May 18th, 2016 by Elma Jane

Terminals are ready, but the software isn’t – many merchants have EMV capable equipment, but has not been activated yet because it still needs to be certified.

The certification process includes security and compatibility tests.

For a small merchant, all you need to worry about is your equipment or software is EMV certified.

For software, developers, terminal manufacturers needs to get certification before they can deploy their products to merchants.

So many merchants who want to accept EMV, are now just waiting for their POS system to get necessary upgrades, which they can’t do until they’re certified.

Slower Checkout Time – common complaint by consumers. Dipping takes several seconds longer than swiping the card. There’s also a chance of forgetting your card because you have to leave your card inserted while waiting for the transaction to get approved.

The fastest Path to EMV – Depending on the nature of your business, the risk of landing yourself for credit card fraud is slim. The easiest way is to contact your merchant account provider and they will tell you what equipment and software you need and how much it will cost.

For our retail customers, we have the iCT250, the smart and compact desktop device designed for maximum efficiency. iCT250 offers a smart and effective payment experience on minimum counter space. Accept all electronic payment methods including EMV chip & PIN, magstripe and NFC/contactless.

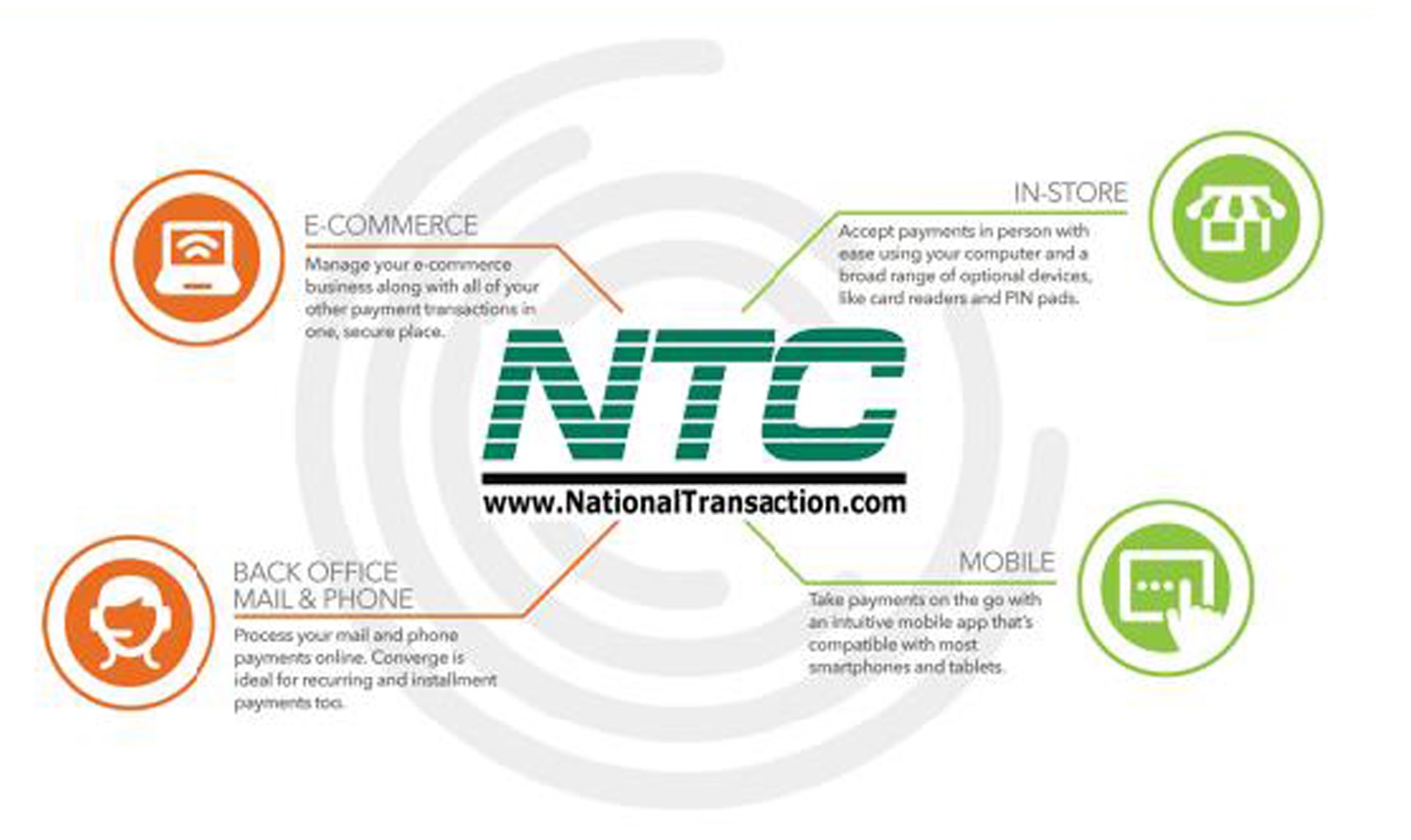

For card-not-present, we have our payment gateway platform that accepts payments your way Online, In-Store and On the Go.

