March 7th, 2017 by Elma Jane

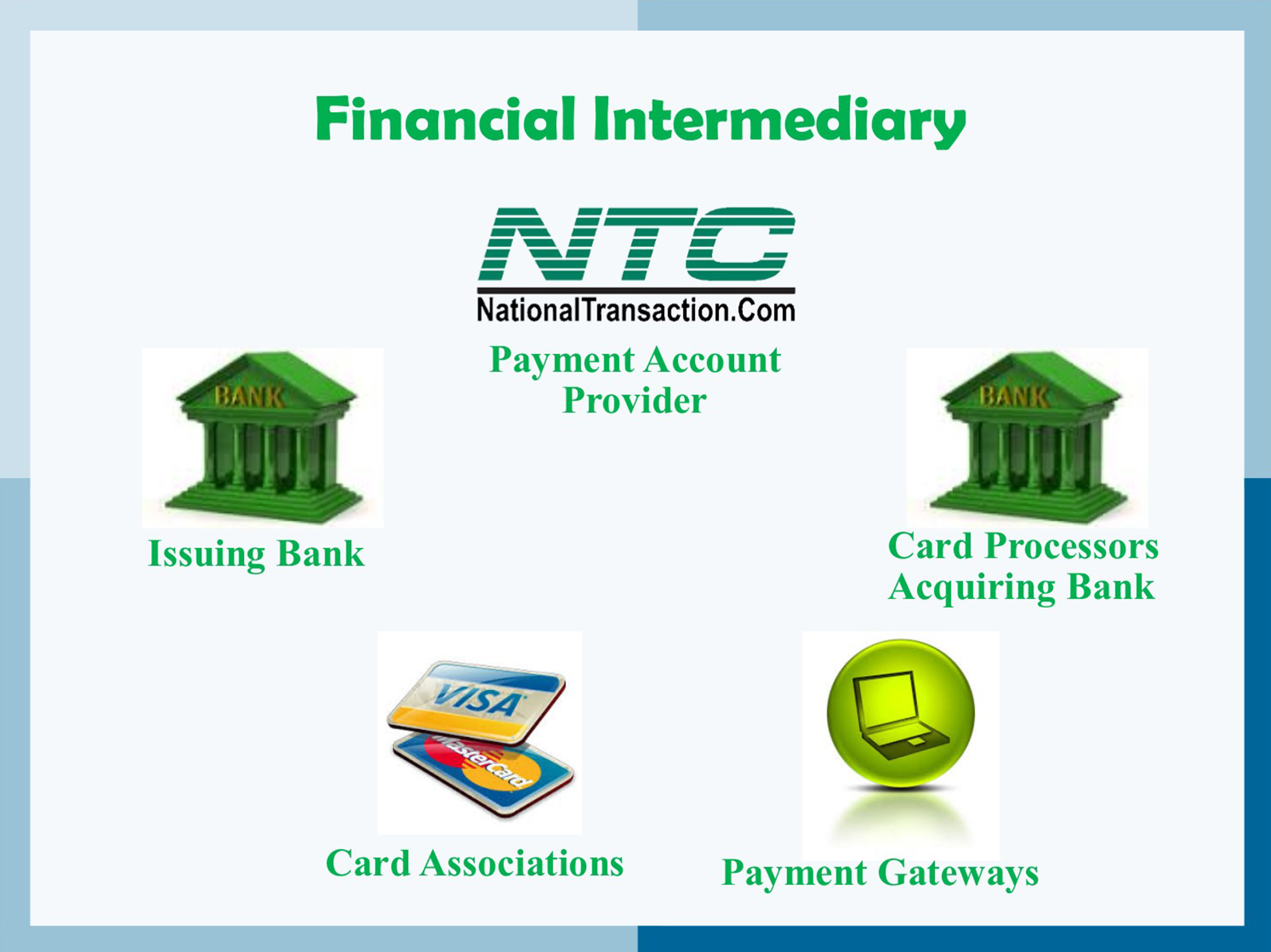

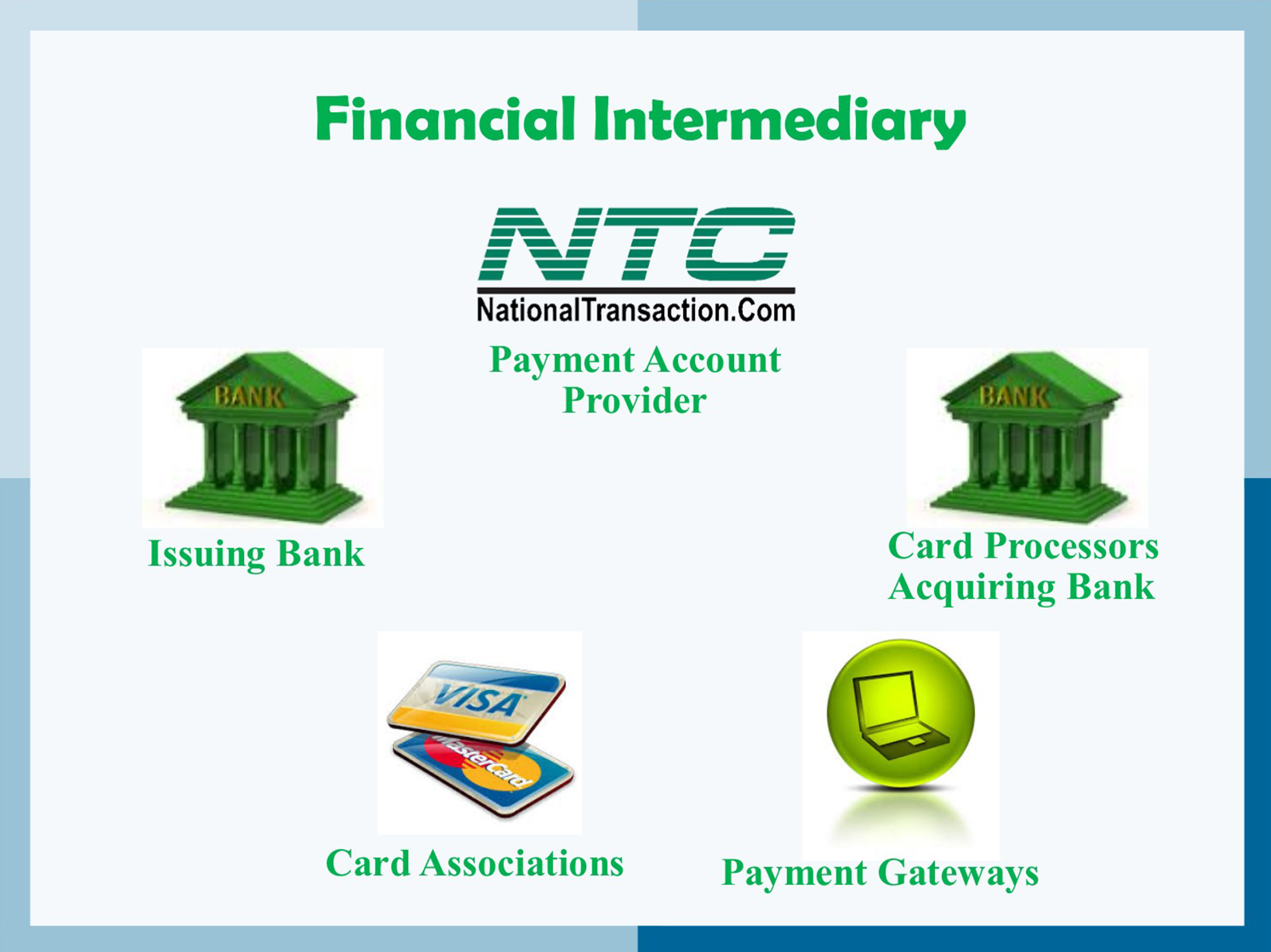

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

January 18th, 2017 by Elma Jane

The cost of accepting card payments is driven primarily by the interchange. When you settle your transactions each day; payment network routes them to the respective card associations (Visa, MasterCard, Discover, and UnionPay) and debit networks through the interchange. Card associations and debit networks establish the rules and manage the interchange of all transactions; for which they charge fees to offset their costs. Interchange fees are paid at the time the transaction is exchanged.

Although interchange fees are applied to all credit card processors equally, they fluctuate in amount, based on a variety of factors. Card associations quote the lowest rate for a transaction, assuming that a number of requirements (which vary according to the card type, the type of business accepting the card payment, and the transaction channel) are met. Transactions that meet all of the requirements for your industry are charged the “qualified rate.” If one or more of these requirements are not met, the transaction is categorized at a more expensive interchange level, known as a Mid-Qualified Non-Qualified the most common “downgrades”.

Some common causes of downgrades include manually entering or requesting voice authorization for a significant number of transactions rather than use a POS device, or you routinely settle

transactions more than 24 hours after they are authorized.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card associations, card payments, debit networks, interchange, payment network, transactions

May 6th, 2014 by Elma Jane

Which fee structure works best remains unclear despite the recent high-profile data security breaches that are emphasizing the need for security measures. Acquirers charge fees – or not – based on what’s best for their business model and their security objectives

Some charge merchants that comply, others charge merchants that fail to comply and a few charge both. Some Independent Sales Organizations (ISOs) don’t charge merchants a fee for helping them comply with the Payment Card Industry data security standards (PCIS DSS).

If there is any trend, it’s that more banks are finding that some sort of funding is necessary to run a program that gets any results. That funding covers costs for security assessments and compliance assistance as well as internal resources for acquirers. When it comes to covering those costs and creating incentives for compliance, no one fee structure is ideal.

Non-compliance fees encourage merchants to comply so they can save money, but the fees may not accomplish that. Unless you charge exorbitantly, it’s not going to have the effect you want it to have, and by the time you charge that much, the merchant’s just going to move to a different ISO.

ISOs charging non-compliance fees often claim the fee revenue goes into an account designated for use in case of a breach. Non-compliance fees can also reward acquirers for doing nothing to increase compliance. You get this situation where a bank has a revenue stream. Their objective is not to increase the revenue stream but to increase compliance, when they increase compliance, the revenue stream goes down.

