September 24th, 2014 by Elma Jane

The CVV Number (Card Verification Value) on your credit card or debit card is a 3 digit number on VISA, MasterCard and Discover branded credit and debit cards. On your American Express branded credit or debit card it is a 4 digit numeric code.

The codes have different names:

American Express – CID or unique card code.

Debit Card – CSC or card security code.

Discover – card identification number (CID)

Master Card – card validation code (CVC2)

Visa – card verification value (CVV2)

CVV numbers are NOT your card’s secret PIN (Personal Identification Number).

You should never enter your PIN number when asked to provide your CVV. (PIN numbers allow you to use your credit or debit card at an ATM or when making an in-person purchase with your debit card or a cash advance with any credit card.)

Types of security codes:

CVC1 or CVV1, is encoded on track-2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for card not present transactions occurring by mail or fax or over the telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless card and chip cards may supply their own codes generated electronically, such as iCVV or Dynamic CVV.

Code Location:

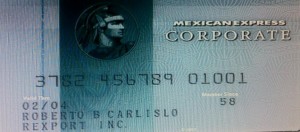

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card. On American Express cards, the card security code is the four digits printed (not embossed) on the front towards the right. The card security code is not encoded on the magnetic stripe but is printed flat.

American Express cards have a four-digit code printed on the front side of the card above the number.

MasterCard, Visa, Diners Club, Discover, and JCB credit and debit cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

New North American MasterCard and Visa cards feature the code in a separate panel to the right of the signature strip. This has been done to prevent overwriting of the numbers by signing the card.

Benefits when it comes to security:

As a security measure, merchants who require the CVV2 for card not present payment card transactions are required by the card issuer not to store the CVV2 once the individual transaction is authorized and completed. This way, if a database of transactions is compromised, the CVV2 is not included, and the stolen card numbers are less useful. Virtual Terminals and payment gateways do not store the CVV2 code, therefore employees and customer service representatives with access to these web-based payment interfaces who otherwise have access to complete card numbers, expiration dates, and other information still lack the CVV2 code.

The Payment Card Industry Data Security Standard (PCI DSS) also prohibits the storage of CSC (and other sensitive authorization data) post transaction authorization. This applies globally to anyone who stores, processes or transmits card holder data. Since the CSC is not contained on the magnetic stripe of the card, it is not typically included in the transaction when the card is used face to face at a merchant. However, some merchants in North America require the code. For American Express cards, this has been an invariable practice (for card not present transactions) in European Union (EU) states like Ireland and the United Kingdom since the start of 2005. This provides a level of protection to the bank/cardholder, in that a fraudulent merchant or employee cannot simply capture the magnetic stripe details of a card and use them later for card not present purchases over the phone, mail order or Internet. To do this, a merchant or its employee would also have to note the CVV2 visually and record it, which is more likely to arouse the cardholder’s suspicion.

Supplying the CSC code in a transaction is intended to verify that the customer has the card in their possession. Knowledge of the code proves that the customer has seen the card, or has seen a record made by somebody who saw the card.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Point of Sale, Visa MasterCard American Express Tagged with: (Card Verification Value), (CVC2), American Express, atm, authorization data, bank/cardholder, card holder data, card identification number, card issuers, Card Not Present transactions, card number, card numbers, card security code, card validation code, card-not-present, card-present transactions, cardholder, cards, cash advance, chip cards, CID, code, Contactless card, credit, credit-card, CSC, customer, customer service, CVC1, CVV Number, CVV1, CVV2, Data Security Standard, debit, debit card, debit cards, device, Diners Club, Discover, fax, gateways, iCVV or Dynamic CVV, individual transaction, internet, issuer, JCB credit, magnetic stripe, mail, MasterCard, merchant, payment card, Payment Card Industry, payment card transactions, payment gateways, PCI-DSS, Personal Identification Number, PIN, point of sale, post transaction authorization, security codes, telephone, terminals, unique card code, virtual terminals, visa, web-based payment

September 4th, 2014 by Elma Jane

EMV, which stands for Europay, MasterCard and Visa, and is slated to be mandated across the United States starting in October 2015 and automated fuel dispensers have until October 2017 to comply. Unlike magnetic swipe cards, EMV chip cards encrypt data and authenticate communication between the card and card reader. Additionally, chip card user is prompted for a PIN for authentication.

