August 21st, 2014 by Elma Jane

Accept Electronic Payments in Their Currency, Convert it to Yours. National Transaction helps you and your customers transact with confidence.

DCC provides convenient currency conversion service at the time of purchase benefiting both the credit card holder and merchants. Our solution provides a system where the Visa or MasterCard holder in a foreign country can shop on an American based website that displays prices in their own local currency. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied.Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line and making international transaction with confidence. We have diverse set of applications to enable various kinds of business models and financial frameworks.

Posted in Best Practices for Merchants Tagged with: Bank Reference, Card Recognition, conversion rate, credit-card, currency, Currency Conversion, customers, DCC, Dynamic Currency, electronic payments, exchange rate, financial, invoice, MasterCard, Merchant's, pricing, rate, receipt, transactions, visa, website

June 19th, 2014 by Elma Jane

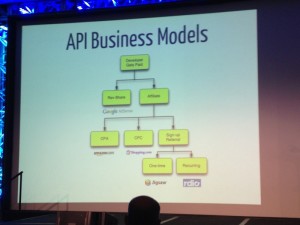

API Software Inc. has created an application ISOs can use to help merchants tabulate the best payment services deals. The Square Deal Pro app for the merchant services industry enables sales reps to compare their company’s rates to those of Square, PayPal, Stripe and other payments aggregators. Essentially, the application takes the mathematics burden off of the merchant and helps an ISO or agent compare bundled pricing with interchange-plus pricing.

Frank Haggar, a software developer, started asking merchants why they chose a certain provider and they just said the pricing was simpler. It might be more expensive, but it was easier for them to understand. That moved to develop Square Deal Pro. It’s a software that salespeople can have right on their phones and it makes a comparison and is easy to understand. Square Deal Pro, which operates on iPhones, Android devices and Windows phones, was established as a vendor-neutral tool that is also available for merchants to download if they were inclined to want to crunch numbers themselves. Service providers pay for the application and all of its sales features, but a free version for price comparisons only is available to merchants.

Merchants are experts in what they know how to do and they may not want something that includes math distracting them from that, but the sales rep can do it for them and use it along the lines of a calculator helping someone figure out mortgage rates. ISOs have various tools at their disposal and lock in key information in their brains to prepare for sales presentations, but most will likely find Square Deal Pro a valuable addition. Something that takes complicated pricing schemes and factors it all into an easy interface that puts out a clear comparison that is valuable, certainly out in the field.

API Software has to deliver something difficult or impossible to copy because that would set this permanently apart as opposed to being a lead to other similar products in the market. An ISO can change rates or make adjustments for a client if the numbers show that another provider is offering a less expensive option, but the numbers in the app don’t lie. The app will show how a bundled rate can work in your favor, such as if you are selling Girl Scouts cookies at $3 a box. Then use Square all day long, but an ISO can compare how his product works compared to others and the app can show, that at a certain time, it might be beneficial to switch over.

Square Deal Pro takes into account factors other than interchange rates, including merchant volume, average ticket price and whether transactions are keyed or swiped or both. All of those things determine where you fit in on the diagram of how your rate should be structured. There is a lot of analysis on minimal focal points. The application may also help defuse potential problems with merchants who sometimes feel their sales rep was not providing a fair assessment of pricing structure or comparisons.

As for the application’s name, Haggar doesn’t want any confusion over whether this might be a new Square product.

Posted in Best Practices for Merchants Tagged with: account, aggregators, Android, assessment, bundled pricing, developer, devices, interchange, interchange rates, interchange-plus pricing, iPhones, ISOs, market, merchant services, merchant volume, Merchant's, mortgage rates, payment, PayPal, phones, pricing, Pro app, products, provider, Rates, sales, Service providers, software, Square, Square Deal Pro app, Stripe, transactions, Windows phones

March 4th, 2014 by Elma Jane

Setting the right price for your products or services can be challenging, particularly given the many outdated ideas and misconceptions surrounding pricing structure. The problem with conventional wisdom is that it’s not always wise to follow. Let’s consider four commonly held ideas about pricing and why they may be standing in the way of increased profit for business.

