September 21st, 2016 by Elma Jane

PCI compliance applies to any company, organization or merchant of any size or transaction volume that either accepts, stores or transmits cardholder data.

Any merchant accepting payments directly from the customer via credit or debit card must be Compliant. The merchant themselves are therefore responsible for becoming Compliant, as the deadline for the merchant becomes overdue.

Understanding and knowing the details of Payment Card Industry Compliance can help you better prepare your business. Because failing and waiting to become compliant or ignoring them, could end up being an expensive mistake.

The VISA regulations have to adhere to the PCI standard forms as part of the operating regulations. The regulations signed when you open an account at the bank. The rules under which merchants are allowed to operate merchant accounts.

The Payment Card Industry Data Security Standard (PCI DSS) is a proprietary information security standard for organizations that handle branded credit cards from the major card schemes including Visa, MasterCard, American Express, Discover, and JCB.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, cardholder, compliance, credit, customer, data, debit card, Discover, jcb, MasterCard, merchant, Payment Card Industry, payments, PCI, transaction, visa

July 21st, 2016 by Elma Jane

Always ask for the card security codes:

CVV2 for Visa

CVC2 for MasterCard

CID for Discover and American Express.

Always use the Address Verification Service (AVS) and only process sales after receiving a positive AVS response.

Avoid using voice authorizations, unless absolutely necessary.

Billing descriptor must set up properly and shows your phone number. Customer can contact you directly if there is an issue,

Consider using the associations’ 3-D secure services:

Verified By Visa

SecureCode by MasterCard

A 3-D transaction confirmation proves card ownership and protects you from certain types of chargeback. An additional layer of security for online credit and debit card transactions.

Inform your customers by email when a refund has been issued or a membership service cancelled. Notify them of the date the refund was processed and provide a reference number.

Make available customer support phone number and email address on your website so that customers can contact you directly. You need to meet this requirement before opening a merchant account.

Make it easy for your customers to discontinue a recurring plan, membership or subscription. Have a no-questions-asked policy.

Notify your customers by email of each transaction and indicate that their cards will be charged.

Obtain a confirmation of delivery for each shipment.

Process refunds as quickly as possible.

Secure an authorization approval for every transaction.

Secure customers’ written or electronic signatures, for recurring payments or monthly fees. Giving you express permission to charge their cards on a regular basis.

Terms and conditions must be clearly stated on your website. Customers must acknowledge acceptance by clicking on an Agree or a similar affirmative button.

Transaction amount must never exceed the authorized amount.

You are required to reauthorize the transaction before settling it if an authorization approval is more than seven days old.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Merchant Services Account Tagged with: card, chargeback, credit, customer, debit, merchant, merchant account, online, sales, Security, service, transaction