- E-commerce – manage your e-com business along with all of your other payment transactions in one, secure place.

- In-Store – accept payments in person with ease using your computer and a broad range of an optional device, like card readers and PIN pads.

- Back Office Mail & Phone – Process you mail and phone payments online. Converge is ideal for recurring and installment payments too.

- Mobile – Take payments on the go with an intuitive mobile app that’s compatible with most smartphones and tablets.

For more details give us a call at 888-996-2273 or check out our website for our products and services.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Internet Payment Gateway, Mail Order Telephone Order, Merchant Account Services News Articles, Mobile Payments, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: card, card readers, Chip & PIN, consumers, contactless, credit card, customers, e-commerce, electronic payment, EMV, fraud, in-store, magstripe, merchant account, merchants, mobile, nfc, online, payment, payment gateway, PIN pads, POS, provider, Security, terminals, transaction

April 14th, 2016 by Elma Jane

Accepting credit card payments is a must if you’re planning to start a business. It’s good to know what is out there and how it applies to your situation. So you need to learn about credit card processing machines, depending on your business.

Here are some of the different types of credit card processing machines:

Dial-Up Terminal – the grandfather of credit card processing machines. Dial-up terminals use a phone line to connect with a credit card processing company. The advantage is that they are normally inexpensive than some higher-end options. The disadvantage is slower processor speed.

IP Terminal – connect the merchant over a high-speed internet connection. The advantage of IP terminal over dial-up terminal is speed. IP machines can process transactions as fast as 3 seconds as opposed the 10 to 25 seconds that a dedicated dial-up machine might take. IP terminals now cost about the same as dial-up units and that a single DSL link can accommodate more than one credit card terminal.

Wireless Terminals – the priciest yet most convenient type is a wireless machine that runs on a wireless network, much like your mobile phone.

Virtual Terminal – virtual terminals are computers running credit card processing software connected to a credit card reader. Virtual terminals are a great addition to an office because they don’t require a standalone credit card processing terminal.

There are many options available for your business, whether you’re e-Commerce, MOTO, In-Store or Mobile there’s a credit card processing machine and platform out there that will fit your business.

Give us a call to know more at 888-996-2273 or visit us at www.nationaltransaction.com

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce Tagged with: card reader, credit card, credit card processing, e-commerce, merchant, mobile, moto, payments, terminal, virtual terminal

April 8th, 2016 by Elma Jane

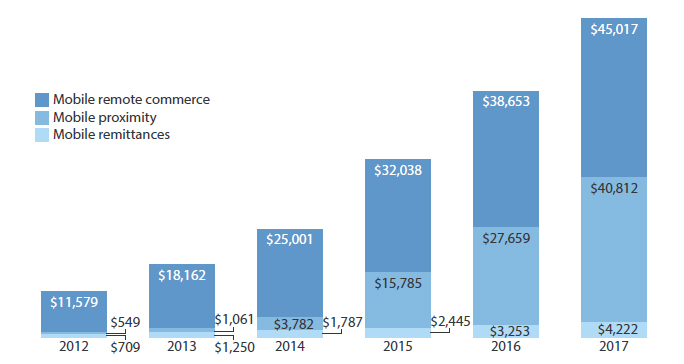

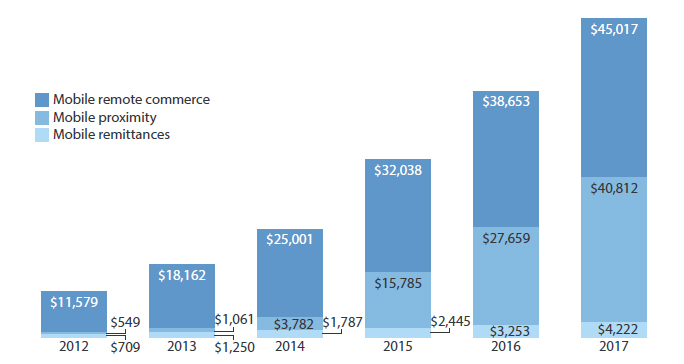

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's

March 31st, 2016 by Elma Jane

Two key features have been released in the latest version (1.2.) of the Converge Mobile app for both iOS and Android:

- Bluetooth Printer Support – You can now use either of the Bluetooth printers – Star SM-T300i or Star SM-T220i – with the Converge Mobile app.