Price Drives Sales More Than Anything Else (Quantity/Price)

Price is definitely a key component in a customer’s having decision but managers overestimate its importance. A computer error caused prices for online retailer products to be displayed at wholesale rather than retail prices for a weekend. The company expected a huge surge in sales, but increase was only marginal, revealing that the company’s customers were more motivated by other factors, such as customer service and the quality of the products themselves, rather than price.

Managers remember the 10-15% of customers that balked at buying due to price instead of noting that 85-90% of customers did not have a problem with the price.

Price Reign Supreme

Finding the perfect price is not the Holy Grail. Small businesses would do better to treat price as function of the value they provide to customers. The greater the value, the higher the price that can be set. Value represents a customer’s return on spending. The benefits receives for each dollar paid. Customers don’t mind paying more if we get more in return, whether the benefits are real or perceived.

Pricing Structure Always Depends On Your Competition

Small businesses set their prices based on what their competitors are charging, but this approach may end up hurting the company. Instead, try to understand how your customers view your product and your brand. Pricing structure shouldn’t depend on your competitors prices unless you and your competitors offer the same bundle of benefits.

Spread Out Price Increases

People gripe about air travel, but many small businesses might benefit by taking a page out of the airline industry’s dynamic pricing playbook. Don’t treat prices as set in stone. Sell 2014 products and services at 2014 prices. Consumers are less likely to grumble about regular, incremental price adjustments than larger increases spread further apart specially, if they aren’t linked to any visible improvements. You’re also more likely to fall out of sync with market realities if you initiate significant price hikes at multi-year intervals.

If you haven’t raised prices since 2006, you might not be losing money, but you’re still losing margin. Your customers want you to stay in business, and you can’t do that if the times change but your prices don’t.

What are you offering that the competition isn’t? (Yours VS Theirs)

Are your locations or hours more convenient?

Do you offer training or other support?

Is same-day delivery available?

Is your sales staff more knowledgeable?

Marketing isn’t about paying people to buy from you by giving away margins. It’s about creating valuable perceived differences between you and your competition, in the eyes of buyers and charging buyers for those differences. Anything out of the ordinary gives existing and potential customers a reason to drop by or click.

Posted in Best Practices for Merchants, Credit card Processing, Small Business Improvement Tagged with: greater value, losing margin, losing money, online retailer, price, pricing, pricing playbook, pricing structure, products or services, profit for business, retail prices, small businesses

October 21st, 2013 by Elma Jane

Good time for merchants to start noting how their provider is handling card company fee changes as well as any future rate and fee changes, especially if your contract will expire in 2014.

October 2013 Rate and Fee Increase Notices

Visa, MasterCard, and Discover Credit card companies generally make rate and fee changes in the April and October time frame, although they have also made changes at other times of the year. Inevitably, some banks and merchant account providers seem to take advantage of the card company changes by increasing or adding their own mark-ups and by pointing too much of the blame at the card companies for the increases. This time around isn’t much different than others and merchants have sent me some rate and fee increase notices that go well beyond any card company changes.

In understanding how your provider is handling the latest card company changes, keep in mind that there are two important changes for October 2013:

Discover introduced a .25 cent increase to all transactions.

MasterCard introduced a .25 cent increase to certain transactions.

Below are two examples of recent notices on the October changes. Understanding the above .25 cent changes, how would you rate these providers?

Notice 1: 0.02 Percent + $0.02 Increase

“MasterCard, Visa and Discover typically evaluate the Interchange rates and fees twice per year most often in April and October. Based on recent changes as well as analysis from other network providers and vendors, the following changes to your merchant account are being implemented and will be reflected in your merchant statements for transactions processed beginning in October:

Interchange Plus Merchants: Percentage charged in excess of Interchange will increase by 2/100ths of a percent; and

Transactions Fees for all authorized transactions will increase by $0.02/transaction.”