July 19th, 2016 by Elma Jane

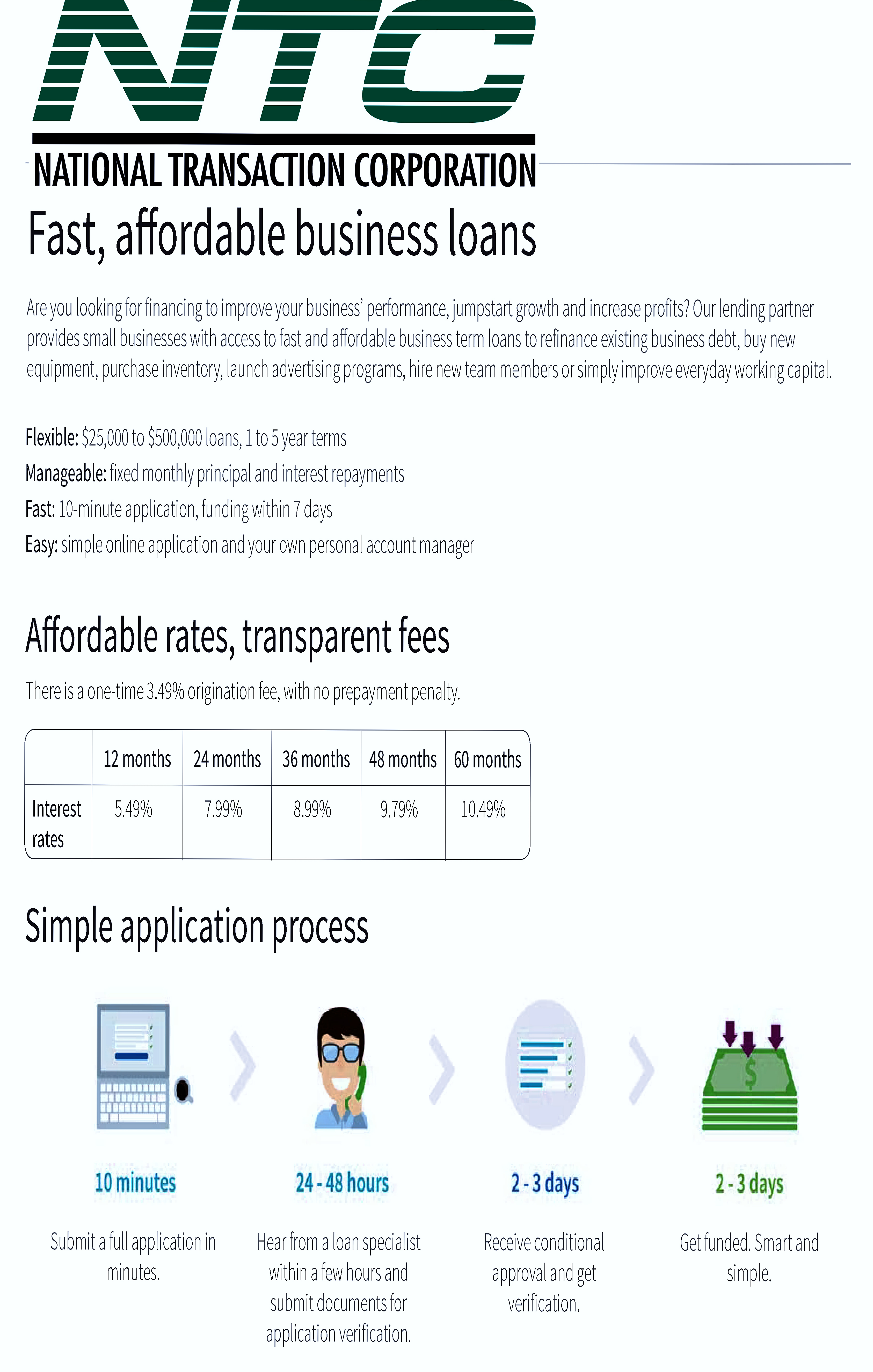

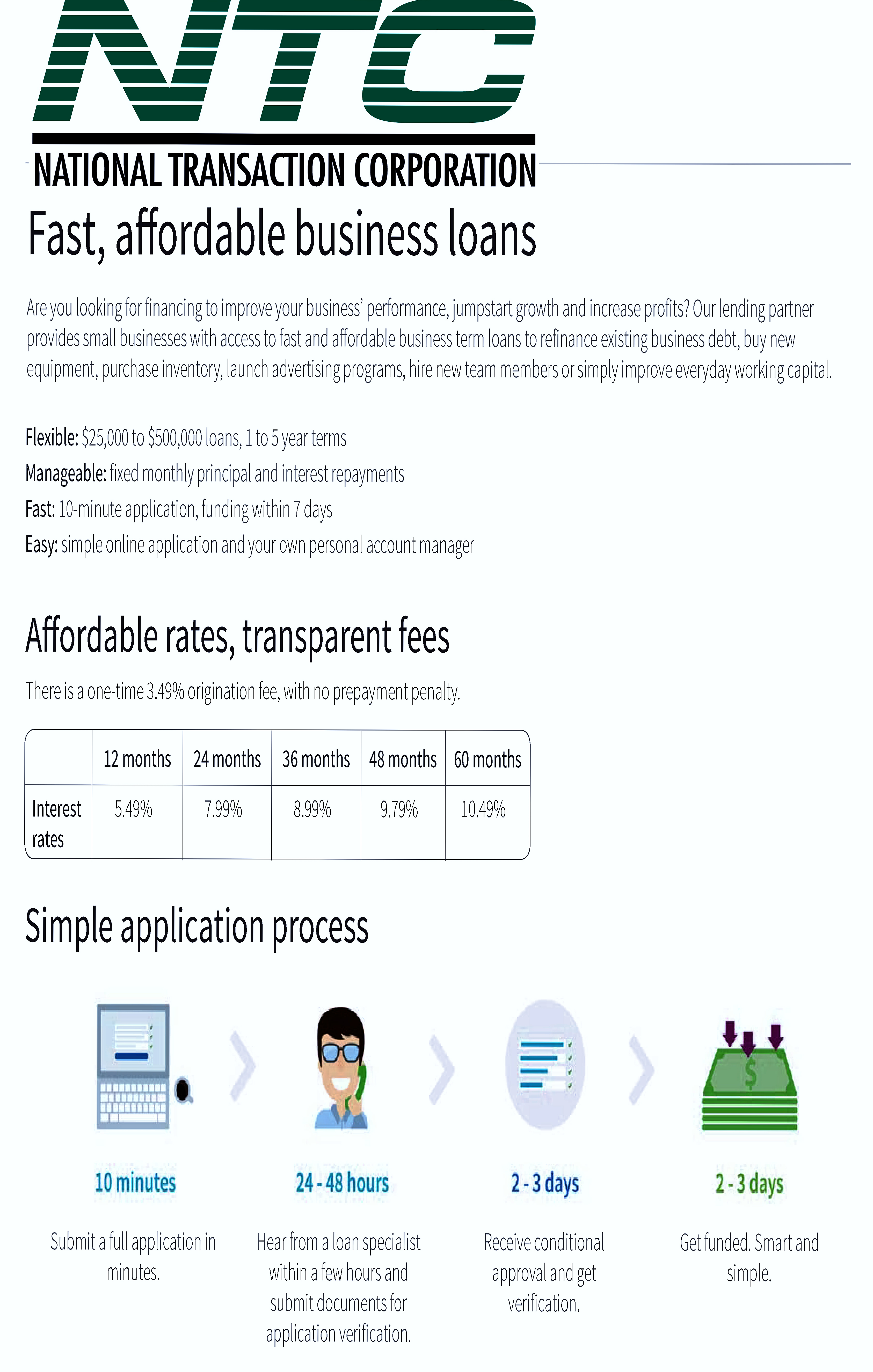

Here are some of the Common Business Loan Fees:

Application Fee – is a fee charged to cover the costs of processing and assessing your loan application.

Bank Wire Fee – When borrowing a loan, lenders commonly wire the money to your bank account via ACH, because the banks need to talk to each other and ensure the money is going to the right place and that no fraud is going on.

Check Processing Fee – ACH transfers are commonly used to collect periodic repayments from the debtor’s bank account. Some lenders offer the option of paying by check, but you’ll have to pay a fee for the extra cost involved.

Closing Cost – not to be confused with closing fees, encapsulate all the fees charged for processing a loan, including origination/closing fees, processing fees, referral fees, and/or packaging fees.

Draw Fee – similar to an origination fee, but is applicable instead for lines of credit.

Guarantee Fee – is charged on all SBA loans above $150K. Guarantee fee is charged to protect against credit-related losses in the mortgage portfolio.

Late Payment Fee – Missing a payment deadline can result in a late fee. A late payment may have an affect on your personal or business credit score.

Origination Fee – an up-front fee charged for processing a new loan application. Prepayment

Penalty – Is a borrower, a bank or mortgage lender agreement that regulates what the borrower is allowed to pay off and when.

Servicing and Maintenance Cost – fees charged to cover the costs associated with collecting payments, maintaining records, following up on delinquencies and any other costs associated with maintaining a term loan or line of credit.

Business loans are available in different types, from merchant cash advances to lines of credit. The most effective way to get the best deal on a business loan is to be educated and know that Fees are Negotiable.

