March 7th, 2017 by Elma Jane

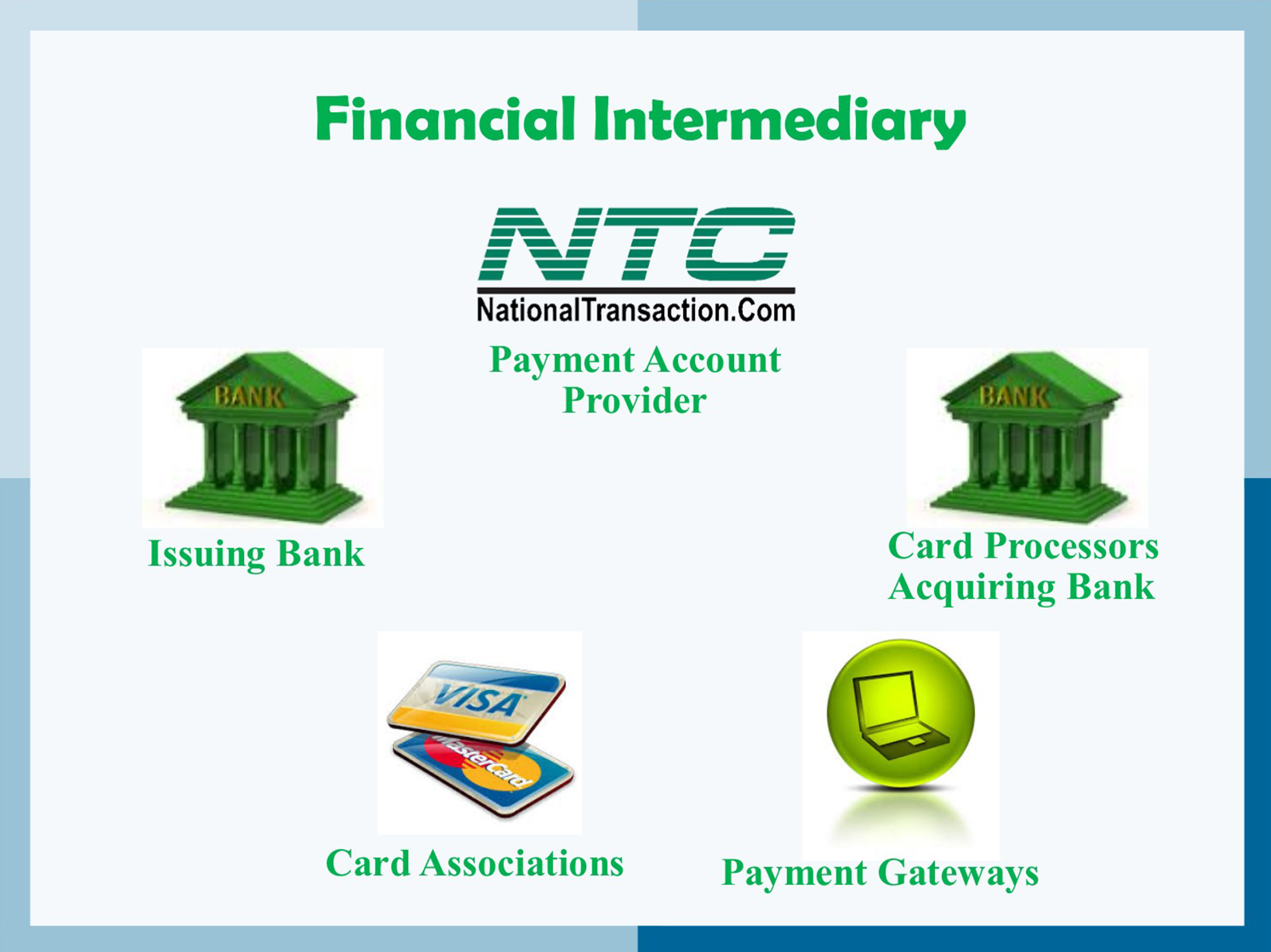

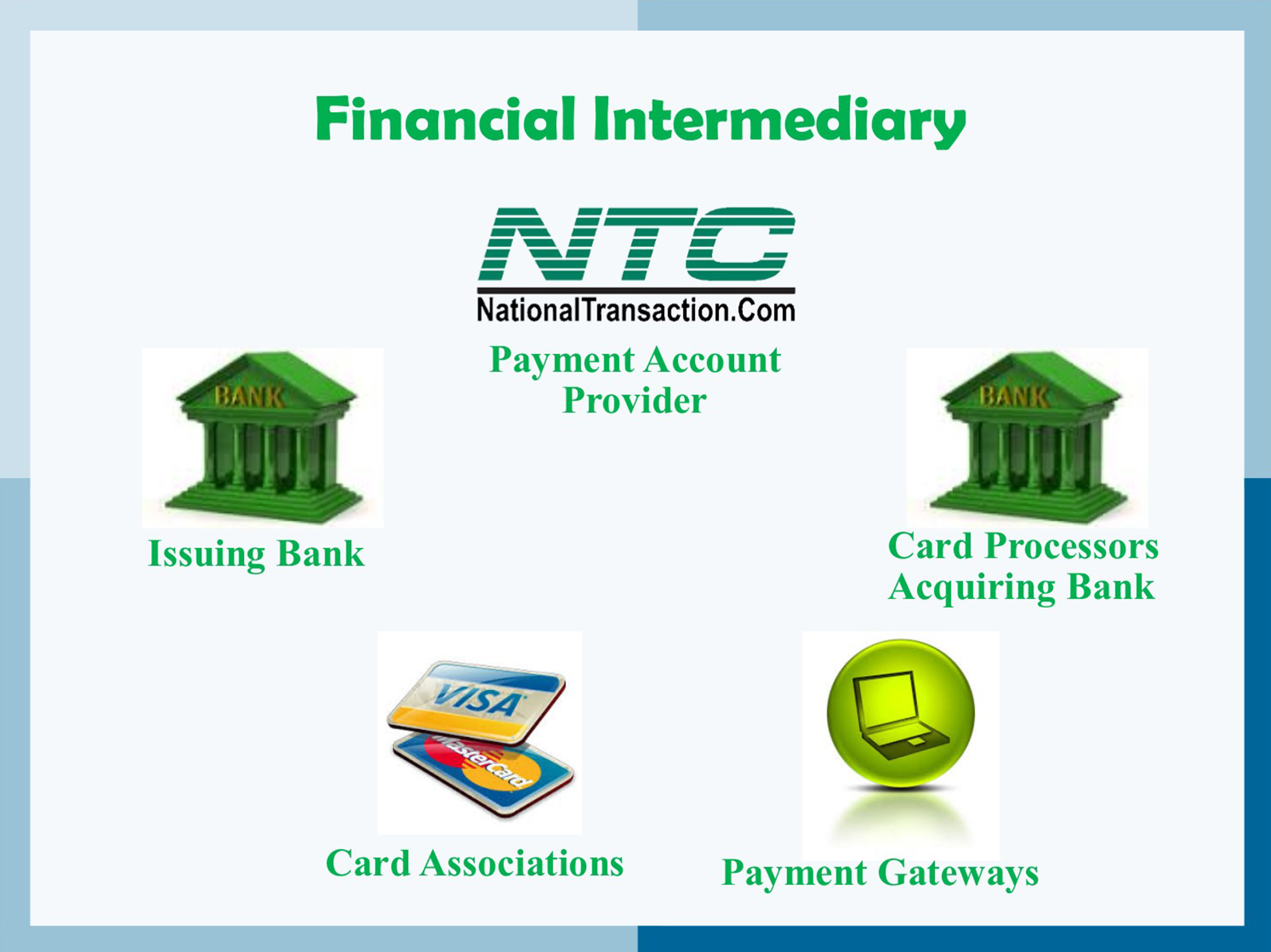

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

February 16th, 2017 by Elma Jane

Chargeback Cycle

A chargeback is also known as a reversal; a credit card transaction that is reversed to a merchant because of the customer or customer’s bank disputes charges. Other reasons include fraud, credit card processing errors, authorization issues and non-fulfillment of copy requests. There’s an assigned reason code for every chargeback. Reason codes may vary by VISA and MasterCard.

How does the chargeback cycle work?

1. A customer files a complaint to card-issuing bank.

2. The bank sends disputed transaction (chargeback) to acquirer.

3. Acquirer receives chargeback and resolves it or forwards to the merchant for documentation.

4. Merchant accepts chargeback or addresses issues and resubmits to Acquirer.

5. Acquirer represents the chargeback to the issues once acquirer agrees the merchant has properly addressed it.

6. The issuer resolves the dispute by reposting to the cardholder’s account.

7. The cardholder receives dispute information and may be rebilled or credited.

Every merchant that offers credit card processing to its customers should be concerned about chargebacks to their merchant account.

Lower your risk of chargebacks by following the tips below:

Verify card logos, credit card numbers, identification, customer signature and check the expiration date.

Call for voice authorization if the card stripe doesn’t work or if the terminal is down or cannot authorize.

Authorize every transaction.

Be sure your customers are familiar with your return or exchange policy.

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, merchant, merchant account, transaction

January 31st, 2017 by Elma Jane

Selecting a Payment Provider

Selecting electronic payments provider for your business is critical. NTC believes that the process starts with an honest assessment of your business and the types of credit card processing options it requires. (Retail or e-commerce, Card Present or Card-Not-Present)

Card present transaction is the most common type of account. Card-Not-Present (CNP) is a different type of account if you run a MOTO (mail order telephone order) or Internet operation.