Tiered Pricing Merchants: Qualified Rate for Visa, MasterCard and Discover will increase 2/100th of a percent;

Notice 2: 0.40 Percent Increase

“Effective October 1, 2013, the discount rates charged for your Visa, MasterCard, and Discover (as applicable) credit card and non-PIN (signature) debit card transactions will increase by 0.400%. We have increased these charges based on a variety of factors, including recent Card Organization changes and our own pricing considerations. This change will appear beginning with your October month-end statement you will receive in November.”

Your Statements Now go back to the statements you received in August and September or any notices you received via mail and read the notice your provider posted for these changes. Did the provider announce the actual change or did it state something quite differently? If it’s the latter, make sure it adjusts pricing accordingly. Also, make sure you monitor your rates, fees, and notices going forward to determine the best long-term course of action. If the provider needs you to extend your contract to correct its overcharges, then there are probably bigger pricing issues and more assertive action required by you to investigate your overall processing cost.

EMV Capable Terminals

To reduce fraud in the U.S., the card companies are introducing cards that have a chip as well as the current magnetic strip. Chip cards are prevalent outside the U.S. and EMV — Europay, MasterCard, and Visa — established the technical standards for processing them.

Brick-and-mortar merchants should understand about EMV.

Brick-and-mortar merchants should have equipment capable of processing EMV chip card transactions by October 2015 as certain fraud liability will shift from the bank that issued the card to the merchant. The equipment may be a terminal or a chip card reader attached to the terminal or POS system.

Certain credit card transactions will require a PIN number instead of a signature similar to PIN debit transactions today. Also, like the current PIN debit devices, each chip reader will need to be encrypted and the encryption code is processor specific. Therefore, if a merchant has an encrypted device, changing processors may be more costly as the encryption cannot simply be downloaded over the phone or Internet as is done with terminal reprogramming now. Instead, the encrypted device will need to go back to the provider for encryption or swapped with an encrypted device or a new encrypted device may be needed.

“EMV capable” can mean very little. In fact, if you have purchased or leased an “EMV capable” terminal it may simply mean that it has the slot or contactless connection to place the chip card and the terminal may have the capability to eventually be encrypted to actually process chip cards. However, the cost and time required to do so could be prohibited.

However, merchants should be planning to have equipment capable of processing chip card by October 2015. In fact, they should be planning to have the equipment capable of processing chip cards well ahead of the October 2015 — perhaps as early as late 2014, to ensure receiving it in time.

If a merchant’s existing terminal fails or is no longer supported, the merchant should inquire about EMV terminals as a replacement. However, ask if it comes fully encrypted and capable of actually processing an EMV transaction or if it will need the encryption later. Right now, the answer is likely that the terminal will need encryption later. If so, the merchant should obtain the time frame, process, and cost for enabling the terminal to actually process chip cards. This should be in writing. Remember, new terminals cost the provider around $150 to $250 and the encryption may be an extra $25 to $50.

Make sure you are comfortable with your provider and have negotiated the best processing cost before changing to encrypted EMV equipment.

Merchants do not need EMV terminals today and very few providers actually have terminals that can process an EMV chip card transaction right now.

Posted in Credit card Processing, Electronic Payments, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: authorized, banks, chip card, contactless, cost, credit-card, debit, devices, Discover, EMV, encrypted, fee, increase, interchange, MasterCard, merchant account providers, network, overcharges, percent, percentage, PIN, POS, pricing, processor, prohibited, rate, rate and fee, statements, terminal, transactions, visa

September 26th, 2013 by Elma Jane

5 Effective and Unusual Ecommerce Pricing Strategies

Most online retailers set pricing using the cost-plus or the value-based method. While these work well, there are several other ways to price products. Here are the five effective and unusual ways to price products on your ecommerce site.

1. Name your Price

This is a variation of the PWYW model, where the price has to exceed a threshold to get the product. This threshold price is not shown to shoppers to allow them to name their own price. This model has been successfully used in the travel industry, among others, where availability of airlines, hotels, and travel dates is based on the named price. This strategy can also work well for online retailers that are selling the following types of products.

Defined Price Ranges – Gifts site where NYP can be a guide to show products that are within that price range. NYP can be used as a guided selling tool to show gifts within a defined price range. The retailers can use price discrimination in combination with this strategy to increase their profits.