Posted in Best Practices for Merchants, Financial Services Tagged with: ach, bank account, check, credit, fee, fraud, loan, payment

July 12th, 2016 by Elma Jane

Interchange is where transactions are submitted for payment from the Acquirer or Merchant Processor to the Card Issuer or Debit Network. It also represents the fees paid by the merchant acquirer to the Card Issuer.

At the time the transaction is exchanged fees are paid and vary based on processing method utilized. It is more expensive to process a hand-keyed transaction than a card-swiped transaction.

Several rates may apply to your transactions, depending on your method of processing each transaction and the interchange qualification that is assigned to each transaction by the Card associations for processing transactions.

Rate qualification criteria: The card associations consider the card product used in the transaction, how the transaction data is entered, the time of settlement versus time of authorization.

Interchange Category Based on Card Type: Credit, Debit, and Rewards purchasing.

Industry Type: Retail or E-commerce.

Qualification Elements: Swiped card or Key entered.

When you settle your transactions each day, Acquirer or Merchant Processor like NTC routes them to the Card Associations (Visa, MasterCard, Discover) and debit networks through Interchange.

Visa, MasterCard, Discover (Card Associations and Debit Networks) establish the rules and manage the Interchange of all transactions.

Posted in Best Practices for Merchants Tagged with: card, card-swiped, credit, debit, e-commerce, merchant, payment, processor, transactions

June 13th, 2016 by Elma Jane

Lines of Credit – is for Businesses with an inconsistent cash flow, businesses that only need to borrow a small amount of capital, businesses that use invoices.