Why are those dates important? Companies lose $5.33 billion to fraud today, with card issuers and merchants incurring 63 and 37 percent of these losses, respectively. Under the EMV mandate, merchants who do not process chip cards will bear the burden of the issuer loss. By accepting chip card transactions, merchants and issuers should see a reduction in fraud.

Overcoming Barriers to EMV Adoption

Given the significant barriers to EMV adoption, it may be tempting for merchants to meet minimum requirements for accepting EMV payments. However, medium to large retailers should also consider the bigger picture of customer security and peace of mind.

Some key critical success factors for a payment initiative of this size include:

Business Continuity Architecture: As with all payment systems, it is imperative to have the EMV system running at all times. The solution should preferably have Active-Active architecture across multiple data centers and have a low Recovery Point Objective (the point in time to which the systems and data must be recovered after an outage).

Cost Benefit Analysis: Take a top down approach and decide accordingly on the scope of the analysis. This will ensure that decisions on scope are made on basis of quantitative data and not just qualitative arguments.

Phased Approach: To overcome time or cost overage in a project of this scope and complexity, retailers should try using an iterative approach for development. The rollout can be divided into multiple releases of six to seven months, which will provide the opportunity to review, capture lessons learnt, and improve subsequent releases.

Proactive Monitoring Alerts: Considering the criticality of business function carried out by EMV, tokenization and payment gateway, a vigorous supervising environment must be defined to perform proactive and reactive monitoring. It should take into consideration the monitoring targets, tools, scope and methods. This will provide advance visibility to the failure points and better ensuring maximum system availability.

Resilience Testing: Typically in a software project, the testing is limited to the unit, integration, performance and user acceptance. However, due to the critical nature of the applications and systems involved, robust resiliency testing is vital. This will ensure that there are no single points of failure and the system remains available when running in error conditions.

Stakeholder Identification: This is a key step to ensure that you have varied perspectives from all departments and their support. It will keep your organization from being blindsided and reduce the risk of disagreements in later stages of the program. Key stakeholders should include Store Operations, Card Accounting, Loss Prevention, Contact Center and IT & Data Security.

Organizations should adopt a five step approach to implement a secure, robust and industry-leading payment solution:

Encryption – Point to point encryption will ensure card data is secure and encrypted from the point of capture to the processor. Usually, merchants use data encryption that is not point to point, rendering their organization vulnerable to data breaches. Software encryption is the most common form of encryption, as it is easily installed and quires little or no hardware upgrades; however, it is less secure, may expose encryption keys, and is prone to memory scanning attacks. Hardware encryption is considered more secure but requires more costly terminal upgrades. Hardware encryption is designed to self-destruct the keys if tampered, but is not well-defined as very limited headway has been made in this space.

Tokenization – Build a Card Data Environment (CDE) that will host a centralized card data storage solution. Only limited applications with firewall access and capability to mutually authenticate via certificates can access CDE and receive card data. The rest of the applications will have tokens which are random numbers. This architecture will ease the merchant’s burden with existing and emerging PCI Data Security Standards.

Payment Gateway – Perform a risk assessment on the current payment gateway and identify gaps in functionality, manageability, compliance, scalability, speed to market and best practices. Determine the alternatives to mitigate the risks. Some of the important aspects of a leading payment gateway solution are support for all forms of credit, debit, gift cards and check transactions. Its ability to work with any acquirer, in-built encryption abilities, support for settlement and reconciliation must also be kept into consideration.

Settlement, Funding and Reconciliation – A workflow-based system to handle chargebacks and the automation of chargeback processing will greatly reduce labor-intensive work and enhance the quality of data used for settlement and reconciliation. Upgrades to the existing receipt retrieval system may be needed.