It is recommended to some acquirers that they consider charging merchants fees for doing things like storing card data, which could be checked with a scanning tool. Merchants that do store data or fail to run the scan would be charged a fee. That is something that could really decrease risk, because if you’re not storing card data, even if you are breached, there’s nothing to get.

Simplifying the compliance verification process, by making assessment questionnaires available on its merchant portal and by teaching merchants about PCI, will minimize the potential impact of fraud by increasing compliance, which saves the company money in the long run versus a more laissez-faire approach of fees without education and compliance tools.

It’s more important to educate the merchant, it’s the spirit and intent of PCI-DSS supported by the card associations. Visa and MasterCard support it because of the severe impact of a breach or other data compromise, not as a revenue source.

ISOs and other players in the payments chain that do not work to help merchants comply are also putting themselves at risk. Breached merchants may be unable to pay fines that come with a data compromise, potentially leaving ISOs responsible for paying them. Merchants that go out of business because of a data breach also stop providing the ISO with revenue.

Plus, when merchants ask why they’re being charged a non-compliance fee, point them to the questionnaire and explain that they’ll stop being charged as soon as they demonstrate they comply with PCI.

Posted in Best Practices for Merchants, Credit Card Security, Merchant Account Services News Articles, Payment Card Industry PCI Security Tagged with: card associations, card data, compliance, compliance fee, data, data security standards, ISOs, MasterCard, Merchant's, Payment Card Industry, portal, security breaches, visa

March 31st, 2014 by Elma Jane

A payment processor is a company often a third party appointed by a merchant to handle credit card transactions for merchant acquiring banks. They are usually broken down into two types: Back and Front-End.

Back-End Processors accept settlements from Front-End Processors and, via The Federal Reserve Bank, move the money from the issuing bank to the merchant bank.

Front-End Processors have connections to various card associations and supply authorization and settlement services to the merchant banks’ merchants. In an operation that will usually take a few seconds, the payment processor will both check the details received by forwarding them to the respective card’s issuing bank or card association for verification, and also carry out a series of anti-fraud measures against the transaction.

Additional parameters, including the card’s country of issue and its previous payment history, are also used to gauge the probability of the transaction being approved.

Once the payment processor has received confirmation that the credit card details have been verified, the information will be relayed back via the payment gateway to the merchant, who will then complete the payment transaction. If verification is denied by the card association, the payment processor will relay the information to the merchant, who will then decline the transaction.

Modern Payment Processing

Due to the many regulatory requirements levied on businesses, the modern payment processor is usually partnered with merchants through a concept known as software-as-a-service (SaaS). SaaS payment processors offer a single, regulatory-compliant electronic portal that enables a merchant to scan checks “often called remote deposit capture or RDC”, process single and recurring credit card payments (without the merchant storing the card data at the merchant site), process single and recurring ACH and cash transactions, process remittances and Web payments. These cloud-based features occur regardless of origination through the payment processor’s integrated receivables management platform. This results in cost reductions, accelerated time-to-market, and improved transaction processing quality.

Payment Processing Network Architecture

Typical network architecture for modern online payment systems is a chain of service providers, each providing unique value to the payment transaction, and each adding cost to the transaction. Merchant>Point-of-sale SaaS> Aggregator >Credit Card Network> Bank. The merchant can be a brick-and-mortar outlet or an online outlet. The Point-of-sale (POS) SaaS provider is usually a smaller company that provides customer support to the merchant and is the receiver of the merchant’s transactions. The POS provider represents the Aggregator to merchants. The POS provider transaction volumes are small compared to the Aggregator transaction volumes. The POS provider does not handle enough traffic to warrant a direct connection to the major credit card networks. The merchant also does not handle enough traffic to warrant a direct connection to the Aggregator. In this way, scope and responsibilities are divided among the various business partners to easily manage the technical issues that arise.

Transaction Processing Quality

Electronic payments are highly susceptible to fraud and abuse. Liability to merchants for misuse of credit card data creates a huge expense on merchants, if the business were to attempt mitigation on their own. One way to lower this cost and liability exposure is to segment the transaction of the sale from the payment of the amount due. Some merchants have a requirement to collect money from a customer every month. SaaS Payment Processors relieve the responsibility of the management of recurring payments from the merchant and maintain safe and secure the payment information, passing back to the merchant a payment token. Merchants use this token to actually process a charge which makes the merchant system fully PCI-compliant. Some payment processors also specialize in high-risk processing for industries that are subject to frequent chargebacks, such as adult video distribution.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Check Services, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Payment Card Industry PCI Security, Point of Sale, Visa MasterCard American Express Tagged with: aggregator, aggregator transaction volumes, back end, card associations, card data, chargebacks, credit card transactions, electronic portal, front end, front-end processors, issuing bank, merchant, merchant bank, network architecture, online payment systems, payment gateway, payment processing, payment processor, payment transaction, pci-compliant, point of sale, POS, SAAS