- Void – You can now void a transaction after it has been submitted and before it has been settled. Transactions that need to be reversed after settlement will need to be done as a refund. Both the Void and Refund functions are done from the transaction menu.

In addition to these features, enhancements were made to the first-time user experience to help get customers up and running on the new mobile app. Several bug fixes were also addressed, including a fix to remedy an issue where some cards were not being accepted via Apple Pay.

Users must download the latest version of the Converge Mobile app to receive these latest features. Updating the app will also push a hardware update to the Ingenico iCMP. We encourage our customers to enable automatic updates for Converge Mobile so you will always have the latest functionality.

Posted in Best Practices for Merchants Tagged with: customers, mobile, transaction

March 17th, 2016 by Elma Jane

A bank in Mexico is the first in the world to publicly experiment with this technology. With their mobile wallet application, cardholders are able to use dynamic CVC/CVV codes, which are generated every twenty minutes.

If somebody is using credit card information stolen from a data intrusion and the merchant accepting payment online asks for the CVV, it likely would have changed by that time, they would enter the wrong CVV and the transaction would be declined.

Cards with CVV code display that randomly changes will ensure that users making orders online are who they say they are. Many e-Commerce sites already ask shoppers for the CVV code during online transactions or over the phone.

The technology is an intuitive solution, but costly to issuers. Cards with displays that enable a dynamic CVV code are 10 times more expensive than chip cards.

As mobile banking, e-commerce, and m-commerce is growing, something had to change sooner or later in the online payment industry.

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce Tagged with: bank, cardholders, cards, credit card, data, e-commerce, m-commerce, merchant, mobile, online, payment, payment industry, transaction, wallet

March 4th, 2016 by Elma Jane

A number of financial institutions are beginning to implement biometric authentication. They started to replace traditional knowledge-based passwords with biometric authentication.

A British multinational banking is introducing biometric tests for its customers in U.K., letting account holders access online banking using their fingerprint or voice. If you’re using phone-banking services you can register your voiceprint with the company instead of using a regular password. A special voice biometrics technology will analyze a customer’s voice when they call the bank.

Customers using Apple’s Touch ID will be able to access their accounts on their mobile phones using their fingerprint.

Customers in the U.S., Canada, Mexico, Hong Kong, and France will have the technology by the end of the year. Other markets will follow in 2017 and 2018. The British multinational banking and financial services company have nearly 50 million retail banking customers around the world.

Posted in Best Practices for Merchants, Financial Services Tagged with: account, bank, banking, biometric, customers, financial, financial institutions, financial services, mobile, online, retail

March 3rd, 2016 by Elma Jane

Apple and Samsung, Plus HCE, Lending Momentum to Contactless

EMV migration in the U.S. is helping to establish NFC since nearly all EMV terminals come with built-in NFC capability. Consumers worldwide will make mobile payments with their handsets using near-field communication this year, nearly 70% will be Apple Pay and Samsung Pay users.

Some banks were offering mobile wallets based on HCE. Banks have responded to HCE because its cloud configuration stores and manages payments information, bypassing the secure element in the phone. This allows banks to introduce tap-and-pay mobile-payments services quickly because it eliminates the need to negotiate terms with mobile carriers and device manufacturers to gain access to the secure element. Cloud-based credentials can be tokenized to protect from hackers. Tokenization and HCE combination is extremely attractive to banks.

Apple, Samsung and a cloud-based technology host card emulation are playing a big role in spreading contactless payments.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: banks, consumers, contactless, contactless payments, EMV, HCE, host card emulation, mobile, Mobile Payments, mobile wallets, Near Field Communication, nfc, payments, terminals, tokenization

February 25th, 2016 by Elma Jane

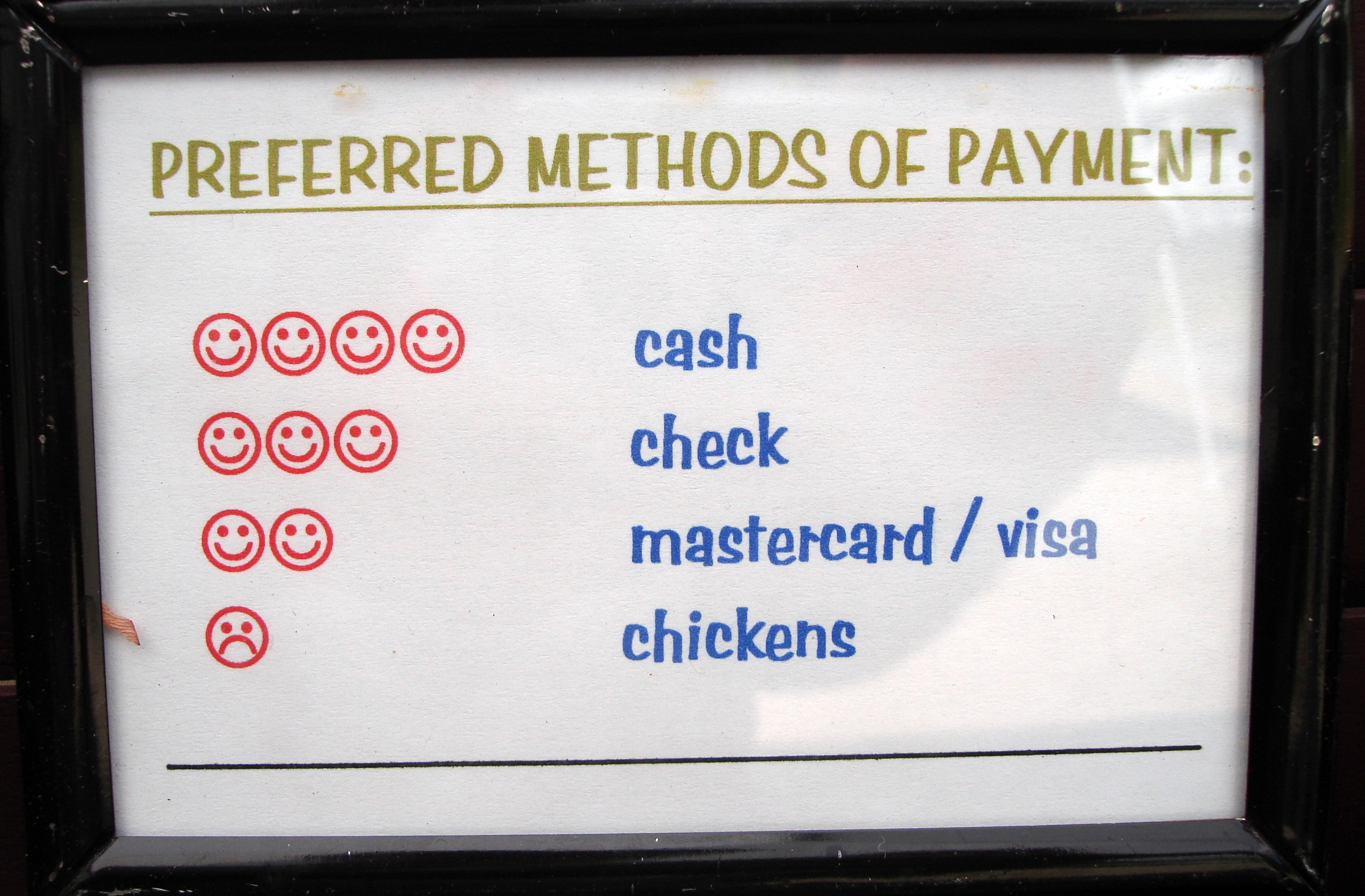

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

February 12th, 2016 by Elma Jane

If there’s an e-commerce trend there’s also a delivery trend.

Will drone be the future of delivery?

Drone delivery is the next big key to e-commerce.

Place an order, payment is collected from a mobile payment system. Drone goes out to deliver the order.

Drone delivery is a great concept to combine for any retail merchants or company that deals with the public. It represents a new system to connect buyers with merchandise, and quickly. The trend for e-commerce delivery.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: e-commerce, merchants, mobile, mobile payment, payment, Retail Merchants

February 11th, 2016 by Elma Jane

E-commerce is a virtual platform, where we can get products and services and make payments through the internet.

E-commerce trend is constantly changing, it is necessary for a merchant to watch out for the upcoming Trends in this industry for a business to success.

To help boost your conversion rates here are the trends to be followed:

Contextual Commerce – The next big thing in payments and e-commerce. Providing complete description with images and videos to help your customer decide to purchase a product. Customization is an important factor as well to convince about the products or services.

Fast Delivery Shipping – Customer wants to receive the products after purchasing as soon as possible. So Reliable, Timely shipping means a lot.

Mobile Shopping – getting your online store ready for mobile shoppers is not an optional feature, it’s a mandatory part of a strategy.

Multiple Channels For Shopping – optimization is a great experience for shoppers. Having online store presence in different technology gadgets is a must.

Real Time Analytics – analyzing consumer behavior based on data entered into a system less than one minute before the actual time of use. Finds out why a customer leaves the store and prevents customer loss.

Virtual Sales Force – Hiring virtual salesforce, utilizing pop-ups and live chat who will help customers which are similar in a physical store.

Step ahead out of the conventional methods and adapt prevailing trends by embracing innovation so you can offer something new to your customer.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: business, consumer, customer, data, e-commerce, internet, merchant, mobile, online, payments