May 1st, 2017 by Elma Jane

3D Secure Authentication

One of the biggest frustration for e-Commerce businesses has been the risk of chargebacks. If a shopper were to tell their issuers that they did not authorize an Internet purchase with their credit card, the merchant can lose the chargeback and the product.

By using 3D Secure capabilities, merchants get detailed evidence of authorized purchases “authentication data”.

The authentication data, together with an authorization approval gives you a transaction that is guaranteed against the most common types of chargebacks: Cardholder not authorized and cardholder not recognized chargebacks.

3D Secure is a security tool that enables cardholders to authenticate their identity to their card issuer through the use of Visa’s Verified by Visa and MasterCard’s SecureCode services.

3D Secure adds another layer of security to cardholders by preventing fraudulent purchases in an e-Commerce environment and reducing the number of unauthorized transactions.

NTC’s Virtual Merchant users processing transactions in an integrated e-Commerce environment are able to take advantage of this functionality.

3D Secure processing is supported with MasterCard and Visa transactions only. Other card types will process as normal and will not trigger 3D secure processing.

For e-Commerce Electronic Payments set up with 3D Secure

call now 888-996-2273! or click here NationalTransaction.Com

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Visa MasterCard American Express Tagged with: chargebacks, credit card, data, e-commerce, electronic payments, MasterCard, merchant, Security, transaction, visa

April 27th, 2017 by Elma Jane

Adding Tokenization Service

Important notes when adding tokenization:

– Tokens replace credit or gift card numbers.

– The terminal must be enabled to accept tokenization.

– Tokens are unique for each merchant, for example:

The same card will produce a different token for each merchant.

– Merchants with multiple terminals sharing tokenization domains will receive the same token for a unique card and the token can be used across their stores if they wish to do so.

– Merchants may supply the token in place of card information in any subsequent transaction.

– Tokenization is supported for both credit cards and gift cards.

Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions. This eliminates the possibility of having card data stolen because it no longer exists within your environment.

Tokens can be used in card not present environments such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments.

Tokens can reside on your POS/PMS or within your e-commerce infrastructure “at rest” and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions “in use”.

For Electronic Payment Set up with Tokenization call now 888-996-2273

or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit, e-commerce, electronic payment, encryption, gift Card, merchant, moto, POS, terminals, tokenization, tokens, transaction

April 24th, 2017 by Elma Jane

Recurring Payments through VirtualMerchant

Providing recurring payments is an easy way to increase retention, grow loyalty, and improve customer satisfaction.

Recurring Payments are automatic payments where a customer authorize a merchant to collect the total charges from a customer’s credit card or bank account every month. It is a useful feature with multiple applications: Donations, Memberships, subscriptions and utility payments.

Handle your recurring and installment payments with our single solution.

To set up a recurring payment, the merchant simply enters the specified charge, chooses the frequency of payment (weekly, monthly, annually) and the customer’s card is billed.

Automated recurring billing is an efficient, convenient and hassle-free service that can help merchants build and manage their business growth.

To set up recurring payment through VirtualMerchant call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, credit card, merchant, payments, recurring

April 18th, 2017 by Elma Jane

NTC Amex OptBlue Program rate are a lot more competitive, with NTC Amex OptBlue you can find a rate that’s right for your business and a faster, easier way to accept the card.

Amex OptBlue Program allows smaller businesses to accept American Express credit cards without paying excessively higher rates. Those who sign up for this program can automatically bundle American Express along with the other major card brands that they already accepting.

Before Optblue, you had one rate option for American Express Card acceptance. Now, because your Merchant Service Provider sets the rate, you could find a deal that works for you.

In some cases, Amex OptBlue is lower than Visa and MasterCard.

If you’re an existing merchant adding Amex Optblue is easy with NTC. You’ll get paid at the same time as your other card brands. One fast deposit!

All the credit cards you accept in one simple statement.

One Customer Service Contact. We can answer questions for every card you take with us.

Give us a call now 888-996-2273 or fill out the form NationalTransaction.Com and we’ll help you get going with Amex OptBlue.

Posted in Best Practices for Merchants Tagged with: amex, card, MasterCard, merchant, payment processing, service provider, visa

April 4th, 2017 by Elma Jane

A Travel Merchant Account That Does More!

Call now 888-472-7112 or click the image to redirect you to contact form landing page.

Posted in Best Practices for Merchants Tagged with: merchant, travel

March 9th, 2017 by Elma Jane

Merchant Cash Advance

A Merchant Cash Advance is a funding product providing working capital to businesses. When it comes to securing a merchant cash advance, businesses are far more likely to be approved and secure the amount of funding you actually need because cash advance is not a loan.

Merchants sell a specific amount of their business’ future credit and debit card receivables at a discount in exchange for the capital they can use for business. Payments are often more flexible as they are based on sales.