Different types of lines of credit:

Cash Account the most basic line of credit – which you can access when you’re in need of capital, whether to make a large purchase or cover a temporary gap in cash flow. This form of financing is that the money is always available when it’s needed, and you only have to pay interest on the amount that you borrow.

Inventory Line of Credit – specifically intended for purchasing inventory.

This kind of loans give the merchant, two advantages:

First, you can purchase inventory wholesale.

Second, purchasing inventory won’t take a large amount out of your cash flow because you’ll be paying in increments instead of one lump sum.

Invoice Financing – basically, this is a line of credit where invoices are the collateral.

Personal Loans Used for Business: Startups and young businesses, merchants who have excellent personal credit.

If your business is new to qualify for a business loan, consider using a personal loan. Personal loans are term loans that can be used for a number of purposes.

Short Term Financing: Is for young businesses experiencing rapid growth.

Short term financing covers merchant cash advances and short term loans.

Term Loans: Is for Businesses that need cash to fund one-time expenses like equipment purchase/real estate or expanding a business. Term loans are basic, everyday loans. The merchant receives the capital in one lump sum and repayments are almost always monthly.

For more information about Loans/Financing give us a call at 888-996-2273

Posted in Best Practices for Merchants, Merchant Cash Advance Tagged with: cash advances, credit, financing, loans, merchant

June 3rd, 2016 by Elma Jane

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 15 years of experience, National Transaction offers a variety of electronic payment services and technology for businesses.

Our services include:

Currency Conversion, credit, and debit card processing, e-commerce and gateways, electronic checks, gift and loyalty card programs, mobile processing, cash advances and loans/funding program. We also have NTC e-Pay and MediPaid.

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, Nothing To Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Travel Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Medical Healthcare, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Small Business Improvement, Travel Agency Agents Tagged with: cash advances, credit, Currency Conversion, customers, debit card, e-commerce, electronic checks, electronic payment, funding, funds, gateways, loans, Loyalty Card, merchants, Mobile Processing, service

May 25th, 2016 by Elma Jane

No one likes waiting in a checkout line, the faster your checkout line moves, the faster you are able to turn more sales. Quick checkout lines lead to increased sales and higher customer satisfaction .

Cut your line and increase your sales by:

Upgrading your POS – if you haven’t upgraded your POS, do it now. Choosing a modern POS that is simple and easy to use like the iCT250, offers a smart, effective and highest security payment experience designed for merchants and easier for employees to understand.

Multiple Checkout – multiple checkout counters may be necessary depending on the size of your store. In a high volume situation such as the holiday season, more opportunities for checkout may be beneficial.

Accept A Variety of Payments – having alternative forms of payment by accepting credit, debit, EMV/NFC and mobile wallets, will open the door for a variety of customers, but also allow the customer to pay the way they want in a most convenient way.

Train Employees – most importantly, train your employees on how to use your new POS system. Employees need to be the expert on POS so that they are able to assist customers who may need help conducting their transaction.

Posted in Best Practices for Merchants Tagged with: credit, customer, debit, EMV, merchants, mobile, mobile wallets, nfc, payment, POS, sales, Security, transaction

May 9th, 2016 by Elma Jane

Preventing double refunds depend on the timing of the chargeback. It is a bit challenging, the key lies in attention to detail.

A chargeback may already exist for the transaction when a customer say they just spoke to their bank. Merchants must pay attention to this big clue.

There are different time limits for resolving disputes before they become actual chargebacks, depending on the issuing bank.

- If customers indicate they did contact their bank, merchants need to call the issuing bank to determine if a case number has been assigned to the transaction dispute.

- If there is a case number that has been assigned, the merchant can disregard the refund request.

If a case number has not been assigned, merchants need to inform the bank that a refund has been initiated and a chargeback is not necessary.

Preventing Double Refunds Before Chargebacks are Filed

Provide prompt refunds to customers when they are warranted.

- Estimate when the funds will be available.

- Let customers know that a refund has been issued.

- Take care to ensure the credit isn’t process as a debit.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, credit, customer, debit, merchants, refunds, transaction

May 6th, 2016 by Elma Jane

A data breach is any instance in which secure data information has been released or stolen intentionally or unintentionally. The organization that exposed or lost your information will notify you. The steps you should take depend on the type of information that was lost or stolen. In general, you may choose to do one or more of the following:

- Monitor all bank and other accounts for suspicious activity.

- Change all passwords, PINs, or user names associated with compromised accounts.

- Order a copy of your credit report.

- Place a fraud alert or credit freeze on your credit file.

Posted in Best Practices for Merchants, Credit Card Security, Travel Agency Agents Tagged with: accounts, bank, credit, data, data breach, fraud

April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction