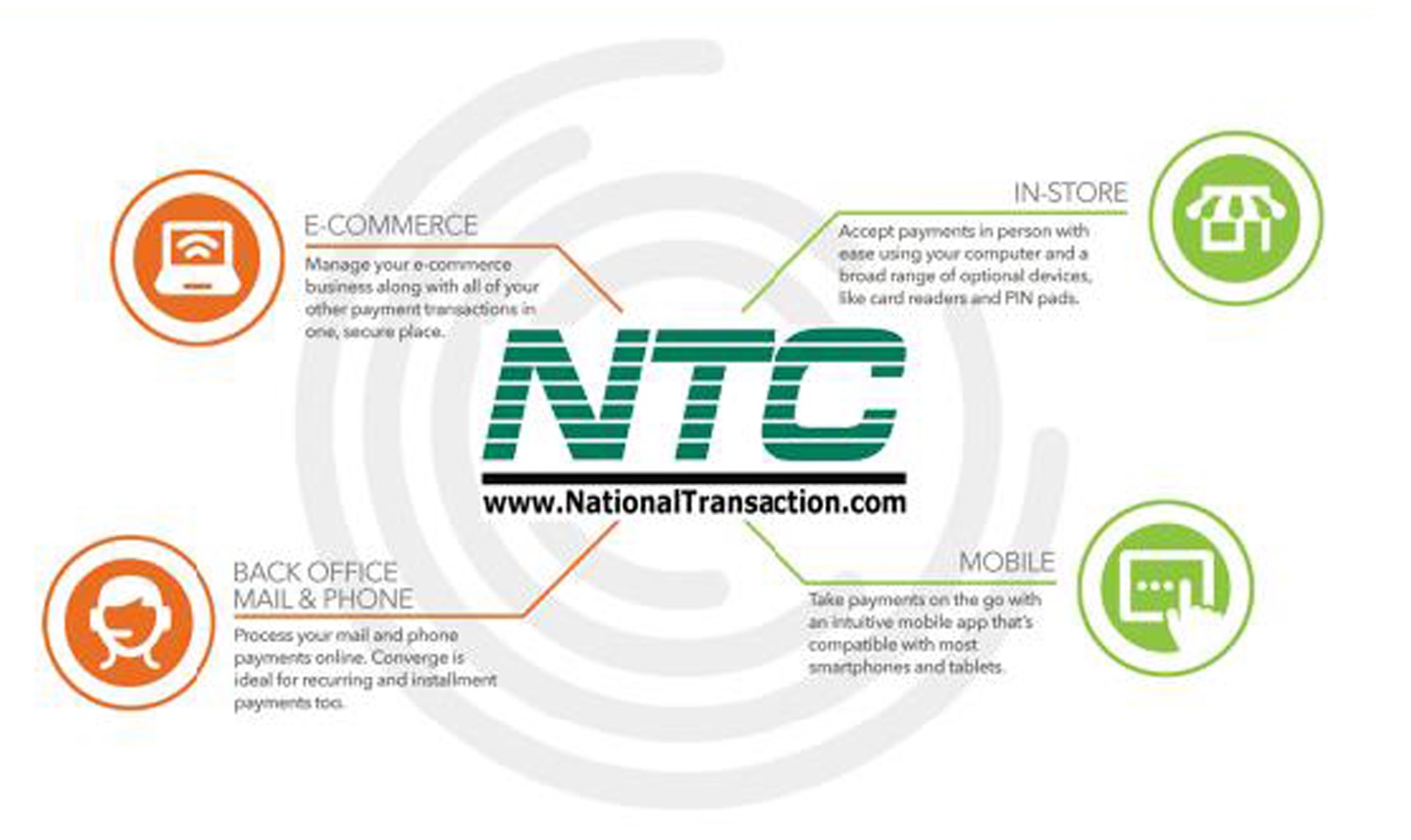

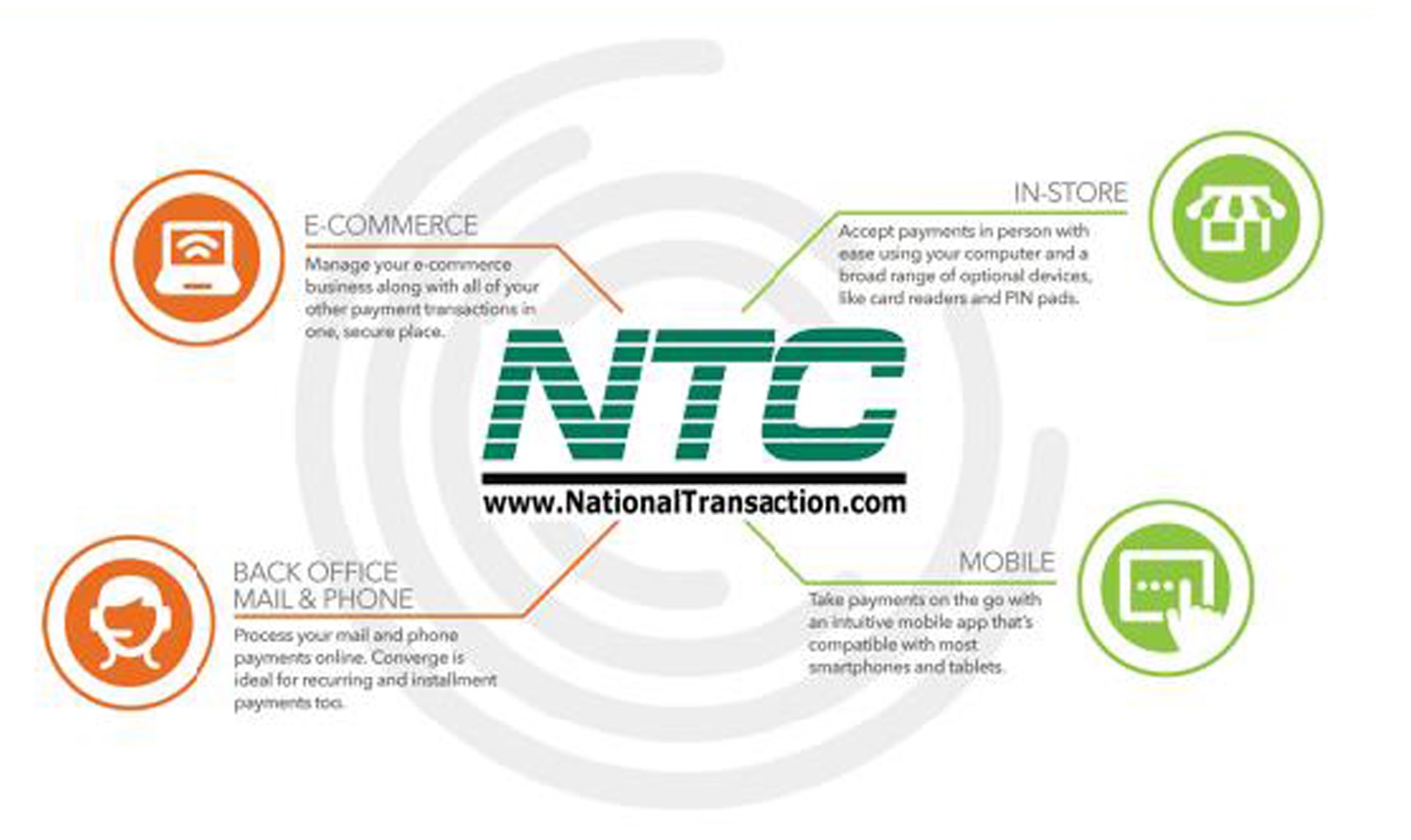

For card-not-present, we have our payment gateway platform that accepts payments your way Online, In-Store and On the Go.

- E-commerce – manage your e-com business along with all of your other payment transactions in one, secure place.

- In-Store – accept payments in person with ease using your computer and a broad range of an optional device, like card readers and PIN pads.

- Back Office Mail & Phone – Process you mail and phone payments online. Converge is ideal for recurring and installment payments too.

- Mobile – Take payments on the go with an intuitive mobile app that’s compatible with most smartphones and tablets.

For more details give us a call at 888-996-2273 or check out our website for our products and services.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Internet Payment Gateway, Mail Order Telephone Order, Merchant Account Services News Articles, Mobile Payments, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: card, card readers, Chip & PIN, consumers, contactless, credit card, customers, e-commerce, electronic payment, EMV, fraud, in-store, magstripe, merchant account, merchants, mobile, nfc, online, payment, payment gateway, PIN pads, POS, provider, Security, terminals, transaction

May 12th, 2016 by Elma Jane

Electronic commerce (eCommerce) is a type of business transaction, that involves the transfer of information on the Internet. This allows consumers to exchange goods and services with no barriers of time or distance electronically.

Business-to-Business (B2B) this refers to electronic commerce, between businesses rather than between a business and a consumer. These transactions electronically provide competitive advantages over traditional methods. It’s faster, cheaper and more convenient.

Creating a successful online store can be difficult if you don’t have knowledge of e-commerce and what it is supposed to do for your online business.

What do you need to have an online store?

- Shopping cart – an operating system that allows consumers to buy goods and or services. Track customers, and tie together all aspects of e-commerce into one.

- Or you can check out our NTC e-Pay no shopping cart Solution.

- Taking online payment by getting a merchant account and accept credit cards through an online payment gateway.

You just need to make a better decision in choosing the right shopping cart and a merchant account for your eCommerce shop.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: b2b, commerce, consumers, credit cards, customers, ecommerce, gateway, merchant, merchant account, NTC e-Pay, online, online payment, payment gateway, shopping cart, transaction

April 25th, 2016 by Elma Jane

There are a lot more details of what makes up a credit card rate, this information is a good start to know more about a merchant account. All merchant accounts are subject to the same costs with respect to interchange fees and assessments.