Here are some points to keep in mind in selecting your electronic payments provider:

Referrals from fellow business owners and checking out payment providers online.

Evaluate products and services as well as cost to determine which electronic payments provider offers the biggest savings for your business.

Make sure the deals you’re considering include all the features and services you need and none that you won’t use.

Keep upgrade options in mind.

Look for 24/365 support and discuss customer service support.

Read the fine print in your contract.

The merchant account provider’s reputation is important, so find out how long they’ve been in business and their reputation in the industry.

NTC has over 20 years’ of Bankcard History. Helping businesses of all sizes for over 25 years in the industry. Call us now 888-996-2273 and tell us all about your business needs and requirements and we’ll put together a package of products and services that will best serve your credit card processing needs. There are a variety of solutions, so it’s important to focus in on those that directly address your needs.

Posted in Best Practices for Merchants Tagged with: cnp, credit card, customer, e-commerce, electronic payments, internet, merchant account, online, payment provider, payments, retail, transaction

January 25th, 2017 by Elma Jane

PIN vs. Signature: What’s the Difference?

PIN Debit – PIN transactions are routed through what are known as (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

Signature Debit – Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, debit card, electronic, electronic funds transfer, online, payment, PIN, POS, terminal, transactions

December 27th, 2016 by Admin

Merchant aggregator is an entity that can run many transactions through a single merchant account, an opposite to the traditional merchant account since you’re the sole owner.

Preferred for a smaller business because its not intended as a long term scalable solution to accepting payments.

For businesses that want to expand their processing needs, traditional merchant account will outgrow an aggregator, since the goal is for a business to grow, but it will always come to what’s best for individual business.

While you have the pros of quick application process and instant approval there are a lot of cons to check before getting an aggregator account.

CONS of an aggregator account:

CUSTOMER SERVICE – aggregators are hard to get hold of.

FEES – fixed fees .

FREQUENT HOLDS and DELAY OF FUNDS – aggregators hold funds 24-48 hours before depositing, while longer holds occur 30 days. (A client of ours who signed up with an aggregator came back in tears and wants to open her merchant account with us again because her funds was held with the merchant aggregator. She then promised will not leave and stay for life with NTC).

LOWER LIMITS – processing limits lower, annual limit of $100k.

PROS of a Traditional Account:

CUSTOMER SERVICE – 24/7 technical support.

FUNDS – next day funding, no frequent account holds.

FEES – tailored to your business needs.

LIMITS – varies by financial strength and business

Setting up a Merchant Account? Call us now! 888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customer, fees, funds, merchant, merchant account, payments, transactions

December 21st, 2016 by Admin

Ways to Prevent CHARGEBACK:

Provide Receipts for every single transaction. Receipt serves as a good reminder to the purchase they make and decreases the likelihood of a charge back. Have the conditions of sale written on the receipt

Be clear about refunds, returns and cancellation policies – include refund, return and cancellation policy on your website.

Make sure charge descriptions are clear. Use dynamic descriptors – with dynamic descriptors, you can include specifics like the product purchased, business name, business location and contact information. Include a number as part of the charge description.

Provide accurate descriptions of products and services – accurate product descriptions are particularly important for online ecommerce where customers often dispute transactions because the product they received is not as it was described online.

Get signed proof of delivery products – especially if you’re an online ecommerce vendors that ships products regularly.

Communicate with customers about renewals – if your customer accounts are set to automatically renew, make sure you notify those customers of their renewal months leading up to the renewal day.

When a cardholder contacts their credit card-issuing bank and asks for a refund on a transaction for a purchase or service made on their card is called chargeback.

Most Common Reasons for Chargebacks:

Point-of-sale processing errors

Customer disputes like, customer doesn’t recognize the charge, customer claims they didn’t receive the item they ordered.

Fraud, or potential fraud (customer claims the transaction is fraudulent – the purchase was made with a stolen card).

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, ecommerce, fraud, online, point of sale, transaction

November 29th, 2016 by Elma Jane

GET THE LOWEST CREDIT CARD TRANSACTION RATES & FEES BY DOING THE FOLLOWING:

1. Use newer POS systems to reduce credit card fees.

2. Find out what percentage of your gross sales go toward credit card rates.

3. Perform a statement review at least annually.

Any time a customer uses a credit card to purchase services and goods the merchant pays various rates and fees processing those transactions. Most of these fees go to the bank issuing the credit card as they take on the bulk of the risk in credit card transactions.

Visa, American Express and Discover own the network on which these credit card transactions are processed on and they receive part of the fee and percentage rate as well as establish these rates and fees. Finally the bank that provides merchant account services gets part of these rates and fees.