High Perceived Value – The perceived value of the product is much higher than the cost of procuring it, prompting the consumers to name a higher price. This can apply to books, music, and food products.

Imprecise Value – The products can be sold at a wide range of prices and still generate a profit. This could include one-of-a-kind products or art, where it is difficult to assess the value.

2. Pay What You Want

The pay-what-you-want strategy — PWYW — has been around for a while but has not been used heavily in the online retail space. A well-publicized offline success is Panera Bread restaurants, which has used this pricing strategy in a few of its restaurants. In the online world, Humble Bundle a music and game store has been using this too. In almost all cases, this strategy did not result in a significant profit or loss but led to a lot of free marketing. That is one of the big reasons for adopting this strategy in retail. There are several types of online retailers that can benefit.

Limited Categories – This strategy does not need to be implemented for your complete online store. It can be limited to a few products or a few categories that are the best fit.

Link to Charities – If your site shares revenue with charities, then PWYW can work, as customers often pay more to help the charity, increasing your share of the revenue in the process.

Offer an Incentive – You can also tie the PWYW strategy with an incentive…such as an additional product once the price exceeds a certain threshold, say $10. This threshold can be kept secret or made public on the site as a marketing tactic to encourage customers to pay more.

Proper Customers – If you believe that your customers are fair-minded and understand the value of your products, then PWYW might be effective.

3. Personalized Pricing

This is a relatively new strategy where specialized yield management algorithms are used to personalize the price offered to each visitor. With the rise of Big Data, most of the personalized pricing is done in real-time by analyzing a variety of factors like customer loyalty, device used by the shopper, customer preferences, history of purchases, and so on. This strategy is best suited for the following types of online retailers.

New Products Regularly – There are many products in the online store, with new products introduced regularly. This makes personalized pricing more effective as repeat customers see the new product and the new promotional pricing to reward their loyalty, or to encourage a first purchase for new ones.

Repeat Customers – Customers know that they will be rewarded with personalized pricing and promotions based on the loyalty to your site.

Wide Profit Margins – Products are sold with good margins, allowing the retailer to offer discounts at any time. For example if the product is sitting in a shopper’s cart for a few days, the retailer might offer a discount or drop the price to encourage the shopper to complete the purchase.

4. Flat Pricing

Flat pricing is a strategy where a limited number of prices are used for all product offerings, such as in dollar stores where every product is priced at one dollar. This strategy works well in the following situations.

Many Similar Products – Your site sells a wide variety of products that are priced nearly the same. In this scenario, flat pricing is simpler to manage, easier for consumers, and also results in greater profit.

Subscription Pricing – A new trend in online retail is subscription pricing, where customers can sign up for a flat price of, say, $25, $49, or $99 to receive a set of products every month.

5. Free

Several software companies are using free pricing successfully where the software is given away for free and customer is charged either for support or for premium features. A free pricing strategy can be an effective strategy for ecommerce merchants to attract customers by following the following guidelines.

Basic vs. Premium Versions – This strategy can be effective if the basic version is free and the customer pays for a premium version. The life insurance industry uses this approach, where a basic $10,000 insurance is often free. If even a small percentage of customers buy the premium offering, the insurer makes a profit.

Emphasize Consumables – Products that have durable and consumable components can benefit from a free pricing strategy, if customers can only buy both pieces from your site. For example, Gillette sometimes offers shaving razors for free since only Gillette shaving blades will work with its razors. On the other hand, it does not make sense to give away a laser printer for free because the printer paper and toner can be bought from anywhere.

Loss Leader – Use this strategy to offer products for free using the loss leader model. Customers come to the site to get the free products and once they are on the site, you can up-sell or cross-sell them other products.

Seasonal Products – If your site sells seasonal products, then this strategy can drive traffic. For example, a retailer could give away free U.S. flags during the July 4th holiday to generate traffic, while also pushing other non-free July 4th merchandise.

Posted in e-commerce & m-commerce, Electronic Payments, Travel Agency Agents Tagged with: Airlines, e-commerce, hotel, online store, pricing, subscription, travel industry