For your loans and funding needs call now at 888-996-2273 Extension 1159

Posted in Best Practices for Merchants Tagged with: cash advance, credit, debit card, loan, merchant, payments

March 7th, 2017 by Elma Jane

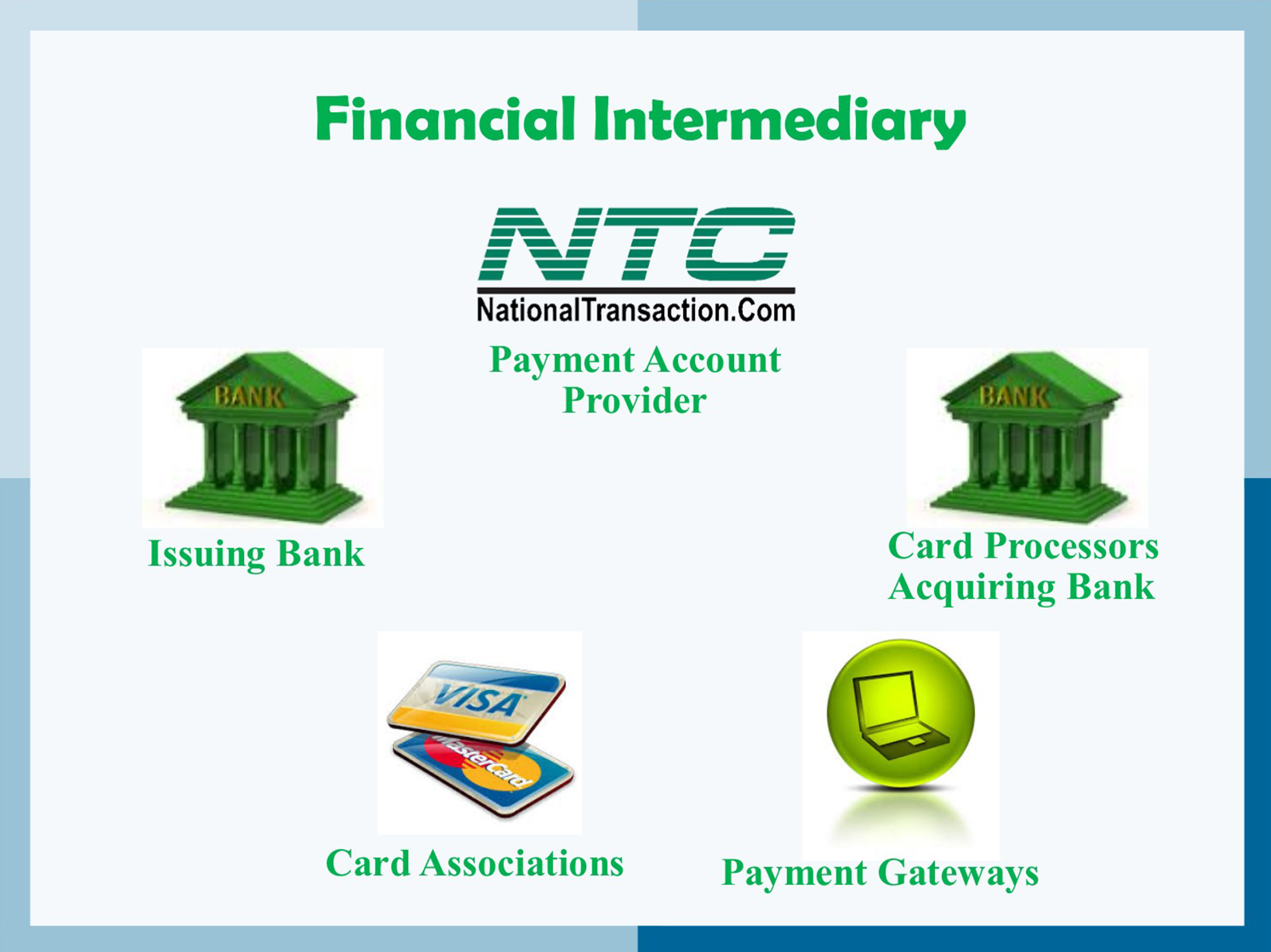

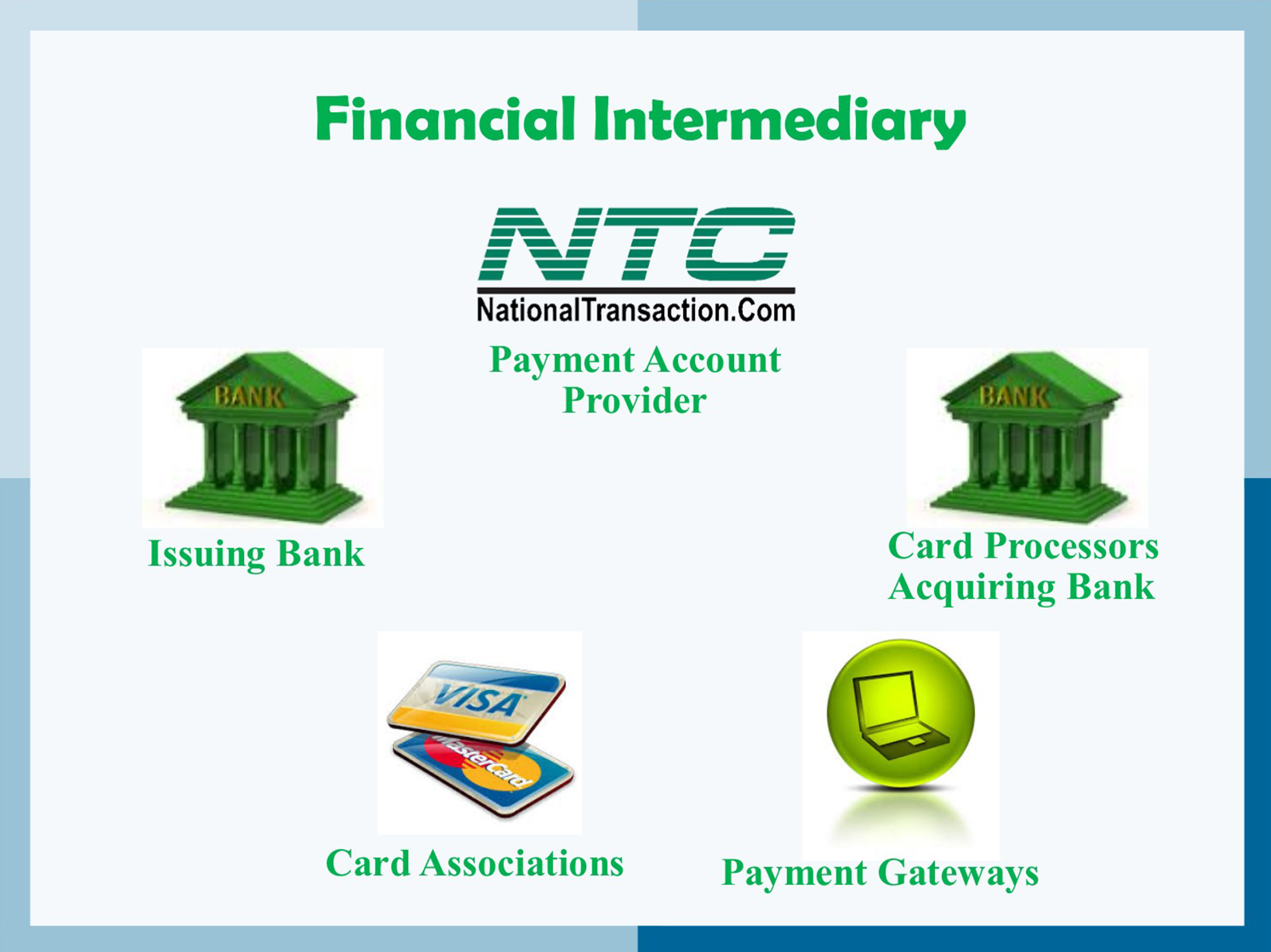

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization

February 16th, 2017 by Elma Jane

Chargeback Cycle

A chargeback is also known as a reversal; a credit card transaction that is reversed to a merchant because of the customer or customer’s bank disputes charges. Other reasons include fraud, credit card processing errors, authorization issues and non-fulfillment of copy requests. There’s an assigned reason code for every chargeback. Reason codes may vary by VISA and MasterCard.

How does the chargeback cycle work?

1. A customer files a complaint to card-issuing bank.

2. The bank sends disputed transaction (chargeback) to acquirer.

3. Acquirer receives chargeback and resolves it or forwards to the merchant for documentation.

4. Merchant accepts chargeback or addresses issues and resubmits to Acquirer.

5. Acquirer represents the chargeback to the issues once acquirer agrees the merchant has properly addressed it.

6. The issuer resolves the dispute by reposting to the cardholder’s account.

7. The cardholder receives dispute information and may be rebilled or credited.

Every merchant that offers credit card processing to its customers should be concerned about chargebacks to their merchant account.

Lower your risk of chargebacks by following the tips below:

Verify card logos, credit card numbers, identification, customer signature and check the expiration date.

Call for voice authorization if the card stripe doesn’t work or if the terminal is down or cannot authorize.

Authorize every transaction.

Be sure your customers are familiar with your return or exchange policy.

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, merchant, merchant account, transaction

January 23rd, 2017 by Elma Jane

What Makes Up The Rate That You’re Paying?

Most rates are made up of three parts:

Interchange – Goes to the bank that issued the card, and is typically made up of a flat rate plus a percentage of the sale.

Assessments – Go to card network like Visa, MasterCard, Amex, Discover etc.

Processor fees – Fees involved with providing the service, risk assessments, the type of transaction, and the size of the transaction. This portion includes the margin between the total rate and the two previous parts, along with any incidental fees, like chargeback or statement fees.

There are a lot more intricacies of what makes up a credit card rate, but this information gets you off to a good start. If you’re interested in learning more about electronic payments, check our website www.nationaltransaction.com or call now 888-996-2273 and talk to our Payment Consultant.

Posted in Best Practices for Merchants Tagged with: bank, card, card network, chargeback, credit card, merchant, payment, processor, transaction