To a small business 2, 3, or even 4% might not sound like much but when these fees are on the gross total of sales they can be significantly higher than originally thought.

For this reason it’s a great idea to assess your merchant account statement to see if rates are in line and that your most frequently used cards and transaction types are getting the best rate possible. By going over your statement, you can see exactly what you pay per transaction and get details about your most common transaction types and credit card used to get the process going.

If you are unfamiliar with what these rates and fees mean on your statement companies like National Transaction can perform the review for you. Free of charge.

Ultimately the best thing to have is a merchant account service provider that will take the time to go over your business with an eye lowering your rates and fees. The savings can be significant. As a business grows it changes and there should be an ongoing strategy at maintaining the best processing rates and fees possible. Today with so many different credit card types, like rewards cards, airline miles programs and more it can pay off to check once or twice a year.

For FREE Rate Review give us 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, credit card, customer, merchant, merchant account, POS, rewards cards, service provider, transaction

November 28th, 2016 by Elma Jane

Payment acceptance is key to making more money.

Let’s talk about your money, and how to make more of it. Today money is taking on a new form. It’s digital, it’s electronic and it’s everywhere and anywhere 24/7/365.

Payment acceptance is key to making more money. You don’t make more money by not accepting a transaction, and making the experience convenient and safe to your customer can bring loyalty.

Let’s break down a transaction.

Cash, but that would mean that the customer has to be in front of you. You could take checks, those are safe to mail, but then you don’t have your money until you drive to the bank and cash or deposit the check.

So how do we easily and securely transfer funds for a transaction? The answer lies in digital or electronic payments. Accepting credit cards, debit cards, ebt cards or even gift & loyalty cards and electronic checks. These provide secure and convenient ways to complete transactions for your customers. If you want to make more money, make it easy for customers to spend it while making it faster for you to receive it. That’s where a merchant account comes in.

A merchant account allows you to deposit funds directly into your bank account in as little as a few hours. Whether the customer swipes their card into your smartphone, calls it in over the phone or keys it into your web site, just having a merchant account can be a huge advantage over competitors.

It allows you to conduct transactions in more ways than cash or checks alone. Transactions are recorded automatically and can easily be reconciled for both customer and merchant. Most importantly it widens the opportunities to conduct sales to the widest customer audience possible.

No matter what you sell or how you sell it, the sale is only complete once the funds are transferred from one party to the other.

It’s important to recognize your missed opportunities. Could accepting electronic payments help increase your revenue stream? We’re here to help you make more money, let us show you the many ways we can do just that. Let’s talk, 888-996-CARD (2273)

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Mail Order Telephone Order, Mobile Payments, Travel Agency Agents Tagged with: credit cards, customer, debit cards, ebt cards, electronic checks, electronic payments, gift & loyalty cards, merchant account, payment, smartphone, transaction

October 14th, 2016 by Elma Jane

Merchant Account is a LOAN!

Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for processors or payment providers; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Posted in Best Practices for Merchants, Financial Services, Travel Agency Agents Tagged with: bank, credit, credit card, customer, loan, merchant, merchant account, payment, payment providers, processors

October 13th, 2016 by Elma Jane

Code 10 merchants first line of defense!

How to use “Code 10”

- Call the voice authorization phone number provided by your Merchant Provider. This number can be found on the sticker on your terminal or call your Merchant Service provider and ask to be transferred to the Voice Authorization department.

- Choose the prompt for “Code 10”. Never call a phone number for the card issuing bank provided by a customer; or let the customer call the card issuing bank for you to obtain an authorization code. Do not accept an authorization code given to you by a customer. Authorization code obtained from your Authorization Center can be verified; but not the one from other sources.

- Provide the cardholder name, billing address and shipping address, if the order is a mail order, phone or Internet sale. The representative will attempt to verify the information you provide with the bank that issued the card to the customer.

- The representative will attempt to verify the cardholder information during your call; the data will be forwarded to an investigator for further research and will attempt to contact you within 24 – 72 hours with the current status or results of the investigation.

- Request another form of payment other than a credit card if an authorization request is declined. Do not split a declined transaction into smaller increments to obtain an authorization.

- Obtain an authorization code for the full amount of the sale. Always obtain the authorization code before shipping the merchandise.

Whether you are in a face-to-face environment, or via mail, phone or Internet that sell goods and services you can employ a “Code 10” authorization to verify additional information on a suspicious transaction.

You may be prompted by your processing terminal to call for voice authorization of the charges (CALL AUTH), or you may simply not feel right about the transaction. In either case, you can use “Code 10” to gain additional information before you release your merchandise.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank, card, cardholder, customer, internet, merchant provider, merchants, service provider, terminal, transaction