Card fraud is on the rise in the U.S., and merchants are the primary target for stealing information. With the EMV deadline just over a year away, the responsible retailer must take steps to prepare now. Although EMV implementation might seem overwhelming to merchants, they should start their journey to secure payments rather than wait for a looming deadline. Solutions such as data encryption and tokenization should be used in combination with EMV to implement a robust payment solution to better protect merchants against fraud. By proactively adopting EMV payment solutions, merchants can stay ahead of the regulatory curve and better protect their customers from fraud.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: authentication, automation, card, card data, Card Data Environment, card fraud, card issuers, card transactions, CDE, chargeback, chargeback processing, check, check transactions, chip, chip cards, credit, customer, customer security, data, data breaches, data encryption, data security, debit, EMV, emv chip cards, EuroPay, fraud, gateway, Gift Cards, host, integration, magnetic swipe cards, MasterCard, Merchant's, payment, payment gateway, payment solution, payment systems, PCI, PCI Data Security Standards, PIN, processor, retailers, Security, software, swipe, terminal, tokenization, tools, visa

March 14th, 2014 by Elma Jane

Merchant and Consumer Groups Seek Senate Support To Forego EMV Chip and Signature As Breach Concerns Rise

There’s no shortage of answers in trying to put a stop to hackers set on throwing chaos into the way consumers transact at the point of sale, or online for that matter. Yesterday, the Banking, Housing and Urban Affairs subcommittee on national security and international trade and finance got its chance to hear some of them.

During the hearing, William Noonan, deputy special agent in charge, U.S. Secret Service, noted the advances in computer technology and greater access to personally identifiable information online, which have created a virtual marketplace for transnational cyber criminals to share stolen information and criminal methodologies. As a result, the Secret Service has observed a marked increase in the quality, quantity, and complexity of cyber crimes targeting private industry and critical infrastructure. These crimes include network intrusions, hacking attacks, malicious software, and account takeovers leading to significant data breaches affecting every sector of the world economy.

The recently reported data breaches of Target and Neiman Marcus represent only the most recent, well-publicized examples of this decade-long trend of major data breaches perpetrated by cyber criminals intent on targeting the nation’s retailers and financial payment systems. The increasing level of collaboration among cyber-criminals allows them to compartmentalize their operations, greatly increasing the sophistication of their criminal endeavors and allowing for development of expert specialization. These specialties raise both the complexity of investigating these cases, as well as the level of potential harm to companies and individuals.

So how should the industry react to prevent further breaches? Those opinions provided during testimony at the hearing varied widely, though both consumer and merchant groups would like the card networks to give up requiring only signatures for smart card purchases at the point of sale.

Consumer program director at the U.S. Public Interest Research Group, called for myriad of changes, citing that the greater risk from the recent breaches is less related to identity theft than it is to fraud on existing accounts, and he said it’s time for players on both sides of the transaction to focus more on protecting consumers than on managing their own risk.

Until now, both banks and merchants have looked at fraud and identity theft as a modest cost of doing business and have not protected the payment system well enough. They have failed to look seriously at harms to their customers from fraud and identity theft -including not just monetary losses and the hassles of restoring their good names, but also the emotional harm that they must face as they wonder whether future credit applications will be rejected due to the fraudulent accounts.

As a first step, Congress should institute the same fraud cap, $50, on debit/ATM cards that exists on credit cards, or eliminate the $50 cap entirely, since it is never imposed because of the zero-liability policies issuers have voluntarily have imposed. Congress also should provide debit and prepaid card customers with the stronger billing-dispute rights and rights to dispute payment for products that do not arrive or do not work as promised, just as many credit card users enjoy.

Congress should endorse a specific technology, such as EMV smart cards and if it does, require the use of PINs when initiating smart card transactions. The current pending U.S. rollout of chip cards will allow use of the less-secure chip-and-signature cards rather than the more-secure chip-and-PIN cards. Why not go to the higher-and-PIN authentication standard immediately and skip past chip and signature? There is still time to make this improvement.”

Retailers have spent billions of dollars on card-security measures and upgrades to comply with PCI card security requirements, but it hasn’t made them immune to data breaches and fraud. The card networks have made those decisions for merchants, and the increases in fraud demonstrate that their decisions have not been as effective as they should have been.