Most rates are made up of three parts:

Assessments – are paid directly to card network associations (Visa, MasterCard, Amex, etc.)

Interchange – are paid to the issuing bank that issued the card, and is typically made up of a flat rate.

Card present transactions (the card is physically present or swiped) are typically lower than card-not-present transactions (the card is keyed-In like e-commerce and mail-order transactions).

Card-not-present transactions have higher interchange rates because they are riskier.

Processor fees – the fees involved with providing the service, risk assessments, the type and size of the transaction. This includes the margin between the total rate and the two previous parts, along with other fees, like chargeback or statement fees.

Posted in Best Practices for Merchants, Credit card Processing, Travel Agency Agents Tagged with: bank, card, card network, chargeback, credit card, merchant account, rate, transaction

March 24th, 2016 by Elma Jane

Dear Virtuoso:

I wanted to praise one of our Virtuoso partners, National Transactions.

We have found National Transactions to be a wonderful partner. We have gotten excellent rates and support for our National Transaction merchant account– but more than that, their employees have helped us improve our processes, and I can already see our productivity rising. We have begun a new, online payment portal. This is an excellent tool we highly recommend!

National Transaction’s Steve Garlenski assisted and John Barbieri custom-designed a fabulous landing page – with all of our terms and conditions, cancellation penalties and places to check to authorize — and automatic receipt sent to both us and the client.

We really appreciate all they have done to help us with this important tool. It is so much better, faster and easier for us than obtaining signed paper credit card authorizations.

Thank you, Steve & John and National Transactions!

————–

Eleanor Hardy

President

The Society of International Railway Travelers®

Proud members of Virtuoso®

#1 Sellers of Virtuoso® Adventure & Specialty Travel, 2012

Winner, 15 Magellan Awards for Excellence

Celebrating the World’s Top 25 Trains since 1983

We thrive on referrals. Please tell your friends.

Web: http://www.irtsociety.com

Facebook | IRT Blog, Track 25

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, merchant account, online payment, travel

March 16th, 2016 by Elma Jane

More and more travel agents and tour operators are working in a card-not-present transaction that opens the door to travel agency credit card fraud. Travel Agencies are among the highest-risk merchants, as far as credit card processors are concerned. The reason is more likely the dispute and chargeback transactions.

So what should you do, whether you have just started your travel agency or have been in business for years to reduce risk?

First, understand the potential liability associated with selling airfares online before you even apply for a merchant account. Understanding risk exposure will help travel agency take adequate steps to minimize losses associated with chargebacks.

A good example is an airline sales agent. A travel agency or a tour operator merchant account may be liable for the entire amount of an airline ticket, if it is successfully disputed by a customer or if it was purchased with a stolen credit card.

To reduce risk, you will need to set up card acceptance policies and procedures to address the following issues:

- Authorization requests approved by an issuer. In most cases, airlines are liable for card-not-present transaction fraud, even when they were approved by the card issuer, because authorization approval is not a proof that the legitimate cardholder is making the purchase, nor is it a guarantee of payment.

- As a travel agency, your organization may not necessarily be a Visa or MasterCard merchant, subject to the Credit Card Associations’ rules and regulations. In most fraud-related transactions, the airline transfers liability to the travel agency it has partnered with as part of the contractual agreement. In such cases, your organization will bear the full financial responsibility.

Selecting a payment processor is a big step, choose one with experience in working with travel agencies and other high-risk merchants. Your processor must be able to assist you with your fraud prevention procedures.

Check out National Transaction Corp. we are the travel experts when it comes to electronic payments for travel agencies! Give us a call now at 888-996-2273 or visit us at www.nationaltransaction.com

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card-not-present, cardholder, chargeback, credit card, customer, fraud, high-risk merchants, merchant account, merchants, payment, processors, risk, transaction, travel, travel agencies, travel agency, travel agents

February 24th, 2016 by Elma Jane

Merchants can bring in new customers and encourage repeat business by using their point-of-sale terminal as a marketing tool. A point-of-sale terminal allows you to process payment and accept debit and credit cards, and generate more business by using the right tools.

Customize Receipts – a customized receipt becomes an advertisement. The customer knows where that receipt is from should they want to contact you.

Gift Cards Program – Gift card recipient are likely to spend over the face value of the card. Customers will appreciate simplified gift shopping.

Loyalty Program – Loyalty program makes customers think of your business first and encourages them to come back often to earn a reward.

Referral Rewards – Print an offer to reward referrals, so they can send people to you.

A merchant account is not just an expense by finding the right tool you can generate more income for your business!

visit www.nationaltransaction.com today, or call 888-996-2273 Extension 1

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Point of Sale Tagged with: credit cards, customers, debit, gift Card, loyalty program, merchant account, merchants, payment, point of sale, terminal