The card networks should forego chip and signature and go straight to chip and PIN. To do otherwise would mean that merchants would spend billions to install new card readers without they or their customers obtaining PINs’ fraud-reducing benefits. We would essentially be spending billions to combine a 1990’s technology chips with a 1960’s relic signature in the face of 21st century threats.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Merchant Services Account, Payment Card Industry PCI Security, Point of Sale, Small Business Improvement, Visa MasterCard American Express Tagged with: banking, Breach, card networks, card-security, chip and signature, chip cards, chip-and-PIN cards, computer technology, credit applications, credit cards, critical infrastructure, cyber crimes, cyber-criminals, data breaches, debit atm cards, EMV, hackers, hacking attacks, international trade and finance, malicious software, managing risk, merchant, national security, netwrok intrusions, new card readers, online, payment system, pci card security requirements, PIN, point of sale, prepaid card customers, smart card transactions, technology chips, the secret service, transnational cyber criminals, virtual marketplace, world economy

December 2nd, 2013 by Elma Jane

Europay, Mastercard, and Visa (EMV) standards. Considered safer and widely used across Europe and other nations, the chip-based cards require insertion of the card into a terminal for the duration of a transaction, a break here from our traditional swipe-and-buy behavior. That’s just one way in which EMV changes things here… but it’s not the only way, nor is it the most important way. By way of reminder, October 2015 is the date by which all restaurants and other merchants are due to have implemented these standards, or potentially be liable for counterfeit fraud, which primarily reflects a shift from magnetic-stripe credit cards to chip cards.

The main driver in the EMV migration is card-related financial fraud. As an example, and traditionally, card fraud in the United Kingdom has always been considerably higher than here in the States, primarily because the U.K. previously used offline card authorization as opposed to the online card methodology used here. As losses due to fraud rose steadily in Europe, despite the best efforts of global law enforcement agencies to reduce it, the pressure to find a solution built around some alternative authentication strategy mounted. From this concern, EMV was born.

Is it working? Recent statistics from the European Central Bank (ECB) revealed that, despite growing card usage, fraud in the Single Euro Payments Area (SEPA) – a mature EMV territory that includes all 28 members of the European Union, Finland, Iceland , Liechenstein, Monaco and Norway, – fell 7.6% between 2007 and 2011. This decline is underpinned by a slowdown in the growth of ATM fraud as well as a 24% drop in fraud carried out at point of sale terminals. The 2008 Canadian roll-out of Chip and PIN had a dramatic impact on fraud there. Card Skimming had accounted for losses totaling $142 million, but that figure dropped to $38.5 million in 2009, according to figures provided by the Interac Association. Some critics point to the fact that most of this decrease comes in the form of face-to-face card fraud, and that criminals merely shift their focus onto some other area that is less anti-fraud focused. Still, there are positive gains and as technologies improve, more successes are sure to follow.

Part of the reason why the U.S. not embraced EMV sooner is because our fraud problem, while significant, has typically been among the lowest rates in the world among highly developed economically mature countries. Much of that is due to the online authentication methods at work here. Here at home, our online authentication methodology permits authorizations to be done in real-time, thus thwarting a significant percentage of the fraudulent attempts at the point-of-sale, the best place to stop fraud. Our online authentication methods also incorporate multiple fraud and risk parameters as well as advanced neural networks that are ‘built-in’ to the approval process. It’s been a highly effective system that works well, when compared to most alternatives. The effectiveness of our authentication processes has helped fuel the resistance to full EMV adoption here. However, the EMV migration has gained momentum to the point where it is only a matter of time. The truth is that, despite the gains in preventing credit card fraud, and despite the best efforts of EMV’s backers to push acceptance through, global adoption of the EMV standard is still considerably less than 100%.

In England’s old offline authentication method, credit card transactions were gathered together at specific times- typically, at the end of the business day- and then batched over to the card issuers for authorization. It’s a method that gave those committing fraud a significant time lag between the transaction and the authorization, and this time lag contributed greatly to the higher levels of fraudulent activities in England. However, for Europe and for much of the rest of the world, adoption of the EMV technologies changes things dramatically, at least in terms of authentication protocols for both online and offline purchases. During an offline transaction using the EMV chip card, the payment terminal communicates with the integrated circuit chip (ICC), embedded in the payment card. This is a break from the old method which involved using telecommunications to connect with the issuing bank. The ICC / terminal connection enables real-time card authentication, cardholder verification, and payment authorization offline. Alternatively, in an online EMV transaction, the chip generates a cryptogram that is authenticated by the card issuer in real time.

Posted in Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Near Field Communication, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: authentication, batched, card, card authorization, card-related, chip cards, chip-based, credit cards, cryptogram, EMV, EuroPay, financial, fraud, fraudulent, icc, insertion, integrated, magnetic stripe, MasterCard, Merchant's, networks, online, payment, restaurants, Skimming, standards, swipe-and-buy, terminal, transaction, verification, visa